A Practical Guide to Prenuptial Agreements in Canada

Let’s clear the air about prenuptial agreements. In Canada, and what we call a marriage contract in Ontario, this document is a smart legal tool couples use before they marry. Its purpose is to lay out a clear plan for financial matters, like assets and support, in case the relationship ever ends.

It’s not about planning for divorce; it’s about responsible financial planning for your life together. Think of it like home insurance—you hope you never need it, but you have it for security and peace of mind.

What Is a Prenuptial Agreement in Ontario?

There’s a common myth that prenups are only for the super-rich or for people who don’t trust their partner. That couldn’t be further from the truth. In reality, they are practical, collaborative tools for any couple starting a life together.

Imagine creating a financial roadmap before you start your journey. That’s what a marriage contract does. It gets you and your partner on the same page about your financial future right from the start.

In Ontario, the Family Law Act gives couples the power to create their own rules for dividing property and handling spousal support. If you don’t create your own rules, the province’s default laws will apply, and those might not fit your unique situation. This process isn’t just about legal protection; it forces you to have honest, open conversations about money, which is a key ingredient for any strong marriage.

A Modern Approach to Financial Planning

More and more couples across Canada are choosing to sign prenups, and it makes a lot of sense when you look at how society has changed. People are getting married later in life. This often means they’re coming into the marriage with their own assets, a growing business, investments, or even significant debt.

According to Statistics Canada, the average age at marriage has been climbing for years. As a result, more people have complex financial lives they need to organize before saying “I do.” You can see how these marriage trends are shaping financial decisions by reading this Global News report.

A well-drafted marriage contract can tackle several key issues:

- Asset Protection: You can clearly state that certain assets—like a family business, an inheritance, or the cottage—will remain separate property.

- Debt Responsibility: It can specify who is responsible for debts brought into the marriage or accumulated during it, protecting you from your partner’s financial liabilities.

- Spousal Support: You can set out the terms for spousal support, agree on an amount, or even waive it entirely.

- Estate Planning: A marriage contract can be a crucial part of a bigger financial picture. It should work alongside your other legal documents, which you can learn more about in our guide on wills and estate law.

Beyond Married Couples: Cohabitation Agreements

What about common-law partners? There’s a document for that, too. It’s called a cohabitation agreement, and it serves the exact same purpose. It sets out rules for property and support, offering legal protections that common-law couples in Ontario don’t automatically receive.

And if you sign a cohabitation agreement and later decide to get married, it can automatically convert into your marriage contract.

When you reframe the conversation from one of doubt to one of smart financial planning, a marriage contract becomes a tool for building a transparent and secure future together. It is an act of mutual respect and foresight.

Will Your Prenup Hold Up in a Canadian Court?

Having a signed prenuptial agreement (or a “marriage contract” as it’s called in Ontario) can give you a real sense of security. But for that security to mean anything, the document has to be ironclad. A Canadian court won’t just rubber-stamp an agreement because you signed it; it has to meet some pretty strict legal tests to be considered valid and binding.

Think of it like building a house. You wouldn’t skip the foundation, right? In the world of Canadian prenups, that foundation is built on three critical pillars. If even one of them is weak, the whole agreement could come tumbling down if it’s ever challenged in court. These pillars are all about ensuring the agreement is fair and that both of you entered into it honestly.

For your prenup to be enforceable, it must first include the essential elements of an enforceable contract—things like an offer, acceptance, and so on. But family law, especially in provinces like Ontario, adds specific, crucial layers of protection on top of that.

Pillar 1: Full and Honest Financial Disclosure

The first pillar is total transparency. You and your partner must provide full and honest financial disclosure. This means every single financial card goes on the table. No holding back.

This isn’t just a quick chat over dinner about your finances. It’s a formal process of exchanging detailed financial statements and supporting documents.

- Assets: List everything you own. This means bank accounts, investments, real estate, business interests, vehicles, and even valuable personal items.

- Debts: You also have to disclose every penny you owe, from mortgages and lines of credit to student loans and credit card balances.

- Income: A clear, documented picture of your earnings from every source is mandatory.

Trying to hide an asset or conveniently forgetting a significant debt is a surefire way to have a court throw out the entire agreement later. The logic is simple: you can’t make a fair deal if you don’t have all the facts.

Pillar 2: Independent Legal Advice (ILA)

This second pillar is arguably the most critical safeguard: Independent Legal Advice (ILA). Each of you needs to have your own separate lawyer review the agreement. This isn’t just a friendly suggestion—it’s a cornerstone of enforceability in Canada.

Your lawyer’s job is to make sure you truly understand what you’re signing. They’ll walk you through the terms, explain what rights you’re giving up, and spell out the potential consequences down the road. It proves you’re signing with your eyes wide open.

An ILA certificate, which is signed by each lawyer, acts as powerful proof that both parties were properly advised and understood what they were agreeing to. This makes it incredibly difficult for someone to later claim they didn’t know what they were signing.

A court will be deeply suspicious of any marriage contract where one or both people didn’t get ILA. This step protects both the financially weaker partner and the partner with more assets to protect.

Pillar 3: Freedom from Duress and Undue Influence

The final pillar is ensuring the agreement was signed freely and voluntarily. There can’t be any pressure, threats, or manipulation involved. In legal terms, this is called signing without duress or undue influence.

A solid prenup is the product of calm, thoughtful negotiation, not a last-minute power play. The classic example of duress? Presenting your partner with the agreement the night before the wedding and saying, “sign this, or the wedding is off.” That won’t fly.

An Ontario court has the power to invalidate a contract if it believes one person was unfairly pressured, manipulated, or simply didn’t have the mental capacity to consent. This is why starting the prenup process months before the wedding is so important—it gives everyone plenty of time and shows the decision was made without improper pressure.

Ignoring these fundamental principles can lead to serious legal challenges, much like what happens in other contract disputes. To get a better sense of the potential consequences, you can read our guide on breach of contract remedies.

What Goes Into an Ontario Marriage Contract? The Key Clauses

Once you’ve handled the crucial steps of financial disclosure and getting independent legal advice, it’s time to actually build the agreement. Think of a marriage contract as a blueprint for your financial life together, constructed from specific clauses. Each clause is a building block that creates a clear, strong, and legally sound structure.

Once you’ve handled the crucial steps of financial disclosure and getting independent legal advice, it’s time to actually build the agreement. Think of a marriage contract as a blueprint for your financial life together, constructed from specific clauses. Each clause is a building block that creates a clear, strong, and legally sound structure.

These aren’t just stuffy legal formalities. They are the practical, real-world instructions that will guide you through specific “what if” scenarios. Whether it’s shielding a family business from a potential split or deciding how spousal support might work, the details in these clauses are what give the agreement its teeth.

Let’s break down the essential pieces that form the foundation of most marriage contracts in Ontario.

Property Division and the Matrimonial Home

One of the main reasons people get a prenup is to create their own rules for dividing property. In Ontario, the Family Law Act has a default setting: most assets built up during the marriage get split 50/50 through a process called equalization. A marriage contract lets you switch off that default and design a system that works for you.

For instance, you could agree that the business you’ve poured your heart into will always remain yours, and any increase in its value won’t be shared if you separate. This is a go-to strategy for entrepreneurs across Burlington and the GTA looking to protect their livelihood.

But there’s one major exception everyone needs to know about: the matrimonial home. In Ontario, the law gives this property special status. No matter what your contract says, both spouses have an equal right to possess the home, and its value is almost always divided equally upon separation. This is one rule you can’t contract out of.

Protecting Specific Assets

Many of us enter a marriage with assets we’ve worked hard for or inherited, and we want to keep them separate. A marriage contract is the perfect vehicle for this. You can literally list specific items and state that they are off-limits when it comes to dividing family property.

Some of the most commonly protected assets include:

- Inheritances and Gifts: You can make it crystal clear that any future inheritance or a significant gift from your family belongs only to you.

- Business Interests: A clause can stipulate that your shares in a company are not subject to equalization, which protects not just you, but your business partners and employees too.

- Pre-Marriage Investments and Savings: You can specify that certain investment portfolios or savings accounts you had before the wedding day remain entirely yours.

Getting this down on paper prevents a world of confusion and potential arguments later on. It also gives tremendous peace of mind to family members who might be gifting you assets or passing down an inheritance.

Addressing Debts and Liabilities

It’s not just about assets; it’s about debts, too. A marriage contract can clearly map out who is responsible for which debts. This is a big deal, especially if one partner is bringing significant student loans, business debts, or a line of credit into the relationship.

The agreement can state that each of you is solely responsible for the debts you had before the marriage. This simple clause ensures you won’t suddenly become liable for your partner’s pre-existing financial obligations.

Spousal Support Provisions

Spousal support is another area where a marriage contract gives you control. You and your partner can be proactive and decide on the terms of support long before it ever becomes an issue.

You have a ton of flexibility here. You could agree to a set amount or timeline for support, or even create a formula to calculate it based on how long you were married and your respective incomes. It’s also possible to include a full waiver, where both parties agree to give up their right to ever seek spousal support from the other.

It’s crucial to remember that a court can set aside a spousal support waiver if enforcing it would be unconscionable or create extreme financial hardship for one person at the time of separation. Canadian courts will always prioritize fairness.

What Can and Cannot Be Included in a Canadian Prenup

While prenuptial agreements in Canada offer plenty of freedom to customize your financial future, there are some hard legal lines you cannot cross. The following table breaks down what’s fair game and what’s strictly off-limits.

| Permissible Clauses (Can Be Included) | Prohibited Clauses (Cannot Be Included) |

|---|---|

| How to divide property acquired during the marriage. | Any clauses related to child custody or decision-making responsibility. |

| Protection of specific assets (like inheritances or businesses) from division. | Rules about parenting time (formerly access) schedules. |

| Responsibility for pre-marriage and post-marriage debts. | Agreements to waive or set child support amounts. |

| Spousal support amounts, duration, or a complete waiver. | Any terms that are considered unconscionable or against public policy (e.g., promoting divorce). |

| Ownership and division of the matrimonial home (though possession rights and value are protected). | Instructions about day-to-day household chores or personal matters. |

| Management of joint bank accounts or investments. | Anything that illegally restricts a person’s rights. |

Essentially, marriage contracts are for financial matters, not for children. Ontario law is firm: a marriage contract cannot make decisions about your kids.

Specifically, you cannot include clauses that dictate:

- Child Custody or Decision-Making: Who gets to make decisions about a child’s health, education, and well-being is not something you can sign away in a prenup.

- Parenting Time or Access: You can’t pre-determine a living schedule for your children.

- Child Support: The obligation to pay child support and the amount are governed by federal guidelines. This right belongs to the child and cannot be negotiated away by the parents.

Courts will always decide these issues based on the best interests of the child at the time of separation. Any part of your agreement that tries to deal with these topics will simply be ignored by a judge. Similarly, things like appointing an executor belong in a will, and if you need to plan for managing finances during the marriage due to incapacity, it’s best to learn what is power of attorney for property.

The Step-by-Step Process to Create a Valid Prenup

Putting a legally solid prenuptial agreement in place isn’t something you rush. Think of it less as a sprint to the finish line and more like building a custom piece of furniture—it takes careful planning, the right tools, and a collaborative spirit to make sure the final product is strong and built to last.

Here’s a clear roadmap for creating an Ontario marriage contract that’s not only fair but also structured to stand up in court.

Step 1: Start with an Open Financial Dialogue

Before a single legal document is drafted, the real work begins with a conversation. The very first step is for you and your partner to sit down and talk openly and honestly about your financial lives, goals, and expectations. This dialogue is the foundation for your entire agreement.

This is your chance to get on the same page about individual assets and debts, spending habits, and what you both imagine for your financial future. When you approach this talk with transparency and mutual respect, the process shifts from a cold legal formality to a powerful exercise in building your partnership.

Step 2: Gather Your Financial Documents

Once you’ve had those initial talks, it’s time to get the paperwork together to back them up. This is the full financial disclosure phase, and in Canada, it’s a non-negotiable step for a valid prenup. Each of you needs to create a complete and accurate snapshot of your financial health.

This means pulling together documents like:

- Statements for bank accounts and investment portfolios.

- Recent pay stubs and tax returns to show your income.

- Deeds and mortgage statements for any property you own.

- Valuations for business interests or other significant assets.

- Statements for all debts, from student loans to credit cards and lines of credit.

Being meticulous here is crucial. Attempting to hide an asset or downplay a debt can put the entire agreement at risk of being thrown out later. This step also gives your respective lawyers the hard data they need to advise you properly. A comprehensive checklist, like the one in our guide to estate planning in Canada, can be a huge help in keeping your financial information organized.

Step 3: Hire Independent Legal Counsel

This part is mandatory in Ontario: each partner must hire their own separate family lawyer. There’s no “one lawyer for both of us” option when you’re creating a marriage contract. This principle is known as Independent Legal Advice (ILA), and it’s a critical safeguard to ensure the agreement is fair and that both of you truly understand what you’re signing.

Your lawyer is there to look out for your best interests, explain your rights and obligations under the law, and make sure the contract is drafted correctly. Having two separate lawyers is proof that neither of you was pressured or taken advantage of, which makes the agreement much stronger against any future legal challenges.

Step 4: Negotiate and Draft the Agreement

With your lawyers on board, the negotiation begins. Your lawyer will work with your partner’s lawyer to draft an agreement that reflects the decisions you’ve made together. This is a back-and-forth process where terms are proposed, reviewed, and tweaked until everyone is satisfied.

This is the stage where you nail down the specifics, from defining what counts as separate property to outlining how spousal support will be handled. Your lawyer’s job is to make sure the language is precise and legally sound, leaving no room for misunderstanding.

People always ask about the cost. While it can vary, reports in Canada show that a standard prenuptial agreement, where both sides have their own lawyer, typically costs between CAD $2,500 and CAD $5,000. You can find more insights into the economics of prenups on Canadian Lawyer Mag.

Step 5: Sign the Agreement Correctly

The final step is making it official. For an Ontario marriage contract to be valid, it must be in writing, signed by both of you, and have your signatures witnessed.

This isn’t a moment to be rushed. The best practice is to have the agreement finalized and signed several months before the wedding day. This timing helps show that the decision was made thoughtfully and without any last-minute pressure, which further solidifies its standing as a fair and voluntary contract.

Common Myths About Canadian Prenups Debunked

Mention a “prenuptial agreement,” and most people’s minds jump straight to Hollywood breakups and dramatic courtroom battles. In Canada, though, the reality of these documents—often called marriage contracts here—is much more grounded and practical. It’s time to clear the air and bust some of the most common myths.

The stigma around prenups often comes from old-fashioned ideas about marriage. But today’s relationships are partnerships built on transparency and smart planning. Let’s make sure our understanding of these agreements reflects that modern reality.

Myth 1: Prenups Are Only for the Ultra-Rich

This is probably the most persistent myth out there. While it’s true that wealthy people use prenups to protect major assets, these agreements are just as valuable for everyday Canadians.

Think about the financial landscape of a modern couple. It’s common for people entering a marriage to already have:

- Individual assets: Maybe you have savings, some investments, or a car you paid off yourself.

- Business interests: You might be a freelancer, own a small business, or be a partner in a startup.

- Pre-existing debt: Student loans and lines of credit are a fact of life for many.

- Future inheritances: You may want to ensure that a future inheritance from your family stays with you.

A prenup simply provides a clear, mutually agreed-upon plan for these everyday financial realities. It’s a smart tool for almost anyone, not just millionaires.

Myth 2: Asking for a Prenup Means You Expect to Divorce

This is a big one. It’s easy to see why someone might think bringing up a prenup is a bad omen for the relationship. But it’s much more accurate to view it as an exercise in building trust and being open with each other.

Talking about a prenup isn’t about planning an escape route; it’s about building a stronger foundation for your future. It forces you to have candid conversations about money, your goals, and what you both expect from the partnership—discussions that are crucial for any healthy marriage.

Ultimately, it’s about setting the financial ground rules together so you can move forward as a united team, free from ambiguity.

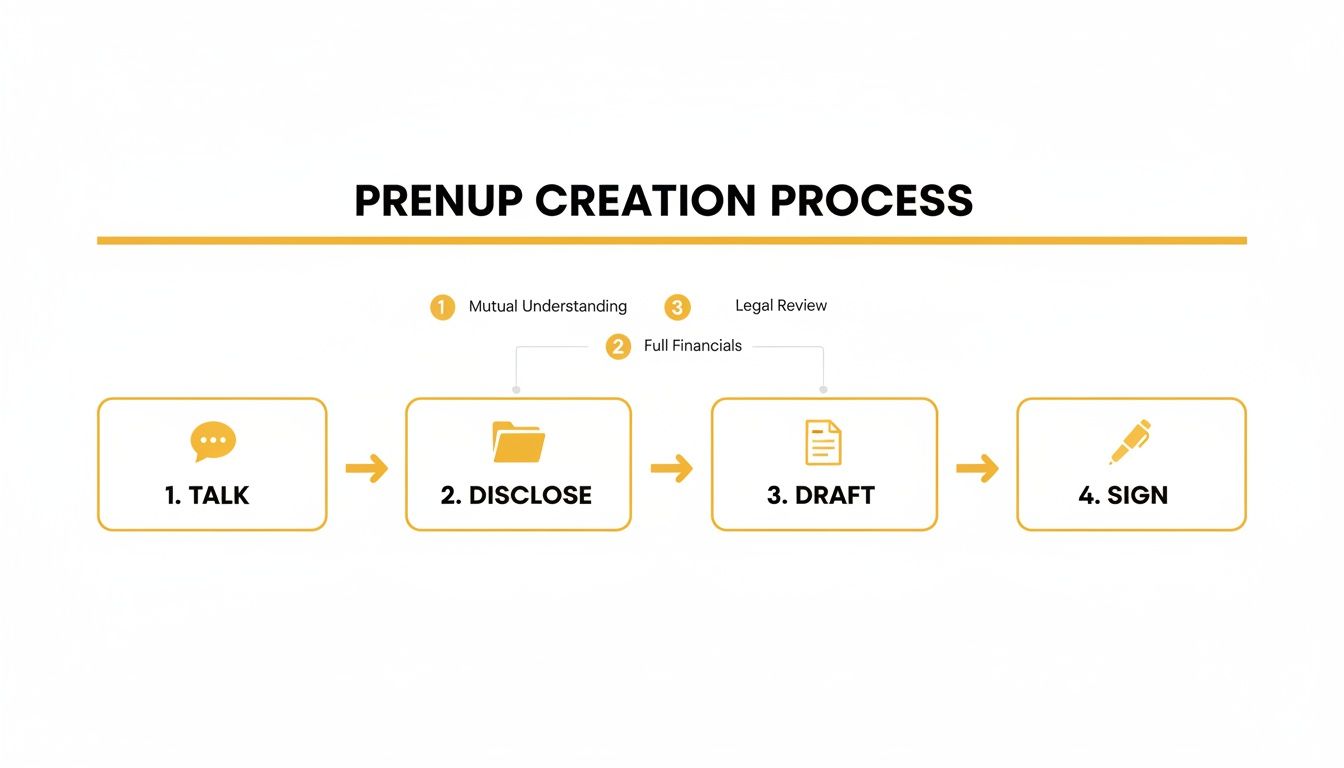

This infographic breaks down the simple, collaborative steps involved, showing it’s a structured conversation, not a conflict.

As you can see, the process is built on communication and independent legal advice, which ensures both partners are on equal footing from the very beginning.

As you can see, the process is built on communication and independent legal advice, which ensures both partners are on equal footing from the very beginning.

Myth 3: A Handshake Deal Is Good Enough

Some couples think a simple verbal understanding—“what’s mine is mine, and what’s yours is yours”—will hold up. Unfortunately, when it comes to the law in Canada, these informal chats are completely unenforceable.

Without a legally sound, written marriage contract, the default property division laws in your province will automatically apply if you ever separate. In a place like Ontario, that typically means an equal split of all wealth built up during the marriage. If you want to set your own terms, you absolutely need a formal agreement that ticks all the legal boxes.

There’s a clear generational shift happening in how people view these agreements. Recent survey data shows younger Canadians are much more open to prenups than older generations. For instance, a 2025 TD Bank survey found that 52% of Gen Z respondents would want their partner to sign a prenup, a stark contrast to the national average of just 31%. You can dig deeper into these generational trends from TD’s findings. It’s clear that for many, prenuptial agreements in Canada are becoming a normal, responsible part of building a life together.

How to Start the Prenup Conversation with Your Partner

Let’s be honest, bringing up a prenup can feel like the single most awkward part of getting married. But it doesn’t have to be. With the right approach, this conversation can shift from a source of anxiety to a really productive, positive step for your relationship.

The trick is to frame it as what it truly is: a collaborative financial planning exercise, not a pre-planned exit strategy.

Timing and tone are everything here. Don’t spring it on your partner right after the proposal or, worse, in the middle of a fight. The best time is during a calm, quiet moment when you’re already dreaming about your future together—maybe when you’re discussing buying a house, saving for a big trip, or even just talking about your career goals.

Framing the Discussion Productively

Think of this as a team huddle. You’re working together to build a strong financial foundation, and that starts with getting on the same page about everything.

Here are a few ways you could gently open the door to the topic:

- “As we’re making all these exciting plans, I think it would be a really smart move for us to map out our finances with a marriage contract. It would help us align on everything from our current assets to our debts.”

- “You know my family’s business/property? We should probably figure out a clear legal plan for it. A prenup would protect it, which ultimately protects both of us down the road.”

- “Since we’re about to merge our lives in every other way, why don’t we create a clear financial roadmap too? A marriage contract is just a tool to make sure we’re being totally transparent and fair from day one.”

The goal is to present a prenuptial agreement as a tool for strengthening your partnership. It’s about ensuring clarity and security so you can focus on building your life together without financial ambiguity hanging over your heads.

As family lawyers who have guided countless couples in Burlington and across the GTA through this, we know how sensitive this is. Sometimes, having a neutral third party in the room can make all the difference, creating a comfortable space to explore your options where both of you feel heard, secure, and respected.

This kind of proactive legal planning is a smart move in many areas of family life. For example, understanding the legal landscape is just as crucial for couples navigating international ties, a topic we cover in our guide on spousal sponsorship in Canada.

Frequently Asked Questions About Prenups in Canada

It’s completely normal to have a lot of questions when you start thinking about a prenuptial agreement in Canada. People often wonder about the cost, the best time to start, or what happens if they move provinces. To help, we’ve gathered some of the most common questions we hear from our clients right here in Burlington and across Ontario.

Think of this as a practical Q&A session. We’ll cut through the legal jargon and give you straightforward answers based on our experience with Canadian family law.

How Much Does a Prenup Cost in Ontario?

The cost of a marriage contract isn’t set in stone, but you should view it as an investment in your financial clarity and future. Generally, a well-drafted agreement in Canada will run anywhere from $2,500 to $5,000.

So, what does that price tag cover? It includes all the critical steps to make sure your agreement is legally sound: initial consultations with your lawyers, the back-and-forth of drafting and negotiating the terms, a thorough review of each person’s financial disclosure, and the formal signing ceremony.

The final bill really depends on how complex your financial picture is and how much negotiation is needed. If your assets are straightforward, you’ll be on the lower end of the scale. But if you’re dealing with things like a family business or property in another country, expect the cost to reflect that extra work.

When Is the Best Time to Get a Prenup?

This is a big one: timing is everything. Ideally, you should kick off the process at least 3 to 6 months before your wedding. Whatever you do, don’t leave this to the last minute.

Starting early does two very important things. First, it gives you and your partner the space to have calm, open conversations without the stress of the wedding looming over you. Second, it adds a layer of legal protection. A judge is far more likely to see an agreement as fair and valid if it was clearly negotiated over a reasonable timeline, not sprung on someone a week before the big day.

If there’s one thing to remember, it’s that a rushed prenup is a risky prenup. Handing your partner a contract just before you walk down the aisle can look like coercion, which is a classic reason for a court to throw it out later.

What Happens if We Signed a Prenup in Another Country?

This situation comes up more than you might think. If you have a prenup from another country but are now separating here in Ontario, that agreement isn’t automatically rubber-stamped by our courts. An Ontario judge will need to take a close look at it first.

The court will assess whether the foreign agreement holds up to Canadian standards. Was there full and honest financial disclosure? Did both of you have your own independent lawyers? Was it signed freely, without pressure? They’ll also check if enforcing the agreement would be grossly unfair or go against fundamental Ontario legal principles.

If your foreign prenup falls short on these points, the court has the authority to change its terms or even set it aside completely.

Working through the details of a marriage contract requires advice that’s specific to your life and your goals. At UL Lawyers, we specialize in crafting fair, solid agreements that give you peace of mind. Contact us today for a consultation to get started.

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies