How to Apply for Disability in Canada: A Practical Guide

If you’re thinking about applying for disability benefits in Canada, the first step is figuring out which program actually fits your situation. You’ll need to submit a detailed application backed by a lot of medical and personal paperwork. The whole process really hinges on proving your condition stops you from working, so you need to build a strong, evidence-based case right from the get-go.

Success starts with knowing which path to take.

Understanding Your Canadian Disability Benefit Options

Starting this process can feel like a lot to handle. In Canada, and particularly for those of us in Ontario, support typically flows from three different streams. Each one has its own purpose and a unique set of rules, so it’s crucial to figure out which one you should be applying for before you even start collecting documents.

The three main sources for disability benefits are:

- Canada Pension Plan (CPP) Disability: This is a federal program for people who’ve paid into the Canada Pension Plan during their working years. You need to show you have a “severe and prolonged” disability that keeps you from working regularly.

- Ontario Disability Support Program (ODSP): A provincial program, ODSP is designed as a last resort for Ontario residents. It’s for those in financial need who also have a substantial physical or mental impairment that’s expected to last a year or more.

- Private Long-Term Disability (LTD) Insurance: These are benefits you get through an insurance policy, which you might have through your job’s group benefits plan. Your eligibility depends entirely on the specific definitions and terms written in that policy.

If you’re dealing with a private insurer, our guide on long-term disability in Canada dives much deeper into what those claims involve.

Key Takeaway: Choosing the right program is the most important first step. If you apply to the wrong one, you’ll waste months only to get an automatic denial and have to start all over again.

Comparing the Main Disability Programs

To help you get your bearings, we’ve put together a quick comparison of the main disability programs available to people in Ontario. This should give you a clearer picture of who runs each program, what their main requirements are, and who they’re really meant for.

Overview of Canadian Disability Benefit Programs

| Benefit Program | Governing Body | Primary Eligibility Requirement | Best For |

|---|---|---|---|

| CPP Disability | Federal Government (Service Canada) | Sufficient CPP contributions; “severe and prolonged” disability. | Individuals with a consistent work history who contributed to CPP. |

| ODSP | Provincial Government (Ontario) | Substantial disability; significant financial need. | Ontario residents with limited income and assets. |

| Long-Term Disability | Private Insurance Company | Medical disability as defined in the specific policy. | Employees covered under a workplace group benefits plan or a private policy. |

As you can see, your work history, financial situation, and insurance coverage are the key factors that will point you in the right direction. It’s rarely a matter of choice; one of these will be the correct—and often only—path for you.

First Things First: Are You Eligible?

Before you dive into the mountain of paperwork, let’s pause. The single most important thing you can do right now is figure out which program you actually qualify for. Each one—federal, provincial, and private—has its own unique rulebook. Applying to the right one from the get-go saves you from the frustration of an automatic denial.

When it comes to the Canada Pension Plan (CPP) Disability program, it all boils down to two things: your medical condition and your work history. Your condition needs to be both “severe and prolonged.” In plain language, that means it stops you from doing any kind of meaningful work, and it’s expected to be a long-term issue, indefinite, or terminal.

Then there’s the money side. You need to have paid into the CPP while you were working. The general rule of thumb is that you must have contributed for at least four of the last six years before your disability stopped you from working, though some exceptions can apply.

How Provincial and Private Plans Differ

Provincial programs like the Ontario Disability Support Program (ODSP) look at things a bit differently. They examine your medical situation and your finances. Medically, you have to meet the definition of a person with a disability under the Ontario Disability Support Program Act—a substantial physical or mental impairment that’s continuous or recurring and is expected to last a year or more.

But here’s the key difference: ODSP has a strict financial test. Your entire household’s income and assets must be below a specific limit. This means you could have a very serious medical condition but still be denied if you have too much in savings or income.

A crucial piece of the puzzle for many federal benefits is the Disability Tax Credit (DTC). While you don’t need it for every program, it’s the gateway for the new Canada Disability Benefit. The reality is shocking: Statistics Canada data reveals that only about 13% of people with disabilities have successfully claimed the DTC, with many giving up on the complicated application. This highlights a huge barrier to accessing much-needed support.

Private Long-Term Disability (LTD) insurance is a whole other world. The rules aren’t set by the government; they’re written right into your insurance policy. The most critical part to find and understand is the “definition of disability,” because it almost always changes after two years.

-

Own Occupation: For the first 24 months, you’re usually covered if your disability prevents you from doing the main tasks of your own job.

-

Any Occupation: After that two-year mark, the goalposts often move. To keep receiving benefits, you now have to prove you can’t do any job that you’re reasonably suited for based on your education, training, and experience.

Getting a handle on these definitions is non-negotiable. This “any occupation” shift is a classic point where insurance companies challenge or deny claims. If you want to dig deeper into what conditions are typically covered, check out our guide on what qualifies for long-term disability in Ontario.

Building a Compelling Medical and Personal File

Think of your disability application as the story of your life since your condition began. The documents you gather are the evidence that backs up every chapter. An adjudicator, who has never met you, needs to see objective, detailed proof to understand your reality. Essentially, you’re building a case for yourself—and the stronger your evidence, the better your chances.

The heart of any solid application is your medical file. It needs to go far beyond simply stating your diagnosis. The real goal is to paint a vivid picture of how your disability genuinely impacts your ability to function day-to-day and, critically, your capacity to work.

Gathering Your Core Medical Documents

First things first: start collecting every relevant piece of your medical history. This isn’t just about getting a letter with a diagnosis. You need to dig deeper for specific records that show the full scope of your condition, its progression over time, and the real-world limitations it imposes on you.

Here’s what you should be looking for:

- Diagnostic Reports: This is your hard evidence. Gather all the MRIs, CT scans, X-rays, and any specialized test results that confirm your medical condition.

- Specialist Consultations: Reports from specialists—whether it’s a rheumatologist, neurologist, or psychiatrist—carry a lot of weight. They prove you’re getting expert care for your specific condition.

- Clinical Notes and Records: Ask your family doctor for your entire file. These day-to-day notes are invaluable because they create a timeline of your symptoms, what treatments you’ve tried, and whether they actually worked.

- A Detailed Doctor’s Letter: This is probably the single most important document you’ll submit. Work with your doctor to write a letter that focuses on your functional limitations. It shouldn’t just repeat your diagnosis; it needs to explain what you physically or mentally cannot do anymore.

If you have medical records from outside of Canada, they must be perfectly clear to the person reviewing your file. For any documents not in English or French, it’s wise to use professional medical document translation services to make sure every crucial detail is understood correctly.

Assembling Essential Non-Medical Paperwork

While the medical evidence is the star of the show, your non-medical documents play a crucial supporting role. This is especially true when applying for programs like CPP Disability or private long-term disability (LTD) insurance, which are directly tied to your work history.

Depending on which benefit you’re after, you’ll almost certainly need:

- Employment Records: For CPP-D and LTD claims, you have to prove your work history. This means tracking down T4 slips, Records of Employment (ROEs), and, if possible, a formal job description that details the physical and cognitive demands of your last role.

- Financial Documents: For income-based programs like ODSP, your financial life will be examined closely. Get ready to provide bank statements, evidence of any income or support, and a complete list of your assets.

- Personal Identification: Have clean copies of your birth certificate, Social Insurance Number (SIN) card, and proof of residency ready to go.

Pro Tip: Don’t just throw all these papers in a box. Buy a binder, get some dividers, and organize everything chronologically. A clean, well-organized file sends a subtle message: you are serious, credible, and have taken the time to build a solid case.

The process for a CPP Disability application, in particular, requires careful document collection. For a more detailed walkthrough on this, you can learn more about how to apply for CPP Disability benefits in our dedicated guide. Getting this preparation right from the start ensures your application is clear, comprehensive, and convincing the moment it lands on the reviewer’s desk.

Tackling the Application Forms

Let’s be honest—the application forms can feel like the biggest mountain to climb. These aren’t just stacks of paper; they’re your one chance to tell your story to an adjudicator you’ll probably never meet. You need to go into this with a plan.

Whether you’re dealing with the CPP Disability application or the notoriously thick ODSP package, the strategy is the same: be detailed, be consistent, and be convincing. The person reviewing your file is trained to connect the dots between your medical diagnosis and your actual, real-world inability to work. A huge mistake people make is just listing their diagnosis without explaining how it stops them from holding a job.

Describing Your Day-to-Day Reality

The most important parts of these forms are where they ask how your condition impacts your daily life and your ability to work. This is where you have to translate medical terms into human experience. Vague answers just won’t cut it.

Saying “I have back pain” tells the adjudicator almost nothing. You need to paint a vivid picture with specific, real-life examples.

- Weak Example: “My depression makes it hard to focus.”

- Strong Example: “Because of my depression and medication side effects, I can’t concentrate for more than 15-20 minutes at a time. This makes it impossible to finish complex tasks or follow multi-step instructions, which was a core part of my job as an office administrator.”

Think through your entire day. What is it like getting dressed? Doing chores? What about sitting, standing, lifting, or even just interacting with people? Every single detail helps build a complete, undeniable picture of your limitations. For more in-depth strategies on this, you can review our complete guide on how to apply for disability benefits.

Getting Your Application Filled Out and Sent In

Accuracy is everything. Double and triple-check every single page before you even think about sending it in. A single missing signature or an incomplete section can cause massive delays or, even worse, get your application denied right out of the gate.

A lot of these applications are now fillable PDFs. If you’re working on a Mac, knowing the right way to handle these files can save you a lot of headaches. There’s a really practical guide on how to fill PDF forms on Mac that can make this part much smoother.

When you’re ready to submit, follow these crucial steps:

- Make copies of everything. We can’t stress this enough. Keep a full copy of the entire package for your records.

- Decide how to send it. For CPP Disability, submitting online through your My Service Canada Account is usually the quickest way. Otherwise, you can mail it or drop it off in person.

- Get proof of delivery. If you’re mailing it, spend the few extra dollars for registered mail. That tracking number is your peace of mind, confirming your application didn’t get lost in transit.

A well-prepared application is more than just paperwork—it’s a lifeline. The employment rate for Canadians with disabilities is a stark 47.1%, a world away from the 66.9% for those without. With over 4 million working-age Canadians living with a disability and facing poverty at double the national rate, getting these forms right has profound consequences.

Taking the time to be meticulous and thorough isn’t just a good idea; it directly influences the outcome. It makes sure that your story gets the serious consideration it deserves from the moment it arrives.

So You’ve Submitted Your Application. Now What?

Let’s be honest, the waiting period after you’ve sent in your disability application is often the hardest part. You’ve poured so much effort into gathering documents and filling out forms, and now it’s completely out of your hands. It can feel like a black box, but knowing what’s happening behind the scenes can make the wait a little less stressful.

The first thing that happens is a basic check for completeness. Whether it’s for CPP Disability or a provincial program like ODSP, someone will make sure every signature is there and every required document is included. A missing piece of paper at this stage can stall your application right out of the gate, so that initial diligence really pays off.

Once it passes that first hurdle, your file lands on the desk of an adjudicator.

The Review Process and How Long It Takes

This adjudicator is the person who makes the call. They don’t know you personally; all they have to go on is the information you’ve provided. Their entire job is to take the medical evidence you submitted and see if it lines up with the program’s strict definition of disability.

It’s crucial to have a realistic idea of how long this can take, as it varies quite a bit.

- CPP Disability: The official target from Service Canada is to give you a decision within 120 calendar days—that’s about four months—from the day they receive a complete application. If your case is complicated, it can definitely take longer.

- ODSP: In Ontario, the timeline for a decision on the medical part of your application is typically within 90 business days. This can shift a bit depending on your local office’s workload.

During this time, the adjudicator is piecing everything together. They’re reading your doctor’s reports, looking at your work history, and carefully considering how you described your day-to-day struggles.

Our Two Cents: Don’t think of this waiting period as dead time. An adjudicator might call or send a letter asking for more details. Responding to these requests as quickly and completely as possible is one of the most important things you can do to prevent delays.

What Might Happen While You Wait

It’s actually quite common for an adjudicator to need more information before they can make a final decision. This isn’t automatically a bad sign. It just means they’re doing their due diligence and need to fill in some gaps.

Here are a couple of things they might ask for:

- Specific Medical Records: They might need a follow-up report from a specialist or ask your family doctor to elaborate on how your condition limits your ability to function.

- An Independent Medical Examination (IME): If the medical evidence isn’t crystal clear, you could be asked to see a doctor chosen by the program. This doctor’s job is to provide a third-party, impartial opinion on your condition and limitations.

Being aware of these possibilities helps you stay prepared. Keep your phone on and check your mail regularly. The more proactive you are in providing what they need, the smoother the process will be while you wait for that final letter.

Responding to a Denied Claim: Reconsiderations and Appeals

Getting that denial letter in the mail can feel like a punch to the gut. It’s easy to see it as a final “no,” but we can tell you from experience, it’s often just one step in a longer journey. Many legitimate claims are turned down the first time for all sorts of reasons—sometimes it’s missing medical details, other times it’s a simple paperwork mistake. The key is not to give up. A thoughtful, strategic response can make all the difference.

Your first move? Act fast. The clock starts ticking the moment you get that letter. For a denied CPP Disability claim, you have exactly 90 days to request a reconsideration. Provincial programs like ODSP have their own tight deadlines for an internal review. If you miss these windows, you could lose your chance to challenge the decision altogether.

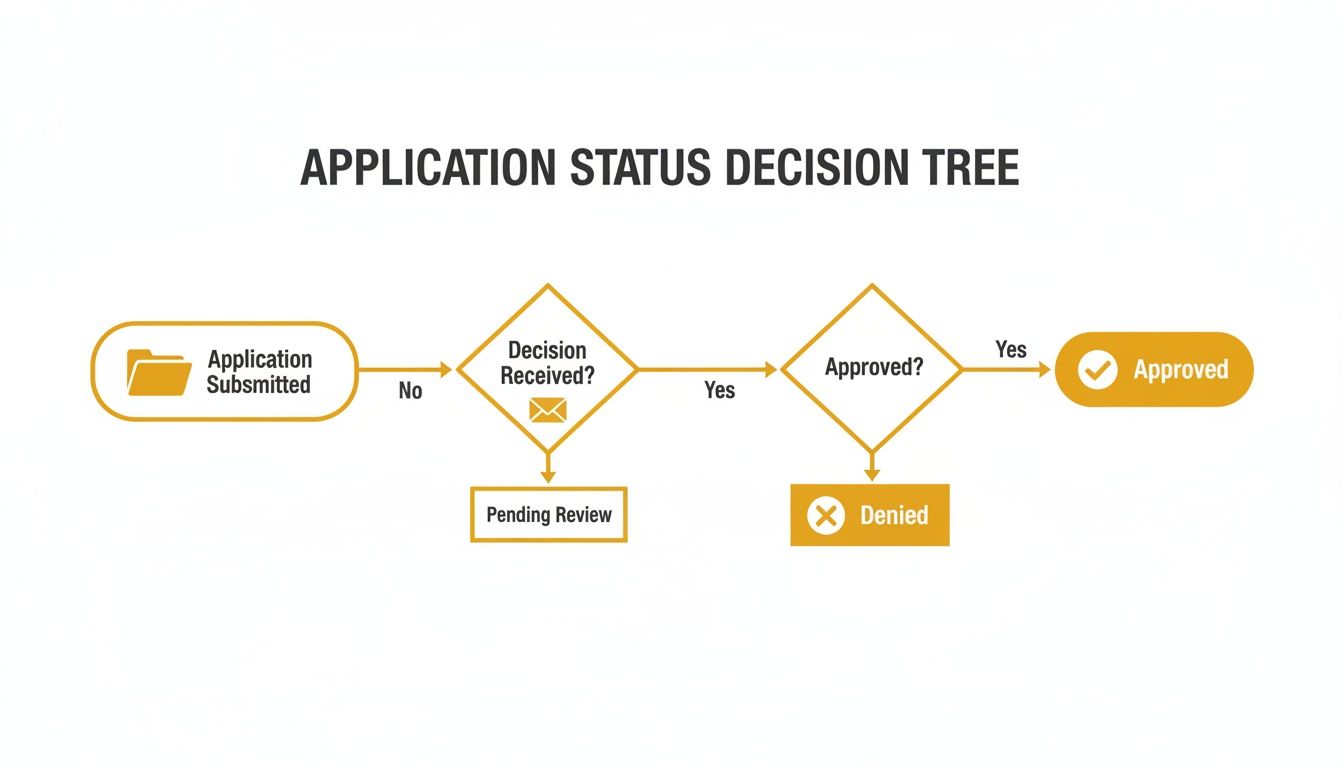

This flowchart maps out the path your application can take, showing you exactly where you are in the process.

As you can see, a denial isn’t a dead end. It’s simply a fork in the road that leads toward the reconsideration and appeal stages.

The Difference Between Reconsideration and Appeal

It’s really important to understand that a “reconsideration” (or “internal review”) isn’t a formal appeal. Think of it as asking for a second opinion from within the same organization. A different person at Service Canada (for CPP-D) or your local ODSP office will take a fresh look at your entire file, including any new information you provide. This is your best, and first, chance to fill in the gaps and strengthen your original application.

A formal appeal is the next level up. This happens if the reconsideration is also denied, and it moves your case to an outside body like the Social Security Tribunal of Canada. This is a much more formal, legalistic process where you argue your case before an independent decision-maker.

Strengthening Your Case After a Denial

Your denial letter is more than just bad news—it’s a roadmap. It should outline exactly why they rejected your claim. Use that information to pinpoint the weak spots in your file. More often than not, the problem is a lack of clear, objective medical evidence that connects your health condition to your inability to hold a job.

Here’s how you can build a much stronger case for the reconsideration:

- Get New Medical Reports: Go back to your doctor or specialist. Ask them for an updated, detailed letter that specifically addresses the reasons for the denial. It needs to be direct and clear.

- Seek More Testing: If there are any further diagnostic tests that can provide concrete proof of your condition’s severity, now is the time to get them done.

- Write a Personal Statement: You should also write a clear, concise letter explaining exactly why you disagree with the decision. Refer back to specific points in your medical records to support your arguments.

The stakes are incredibly high. A 2023 disability poverty report from Campaign 2000 found that 16% of Canadians with disabilities lived in poverty—a rate double the national average. With initial CPP disability approval rates hovering around 60%, knowing how to effectively fight a denial is crucial for getting the financial support you need to live.

The process can get even trickier when you’re dealing with a private insurance company. If you’ve been denied by an insurer, knowing what to do next is critical. For more guidance, read our article on what to do when your long-term disability claim is denied.

At this stage, bringing in a disability lawyer can be a game-changer. They have the expertise to navigate the complex appeals process and fight for the benefits you rightfully deserve.

Your Top Questions About Applying for Disability in Canada

When you’re navigating a disability claim in Canada, you’re bound to have a lot of questions. It’s a complex system, and getting straight answers can make all the difference. Let’s tackle some of the most common questions we hear from our clients across the GTA and Ontario.

Can I Still Work While on Disability?

This is probably the number one question people ask, and for good reason. The short answer is: it depends entirely on which program is paying your benefits.

For CPP Disability, the government recognizes that you might be able to do some work. You’re allowed to earn up to a certain amount—for 2024, that magic number is $6,800 (gross) for the year—without it affecting your benefits. This is designed to let you test your ability to work, but be careful. If you earn more than that, it can trigger a review of your file.

ODSP has a different set of rules. The program actually encourages you to work if you can. You can earn up to $1,000 net in a month without any clawback on your ODSP payment. Once you go over that, your benefits are reduced by 75 cents for every dollar you earn.

And then there’s private long-term disability (LTD). These policies are all unique. Each has its own rules about returning to work or earning income, so you absolutely have to read the fine print in your specific policy.

The Bottom Line: At its core, being on “disability” means your medical condition stops you from holding down a regular, paying job. While some programs let you earn a small amount, going over their limits sends a signal that you might be capable of working, which could put your benefits at risk.

How Do Different Disability Benefits Work Together?

It’s really common to be eligible for more than one type of benefit, and it’s critical to understand how they affect each other. They don’t just stack up.

Think of it this way: if you get approved for both a private LTD plan and CPP Disability, your insurance company won’t pay you the full amount of both. They will almost certainly reduce your LTD payment by the exact amount you get from CPP. This is called an “offset,” and it’s a standard part of nearly every group insurance policy in Canada.

The same thing happens with provincial support. If you’re on ODSP and then get approved for CPP Disability, your ODSP payment will be reduced dollar-for-dollar by whatever you receive from CPP. The system is designed to provide a financial safety net, not to let you collect multiple full benefits.

That’s why you must report any disability income you receive from one program to the others. It keeps you out of trouble and prevents you from having to pay back a hefty overpayment down the road.

Navigating the complexities of a disability claim requires knowledge and experience. If your application has been denied or you need guidance at any stage of the process, UL Lawyers is here to help. Contact us for a free consultation to ensure your rights are protected. Learn more at https://ullaw.ca.

Related Resources

A Guide to the CPP Disability Calculator in Ontario

Continue reading A Guide to the CPP Disability Calculator in OntarioNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies