Ontario's Car Accident Law Explained

When the dust settles after a collision, the moments that follow are a blur of confusion and adrenaline. It’s a chaotic time, but knowing what to do right away is the first step in navigating Ontario’s car accident law. The actions you take—making sure everyone is safe, documenting everything you can, and reporting the incident—aren’t just procedural; they are the bedrock of any future insurance claim or legal action.

Your First Steps After an Ontario Car Accident

It’s tough to think straight with your heart pounding after a crash. Everything feels chaotic. But having a clear, step-by-step approach can protect your health and your legal rights down the road. The goal is to stay as calm as possible, take stock of the situation, and collect the crucial details you’ll need later.

Your absolute first priority is safety. If you can, pull your vehicle over to the shoulder and switch on your hazard lights to warn other drivers. Check yourself and your passengers for any injuries, then, if it’s safe to do so, check on the people in the other vehicle. Call 911 immediately if anyone is hurt or if the cars are too damaged to move.

Documenting the Scene and Gathering Information

Once you’ve made sure the scene is as safe as it can be, it’s time to switch into investigator mode. The evidence you gather right now is invaluable. Use your smartphone to take photos and videos of everything from every possible angle. Get shots of the damage to all vehicles, the road conditions, any traffic signs or signals nearby, and even the weather.

It’s just as critical to swap information with the other driver. Never, ever leave the scene without getting these essential details:

- Driver’s Information: Their full name, address, and phone number.

- Vehicle Details: The make, model, licence plate number, and the vehicle identification number (VIN).

- Insurance Information: The name of their insurance provider and their policy number.

If anyone saw what happened, ask for their name and number. A witness who can provide an unbiased account is worth their weight in gold.

Reporting the Collision

In Ontario, the law is clear: you must report a collision to the police or a Collision Reporting Centre if the total damage to all vehicles looks to be more than $2,000, or if someone has been injured. Skipping this step can lead to serious problems. The sheer volume of accidents makes these rules essential. Just to put it in perspective, roads in California see around 1,370 crashes every single day. That number shows just how common these incidents are and why having a standard reporting process is so important for everyone. You can find more statistics on traffic accident frequency at sigelmanassociates.com.

Remember this key takeaway: The information you collect right after a crash is the most powerful. Memories get fuzzy and details change over time, but photos and notes from the scene create a concrete record of what really happened.

Understanding Ontario’s No-Fault Insurance System

When you hear “no-fault” insurance, it’s easy to think it means no one gets blamed for a collision. That’s probably the biggest myth in Ontario’s car accident law. The reality is much more practical.

The “no-fault” system doesn’t make blame disappear. It simply changes who cuts the first cheque for your recovery costs. Think of it this way: your own insurance policy is your financial first responder. No matter who caused the crash, you go to your own insurer first to get the benefits you need to get back on your feet.

This whole setup is designed to get you quick access to medical care and financial help without having to wait months—or even years—for lawyers and insurance companies to officially decide who was responsible. But make no mistake, they will investigate and assign fault. That decision ultimately affects insurance premiums and whether you can sue the at-fault driver for further damages.

Your Right to Statutory Accident Benefits

The benefits you get directly from your insurer are known as Statutory Accident Benefits (SABS). They’re a mandatory part of every single auto insurance policy in Ontario, and they act as your primary lifeline after a crash.

SABS are there to bridge the financial gap between the moment of the accident and any potential settlement down the road. They ensure you can start physiotherapy, cover some of your lost wages, and manage your household while you heal. It’s a cornerstone of how car accident law works here.

The level of benefits you can access hinges on how severe your injuries are, which get classified as minor, non-catastrophic, or catastrophic. Knowing what you’re entitled to is the crucial first step.

The table below breaks down the main types of support you can expect from SABS.

Key Statutory Accident Benefits (SABS) in Ontario

Here’s a look at the primary accident benefits available to injured parties under Ontario’s no-fault system, regardless of who was at fault.

| Benefit Type | Purpose | Common Examples |

|---|---|---|

| Medical & Rehabilitation | To cover necessary healthcare costs that OHIP doesn’t pay for. | Physiotherapy, chiropractic care, massage therapy, psychological counselling, prescription drugs, crutches, wheelchairs. |

| Income Replacement (IRB) | To replace a portion of your income if you can’t work due to your injuries. | Weekly payments of up to 70% of your gross income, capped at a maximum of $400 per week (unless you bought extra coverage). |

| Attendant Care | To pay for a personal support worker if your injuries prevent you from caring for yourself. | Help with daily activities like bathing, dressing, grooming, and mobility. |

| Caregiver | To cover the cost of hiring someone to care for your dependents if you can no longer do so. | Paying for a nanny for your children or a support worker for an aging parent you were caring for. |

| Non-Earner | To provide a modest weekly benefit if you don’t qualify for IRBs but your injuries stop you from living a normal life. | Payments for students, retirees, or unemployed individuals who suffer significant injuries. |

These benefits work together to form a comprehensive support system, helping you manage the different challenges that arise during your recovery.

A Closer Look at Key SABS Categories

Your SABS coverage is divided into these different streams, each tackling a specific part of your recovery.

-

Medical and Rehabilitation Benefits: This is the big one for most people. It pays for all the reasonable and necessary treatments that OHIP won’t cover. Think physiotherapy, counselling, prescriptions, or even assistive devices you need to get around.

-

Income Replacement Benefits (IRBs): If your injuries keep you from working, IRBs are designed to soften the financial blow. The standard benefit replaces 70% of your gross weekly income, but it’s capped at $400 per week. If you earn more, you’d only get that higher amount if you had purchased optional coverage beforehand.

-

Attendant Care Benefits: For those who suffer very serious injuries, this benefit is a lifesaver. It covers the expense of hiring an aide to help with personal care—things like getting dressed, bathing, and moving around safely.

-

Caregiver Benefits: Were you the primary, unpaid caregiver for a child or an elderly parent before the crash? If your injuries now prevent you from doing that job, this benefit can help pay for someone to take over those responsibilities.

-

Non-Earner Benefits: What if you weren’t working when the accident happened? If you were a student, unemployed, or retired and are now completely unable to carry on your normal life, you may qualify for this weekly payment, which usually kicks in after a four-week wait.

Trying to figure all this out on your own can be overwhelming. Each benefit has its own rules and application forms. This is where getting advice from a legal professional who lives and breathes Ontario’s car accident law can make all the difference in getting the support you deserve.

How Is Fault Decided in an Ontario Car Accident?

Even though your own insurance company steps in right away to provide benefits after a crash, the question of “who’s to blame?” is far from settled. In Ontario, figuring out who was at fault is a crucial process that runs alongside your benefits claim. The final decision is a big deal—it affects everything from your future insurance rates to whether you can sue the other driver for damages.

Assigning blame isn’t about pointing fingers or gut feelings. Insurance companies in Ontario must follow a strict, standardized guide called the Fault Determination Rules. These rules are baked right into the province’s Insurance Act and outline over 40 common accident scenarios, assigning a clear percentage of fault for each one.

Think of it as a detailed playbook for car crashes. Whether you were rear-ended on the 401, T-boned at a downtown intersection, or sideswiped changing lanes, there’s a rule that covers your exact situation. The insurance adjuster handling your case will match the facts of your accident to this playbook to decide who was at fault.

The Role of the Fault Determination Rules

So, why have these rules? Their main purpose is to make the process of assigning fault consistent and efficient. Without them, every claim would turn into a long, drawn-out argument. Instead, the rules create a clear, predictable framework that helps insurers resolve claims fairly and quickly.

For example, the rules are very clear about rear-end collisions. If one car hits another from behind, the driver of the trailing car is almost always found 100% at fault. This is based on the simple principle that every driver is responsible for leaving a safe following distance. While there are a few rare exceptions, this rule provides a straightforward starting point.

The rules scrutinize what each driver was doing just before the impact. Unsurprisingly, risky driving is a major factor. Across North America, things like speeding and distracted driving are top causes of collisions. To put it in perspective, 2024 statistics from California showed speeding was a factor in a staggering 77,822 accidents, and distracted driving was responsible for nearly 10,200. Numbers like these underscore why traffic laws—and these fault rules—put so much emphasis on driver responsibility. You can dig deeper into these kinds of numbers by exploring more car crash statistics on bestonlinetrafficschool.co.

What Happens When Both Drivers Are to Blame?

It’s not always black and white. What if both drivers made a mistake? This is where the concept of contributory negligence comes in. It’s just a legal term for shared fault. The Fault Determination Rules provide a guide for splitting the blame when more than one person contributed to the crash.

Picture this: a driver makes a risky left turn at an intersection, but the oncoming car was speeding to get through a yellow light. In a case like that, the fault might be split 50/50. Or, depending on the specifics, it could be a 75/25 split.

This shared fault has two immediate consequences for you:

- Your Insurance Rates: Even if you’re only found partially at fault, your insurance premiums can still go up.

- Your Lawsuit: If you sue for pain and suffering or other losses, your final compensation will be reduced by your percentage of fault.

Let’s say you’re awarded $100,000 in a lawsuit, but you were found to be 25% responsible for the accident. Your award would be cut by $25,000, meaning you would walk away with $75,000.

A Few Common Scenarios

To see how this works in the real world, let’s break down how the rules apply to a few everyday situations.

-

Rear-End Collisions: As we mentioned, the driver who hits the car in front is almost always considered 100% at fault. The law assumes they weren’t paying attention or were following too closely to stop in time.

-

Intersection Accidents: At an intersection with no stop signs or lights, the driver who gets there first has the right of way. If two drivers pull up at the same time, the one to the right gets to go first. Whoever fails to yield will be found at fault.

-

Lane Change Accidents: When you change lanes, the responsibility is entirely on you to make sure it’s safe to do so. If you collide with another car while moving over, you will almost certainly be found 100% responsible.

-

Parking Lot Accidents: These can be a bit more complicated. If you’re pulling out of a parking space, you have to yield to cars already moving in the laneway. But if two cars back into each other at the same time? That’s usually a 50/50 split of fault.

Getting a handle on these rules is important. The fault determination isn’t just a formality; it’s a critical decision that has a direct and lasting impact on your life after an accident.

Filing a Lawsuit for Serious Injuries

While Statutory Accident Benefits are a critical first line of support, they have their limits. They’re designed to cover immediate needs but often don’t come close to addressing the full, lifelong consequences of a truly devastating injury.

When a collision turns your life upside down, Ontario’s car accident law gives you the right to go beyond the standard no-fault benefits. You can file a lawsuit—what we call a “tort claim”—directly against the driver who caused the accident. This is your chance to seek compensation for the heavy losses that accident benefits simply don’t touch, like pain and suffering or your lost future income.

But it’s not an automatic right. To launch a lawsuit for these kinds of damages, the law says your injuries have to be serious enough to qualify.

Meeting the “Serious Injury” Threshold

In Ontario, you can’t sue for pain and suffering over minor injuries. The law establishes a specific bar you have to clear, known as the threshold. To meet it, your injuries must have caused a “permanent serious impairment of an important physical, mental, or psychological function.”

That’s a mouthful, so let’s break down what it actually means in the real world.

- Permanent: The injury isn’t going away. It’s a condition you’ll be living with for the foreseeable future, with no expectation of substantial improvement.

- Serious: The impairment gets in the way of your life. It has to significantly interfere with your ability to work, manage your home life, or enjoy your usual activities.

- Important Function: We’re talking about an impairment to something essential, like your ability to walk, think clearly, earn a living, or even just take care of yourself.

This is where a seasoned personal injury lawyer becomes invaluable. Their job is to work with medical experts to build a strong case, gathering the proof needed to show that your injuries meet this critical legal test. Clearing this threshold is the only way to unlock compensation for your pain and suffering.

The Stages of a Car Accident Lawsuit

Filing a lawsuit isn’t a single event; it’s a journey with several well-defined stages. Knowing what to expect can make a long and sometimes stressful process feel much more manageable. It requires patience—these things don’t get resolved overnight.

Here’s a look at the typical roadmap:

-

Hiring a Lawyer and Filing the Claim: Your journey begins when you partner with a personal injury lawyer. They will prepare and file a Statement of Claim with the court, which is the official document that lays out who you’re suing, why, and what you’re asking for.

-

The Discovery Process: This is the fact-finding phase. Lawyers for both sides exchange all relevant documents—think medical records, expert reports, and income statements. You’ll also have to participate in what’s called an “examination for discovery,” where the other side’s lawyer questions you under oath about the accident and its aftermath.

-

Mediation: Before a case can ever see the inside of a courtroom in most of Ontario, both parties are required to try and settle. You’ll attend a mandatory mediation session where a neutral third party helps you and the other side negotiate and look for common ground. Many cases are resolved here.

-

Trial: If you can’t reach a settlement at mediation, the final step is a trial. This is where a judge (or a judge and jury) hears all the evidence and makes a final, legally binding decision on who was at fault and how much compensation you should receive.

What Kind of Compensation Can You Claim in a Lawsuit?

The entire point of a lawsuit is to secure financial compensation, legally known as damages, that can help put you back in the financial position you were in before you were hurt. This compensation is broken down to cover different kinds of losses.

Some of the key damages you can claim are:

- Pain and Suffering: Compensation for your physical pain, emotional trauma, and the loss of your ability to enjoy life as you once did.

- Future Care Costs: Money to pay for all the medical care you’ll need down the road, from physiotherapy and medication to attendant care and modifications to your home.

- Loss of Income: This covers the wages you’ve already lost and, just as importantly, the income you won’t be able to earn in the future.

- Housekeeping and Home Maintenance: Funds to hire help for the chores and tasks around the house that you can no longer manage on your own.

Navigating a tort claim is a complex process, no doubt about it. But for someone whose life has been fundamentally changed by an accident, it’s the most powerful tool available to secure a stable and supported future.

When it comes to a car accident claim, the clock starts ticking the second the collision happens. Ontario’s legal system runs on a set of strict deadlines, legally known as “limitation periods.” If you miss one of these dates, you could lose your right to compensation forever, no matter how clear-cut your case is. It’s a tough reality, but getting a handle on these timelines is the first step to protecting your rights.

Think of it as a series of gates that lock on specific dates. To keep your claim moving forward, you have to get through each one before it closes. The first gate shuts incredibly fast.

You must notify your own insurance company about the accident, in writing, within 7 days. This is the official starting pistol for your accident benefits claim.

Shortly after, you’ll hit another crucial deadline. You need to complete and send in your Application for Statutory Accident Benefits (SABS) within 30 days of getting the forms from your insurer. This detailed application is what unlocks access to essential medical, rehab, and income replacement benefits you’ll need to recover.

The Two-Year Lawsuit Deadline

While those initial deadlines are important, the most critical date in any Ontario car accident case is the one for suing the at-fault driver. You have exactly two years from the date of the accident to file a lawsuit (also called a tort claim).

Let me be clear: this two-year window is firm. If you file your claim even one day late, the court will almost certainly throw it out. This is why it’s so important to act quickly to preserve evidence and get legal advice.

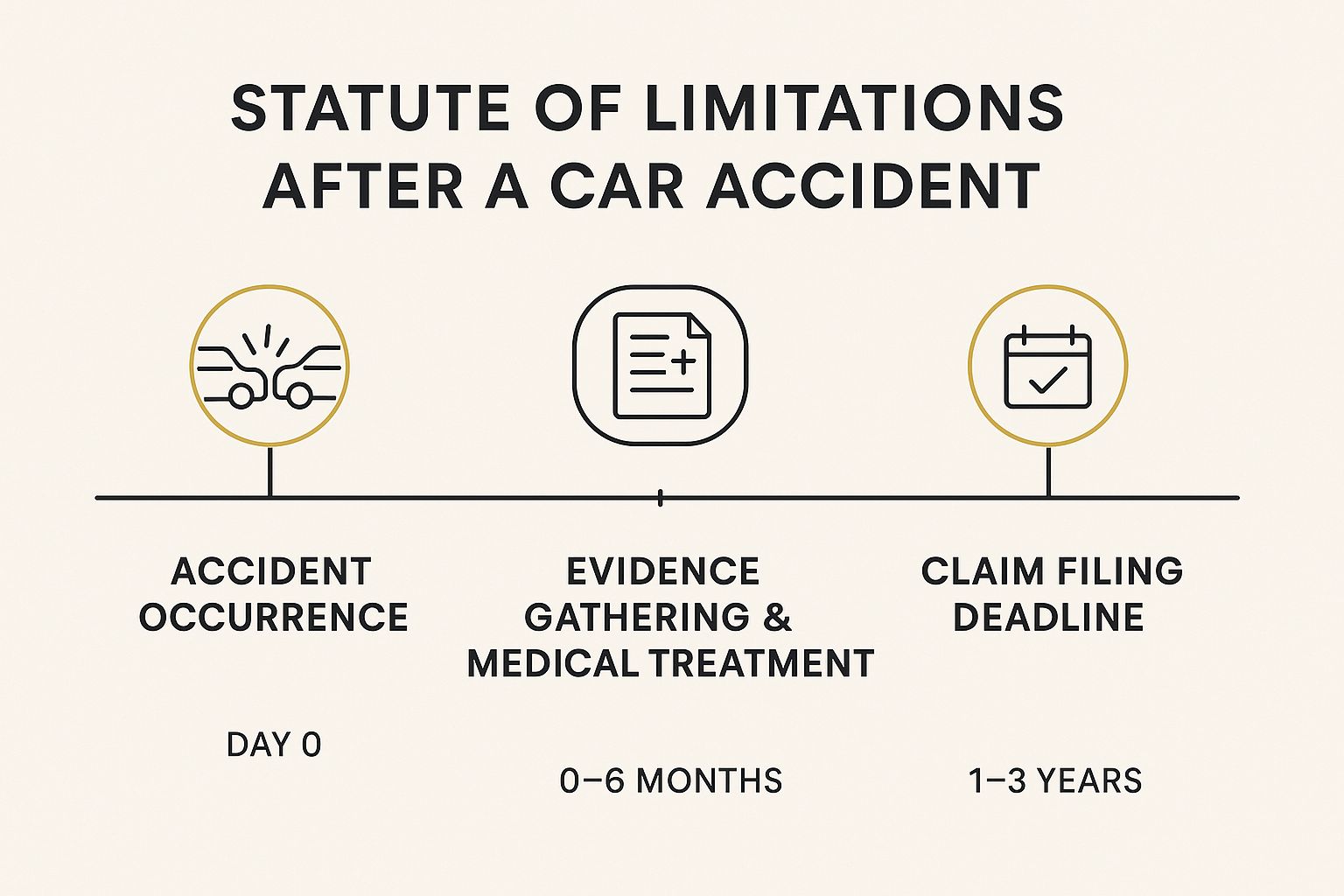

This image breaks down the key phases and timelines you’ll need to keep in mind.

As you can see, the time right after the crash is all about immediate notifications and gathering information, while that two-year mark is the absolute final cutoff for taking legal action against the person who caused your injuries.

Are There Any Exceptions?

You might be wondering if there are exceptions to these rules. The short answer is yes, but they are extremely rare and difficult to prove. A legal concept known as the “discoverability principle” can sometimes push the deadline out, but only if you couldn’t have reasonably known about your injury and its link to the accident. For instance, if a subtle but serious brain injury symptom doesn’t show up for many months.

Never assume an exception will apply to you. Counting on one of these narrow loopholes is a huge gamble that can cost you your entire claim. Always, always act as if the two-year deadline is absolute.

To help you keep these critical dates straight, here is a quick-reference table.

Ontario Car Accident Claim Deadlines

This table summarizes the most important limitation periods you need to know after being involved in a car accident in Ontario.

| Action Required | Deadline | Importance |

|---|---|---|

| Notify Your Insurer | Within 7 days of the accident | Crucial. This is the first step to accessing your own accident benefits. |

| Submit Benefits Application | Within 30 days of receiving the forms | Essential. This formal application is needed to start receiving medical, rehab, and income benefits. |

| File a Lawsuit (Tort Claim) | Within 2 years of the accident | Absolute. This is the final deadline to sue the at-fault driver for damages like pain and suffering. |

| Notify a Municipality | Within 10 days of the accident | Critical. Only applies if a city or town’s negligence (e.g., a poorly maintained road) contributed to the accident. |

Meeting these deadlines is non-negotiable for a successful claim.

The best way to protect yourself is to consult with a legal professional at UL Lawyers Professional Corporation long before these dates get close. An experienced lawyer can manage these timelines for you, making sure every form is filed correctly and on time. That leaves you free to focus on what truly matters: your recovery.

Common Mistakes to Avoid in Your Accident Claim

After a car accident, you’re not just dealing with injuries and a damaged vehicle; you’re also navigating a legal minefield. One wrong move can significantly reduce your claim’s value or even get it denied. Knowing the ins and outs of Ontario’s car accident law is crucial, but side-stepping the common pitfalls is what truly protects your right to fair compensation.

Many people, understandably rattled and stressed, make simple mistakes in the days and weeks following a crash. These missteps often happen because of a lack of information or pressure from insurance companies. Let’s walk through some of the most common traps so you can make smarter decisions from the get-go.

Giving a Recorded Statement Too Soon

You can bet that shortly after the accident, an adjuster from the other driver’s insurance company will call. They’ll sound friendly, concerned, and helpful, and they’ll likely ask for a recorded statement about what happened. Tread very, very carefully here.

This isn’t just a friendly chat. The adjuster’s primary goal is to protect their company’s bottom line, which means finding ways to minimize or deny your claim. They are skilled at asking questions designed to get you to downplay your injuries or even inadvertently admit partial fault. It’s always best to politely decline until you’ve had a chance to speak with a lawyer.

A simple comment like, “I’m feeling okay, I guess,” can be twisted and used against you down the road when your injuries prove to be more serious. The safest response is to say you aren’t prepared to give a statement and that your legal representative will be in touch.

The Dangers of Social Media Oversharing

What you post online can—and will—be used against you. Insurance companies routinely hire investigators to comb through claimants’ social media profiles, searching for anything that contradicts their injury claims.

Think about it: a picture of you smiling at a family get-together or a post about taking a short walk could be presented as “proof” that your injuries aren’t as debilitating as you claim. The smartest thing you can do for your case is to take a complete break from social media. If you can’t, lock down all your accounts to the highest privacy settings and avoid posting anything about the accident, your recovery, or your daily life.

Accepting a Quick Settlement Offer

When the other driver is clearly at fault, their insurer might dangle a quick cash settlement in front of you. With medical bills mounting and no income, this can look incredibly tempting. Be warned: these initial offers are almost always low-ball amounts, a fraction of what your claim is actually worth.

It can take weeks, or even months, for the full extent of your injuries—especially soft-tissue damage or psychological trauma—to become clear. Once you sign that release and accept the money, your claim is closed for good. You can’t go back for more, even if you need surgery a year later. Never sign away your rights without a complete medical picture and sound legal advice.

While the risk of accidents is ever-present, some safety trends are encouraging. For example, preliminary 2025 data from California showed a 36% decrease in motor vehicle deaths, even as total miles driven increased. This shows that safety initiatives can make a real difference. Still, accidents happen, and knowing how to protect yourself afterward is key. To see more on these trends, you can review some detailed car accident statistics on blairramirezlaw.com.

Frequently Asked Questions About Ontario Car Accident Law

After a collision, your mind is often racing with questions. Even if you have a handle on the basics of accident law, every crash is unique and can leave you feeling confused and overwhelmed. Here, we’ll tackle some of the most common questions we hear from people navigating the system in Ontario.

Getting straight answers is the first step toward making smart decisions during a very stressful time. Let’s clear up some of the more confusing parts of the insurance and legal journey.

Will My Insurance Rates Go Up if I Am Not at Fault?

This is probably the number one worry for drivers after an accident. The good news is that in Ontario, if you are found 100% not at fault, your insurance company cannot legally raise your rates for that specific claim.

The grey area comes in when you’re found partially to blame. If you’re assigned even a small percentage of fault—say, 10% or 25%—your insurer might increase your premiums when your policy comes up for renewal. How much it goes up really depends on your specific policy, your driving history, and the insurance company’s internal rules.

It’s a common myth that any accident claim automatically leads to higher rates. The key factor is the fault determination, which is why understanding how blame is assigned is so important for your financial future.

This protection for innocent drivers is a core part of the system, underscoring just how critical the official fault-finding process is.

What if the At-Fault Driver Has No Insurance?

It’s a scary thought: being hit by a driver who doesn’t have insurance. Thankfully, you’re not left to fend for yourself. Every standard auto insurance policy in Ontario is designed to protect you from this exact scenario.

Your own policy acts as a crucial safety net in a couple of ways:

- Uninsured Automobile Coverage: This is a standard part of your policy. It kicks in to cover your injuries and damages if the driver who caused the crash has no insurance at all.

- Family Protection Endorsement (OPCF 44R): This is an optional add-on that I highly recommend to every driver. It tops up the compensation if the at-fault driver has insurance, but their policy limits aren’t high enough to cover all of your losses.

So, even in a worst-case scenario like this, your own insurer steps into the shoes of the at-fault driver’s missing insurance, ensuring you can still get the compensation you need.

Can I Claim Benefits as a Pedestrian or Cyclist?

Yes, absolutely. The no-fault Statutory Accident Benefits (SABS) we’ve discussed aren’t just for people inside a car. If a vehicle hits you while you’re walking or cycling in Ontario, you are entitled to the very same benefits for medical care, rehabilitation, and income replacement.

The claims process is just a little different. Your first stop is your own auto insurance policy, if you have one. If you don’t own a car and aren’t listed on anyone else’s policy, you claim benefits directly from the insurance company of the driver who hit you. The system is designed so that everyone injured in a motor vehicle accident has access to support.

Navigating the complexities of a car accident claim requires expertise and dedicated advocacy. At UL Lawyers Professional Corporation, we treat our clients like family, providing compassionate guidance and zealous representation to secure the best possible outcome for your case. If you have been injured, contact us for a free consultation to understand your rights. Visit https://ullaw.ca to learn more.

Related Resources

Find a Car Accident Lawyer in Mississauga Fast

Continue reading Find a Car Accident Lawyer in Mississauga FastNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies