Guide: Challenging a Will in Ontario for Contesting an Estate Effectively

Challenging a will in Ontario isn’t just about disagreeing with it; it’s a formal legal process you can start if you have a legitimate reason to believe the will is invalid or deeply unfair. It means going to court to dispute the document, usually based on specific concerns like the will-maker’s mental state, pressure from others, or a failure to follow the legal rules for signing.

Understanding Your Right to Contest a Will

Seeing a loved one’s will for the first time can be a shock, especially when you’re already grieving. What if the document doesn’t match the promises they made to you for years? Or what if it seems completely out of character, leaving you and your family in a precarious financial spot? It’s a gut-wrenching experience.

The most important thing to know is that you have options. The law in Ontario provides clear, established pathways for challenging a will, and you don’t have to navigate this complicated situation on your own.

Why More People Are Contesting Wills

These days, estate disputes are happening more often. We’ve seen a noticeable shift in our practice, and the numbers back it up. Data from the Superior Court of Justice reveals a 25% rise in wills and estates litigation between 2015 and 2023. Just in 2022, around 1,200 applications to challenge wills were filed in the province.

Many of these cases involve claims under Ontario’s Succession Law Reform Act (SLRA), which has very strict deadlines for dependants seeking support. It’s a complex area of law, and the stakes are high.

This guide is here to cut through the confusion and give you the confidence to figure out your next steps. I’ll walk you through the real legal grounds for a will challenge and translate the jargon into plain English.

A will is meant to be a person’s final, freely made decision. When there’s a good reason to believe it isn’t—because of coercion, mental decline, or outright deception—the law provides a way to set things right.

What This Guide Will Cover

My goal is to give you the practical knowledge you need to protect your rights. Here’s what we’ll go over, step by step:

- Valid Legal Grounds: What are the legally accepted reasons to challenge a will? We’ll cover the big ones, from lack of mental capacity to undue influence.

- The Process Explained: How does a will challenge actually work in court? I’ll outline the key steps, from filing the first documents to mediation and settlement talks.

- Critical Timelines: Timing is everything. You’ll learn about the strict deadlines that can make or break your case.

- Costs and Outcomes: Let’s talk about the bottom line. What can you realistically expect when it comes to legal fees and the potential results?

If you’re looking for a solid overview of the general process, reading up on how to contest a will can give you a good foundation. While the details vary between jurisdictions, the core principles are often quite similar.

This can be a tough road, but getting a handle on the basics is the first step toward a fair resolution. For more in-depth information on related topics, you can always explore our resource hub on https://www.ullaw.ca/resource/wills-and-estate-law.

The Four Main Reasons a Will Can Be Invalidated

Challenging a will in Ontario isn’t about whether you think the distribution was “fair.” The courts don’t weigh in on hurt feelings or family disagreements. Instead, a successful challenge hinges on proving the will itself is legally invalid.

Think of it this way: the law has a checklist for what makes a will legitimate. If the circumstances surrounding its creation fail to tick those boxes, you may have a case. While every family situation is different, nearly all successful will challenges in Ontario fall into one of four key categories.

Lack of Testamentary Capacity

This is probably the most common reason we see wills contested. For a will to be valid, the person who made it—the testator—must have had what’s called testamentary capacity at the very moment they signed the document. This isn’t just a general medical state; it’s a specific legal standard.

In plain English, the testator needed to be of “sound mind, memory, and understanding.” The courts will look for evidence that they clearly understood three things:

- The fact they were making a will and what that meant.

- The general nature and value of the assets they were giving away.

- Who the people are that would normally have a claim to their estate (like a spouse or kids), even if they ultimately decided to leave them out.

Just being elderly, physically weak, or even having a dementia diagnosis doesn’t automatically disqualify a will. The crucial question is: what was their mental state when they put pen to paper?

A Real-World Scenario

Picture an 88-year-old father in Mississauga who suddenly drafts a new will just weeks after being diagnosed with Alzheimer’s. This new will leaves his entire estate to a neighbour he barely knows, completely cutting out his two children who have cared for him for years. This is a classic red flag.

The children could challenge the will based on his lack of capacity. To build their case, their lawyer would start digging for evidence like:

- Medical Records: A family doctor’s notes, cognitive test results, and reports from specialists are invaluable for showing a pattern of decline.

- Witness Testimony: What did family, friends, and caregivers see? Statements describing confusion, memory lapses, or erratic behaviour around the signing date are powerful.

- The Drafting Lawyer’s File: The notes from the lawyer who prepared the will can be a goldmine. Did they take proper steps to assess his capacity, or did they just push the paperwork through?

A key piece of evidence in these cases is often a Mini-Mental State Examination (MMSE) score. In fact, many successful capacity challenges point to scores below 24 out of 30. This was a significant factor in the major 2018 Ontario case Royal Trust Corp. v. Struth, which ultimately invalidated a $5 million bequest due to capacity concerns.

Undue Influence and Coercion

This is a darker, more difficult ground to prove. It alleges that the testator wasn’t making their own choices but was instead being manipulated, pressured, or outright bullied by someone else. Undue influence isn’t just nagging or persuasion; it’s when someone’s free will is so overpowered that the resulting will reflects the influencer’s wishes, not the testator’s.

The person pulling the strings is often in a position of trust—a caregiver, a new romantic partner, or even one of the children. Since this manipulation usually happens in private, proving it means looking for suspicious patterns and red flags.

Courts often look for tell-tale signs:

- Isolation: The influencer systematically cuts the testator off from other family members and friends.

- Dependence: The testator becomes completely reliant on the influencer for their daily needs, giving them immense power.

- Sudden Changes: A brand-new will appears, drastically altering a long-standing estate plan without a logical explanation.

- Secrecy: The will is prepared in secret, often with a lawyer the family has never heard of.

Improper Execution or Formal Invalidity

Ontario’s Succession Law Reform Act is extremely particular about how a will must be signed and witnessed. If these strict technical rules—known as the formalities of execution—aren’t followed to the letter, a court can throw the will out, no matter what the testator intended.

For most wills in Ontario, the core requirements are:

- The will has to be in writing.

- The testator must sign it at the very end of the document.

- That signature must be made (or acknowledged) in front of two or more witnesses, all present at the same time.

- Those two witnesses also have to sign the will in the testator’s presence.

A simple mistake can have huge consequences. For instance, if a beneficiary acts as a witness, they won’t invalidate the whole will, but they will lose any gift left to them. A bigger error, like the testator signing alone and getting witness signatures later, can make the entire document worthless. If you want to see how it’s done correctly, our guide on how to make a valid will in Ontario breaks it down.

Fraud or Forgery

This is exactly what it sounds like, but it can be the hardest claim to prove. A challenge on these grounds argues the will is a complete sham. This can take a few forms:

- Outright Forgery: Someone simply faked the testator’s signature.

- Fraudulent Inducement: The testator was tricked into signing the will, believing it was some other document, like a power of attorney or a greeting card.

- Deception: The will was based on lies. For example, a son might tell his aging mother that his sister has a serious gambling problem (when she doesn’t), convincing the mother to write her out of the will. The will is technically signed by the mother, but it’s based on fraud.

Proving forgery might require a handwriting expert, while proving deception means finding concrete evidence of the lies. These cases are less frequent, but when you have the proof, they are incredibly strong.

Securing Support for Dependants Left Out of a Will

Sometimes, challenging a will isn’t about whether the person who wrote it was sound of mind. It’s about fairness. What happens when a spouse, a child, or another dependant is left out in the cold, without the support they relied on?

This is where a powerful legal tool comes into play: the dependant’s relief claim. Governed by Ontario’s Succession Law Reform Act (SLRA), this type of claim doesn’t argue that the will is invalid. Instead, it argues that the will fails to provide for someone the deceased had a moral and financial duty to support. Essentially, it allows a court to step in and rewrite the will to make things right.

Who Actually Qualifies as a Dependant in Ontario?

The term “dependant” is broader than most people think. It’s not just about minor children. The law in Ontario opens the door for several people who were relying on the deceased for financial support.

You might have a claim if you are the deceased’s:

- Spouse: This includes legally married partners.

- Common-law Partner: You need to have lived together for at least three years, or have been in a lasting relationship and had a child together. For a deeper dive, check out our guide on what is considered a common-law marriage in Canada.

- Parent: This applies if the deceased was providing support to you, or was legally required to.

- Child: This covers biological and adopted children, and even step-children if the deceased treated them as their own.

- Sibling: A brother or sister can qualify if the deceased was supporting them or had an obligation to do so.

This means an adult child who was still financially reliant on a parent—perhaps due to a disability or because they were still in school—could have a strong case for support from the estate.

The court’s main goal is to ensure “adequate provision” for the dependant. This isn’t a one-size-fits-all formula. It’s a flexible concept that depends entirely on a family’s unique situation, and judges will look at the entire picture before making a call.

What Does “Adequate Support” Really Mean?

There’s no magic number here. The court weighs many different factors to figure out what is fair and necessary for the dependant to live properly.

Here are some of the key things a judge will look at:

- The dependant’s current and future financial needs.

- The size of the estate—is there enough to go around?

- The standard of living the dependant was used to.

- The dependant’s age, physical health, and mental well-being.

- Any existing agreements, like a separation agreement or court order.

- The deceased’s legal and moral obligations to the dependant.

Let’s Look at a Real-World Scenario

Imagine a woman in Burlington who was in a common-law relationship for 20 years. She ran the household and cared for her partner, but he died with an old will that left everything to a distant sibling he hadn’t seen in years. She’s left with nothing. This is a classic case for a dependant’s relief claim. A court would almost certainly find that her partner had a moral obligation to provide for her and would order a significant chunk of the estate to be redirected to her support.

The statistics back this up. For estates over $1 million, spouses and dependent children who bring these claims succeed about 55% of the time. What’s more, 78% of successful claims by spouses end up with an award of 30-50% of the entire estate.

The Unforgiving Six-Month Deadline

If you think you have a claim as a dependant, time is not on your side. The SLRA imposes a strict six-month limitation period to file your claim. That clock starts ticking the moment the court officially grants the Certificate of Appointment of Estate Trustee (what most people call “probate”).

Missing this deadline is usually fatal to your case. The court has very little power to grant an extension, and it’s rarely done. This is why getting legal advice right away is absolutely crucial if you’ve been left out of a will and need support.

The Practical Steps of a Will Challenge

Knowing you have grounds to challenge a will is the first hurdle. But what happens next? The journey from suspicion to resolution can feel overwhelming, but it follows a pretty clear path—and most of the time, it doesn’t end up in a courtroom drama.

Let’s walk through what actually happens, step-by-step, so you know exactly what to expect.

Building Your Case: It Starts with Evidence

Before a single court document is filed, the real work begins. Your first and most important task is to gather the proof that supports your claim. Think of it as building a strong foundation; without it, the whole case can collapse.

What you’ll need depends entirely on why you’re challenging the will:

- For mental capacity claims: We’re looking for medical records, doctor’s notes, or hospital reports that paint a picture of cognitive decline or a specific diagnosis like dementia.

- For undue influence: We’ll dig into financial records. Bank statements, property deeds, and investment reports can expose strange transactions or sudden, unexplained changes that favour one person.

- For any claim: Personal communications are gold. Emails, texts, and even old letters can reveal the deceased’s true intentions, their state of mind, or the nature of their relationship with the person who benefited from the will.

A vague feeling that something is “off” isn’t enough to get started in an Ontario court. You need to come to the table with tangible proof that casts serious doubt on the will’s validity.

Pressing Pause on the Estate

Once you’ve got a solid base of evidence, the first legal move is to stop the estate from being paid out. The last thing you want is for all the assets to be distributed before your challenge is even heard.

Your lawyer does this by filing a Notice of Objection with the court. It’s a straightforward but incredibly powerful document. It effectively freezes the entire estate administration, letting the court and the executor know there’s a dispute. This ensures the money and property are still there if you win.

This is where the formal legal process kicks into gear. If you’re curious about how this intersects with the standard duties of an executor, our guide on how to probate a will in Ontario provides a good overview of the normal process.

The Court Process and Getting the Facts Straight

With the estate on hold, the next move is to file a formal court application. This document is where we lay out your entire case in detail: who you are, the legal grounds for the challenge, and what you’re asking the court to do.

This triggers a phase called discovery, which is all about transparency. Both sides must show their hands, exchanging all relevant documents and evidence. You’ll see everything they have, and they’ll see everything you have. No surprises.

The discovery phase is the moment of truth. It’s where the strengths and weaknesses of each side become crystal clear, forcing everyone to get realistic. This is precisely why the vast majority of cases never make it to trial.

During discovery, lawyers can also conduct examinations under oath. These aren’t held in a courtroom but in a boardroom, where we can ask direct questions to the opposing party and lock in their testimony. All that evidence you gathered earlier? This is where it pays off.

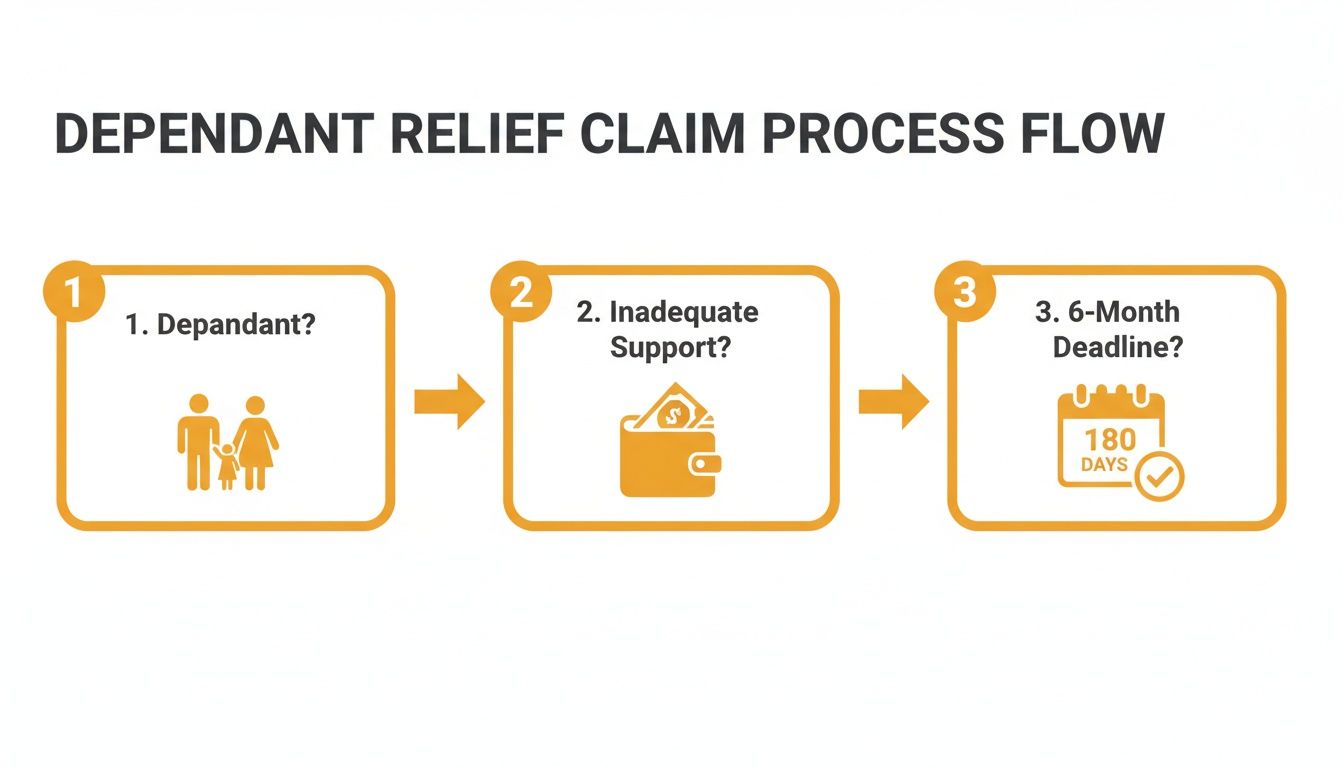

This infographic gives you a quick visual on the key questions for a dependant’s relief claim—one of the more common types of will challenges.

It boils down to three core tests: proving you are a dependant, showing the will didn’t provide for you adequately, and, critically, acting within the tight six-month deadline.

Finding a Solution Without a Trial

Forget what you see on TV. The reality is that very few will challenges end up in a drawn-out courtroom battle. In my experience, well over 90% of estate disputes in Ontario are resolved through negotiation or mediation.

In major centres like Toronto, Ottawa, and Windsor, mediation is a required step. It’s a process where a neutral third-party mediator helps both sides talk, find common ground, and hammer out a settlement that works for everyone.

It’s less formal, far cheaper, and infinitely less stressful than a trial. The goal is to find a practical compromise that lets the family move on and the estate finally get settled.

Roadmap of a Typical Will Challenge

To give you a clearer picture, here’s a rough timeline of how a will challenge typically unfolds. Timelines can vary greatly depending on the complexity of the case and the willingness of the parties to cooperate, but this provides a general framework.

| Stage | Typical Duration | Key Action |

|---|---|---|

| Initial Consultation & Evidence Gathering | 2-6 weeks | Meeting with a lawyer, collecting medical/financial records, and witness statements. |

| Filing Notice of Objection & Claim | 1-2 months | Lawyer drafts and files court documents to freeze the estate and start the lawsuit. |

| Discovery Phase | 4-8 months | Both sides exchange all relevant documents and conduct examinations under oath. |

| Mediation | 1-2 months | A mandatory settlement conference with a neutral mediator to attempt a resolution. |

| Pre-Trial & Trial (If Necessary) | 6-12+ months | If mediation fails, preparing for and conducting a court trial. Most cases settle before this. |

As you can see, the process is a marathon, not a sprint. The early stages are all about preparation, and the vast majority of resolutions happen during the mediation stage, long before a judge ever needs to get involved.

Costs and Timelines: The Two Things You Can’t Ignore

Let’s get right to it. When you’re thinking about challenging a will, two questions probably jump to the front of your mind: “How much is this going to cost?” and “Am I too late?”

These aren’t just details; they’re the make-or-break factors that often decide whether you can even start. The good news is, the answers might be more favourable than you think. But you have to understand how the system works, because when it comes to deadlines, there’s zero room for error.

How Much Does It Actually Cost to Challenge a Will?

The fear of a massive legal bill stops a lot of people from even making the first call. But in the world of estate litigation, the financial side of things is often structured differently. You might not need a pile of cash upfront.

Here’s how the fees usually break down:

- Contingency Fee Agreements: This is a very common arrangement in will challenges. It means our fee is simply a percentage of what you recover. If you don’t win, you don’t pay us any legal fees. It’s a way for you to move forward with a strong claim without having to worry about funding it yourself.

- Costs Paid by the Estate: This one is a game-changer. In many successful will challenges, the judge will order the estate itself to pay the legal costs for everyone involved. The court sees it this way: your challenge was necessary to sort out what the deceased truly wanted, so the estate should cover the expense of getting to the truth.

It’s a huge myth that you’ll be on the hook for a huge bill no matter what happens. If you have reasonable grounds for the challenge and you’re successful, there’s a very good chance the estate will cover your costs.

This approach ensures that people with legitimate concerns aren’t priced out of justice. It all comes down to having a solid case built on good evidence. Speaking of estate expenses, you can get a better sense of one of the major administrative costs by trying out our probate fees calculator for Ontario.

The Clock Is Ticking: Critical Deadlines You Absolutely Cannot Miss

While legal costs have some flexibility, the deadlines do not. They are set in stone. If you miss a limitation period, your right to challenge the will can be gone for good—it doesn’t matter how strong your case is.

Pay close attention to these two key timelines in Ontario:

- Dependant’s Relief Claims: If you’re a dependant and the will didn’t adequately provide for you, the deadline is incredibly tight. You have just six months from the date the court issues the Certificate of Appointment of Estate Trustee (also known as probate). This is a hard-and-fast rule.

- All Other Will Challenges: For most other grounds—like lack of capacity, undue influence, or fraud—you generally have a two-year window. This period starts when you “discover” the claim. That means the day you knew, or reasonably should have known, you had a reason to challenge the will.

Think about this scenario: a daughter finds out her father passed away, but his new wife doesn’t show her the will for another five months. When she finally sees it, she’s shocked to find she’s been completely cut out. Her two-year clock would likely start ticking from the day she saw the will, not the day her father died.

Hesitating is the single biggest mistake people make. When it comes to challenging a will in Ontario, time is not on your side.

How an Experienced Lawyer Can Steer Your Claim

We’ve walked through the legal minefield of challenging a will in Ontario—the complex grounds, the unforgiving deadlines, and the sheer emotional toll it takes. Going it alone isn’t just tough; it’s a gamble that can cost you a fair outcome. This is precisely where bringing in a seasoned estate litigation lawyer becomes the most important decision you can make.

A good lawyer is so much more than someone who just files paperwork. They’re your strategist, your investigator, and your advocate, making sure every move is calculated and effective. They know how to build a case that stands up to scrutiny—one based on solid evidence, not just gut feelings.

Turning Confusion into a Clear Plan of Action

The first thing an experienced lawyer does is cut through the noise. They’ll dive into the specifics of your situation, figure out which legal arguments have the most teeth, and map out a clear, practical strategy.

Here’s what that actually looks like:

- Digging for Evidence: They know exactly what to look for. For a capacity challenge, that means tracking down medical records and doctors’ notes. If you suspect undue influence, they’ll be hunting for financial statements and communication records that tell the real story.

- Leading the Negotiation: They take over the difficult conversations with the estate trustee and other beneficiaries. The goal is often to find a resolution through smart negotiation or mediation, which can save everyone time, money, and a lot of heartache.

- Fighting for You in Court: If a reasonable settlement can’t be reached, they’re prepared to take your fight to court. They will stand up for your interests and present your evidence in a powerful, persuasive way that a judge will understand.

Navigating an estate dispute is about more than just knowing the law—it’s about providing guidance with empathy. A great lawyer protects your legal rights while appreciating the delicate family dynamics and emotional stress at play, supporting you every step of the way.

From our home base in Burlington, UL Lawyers helps clients across the GTA and all of Ontario, from Toronto to communities large and small. We know that taking the first step feels like the hardest part. That’s why we offer a free, no-obligation consultation.

It’s a chance for you to tell us what happened, learn about your options, and see a clear path forward—all without any pressure or cost. Let us give you the clarity and confidence you need to pursue the fair resolution you deserve.

Your Top Questions About Ontario Will Challenges, Answered

When you’re questioning a will, you’re bound to have a lot on your mind. Here are some answers to the questions we hear most often from people in your situation.

Can I Still Challenge a Will if I’m Not a Dependant?

Yes, absolutely. It’s a common misconception that only dependants can launch a challenge.

While a dependant’s relief claim is a specific path for spouses, children, or others who relied on the deceased for financial support, it’s far from the only way to contest a will. If you have a legitimate financial interest in the estate (for instance, as a child who was unexpectedly disinherited), you have the right to challenge the will’s validity on other grounds, such as:

- Lack of mental capacity

- Undue influence or coercion

- Improper signing or witnessing

The key isn’t whether you were a dependant, but whether you can build a strong case proving the will is invalid for one of these reasons.

What Happens if the Will Has a “No-Contest” Clause?

You might come across a clause in the will that says anyone who challenges it will forfeit their inheritance. This is called an in terrorem clause, and its main purpose is to intimidate beneficiaries into staying silent.

Don’t let it stop you. Ontario courts look at these clauses very carefully. If you have a legitimate reason to question the will and you’re acting in good faith (not just trying to stir up trouble), a judge will almost certainly refuse to enforce the clause. They see it as being against public policy to punish someone for raising a valid concern.

Key Takeaway: A no-contest clause is not an ironclad shield. The court’s job is to ensure a will is legally sound and reflects the testator’s true wishes—not to penalize beneficiaries for asking legitimate questions.

How Long Does a Will Challenge Take in Ontario?

This is the classic “it depends” answer, but I can give you some realistic timelines based on my experience.

If everyone involved is willing to negotiate and you can reach an agreement through direct talks or mediation, the matter could be wrapped up in as little as 6 to 12 months.

However, if the dispute is complex and emotions are running high, forcing the case to go all the way to a court trial, you could be looking at a timeline of two years or longer. Court backlogs, the number of issues to resolve, and the other side’s willingness to cooperate all play a major role.

Is Going to Court My Only Option?

Not at all. In fact, it’s highly unlikely you’ll ever see the inside of a courtroom.

The vast majority of will challenges in Ontario are settled out of court. We use negotiation and mediation to find common ground and reach a fair settlement. While we have to start the court process to formally state your claim and protect your rights, the goal is almost always to avoid a drawn-out, costly, and emotionally draining trial.

Navigating a will challenge is tough, but you don’t have to do it alone. At UL Lawyers, we have the experience to guide you through this process with clear, strategic advice. We’re here to protect your rights and help you find a fair resolution. Reach out today for a free, no-obligation consultation to talk about your options. Learn more at https://ullaw.ca.

Related Resources

A Guide to Ontario Prenuptial Agreements and Marriage Contracts

Continue reading A Guide to Ontario Prenuptial Agreements and Marriage ContractsEstate Planning Lawyers Near Me: A Guide for Ontarians

Continue reading Estate Planning Lawyers Near Me: A Guide for OntariansNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies