Your Guide to Long Term Disability Canada

If a serious illness or injury suddenly pulls the rug out from under you, leaving you unable to work for a long time, long-term disability is the financial cushion you need. It’s a type of insurance, not a government program, that steps in to replace a chunk of your income so you can keep your head above water financially. This allows you to focus on what truly matters: your recovery.

What Exactly Are Long Term Disability Benefits

Think of Long-Term Disability (LTD) as your personal financial safety net. When a health condition sidelines you from your job, LTD insurance kicks in to provide a regular monthly payment. Whether this payment is tax-free or taxable all depends on who paid the insurance premiums—you or your employer.

It’s vital to understand that this isn’t a government handout. LTD is a private insurance product, which means all the rules—from who qualifies to how much you get paid—are laid out in a specific policy document. Getting a firm grip on this distinction is the very first step toward making a successful claim in Canada.

Who Provides LTD Benefits

In Canada, you’ll typically find LTD coverage in one of two places. The most common source is through a group benefits plan offered by your employer, which is standard for many people working in Burlington, Toronto, and throughout the GTA. The other option is a private policy that you buy for yourself directly from an insurance company.

Either way, your insurance policy is the rulebook for your claim. It contains all the critical details you need to know, including:

- The specific definition of “total disability” you have to meet.

- The percentage of your income the benefit will replace (it’s usually somewhere between 50% to 70%).

- The “elimination period” – basically, a waiting period before your benefits can start.

- Any exclusions or limitations that could trip up your claim.

Your policy is a legal contract between you and the insurance company. Every single term and condition matters, dictating your rights and obligations. Skimming over the fine print is a surefire way to run into unexpected denials or roadblocks.

How LTD Differs From Other Benefits

It’s easy to get LTD mixed up with the other types of support available in Ontario, but they each play a very different role. Short-Term Disability (STD), for instance, is designed to cover the first few weeks or months you’re off work, often acting as a bridge until LTD begins.

Then there’s the Canada Pension Plan (CPP) Disability benefit, a federal program with its own separate and very strict eligibility rules. And WSIB (Workplace Safety and Insurance Board) benefits are only for injuries or illnesses that happen at work or are a direct result of your job. An LTD policy, on the other hand, is meant to cover disabilities no matter how they happened—at home, at work, or anywhere else. For example, understanding mental health sick leave can offer perspective on conditions that often lead to these kinds of absences.

Trying to figure out this web of benefits can feel overwhelming, but knowing which one fits your situation is essential. For more detailed guidance, our team can help you make sense of your options for long-term disability claims.

How to Qualify for Long-Term Disability in Ontario

Figuring out if you qualify for long-term disability in Ontario can feel complicated, but it all boils down to one thing: proving to the insurance company that your medical condition meets their specific definition of “disability.” It’s not as simple as just getting a doctor’s note; you need to build a strong, convincing case right from the very beginning.

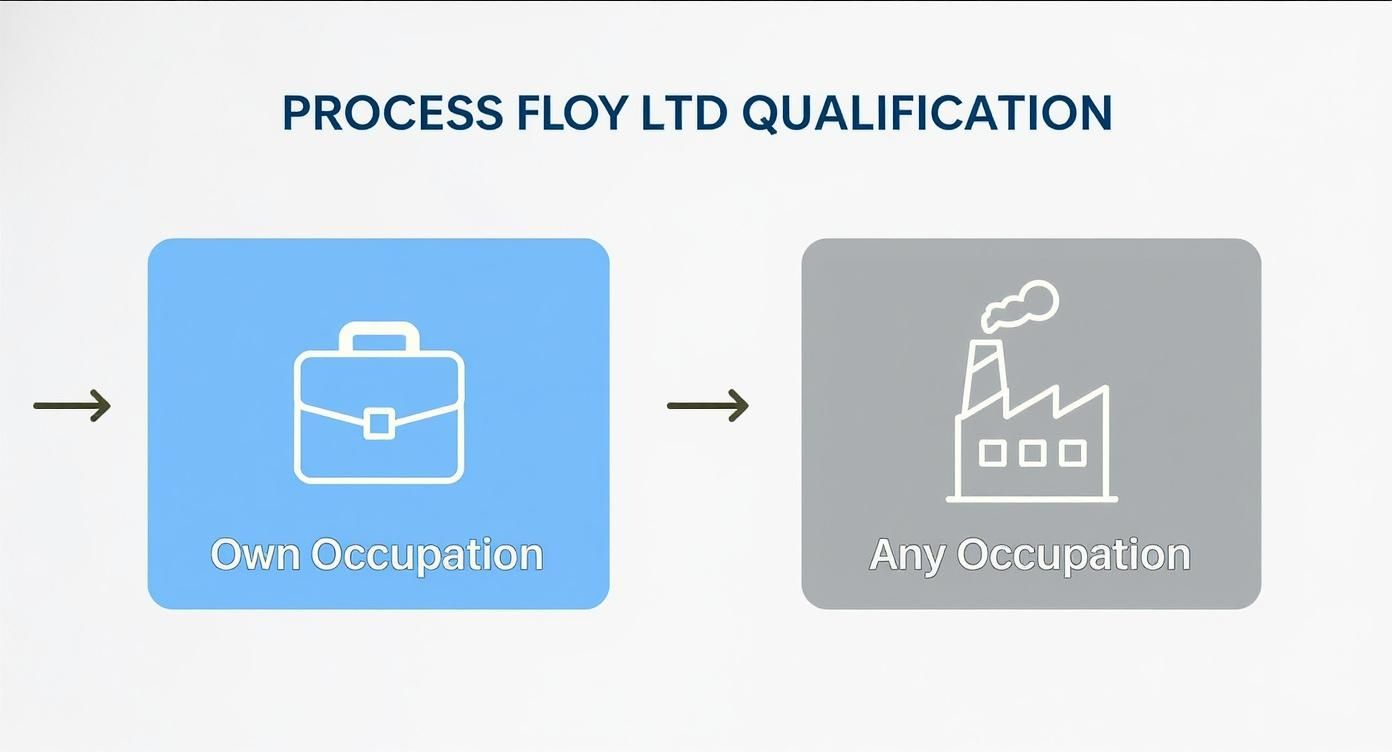

The heart of every long-term disability claim is the concept of total disability. Now, that term sounds extreme, but it doesn’t mean you have to be bedridden or completely helpless. It’s actually a specific legal term defined in your insurance policy, and its meaning changes over time—usually in two distinct stages.

Understanding the Two Phases of Disability

For the first two years, you’re typically in what’s called the “own occupation” period. During this initial 24-month window, you just need to show that your illness or injury stops you from performing the key tasks of your own specific job.

Think about it this way: a construction worker in Mississauga with a serious back injury can’t do the heavy lifting their job demands, so they would likely qualify. In the same way, a graphic designer from Burlington who develops chronic migraines and can no longer stare at a screen for hours would also fit this definition. They can’t do their own occupation.

But after that initial period, the rules of the game change. The definition of disability often shifts to the much tougher “any occupation” standard.

To keep receiving your benefits, you now have to prove that your condition prevents you from working in any job for which you’re reasonably suited based on your education, training, and experience. This is a much higher hurdle to clear, and it’s the point where many insurance companies will challenge or deny a claim.

That two-year mark, when the definition switches from “own occupation” to “any occupation,” is a make-or-break moment for many claims. The insurer might argue that while you can’t go back to your old job, you could handle a different, less demanding one, and then try to cut off your benefits.

Building Your Case: What Insurers Are Looking For

Proving you meet either definition of disability takes more than just a diagnosis on a piece of paper. Insurance companies in Canada need to see consistent, objective evidence that shows exactly how your condition limits your ability to function.

First off, you must be under the regular and ongoing care of a physician. If you only see your doctor once in a blue moon, the insurer will see that as a red flag. Consistent medical appointments show that your condition is serious and that you’re doing everything you can to get better.

Your claim also needs to be backed by solid medical evidence, such as:

- Objective Test Results: This is the hard data. Think MRIs that show a herniated disc, blood work confirming an autoimmune disease, or a neuropsychological assessment that details cognitive issues.

- Specialist Reports: A report from a specialist—like a rheumatologist for fibromyalgia or a psychiatrist for a mental health condition—carries a lot of weight with insurers.

- Documented Treatment Plans: Having a clear record of your medications, physical therapy, counselling sessions, and other treatments shows you are actively following medical advice.

When you’re putting everything together, it really helps to understand how to apply for disability benefits the right way from the get-go.

Common Conditions That Qualify for LTD

While just about any severe medical condition could qualify for long-term disability in Canada, some pop up more frequently than others. National surveys have shown that musculoskeletal problems and mental health disorders are two of the biggest reasons people file claims. In fact, the 2022 Canadian Survey on Disability found that among working-age Canadians with disabilities, pain-related conditions affected 63% of them, and mental health-related conditions affected 46%.

Some of the conditions that are commonly approved include:

- Musculoskeletal Issues: Things like chronic back pain, fibromyalgia, severe arthritis, or spinal cord injuries that make it hard to move or maintain stamina.

- Mental Health Disorders: Major depression, anxiety disorders, bipolar disorder, or PTSD can seriously impair your ability to concentrate, make decisions, or even interact with colleagues.

- Chronic Illnesses: Conditions like cancer, multiple sclerosis (MS), lupus, or heart disease can be completely debilitating, either because of the illness itself or the side effects of treatment.

- Neurological Disorders: The after-effects of a stroke, Parkinson’s disease, or other conditions that mess with your motor skills and cognitive function.

At the end of the day, getting your claim approved is all about showing the insurance company, with clear evidence, how severe your condition is and exactly how it stops you from being able to work.

Navigating Your Long Term Disability Application

Applying for long term disability in Canada often feels like building a legal case, where every single detail carries significant weight. You’re not just filling out forms; you’re painting a clear, consistent, and convincing picture of how your medical condition has turned your ability to work upside down. Getting this narrative right from the very beginning can make all the difference between a smooth approval and a frustrating denial.

The whole process hinges on three key documents. Each one offers a unique perspective on your situation, and for your claim to be strong, they must all tell the same story. Think of them as three legs of a stool—if one is wobbly, the entire structure is at risk of collapsing.

The Three Pillars of Your Application

Putting together your application package is a group effort, and it requires careful coordination between you, your employer, and your doctor.

- Your Member’s Statement: This is your chance to tell your story. In your own words, you need to explain how your disability affects your day-to-day life. Be specific about your symptoms, your physical and cognitive limitations, and the daily challenges you face.

- The Employer’s Statement: This form gives the insurance company the lowdown on your job. It details your official duties, the physical demands of the role, and your salary. This is crucial for establishing the “own occupation” part of your disability claim.

- The Attending Physician’s Statement (APS): This is the medical heart of your application. Your doctor provides a detailed report that covers your diagnosis, prognosis, symptoms, and the objective medical evidence that proves you cannot work.

It is absolutely essential that the information across these three documents lines up. If you say that severe pain prevents you from sitting for more than 15 minutes, your doctor’s report needs to back that up. Any inconsistencies can raise red flags for the insurer.

To help clarify how these pieces fit together, here’s a look at the key steps and who is responsible for what.

Key Steps in the LTD Application Process

| Stage | Key Action Required | Who is Responsible | Important Note |

|---|---|---|---|

| 1. Initial Forms | Completing the Member’s Statement with detailed personal accounts of how the disability impacts daily life and work tasks. | You (the applicant) | Be honest and thorough. This is your most direct way to communicate with the insurer. |

| 2. Employment Verification | Filling out the Employer’s Statement with job title, duties, physical demands, and salary information. | Your Employer | Follow up to ensure they complete this accurately and on time. Delays here will stall your entire application. |

| 3. Medical Evidence | Completing the Attending Physician’s Statement (APS) with diagnosis, treatment plans, and objective medical findings. | Your Physician | Provide your doctor with your job description so they can connect your limitations directly to your work duties. |

| 4. Submission & Review | All three completed forms are submitted to the insurance company for assessment by a claims adjudicator. | You (or your representative) | Double-check that all forms are fully completed before submitting to avoid unnecessary delays. |

Getting these steps right from the outset prevents many of the common headaches that can lead to a claim being denied.

Mastering Your Member’s Statement

Your personal statement is your most powerful tool. Don’t just state your diagnosis; describe what a typical day looks like for you now. Explain exactly how your condition prevents you from doing specific tasks your job requires.

For instance, instead of just writing “I have chronic back pain,” you could say, “My chronic back pain causes severe spasms that make it impossible to sit at my desk for more than 20 minutes at a time. This prevents me from completing the computer work that makes up most of my job.”

Treat your statement like a sworn testimony. Honesty, detail, and consistency are your greatest assets. Exaggerating your symptoms can backfire, but downplaying your struggles can give the insurer an easy reason to deny your claim.

It pays to be organized, especially if you’re also applying for government benefits, which often have different rules. You can learn more about how to apply for CPP Disability to understand how that process compares.

Crucial Timelines and Waiting Periods

In the world of disability claims, timing is everything. Nearly every long term disability policy has an elimination period, which is just another name for a waiting period. This is a set amount of time you must be continuously disabled and unable to work before you can start receiving benefits. This period is typically between 90 to 180 days.

You won’t get any LTD payments during this gap, which is why many people rely on Short-Term Disability (STD) or Employment Insurance (EI) sickness benefits to stay afloat financially. It’s smart to start preparing your LTD application long before your elimination period is over to prevent any lag in payments. Missing a deadline can put your entire claim at risk, so get those dates on your calendar and be proactive.

As your claim progresses, you might see the definition of “disability” itself change.

This shift—from being unable to do your own job to being unable to do any job you’re suited for—is a critical moment in a claim’s lifecycle. It’s often the point where insurers look for reasons to terminate benefits.

What to Do When Your LTD Claim Is Denied

Getting that denial letter for your long-term disability claim can feel like a punch to the gut. After everything you’ve been through—endless doctor’s visits, stacks of paperwork, and the daily struggle with your health—hearing “no” is absolutely disheartening. But it’s so important to understand that this is rarely the end of the road.

Think of it this way: insurance companies are businesses. A denial is often just their opening move in a negotiation, not the final word on your condition. The key is not to give up. That letter actually gives you a roadmap; it spells out exactly why they denied you, which tells you precisely what you need to fight back against.

Why Do Insurers Deny LTD Claims?

Insurance companies have a whole playbook of reasons for denying claims. While your situation is unique, most denials tend to fit into a few common patterns. Knowing which one applies to you is the first step in building your counter-argument.

- “Insufficient” Medical Evidence: This is the big one. The insurer will claim your medical file just doesn’t prove you’re unable to work. They might point to a lack of specific test results, say your treatment history isn’t consistent, or argue that your doctor’s reports are too vague.

- Competing Medical Opinions: Insurers often have their own team of doctors review your case. It probably won’t surprise you to learn that these “independent” medical consultants frequently disagree with your own physician’s assessment of what you can and can’t do.

- Surveillance Tactics: Yes, it happens in Canada. Some insurers will hire private investigators to watch you. They’ll look for anything—a short video clip of you carrying groceries, a photo on social media—that they can take out of context to argue you aren’t as disabled as you claim.

- Missed Deadlines & Technicalities: Sometimes, a denial has nothing to do with your health. If you miss a deadline for submitting a form or don’t follow a procedure exactly as laid out in the policy, they can deny you on a technicality, even if your medical case is rock-solid.

Figuring out their specific reason for the denial is crucial because it dictates your entire strategy for turning things around.

Your Two Paths Forward: Appeal or Lawsuit

When your claim is denied, you generally have two choices in Ontario: you can file an internal appeal, or you can start a lawsuit. They might sound similar, but they are worlds apart in terms of effectiveness.

An internal appeal means you’re asking the insurance company to take a second look at its own decision. You’ll submit more medical records and argue your case, but you’re still playing in their sandbox, by their rules. They control the process, the timeline, and ultimately, the outcome.

A lawsuit, on the other hand, immediately takes the power out of the insurer’s hands and puts it into a neutral setting: the legal system. By filing a lawsuit, you send a clear message that you won’t be pushed around and are prepared to fight for what you’re owed.

In most situations, especially in Ontario, launching a lawsuit is the more powerful strategy. It moves the dispute to neutral ground and often leads to a fair settlement faster than getting stuck in an endless loop of internal appeals.

The financial pressure of being off work is immense. This is a tough reality for many, and national data shows just how big the employment gap is for people with disabilities. In 2022, only 65.1% of working-age Canadians with disabilities had a job, compared to 79.1% of those without disabilities. This gap underscores why a fair and functioning benefits system is so critical. You can read the full Statistics Canada report on disability and employment to learn more.

The Role of a Disability Lawyer

This is where bringing in an experienced disability lawyer becomes a game-changer. Insurance companies have entire teams of adjusters and lawyers working to protect their bottom line. Going up against them alone is a classic uphill battle.

A good lawyer instantly levels the playing field. They’ll take over all communication with the insurer, so you don’t have to worry about saying the wrong thing. More importantly, they know exactly what kind of medical evidence is needed to dismantle the insurer’s arguments and will work with your doctors to get the powerful, detailed reports required to win.

Ultimately, a lawyer helps you use that denial letter as a launchpad for a successful fight. They know the insurer’s tactics and can make sure their attempts to delay, downplay, or dismiss your claim simply don’t work. If you’re facing a denial, you can get more detailed information in our guide on what to do when your long-term disability benefits are denied.

Managing Your Responsibilities While on LTD

Getting approved for long-term disability benefits is a huge relief, but it’s not the finish line. Think of it as the start of a long-term relationship with your insurance company. To keep your benefits secure, you need to know what’s expected of you. It’s a balancing act: you have to provide the information they need, but you also need to protect your privacy and focus on your health.

This isn’t a “set it and forget it” situation. The insurance company will keep an eye on your claim, and staying on top of your obligations is the best way to prevent your payments from being cut off. It’s a two-way street, and you need to hold up your end of the bargain.

Your Ongoing Duties to the Insurer

Once you start receiving benefits, your insurer will check in regularly to make sure you still qualify. This is standard practice for any long-term disability claim in Canada.

Here’s what they’ll typically expect from you:

- Continuing Medical Treatment: You need to stick with the treatment plan your doctors have laid out. For insurers, this is proof that you’re doing everything you can to get better.

- Providing Regular Updates: Be prepared to send in updated medical forms and reports from your doctor, usually every few months. Your case manager uses this paperwork to track your progress and confirm your limitations haven’t changed.

- Reporting Other Income: You must tell the insurer about any money you earn. This includes income from part-time work, government benefits like CPP Disability, or any other source. Your LTD payment will almost certainly be reduced by these other earnings.

If you drop the ball on any of these, you’re giving the insurance company a reason to question, suspend, or even terminate your benefits.

Navigating Return to Work Programs

As you start to feel better, your insurer or employer might bring up a return-to-work (RTW) program. These can be a great way to ease back into your job, but you have to approach them with caution. The goal is to support your recovery, not to be pushed back to work before you’re truly ready.

A proper RTW plan should be gradual and have your doctor’s full support. This often means starting with modified duties or fewer hours. You have every right to ask for reasonable accommodations that match your documented medical restrictions.

Sadly, this is where things often go wrong for Canadians with disabilities. A 2024 Statistics Canada survey found that a staggering 69% of employed people with disabilities faced accessibility barriers at work. For 46% of them, these barriers seriously impacted their ability to do their job. These numbers show just how important it is to have the right accommodations in place. You can read more about these workplace accessibility findings to see the full picture.

You are never obligated to accept a return-to-work plan that your doctor feels is unsafe or could set your recovery back. Your medical team’s opinion is the most important factor in deciding what you can and can’t handle.

Protecting Your Rights

While you have duties to the insurer, they also have a duty to you. They are legally required to act in good faith, which means they must be fair and honest in how they manage your claim. They can’t just go looking for reasons to cut you off; they have to conduct a balanced and reasonable investigation.

You also have a right to privacy. The insurer is entitled to medical information directly related to your disability, but that’s where it ends. They don’t get a free pass to dig into your entire medical history. Knowing where to find general disability advice and support resources can be incredibly helpful for navigating these tricky situations and ensuring your rights are protected.

Why a Disability Lawyer Is Your Strongest Ally

Going up against a huge insurance company by yourself can feel like a David-and-Goliath situation. These companies have entire teams of adjusters and legal professionals dedicated to protecting their financial interests. A disability lawyer is the expert you need in your corner to level the playing field and defend your rights.

And it’s a misconception that lawyers only step in after a denial. An experienced lawyer can be invaluable from the very beginning, especially if your medical condition is complex or isn’t easily proven with a simple X-ray or blood test. They know the common traps and can help you sidestep them before they become a problem.

How a Lawyer Strengthens Your Claim

A disability lawyer does so much more than just fill out forms. They act as your strategic partner, taking charge of your claim to build the most compelling case possible from the ground up.

Here’s a look at what they actually do:

- Interpreting Your Policy: They’ll pour over the fine print of your insurance policy, decoding the legal jargon to understand exactly what you need to prove to meet their definition of disability.

- Gathering Critical Evidence: A good lawyer understands what kind of evidence an insurer finds convincing. They’ll work directly with your doctors to get the specific, objective medical proof needed to validate your limitations.

- Managing Communications: They take over all the back-and-forth with the insurance company. This shields you from the stress of constant phone calls and confusing requests for more information.

- Fierce Advocacy: If your claim is denied and you need to take legal action, your lawyer becomes your champion, fighting for you every step of the way in the Ontario legal system.

Bringing a lawyer on board isn’t a sign of a weak case—it’s a smart, proactive move to ensure your claim gets the serious attention it deserves right from the start. Think of it as an investment in your financial future.

Demystifying Legal Fees in Ontario

One of the biggest worries for people across the GTA and Ontario is how they can possibly afford a lawyer when they aren’t able to work. That’s a completely valid concern, and it’s why most reputable disability law firms operate on a contingency fee basis.

What does that mean for you? It means you pay absolutely no upfront fees.

Your lawyer’s payment is a pre-agreed percentage of the benefits or settlement they successfully recover for you. To put it simply: if you don’t get paid, they don’t get paid. This model ensures everyone has access to top-tier legal help, no matter their financial situation. For a conversation about your specific case, finding the right disability lawyer near me is the best next step.

Answering Your Top Questions About Long-Term Disability

If you’re dealing with a long-term disability claim in Canada, you’ve probably got a lot on your mind. It’s a confusing process, and it’s completely normal to have questions. Let’s walk through some of the most common ones we hear from our clients in Burlington and across Ontario.

Can the Insurance Company Just Cut Off My LTD Benefits?

Unfortunately, yes, they can. An insurance company can stop your payments if they decide you no longer fit the policy’s definition of “disabled.” This is a major hurdle for many people, especially around the two-year mark.

Why two years? That’s often when the definition of disability in a policy changes. It shifts from being unable to do your “own occupation” to being unable to do “any occupation” for which you are reasonably suited. The insurer might also use surveillance or argue you aren’t following your doctor’s orders to justify cutting you off. This makes it absolutely critical to stick with your treatment plan and keep your doctors in the loop.

Will I Have to Pay Taxes on My LTD Benefits?

This is a big one for financial planning, and the answer comes down to a simple question: who paid the insurance premiums?

- Your employer paid 100%: In this case, your LTD benefits are considered taxable income.

- You paid 100% (with after-tax money): Good news. Your benefits are tax-free.

- You and your employer split the cost: This gets a bit more complicated. Generally, the portion of the benefit related to your employer’s contributions will be taxed.

Most group benefit plans in Canada are paid for by the employer, so you should probably plan for the benefits to be taxable. But don’t assume—always check.

Your benefits booklet is your best friend here. It will spell out exactly how your plan is funded. Understanding this is key to managing your finances while you can’t work.

How Do CPP Disability Benefits Affect My LTD Payments?

Getting approved for Canada Pension Plan (CPP) Disability is a good thing, but it will almost certainly change your LTD payment. Nearly every private LTD policy in Canada has what’s called an “offset” clause.

This clause lets your insurance company subtract the amount you get from CPP Disability directly from their payment. Think of it like this: if your LTD policy pays you $3,000 a month and you start receiving $1,200 from CPP Disability, your insurer will reduce their payment to $1,800. Your total monthly income stays the same at $3,000, but it’s now coming from two different places.

What if My Company Goes Out of Business While I’m on LTD?

This is a scary thought, but the answer depends on how your plan was set up. If your employer was self-funding the disability plan (which is rare), your benefits could be in real jeopardy if they go bankrupt.

However, the vast majority of LTD plans in Canada are handled by a separate, third-party insurance company. If that’s your situation, you can breathe a little easier. Your claim is with the insurance company, not your employer. As long as you continue to meet the policy’s requirements for disability, your benefits should continue even if your old company shuts down.

Trying to figure all this out on your own can feel overwhelming, especially when you should be focused on your health. At UL Lawyers, we are based in Burlington and serve clients across the GTA and all of Ontario, helping people protect their rights and get the benefits they deserve. Contact us today for a free consultation.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies