Critical Illness Insurance Lawyer Burlington | Get Expert Help

When you’re diagnosed with a serious medical condition, the last thing you need is a denial letter from your insurance company. It’s a devastating blow, especially when you were relying on that financial support to get you through.

If your insurer has denied your claim, a critical illness insurance lawyer in Burlington can challenge that decision and fight for the lump-sum payment you’re entitled to. This isn’t the end of the road. Expert legal help is available across Ontario to hold your insurance company accountable. Our firm, based in Burlington, proudly serves clients throughout the GTA and all of Ontario.

Understanding Why Your Critical Illness Claim Was Denied

When you buy a critical illness policy, you’re buying peace of mind. The whole point is to get a tax-free, lump-sum payment after a life-altering diagnosis like cancer, a stroke, or a heart attack. This money gives you the freedom to focus on what truly matters: your health.

But here’s the tough reality: insurance companies are businesses, and their priority is their bottom line. They often hide behind complicated policy language and their own strict, internal definitions to find reasons to deny legitimate claims. For many people in Burlington and the Greater Toronto Area (GTA), this truth hits home when they are at their most vulnerable.

Common Scenarios Leading to a Denial

That denial letter can feel so final, but it’s often based on arguments that an expert can successfully challenge. Insurers tend to lean on a few common reasons to refuse payment, leaving policyholders feeling completely overwhelmed and confused.

Some of the most frequent reasons for a denial in Ontario include:

- Policy Definition Disputes: The insurer might agree your diagnosis is serious but argue it doesn’t perfectly match the rigid, specific definition of the illness buried in their policy documents.

- Alleged Application Errors: They could claim you left out a piece of information or made a mistake on your original application. This tactic, known as “material misrepresentation,” is often used to try and void your coverage entirely.

- Pre-Existing Condition Exclusions: The insurance company may try to argue your illness is connected to a condition you had before your policy even started, no matter how weak that link might be.

A denial isn’t a final judgment on your health or your right to benefits. It’s simply the insurance company’s interpretation of their contract. An experienced lawyer’s job is to build a counter-argument so compelling that the insurer has no choice but to reconsider and pay what they owe you.

This isn’t a problem unique to critical illness claims. We see these same tactics play out all the time when a policyholder’s long-term disability is denied. Recognizing these patterns is the first step toward building a powerful appeal with a dedicated critical illness insurance lawyer in Burlington on your side.

Getting to Grips with Your Critical Illness Policy

It’s tempting to think of your critical illness policy as a simple safety net. But in reality, it’s more like a complex rulebook written for—and by—the insurance company. When a claim gets denied, the reason isn’t a mystery; it’s almost always buried deep within that rulebook, hidden in the fine print and technical jargon that most of us find impossible to decipher.

This confusing language isn’t an accident. It’s designed to create a gap between what your doctor says and what your policy says. Your doctor might diagnose you with a serious illness, but if it doesn’t tick every single box in the insurer’s rulebook, they have grounds for a denial. For them, only their definitions matter.

The Devil Is Always in the Definitions

The heart of most claim disputes boils down to one thing: definitions. The insurance company’s definition of an illness can be worlds apart from the one your own doctor uses.

For example, your medical charts might clearly state you’ve had a heart attack. But the insurer could still deny your claim, arguing that your specific enzyme levels or ECG results don’t meet their rigid criteria for what they consider a “payable” heart attack.

It’s the same story with strokes. A policy might define a stroke as a “cerebrovascular event” where neurological symptoms must persist for a minimum period. If your symptoms, thankfully, resolve sooner than that, the insurer may argue your condition doesn’t qualify under their rules—even though you and your medical team know you had a stroke. This is precisely where a critical illness insurance lawyer in Burlington can make all the difference.

Making Sense of Key Clauses and Timelines

Beyond the definitions, you’ll find other crucial clauses that can make or break a claim. The “survival period” is one of the most important and often misunderstood.

- The Survival Period: This is a non-negotiable waiting period built into most Canadian policies, typically lasting 30 days. You must survive for this full period after the date of your diagnosis to qualify for the benefit. If you pass away on day 29, the claim will be denied, even if the diagnosis was rock-solid.

This rule can feel incredibly harsh and unfair, especially for families already dealing with a devastating loss. It’s technicalities like this that contribute to a surprisingly high number of rejected claims. A recent Munich Re survey found that 17% of all critical illness claims in Canada were denied between 2019 and 2023, often because of these very specific policy requirements. You can discover more insights about these claim denial trends and what they mean for Canadian families.

Think of your policy as a legal contract. Every single word was chosen to protect the insurer’s bottom line. To win a denied claim, you have to prove that your situation fits their precise terms, not just that you were truly sick.

Getting your head around these rules is the first step. But it’s also important to know that these policies are often linked to other benefits you might have. For more information, you might be interested in our guide on how long-term disability insurance works. A good lawyer will look at the whole picture, reviewing all your coverages to build the strongest possible case for you.

Why Insurance Companies Deny Critical Illness Claims

If your critical illness claim has been denied, you’re probably feeling shocked and frustrated. But for the lawyers who handle these cases every day, it’s rarely a surprise. Insurance companies are businesses, and their goal is to manage financial risk. They often rely on a handful of common—and often challengeable—reasons to reject a claim.

Understanding these tactics is the first step toward fighting back. For people here in Burlington and across the GTA, seeing your situation reflected in these patterns can be empowering. It shows that a denial isn’t the end of the road; it’s the start of a fight you can win.

Let’s break down the most frequent arguments insurers use and how a lawyer can push back.

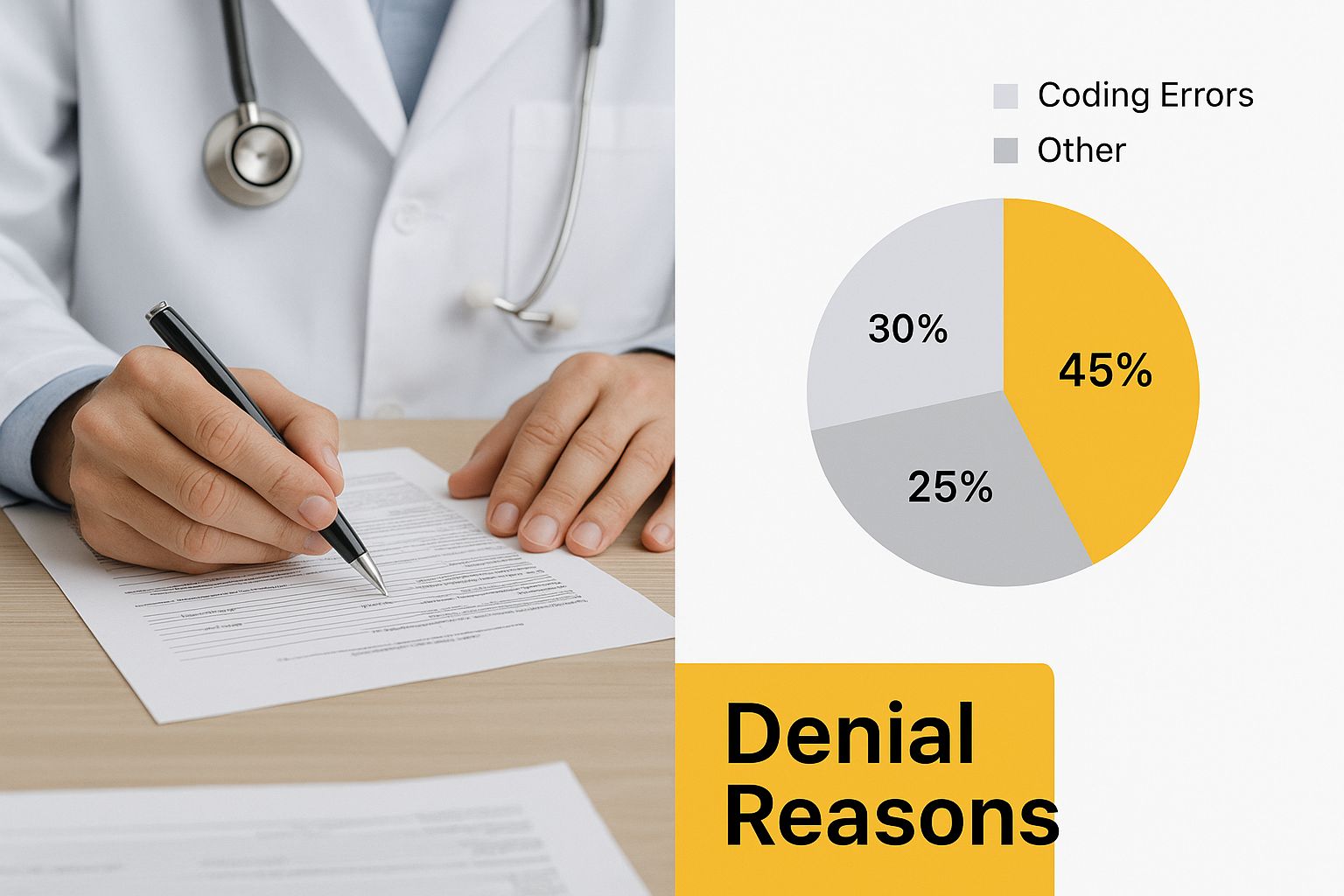

As you can see, most denials come down to arguments over paperwork and medical definitions—areas where an expert can build a powerful counter-argument.

1. Material Misrepresentation or Non-Disclosure

This is the big one. Material misrepresentation is the legal term for when an insurer claims you left out important information or gave incorrect details on your original application. After you file a claim, they will put your medical history under a microscope, searching for any tiny detail you may have missed.

Imagine you forgot to mention a one-time visit to a specialist for a minor complaint ten years ago. If you’re later diagnosed with a critical illness like cancer, the insurer might seize on that omission. They’ll argue it was “material” to their decision and use it to void your policy entirely, claiming they never would have offered you coverage if they’d known.

For a denial to hold up, the insurer has to prove that the information you omitted was so significant it would have changed their decision to insure you in the first place. An innocent mistake or an unrelated medical detail often isn’t enough to justify tearing up your policy.

A skilled critical illness insurance lawyer in Burlington knows how to fight this. They can argue that the oversight was an honest mistake and had no bearing whatsoever on your current diagnosis, forcing the insurer to prove its relevance.

2. The Diagnosis Doesn’t Meet the Policy Definition

This is another incredibly common hurdle. The insurer might not dispute that you’re sick, but they’ll argue your condition doesn’t fit the exact, often convoluted, definition written in your policy.

It’s a frustrating game of semantics. Your doctor says you had a heart attack, but the insurer’s policy might have a hyper-specific definition requiring certain enzyme levels or EKG results that your case didn’t produce. It’s a way for them to deny a legitimate claim on a technicality.

3. Disagreements Over Medical Evidence

Sometimes, the battle comes down to a “he said, she said” between doctors. Here’s how this usually plays out:

- Your condition isn’t “severe” enough: They might agree you have the diagnosed illness but claim it hasn’t progressed to a stage they consider severe enough to trigger a payout.

- They hire their own doctors: Insurance companies often pay for an “Independent Medical Examination” (IME). Unsurprisingly, the doctors they hire frequently write reports that support the insurer’s decision to deny the claim.

These arguments can feel overwhelming, but they are not the final word. A good lawyer works with your own treating physicians and specialists to gather the evidence needed to prove your case. They know how to challenge the findings of the insurer’s hand-picked doctors and make sure your medical reality is the one that counts.

To make this clearer, here’s a look at how a lawyer directly counters these common denial tactics.

How a Lawyer Responds to Common Claim Denials

This table breaks down the typical arguments insurance companies use and illustrates how an experienced lawyer systematically dismantles them.

| Reason for Denial | What the Insurer Claims | How a Lawyer Fights Back |

|---|---|---|

| Material Misrepresentation | ”You failed to disclose a pre-existing condition or past medical visit on your application, so we are voiding your policy.” | Proves the omission was unintentional, innocent, and completely unrelated to the current critical illness. Argues it wasn’t “material” to the insurer’s original risk assessment. |

| Diagnosis Definition Mismatch | ”While you are ill, your condition does not meet the strict technical definition outlined in Clause 4(b) of your policy.” | Gathers detailed reports from your treating specialists to show how your diagnosis does meet a reasonable interpretation of the policy’s language. Highlights ambiguities in the contract that should favour you. |

| Insufficient Severity | ”Your cancer is ‘in situ’ or your heart attack was ‘minor,’ so it doesn’t meet the severity threshold for a payout.” | Presents expert medical evidence demonstrating the life-altering impact of the diagnosis, regardless of the insurer’s label. Focuses on the real-world effects on your health and ability to work. |

| Conflicting Medical Opinion | ”Our independent medical expert reviewed your file and concluded that your condition is not as serious as your doctors claim.” | Challenges the credibility and objectivity of the insurer’s paid expert. Obtains stronger, more detailed evidence from your own long-term medical team to counter the IME report. |

Ultimately, a lawyer’s job is to level the playing field. They take the insurer’s technical arguments and reframe the conversation around a simple, powerful truth: you bought a policy for protection, you got critically ill, and you deserve to be paid.

How a Lawyer Can Win Your Benefits Back

When an insurer denies your critical illness claim, bringing a lawyer on board isn’t about rushing into a courtroom battle. It’s a calculated move to get the insurance company to take a second look and honour the policy you paid for. Partnering with an experienced critical illness insurance lawyer in Burlington levels the playing field, signalling that you understand your rights and won’t be easily dismissed.

The whole process is methodical, designed from the ground up to build an ironclad case that pressures the insurer to reverse their decision. It all starts with a simple, free consultation where the lawyer will listen to your side of the story and go over the denial letter with you.

The Strategic Legal Process Unfolded

Once you give the green light, your lawyer steps in as your champion. They handle all the complex legal work, freeing you up to concentrate on what truly matters: your health and recovery. This legal journey follows several key steps, each one chipping away at the insurer’s reasons for denial while building irrefutable proof that you deserve your benefits.

The first step is always a meticulous review of your policy. Your lawyer will dig into every clause, every definition, and every exclusion—the same fine print the insurer used against you—to find the weak points in their reasoning. This deep dive into the contract is the bedrock of a successful strategy.

Building a Rock-Solid, Evidence-Based Case

Next, your lawyer shifts focus to gathering powerful medical evidence. This isn’t about just resending your doctor’s original notes; it’s a much more thorough process. It involves:

- Consulting Specialists: We work to get detailed reports from your doctors and specialists that speak directly to the specific medical definitions laid out in your policy.

- Clarifying Medical Facts: We collaborate with your medical team to ensure their reports use clear, legally precise language, leaving no room for the insurer to misinterpret the facts.

- Challenging the Insurer’s Experts: If the insurance company used their own doctor to justify the denial, your lawyer will scrutinize and challenge the credibility and objectivity of that assessment.

With a strong case built on solid evidence, your lawyer takes over all communication with the insurance company. They’ll negotiate from a position of strength, aiming to secure the settlement you’re entitled to. Given the prevalence of serious illnesses and the complexity of these policies, having an expert guide you is essential. You can learn more about the landscape of critical illness insurance costs and claims in Canada to see just how common these issues are.

The crucial thing to remember is that the vast majority of these cases are successfully settled out of court. The goal is to make it clear to the insurer that fighting your claim is a losing proposition, leading them to offer a fair resolution.

This proven process lets you focus on your recovery while your legal team handles the fight. To see how this strategic approach leads to success, you can review some of our past case results and understand the real-world impact of expert legal representation.

Choosing the Right Lawyer for Your Case

When your critical illness claim is denied, picking the right lawyer isn’t just another step—it’s the most important decision you’ll make. Not all lawyers are equipped to go toe-to-toe with a massive insurance company and win. You don’t need a jack-of-all-trades; you need a specialist.

Think about it this way: if you had a serious heart problem, you wouldn’t see your family doctor. You’d go straight to a cardiologist. It’s the exact same principle here. You need a lawyer who lives and breathes this specific area of law, one who knows the insurance companies’ playbook inside and out.

Key Qualities of a Top Insurance Lawyer

As you search for a critical illness insurance lawyer in Burlington or the GTA, your goal is to find someone whose track record speaks for itself. This is about more than just a law degree; it’s about proven, real-world experience.

Here’s what you should be looking for:

- An Exclusive Focus on Insurance Law: Their practice should be built around disability and insurance claims. This shouldn’t be a side gig they do between real estate closings and preparing wills.

- A History of Success: Can they point to actual results? Look for testimonials from people who were in the same boat you are now. A firm that’s proud of its work will be open about its successes.

- Deep Knowledge of Ontario Law: They need a masterful grasp of the Ontario Insurance Act and the court decisions that shape how these cases are won and lost.

- No Upfront Fees: This is a big one. The top lawyers in this field work on a contingency fee basis. Simply put, you don’t pay a dime unless they win your case.

This level of expertise is non-negotiable. The Canadian insurance market is a complicated web, with over two dozen major players like Sun Life, Manulife, and Canada Life. Each has its own unique policy language, which gives them plenty of room to find reasons for a denial.

Understanding the Contingency Fee Agreement

The contingency fee model is a game-changer. It ensures that anyone can afford top-tier legal help, no matter their financial situation. It also aligns your lawyer’s goals directly with yours—they only succeed if you do.

This arrangement takes all the financial risk off your shoulders. You can hire the best legal team to fight for what you’re owed without worrying about hourly rates or big upfront retainers. Your only job is to focus on your health.

Before you sign anything, have a frank conversation about the fee structure. Your lawyer should clearly explain the percentage they’ll receive from the final settlement and what other costs might be involved. A transparent, upfront discussion about money is a sure sign you’re dealing with a professional you can trust.

If you’re looking for someone in your area, our guide on finding a disability lawyer near you has some great tips to help you get started.

Your Questions About Critical Illness Claims Answered

When your critical illness claim is denied, the world can feel like it’s been pulled out from under you. Suddenly, you’re buried under a mountain of questions and uncertainty. It’s an incredibly stressful and confusing time, but getting clear, straightforward answers is the first step toward taking back control.

Below, we’ve tackled some of the most pressing questions we hear from our clients in Burlington and across the GTA. These answers are grounded in the realities of Ontario law, giving you the practical clarity you need to decide on your next move.

How Much Does a Critical Illness Lawyer Cost in Burlington?

Most experienced critical illness insurance lawyers in Ontario, including our team serving Burlington and the GTA, work on a contingency fee basis.

Think of it as a partnership. This payment structure is designed specifically to help you when you’re most vulnerable. It means you pay absolutely nothing upfront for legal fees. Your lawyer only gets paid if they win—taking a pre-agreed percentage of the money they successfully recover for you.

If for some reason your case isn’t successful, you owe them nothing for their time. This completely removes the financial risk from hiring a lawyer, giving you access to top-tier legal help without the worry of racking up hourly bills.

How Long Do I Have to Sue After a Claim Denial in Ontario?

This is where you need to act fast. The law in Ontario is crystal clear on this point: you generally have only two years from the date your insurer gave you a clear and final denial to file a lawsuit.

This deadline is called a limitation period, and it’s non-negotiable. If you miss that window, you could lose your right to challenge the insurer’s decision in court forever.

It is absolutely critical to speak with a lawyer the moment you receive a denial letter. Getting advice quickly protects your legal rights and gives your lawyer the time needed to build the strongest possible case for you.

Can I Fight a Denial if the Insurer Says I Made a Mistake on My Application?

Yes, absolutely—and you should. Insurers often use this tactic, known in legal terms as material misrepresentation, as a reason to deny a perfectly valid claim.

But they can’t just point to a tiny error and walk away. To legally cancel your policy, the insurance company has to prove two very specific things: first, that you left out information on purpose, and second, that this information was so important it would have changed their decision to insure you in the first place.

A skilled critical illness insurance lawyer in Burlington knows exactly how to pick this argument apart. They can show that an error was just an honest mistake, that the application question itself was confusing, or that the detail you missed has nothing to do with your current illness. The entire goal is to prove the insurer’s attempt to void your policy is both unfair and legally unjustified.

Do I Have to Go to Court to Get My Benefits?

It’s highly unlikely. The vast majority of insurance denial lawsuits in Ontario never see the inside of a courtroom. Instead, they are resolved through negotiation and settled privately.

A good lawyer’s main job is to build such a powerful, evidence-backed case that the insurance company feels intense pressure to offer a fair settlement. They would much rather pay you what you’re owed than face the risk, negative publicity, and massive expense of a court battle they are probably going to lose. The entire strategy is designed to get you your money as efficiently as possible, without the added stress of a trial, so you can focus on what matters most: your health.

For more answers to common legal questions, you can explore our firm’s comprehensive FAQ page.

At UL Lawyers, we believe you shouldn’t have to fight an insurance company alone, especially when you’re focused on your health. If your critical illness claim has been denied, contact us today for a free, no-obligation consultation. Let our family help yours. https://ullaw.ca

Related Resources

A Simple Guide to Passing the Citizenship Test in Canada

Continue reading A Simple Guide to Passing the Citizenship Test in CanadaHow to Make a Will in Ontario: A Complete Guide

Continue reading How to Make a Will in Ontario: A Complete GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies