Toronto Long Term Disability Lawyer: Expert Legal Help

When you receive a denial letter for your long-term disability claim, it’s easy to feel like you’ve hit a brick wall. But it’s important to remember this isn’t personal—it’s business. For many insurance companies, denying a legitimate claim is often just part of their standard process, not a final judgment on your condition. Knowing their playbook is the first step to pushing back effectively.

Why Insurers Deny Disability Claims in Toronto

At the end of the day, insurance companies are for-profit businesses. Paying out on a long-term disability claim is a significant cost that cuts directly into their profits. So, a denial letter isn’t always the last word; often, it’s just their opening move. They count on many people simply giving up after that initial rejection, which saves them a fortune.

This strategy is more common than you might think. Here in Toronto and right across Canada, the initial denial rate for LTD claims is surprisingly high. While precise industry-wide statistics are guarded by insurers, legal experts estimate that a significant percentage of initial claims are denied. This number really drives home how complex these claims are and why getting the right legal help can completely change the outcome.

Common Reasons for a Claim Denial

Insurers tend to pull from the same list of reasons when they issue a denial. You’ll likely see one of these justifications in your letter, even if it feels totally disconnected from your day-to-day reality.

- Insufficient Medical Evidence: This is the big one. The insurer might say your doctor’s notes lack detail or don’t provide “objective proof” of how your condition limits you.

- Missed Deadlines: LTD policies are packed with strict deadlines for filing your claim and any subsequent appeals. Being late by even a single day can lead to an automatic denial.

- Policy Exclusions: Buried in the fine print of your policy, there could be exclusions for pre-existing conditions or specific illnesses that they’ll use to reject your claim.

- Disagreement on “Total Disability”: This is where it gets tricky. In Ontario, insurance policies often have a very narrow definition of “total disability.” They might agree you can’t do your own occupation but then argue you could do any other occupation, regardless of how unrealistic that is.

A classic example we see all the time is an office administrator with severe, chronic back pain being told she could work as a parking lot attendant. The insurer completely ignores that this job also requires long periods of sitting or standing, choosing instead to focus only on the fact that it’s a different occupation.

Surveillance and Social Media Checks

Don’t be surprised if the insurance company starts looking into your life to find reasons to deny your benefits. They often hire private investigators for surveillance or will meticulously go through your social media accounts. They’re searching for anything that seems to contradict your claim.

A single photo of you smiling at a family barbecue can be twisted into “evidence” that you’re not as disabled as you say you are.

Understanding these tactics is your best defence. A denial letter is rarely the end of the road; it’s a signal that it’s time to build a much stronger case. If your claim was rejected, it’s critical to learn what happens when your long-term disability is denied and figure out your next move.

Knowing When to Hire a Disability Lawyer

Most people figure you only call a lawyer when things have gone completely wrong. But with long-term disability claims, waiting too long can put you in a tough spot. From our experience, the best time to get legal advice is often much, much earlier than you might think.

Getting a professional involved early on is about protecting your rights before you accidentally say or do something the insurance company can twist to their advantage. The moment you get a letter or a phone call from your insurer that feels confusing, intimidating, or even a little dismissive, that’s your cue.

Those first few interactions set the tone for your entire claim. A long term disability lawyer in Toronto can help you start the process on the strongest possible footing.

Clear Triggers to Call a Lawyer

While you can—and should—reach out for advice at any point, some situations are absolute red flags. If any of these happen to you, it’s time to pick up the phone.

- You Receive a Denial Letter: This one’s the most obvious. A denial isn’t the end of the road, but it’s the official start of a fight. Insurance companies are often counting on you to feel overwhelmed and just give up.

- Benefits Are Suddenly Cut Off: If your monthly payments just stop, and you haven’t received a clear, reasonable, and well-documented reason why, you need to act fast.

- The Insurer Pushes for an IME: An “Independent” Medical Examination (IME) is rarely as independent as the name suggests. It’s often a tactic used by insurers to find a doctor who will disagree with your own physicians, giving them a reason to deny or terminate your benefits.

- You’re Nearing a Deadline: LTD policies are loaded with strict deadlines for appeals and legal action. Miss one, and you could be barred from ever receiving the benefits you’re entitled to.

The reality is that the disability landscape in Canada is becoming more crowded. Insurers face more claims and, as a result, apply greater scrutiny to each one. This environment makes professional guidance more important than ever.

The Growing Need for Legal Expertise

The number of Canadians living with a disability is rising, and that’s directly impacting the demand for experienced long-term disability lawyers in hubs like Toronto. Statistics Canada data from 2017 shows that over 6 million Canadians aged 15 and over (22% of the population) have one or more disabilities. These are precisely the kinds of conditions that often lead to a need for long-term income support.

What does this mean for you? It means insurance companies are scrutinizing claims more intensely than ever before. They have their own teams of lawyers and medical experts dedicated to minimizing payouts. Hiring a lawyer isn’t just about getting an advocate; it’s about levelling the playing field against a very well-resourced opponent.

If you’re just starting to look for help, a great first step is understanding what a local professional brings to the table. You can explore our guide on finding a disability lawyer near me to see what you should be looking for right here in the Greater Toronto Area. Don’t wait until it’s too late—protecting your claim starts today.

Finding the Right LTD Lawyer in the GTA

Choosing a lawyer is probably the most important decision you’ll make for your disability claim. This isn’t just about finding someone with a law degree; it’s about finding an advocate who will go to bat for you against a huge, well-funded insurance company. Honestly, not every lawyer is cut out for these kinds of fights.

Your search will likely start online, but you have to learn how to see past the marketing fluff. So many law firm websites use the same slogans, like “we fight for you.” You need to dig deeper for real proof they know what they’re doing.

How to Vet a Lawyer’s Experience

A lawyer’s real-world track record is what truly matters. When you’re looking at a firm’s website, hunt for concrete details that show they live and breathe disability law, not just dabble in it.

Here’s what you should be looking for:

- Real Results: Do they post specific (but anonymous) examples of cases they’ve won or settled? Look for the names of big Canadian insurers like Manulife, Sun Life, or Canada Life. That’s a sign they’ve been in the trenches and won.

- Client Stories: What are former clients from Ontario saying? Read their testimonials. Do they talk about the lawyer being a good communicator, showing empathy, and getting them a result that changed their life?

- A Clear Focus: Make sure the firm actually specializes in this area. A general “jack-of-all-trades” lawyer won’t know the sneaky tactics insurance companies use to deny claims. Our firm, for instance, is built around handling long-term disability claims; it’s what we do day in and day out.

Your First Meeting: What to Ask

That free consultation is more than just a sales pitch—it’s your opportunity to interview the lawyer. Remember, you’re the one doing the hiring. Come to that meeting armed with specific questions to see if they really have the experience they claim.

When you’re ready to hire a long term disability lawyer in Toronto, a little preparation goes a long way. Use this checklist during your initial consultations to make an informed decision and find the best fit for your case.

Key Questions for Your Lawyer Consultation

| Question to Ask | What a Good Answer Looks Like | Red Flags to Watch For |

|---|---|---|

| What percentage of your practice is LTD cases? | ”It’s the primary focus of my work—I handle these cases every day.” A confident, specific number (e.g., 75% or more) is a great sign. | ”We handle all sorts of personal injury cases.” Vague answers suggest they aren’t a specialist. |

| Who will be my day-to-day contact? | ”You’ll speak directly with me, and my law clerk, [Name], will also be available to help with updates and scheduling." | "Our case managers will handle it.” You should have direct access to the lawyer, not just support staff. |

| Can you describe your experience with [My Insurance Company]? | ”Yes, we’ve dealt with them many times. They tend to [mention a specific tactic], so our strategy will be to…" | "All insurers are pretty much the same.” This is simply not true and shows a lack of deep experience. |

| What are the next steps if we work together? | A clear, logical outline of the process: “First, we’ll notify the insurer. Then, we’ll gather…” | Rushing you to sign documents without explaining the process or your rights. |

| How are your fees structured? | ”We work on a contingency fee basis. You pay nothing unless we recover money for you. Our fee is a percentage of that recovery.” | Any mention of upfront retainers, hourly billing, or fees for an initial case review. |

Going into a consultation with these questions shows you’re serious and helps you cut through the noise. It empowers you to compare your options and choose a lawyer with confidence.

Remember, you’re not just hiring legal muscle; you’re entrusting someone with your financial future and well-being. The right lawyer gets the legal side, but they also get the immense stress you’re under and will treat you with the respect you deserve.

Finally, let’s be crystal clear about the money. Any reputable long term disability lawyer in Toronto will work on a contingency fee basis. That means you pay zero dollars upfront. Their fee is a percentage of the money they win back for you, paid only at the very end.

If any lawyer asks you for a retainer or any upfront fees for an LTD claim, walk away. That’s a massive red flag. The contingency model ensures their goals are perfectly aligned with yours: getting you the best possible outcome.

Navigating the Legal Process in Ontario

Once you’ve got a long-term disability lawyer on your side, one of the first things you’ll notice is a sense of relief. The constant calls and stacks of paperwork from the insurance company? They’re no longer your problem. Your legal team takes over all of that communication right away, which lets you step back and focus on your health while they get to work building your case.

This initial phase is all about gathering the right ammunition. Your lawyer will start methodically collecting every document that tells your story: your complete medical file, reports from specialists, diagnostic imaging, and your employment records. Think of it as building a detailed timeline that clearly shows how your condition keeps you from working. This evidence is the bedrock of your entire claim.

Filing the Statement of Claim

After pulling together a solid file of evidence, your lawyer drafts and files a Statement of Claim with the Ontario Superior Court of Justice. This is the official document that kicks off a lawsuit against the insurance company. It lays out the facts, explains how the insurer broke their contract by denying your benefits, and states exactly what you’re seeking in compensation.

Filing this claim sends a powerful signal to the insurer. It tells them you’re serious and won’t be pushed aside by their initial denial.

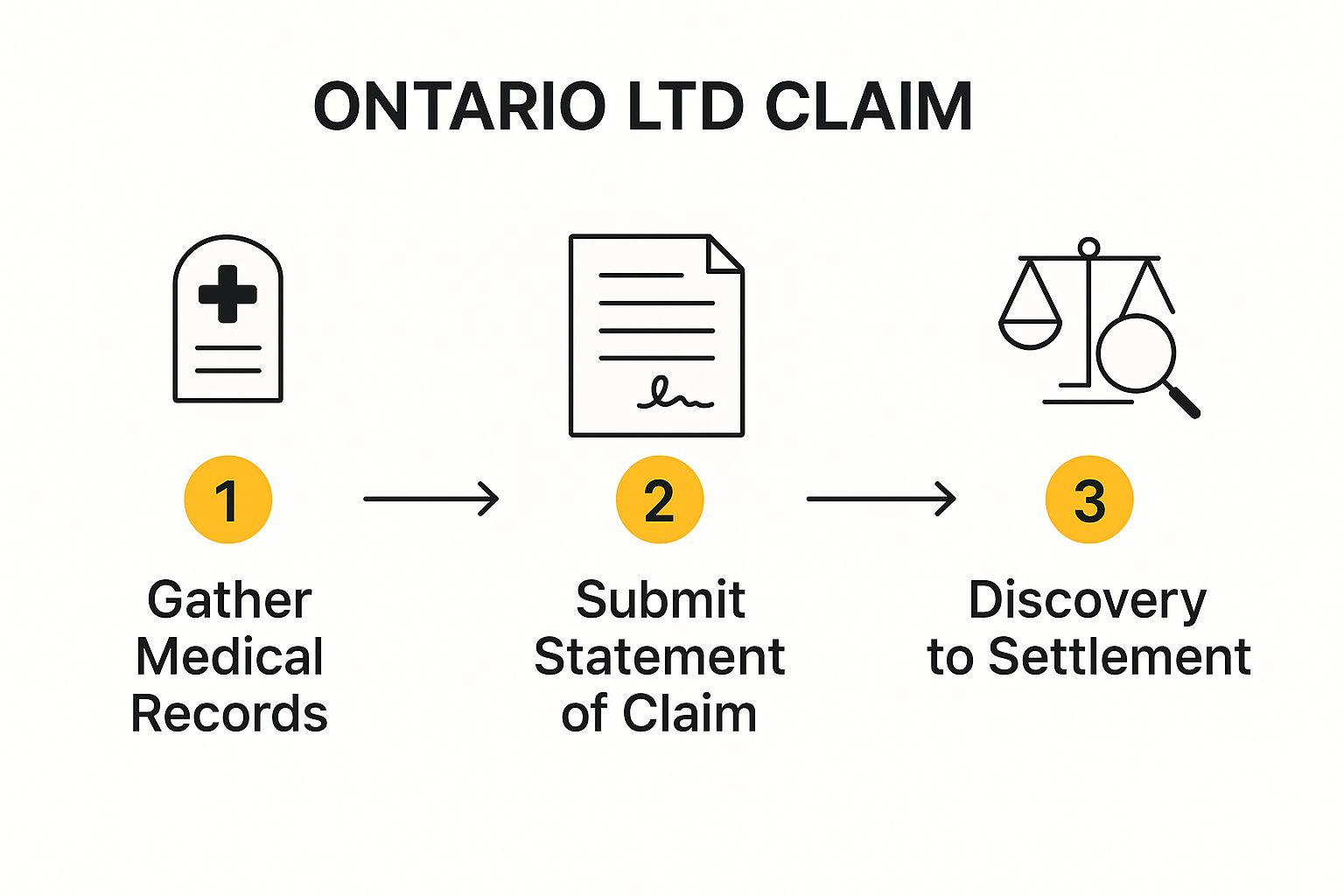

This infographic breaks down the key stages your claim will likely move through, from gathering evidence to a potential settlement.

As you can see, it’s a structured journey. Each step is designed to methodically strengthen your position before you reach a final resolution.

The Discovery Phase

With the lawsuit filed, the process enters a stage known as discovery. This is where both sides lay their cards on the table, exchanging all the information and documents they have related to your claim. It’s a crucial period where your lawyer gets a deep look into the insurance company’s arguments and learns exactly why they denied your benefits in the first place.

A key part of this is the Examination for Discovery, where the insurance company’s lawyer will ask you questions under oath about your disability. Your lawyer will be right beside you, having prepped you on what to expect and making sure the questions stay fair and on-topic. It can sound daunting, but with the right preparation, it’s a very standard and manageable part of the process in Ontario.

During the discovery phase, the true strengths and weaknesses of each side’s case really come to light. A strong, well-prepared case often puts enough pressure on the insurance company to start thinking about a fair settlement instead of risking a trial.

The legal system in Ontario is set up for this kind of structured process, and experienced lawyers have a proven track record. Firms that specialize in these cases have successfully fought and won thousands of claims against major Canadian insurers like Manulife, Sun Life, and Canada Life. This just goes to show how effective a skilled legal advocate can be.

Reaching a Settlement

Most people assume a lawsuit means a dramatic courtroom battle, but that’s rarely the case with disability claims in Ontario. The reality is that the vast majority—often over 95%—are resolved through a negotiated settlement. As your case moves forward and the evidence piles up, the insurance company usually sees the writing on the wall and becomes more willing to negotiate.

These negotiations can happen at any point, but they often ramp up after the discovery phase or during a formal meeting called mediation. This is where an experienced Toronto long-term disability lawyer truly shines. They use their expertise to negotiate the best possible outcome for you, whether that means getting your monthly benefits reinstated or securing a lump-sum payment. You can find more details in our guide to long-term disability insurance.

Understanding Legal Fees and What a Successful Claim Looks Like

When your income has stopped because of an illness or injury, the idea of hiring a lawyer can feel completely out of reach. It’s a common worry, but let me put it to rest. The way long-term disability claims are handled in Ontario means you don’t need a cent upfront to get top-tier legal help.

Most experienced long-term disability lawyers in Toronto work on what’s called a contingency fee basis. Simply put, this means you don’t pay any legal fees unless we win your case. There’s no retainer, no hourly rate, and no surprise bills showing up in the mail.

How Do Contingency Fees Actually Work?

A contingency fee is just a pre-agreed percentage of the money we recover for you. This fee only comes out of the final settlement or award after we’ve successfully resolved your claim. In Ontario, these agreements are regulated to ensure they are fair and transparent.

This setup is crucial because it means our goals are perfectly in sync with yours. We are invested in getting you the best possible outcome because we only get paid if you do. Before we even start, we’ll walk you through the agreement so you know exactly what the percentage is and how it’s calculated. No guesswork, no fine print.

This model levels the playing field. It gives you the ability to take on a massive insurance corporation, with all its resources, without putting your own finances at risk. Your job is to focus on your health; our job is to handle the fight.

The Two Main Ways a Claim Can Be Resolved

When you hire a long-term disability lawyer, the primary goal is to get you the benefits you’re entitled to under your policy. How we achieve that can look a couple of different ways, and the right path depends entirely on your specific circumstances and what makes the most sense for your future.

Here are the two typical outcomes we aim for:

- Getting Your Monthly Benefits Reinstated. Sometimes, the best result is forcing the insurance company to do what they should have done in the first place: approve your claim. In this case, they would pay you a lump sum for all the payments they’ve missed (arrears) and then start sending your regular monthly benefit cheques again.

- Negotiating a One-Time, Lump-Sum Settlement. More often than not, it’s better for everyone to settle the entire claim for a single payout. This figure represents the total value of your past and future benefits, all paid at once. It gives you complete financial freedom and, just as importantly, means you never have to deal with that insurance company again.

Let’s look at a quick example. Say your benefit is $2,500 per month and the insurer has denied you for a full year. You’d already be owed $30,000 in arrears. A lump-sum settlement would cover that amount, plus a negotiated value for your future benefits, often resulting in a substantial settlement. Deciding which route to take is a strategic choice we’ll make together, always with your long-term well-being as the priority.

Your Top Questions About Toronto LTD Claims

When your disability benefits are cut off, your mind starts racing with questions. It’s a stressful, uncertain time, and you need clear answers. Let’s walk through some of the most common questions we hear from people just like you across Toronto and the GTA.

What’s This Going to Cost Me? A Look at Lawyer Fees

This is, understandably, the first thing on most people’s minds. The good news is that experienced long-term disability lawyers in Toronto almost always work on a contingency fee basis.

What does that mean for you? Simply put, you don’t pay a dime upfront. There are no retainers or hourly bills to worry about. Your lawyer’s fee is a percentage of the money they recover for you, and it’s only paid out after they’ve successfully won your case. This setup removes the financial barrier, allowing you to get top-tier legal help when you need it most.

How Long Do I Have to Take Legal Action in Ontario?

This is a critical one. In Ontario, the law is very strict. You generally have a two-year limitation period to file a lawsuit, which starts from the date your insurer first denied or terminated your benefits, as outlined in the Limitations Act, 2002.

If you miss that deadline, you could lose your right to sue for good. That’s why it’s so important to contact a lawyer the moment you get that denial letter in the mail.

When you’re dealing with a serious health issue, it’s easy for time to slip away. But the insurance company is counting on that two-year clock. Acting fast is the single best way to protect your rights.

Will My Case End Up in a Courtroom?

The thought of going to court is stressful for anyone, but you can breathe a little easier. The reality is that the vast majority of these cases never see the inside of a courtroom.

Well over 95% of long-term disability lawsuits in Ontario are resolved out of court. This usually happens through direct negotiation between your lawyer and the insurer’s legal team, or a structured settlement meeting called a mediation. A good lawyer focuses on building such a strong case with compelling medical evidence that the insurance company has no real choice but to offer a fair settlement.

Can You Represent Me if I’m Not in Toronto?

Absolutely. While our home base is in Burlington and we serve the GTA, our practice covers the entire province of Ontario. Thanks to video calls, email, and secure digital document signing, we can handle every aspect of your case just as effectively whether you live in Thunder Bay, Ottawa, or right around the corner. Geography is no longer a barrier to getting the right legal help.

We’ve compiled even more answers on our frequently asked questions page about disability claims in Ontario. We’re committed to giving you the support and legal firepower you need, no matter where you are.

At UL Lawyers, we know firsthand the pressure and anxiety a denied disability claim creates. Our entire focus is on fighting for your rights and getting you the benefits you’re owed. If your insurer has cut you off, reach out to us today for a free, no-pressure consultation. Let us take on the fight so you can focus on what matters most: your health. Contact us online or call our 24/7 hotline.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioHow to Apply for Disability in Canada: A Practical Guide

Continue reading How to Apply for Disability in Canada: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies