How to Make a Will in Ontario: A Complete Guide

So, you’re ready to create your will in Ontario. At its core, a will is a written document that lays out your final wishes. It needs to name an executor to manage everything, and you must sign it correctly in front of two valid witnesses. To be legally sound, you have to be of sound mind and over the age of majority when you create it, ensuring your assets go exactly where you want them to.

Understanding What Makes a Will Valid in Ontario

Before you start writing, it’s really important to get a handle on the legal rules that govern wills in Ontario. A will is much more than a simple list of who gets what; it’s a formal legal document with strict criteria. If you miss a step, your will could be declared invalid. Should that happen, the province decides how your estate is divided, which might be completely different from what you intended.

Think of this as building a solid foundation. Getting these basics right is the first step toward creating a document that gives your loved ones clarity and security. The rules are primarily laid out in Ontario’s Succession Law Reform Act, and they aren’t flexible.

The Key Players in Your Will

Every will has three main roles, and it’s essential to understand what each one does so you can make smart decisions.

- Testator: That’s you—the person making the will. You’re the one deciding how your property and assets will be handled and distributed after you’re gone.

- Executor: In Ontario, this person is officially called an “estate trustee.” You appoint this individual or institution to follow the instructions in your will. They’ll do everything from paying your final bills to making sure your beneficiaries receive their inheritance.

- Beneficiary: These are the people, charities, or other organizations you name to receive your assets. You can leave specific items to certain people or give them a percentage of your overall estate.

Choosing the right people, especially your executor, is one of the biggest calls you’ll make. It’s a job that demands a lot of trust and confidence in their ability to manage your affairs responsibly.

Core Legal Requirements for a Valid Will

For a will to hold up in court, it must meet several non-negotiable conditions.

First, you (the testator) must be the age of majority, which is 18 years old in Ontario. There are some very narrow exceptions, like for members of the Canadian Forces on active service.

You also need to have testamentary capacity. This is a legal term meaning you must be of “sound mind” when you sign the will. Specifically, you need to understand:

- What a will is and what it does.

- A general sense of the property you own and are giving away.

- Who the people are that would naturally expect to inherit from you (like a spouse or children).

- That your decisions aren’t being skewed by a delusion or disorder of the mind.

Your will must be a true reflection of your wishes, free from any undue pressure or influence from others. If a court finds that someone coerced you into making certain decisions, that portion of the will—or even the entire document—could be invalidated.

The Two Types of Wills Recognized in Ontario

Ontario law recognizes two main kinds of wills, and each has its own set of rules. The one you choose will likely depend on your personal situation and whether you can meet the legal formalities. You can learn more about the complexities of Ontario’s wills and estate law and how they apply to different family situations.

Comparing Will Types Recognized in Ontario

Here’s a side-by-side look at the two will formats to help you see the key differences at a glance.

| Feature | Formal Will (Standard) | Holograph Will (Handwritten) |

|---|---|---|

| Creation Method | Typically typed or computer-printed. | Written entirely in the testator’s own handwriting. |

| Signature | Must be signed at the end by the testator. | Must be signed at the end by the testator. |

| Witnesses Required? | Yes, two witnesses must be present. | No witnesses are required. |

| Common Use Case | The standard and most reliable method for estate planning. | Often used in emergencies or for very simple estates. |

| Potential Risks | Lower risk of being challenged if executed correctly. | Higher risk of challenges related to authenticity, interpretation, or capacity. |

A Formal Will is what most people have. It’s prepared (usually typed), then signed by you in front of two witnesses, who must also sign it right there with you.

On the other hand, a Holograph Will is one you write out entirely by hand. The critical difference is that it doesn’t need any witnesses. While this can be a lifesaver in an emergency, it’s also much easier for someone to challenge later on, arguing about whether it’s really your handwriting or what you actually meant.

Building Your Will from the Ground Up

Now that we’ve covered the ground rules, it’s time to get practical and start drafting your will. This is where you translate your intentions into clear, legally binding instructions. It’s about making sure your executor knows exactly what to do and your loved ones are provided for. The process is detailed, but if you approach it methodically, you can be confident that nothing—and no one—is overlooked.

The very first thing to do is a full inventory of everything you own. This isn’t just about the big-ticket items; you need to create a complete and honest picture of your estate. A detailed list is the best way to prevent confusion down the road and ensure assets don’t get lost in the shuffle.

Taking Stock of Your Assets

Before you can decide who gets what, you need a crystal-clear picture of what you actually have. Your assets are everything you own that has value, and you might be surprised by the full extent of your estate once you lay it all out.

To keep things organized, we always advise clients to break it down into categories:

- Real Estate: This includes your primary home, a cottage up in Muskoka, any rental properties you might own in the GTA, or even that plot of undeveloped land.

- Financial Accounts: Jot down every single one—chequing and savings accounts, TFSAs, RRSPs, LIRAs, and any non-registered investment accounts.

- Personal Possessions: Think about your car, jewellery, art collection, furniture, and family heirlooms. Get specific here. “My grandfather’s gold pocket watch” is infinitely better than “family watch.”

- Digital Assets: This is a big one that people often forget. We’re talking about cryptocurrency wallets, social media accounts with sentimental value, online business assets, and even domain names. You’ll want to include access information in a separate, secure document that your will references.

To make this step easier, our estate planning checklist for Canada is a great resource. It guides you through itemizing everything you own and owe, ensuring no critical details are missed.

Naming Your Beneficiaries Clearly

With your asset list complete, your next job is deciding who will inherit them. These people or organizations are your beneficiaries. We can’t stress this enough: clarity here is absolutely paramount if you want to prevent disputes among your family.

You can give gifts, or “bequests,” in a few different ways:

- Specific Bequests: This is a gift of a particular item. For example, “I give my 2023 Toyota RAV4 to my nephew, David Chen.”

- General Bequests: This is usually a gift of money, like “I give the sum of $10,000 to my sister, Maria Sanchez.”

- Residuary Bequests: The “residue” is a legal term for whatever is left in your estate after all the debts, taxes, and specific gifts have been paid out. You can leave the whole residue to one person or split it up—for instance, “50% to my spouse and 25% to each of my two children.”

It’s also smart to name alternate beneficiaries. Think of it as a backup plan. For instance, “I give my house to my spouse, but if my spouse does not survive me, I give it to my son.” This kind of contingency planning prevents that asset from falling back into the residue of your estate if your primary beneficiary passes away before you.

Key Takeaway: Vague wording is the enemy of a strong will. Instead of saying “I leave my jewellery to my daughters to share,” specify exactly who gets what piece. Your goal is to leave a legacy of care, not a legacy of confusion and potential conflict.

Choosing Your Executor: The Most Important Job

Your executor, who is officially called an estate trustee in Ontario, is the person or institution you appoint to carry out your will’s instructions. This is arguably the most critical decision you’ll make. Their job is to manage your entire estate from start to finish—a role that demands integrity, incredible organization, and a whole lot of patience.

An executor’s to-do list is extensive. They are responsible for:

- Locating your will and tracking down all your assets.

- Applying to the court for probate, if it’s needed.

- Paying off all your final debts and taxes.

- Managing and protecting the estate assets until they can be handed out.

- Distributing the assets to your beneficiaries exactly as your will directs.

When you’re thinking about who to choose, pick someone trustworthy, responsible, and who lives in Canada (preferably Ontario, to avoid legal and tax headaches). It’s often a spouse, an adult child, or a close friend. And always, always name an alternate executor in case your first choice can’t or won’t do the job.

Appointing a Guardian for Minor Children

For any parent with children under 18, this is the single most important reason to have a will in Ontario. If you and the other parent were to pass away, who would raise your kids? Your will is the only legal document where you can name a guardian.

If you don’t make this appointment, the court will decide who takes on this role, and their choice might not be what you would have wanted. Have a serious conversation with your potential guardian beforehand to make sure they are willing and able to accept this profound responsibility.

You should also set up a trust within your will for your children’s inheritance. This allows a trustee (who can be the guardian or someone else) to manage the funds for your children’s benefit until they reach a more mature age, like 21 or 25. For those looking to streamline the creation process, exploring legal document generation software can be highly beneficial, as these tools often include straightforward options for wills with trust provisions. This ensures their financial future is both secure and managed responsibly.

Getting Your Will Signed and Witnessed the Right Way

You’ve done the hard work of thinking through your wishes and putting them on paper. Now comes the final, crucial step: making it legally binding. Signing your will might seem like a simple formality, but this is where many DIY wills go wrong. In Ontario, the law is incredibly strict about how a will is signed and witnessed. One small mistake here can unravel everything you’ve planned.

This formal signing process, legally known as “execution,” is your final stamp of approval. It’s the legal system’s way of ensuring the document truly reflects your intentions and that you signed it free from any pressure or fraud. Getting this part right is absolutely non-negotiable.

The Golden Rule: Your Two Witnesses

Under Ontario’s Succession Law Reform Act, a standard will needs to be signed in the presence of two credible witnesses. This isn’t a friendly suggestion; it’s a hard-and-fast legal requirement.

The biggest pitfall to avoid is choosing the wrong people to witness your signature. It’s one of the most common—and heartbreaking—mistakes we see.

Here’s who your witnesses cannot be:

- Anyone who is a beneficiary in your will.

- The spouse or common-law partner of a beneficiary.

- The child of a beneficiary.

- Anyone under the age of 18.

Why is this so important? If a beneficiary (or their spouse) acts as a witness, the gift to that specific beneficiary becomes void. The rest of your will might stand, but the very person you intended to provide for gets nothing. This rule exists to prevent any hint of conflict of interest or suspicion that a witness might have influenced you for their own benefit.

What “In the Presence Of” Really Means

The law is crystal clear on the logistics. You (the person making the will, or the “testator”) and your two witnesses must all be physically in the same room, at the same time, and literally watch each other sign the will. This is the “in the presence of” requirement.

It means you can’t sign it one day and have your witnesses sign it the next. It also means you can’t have one witness in the room and another on a video call. Everyone has to be there, together, for the entire signing ceremony.

Here’s how it should play out in practice:

- Gather the Trio: You and your two witnesses are all together in the same room.

- You Sign First: While both witnesses watch, you sign your name at the very end of the will.

- Witness #1 Signs: Immediately after you, the first witness signs their name as you and the second witness watch.

- Witness #2 Signs: The second witness then signs their name while you and the first witness watch.

Pro tip: Have everyone initial the bottom of each page (except the final signature page). This simple act helps secure the document and prevents pages from being swapped out later on.

Who Makes a Good Witness?

Finding two suitable people is easier than you think. You’re looking for neutral, independent adults who have nothing to gain from your will.

Think about people like:

- Neighbours or friends who aren’t named as beneficiaries.

- Trusted coworkers.

- If you’re working with a lawyer, their staff often act as professional, impartial witnesses.

The key is to pick reliable people who can be found years from now, just in case they’re needed to confirm the will’s validity. Remember, they don’t need to read the will or know its contents—their job is simply to confirm they saw you sign it.

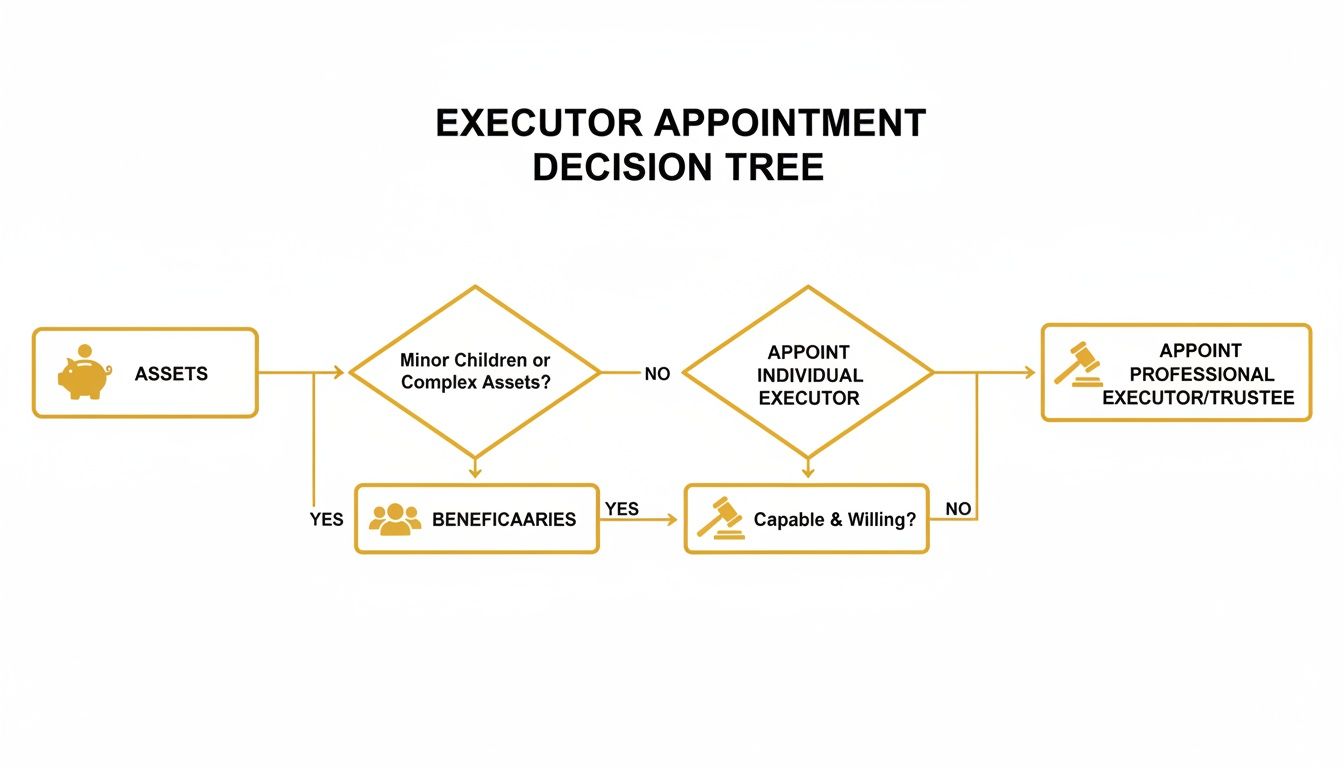

This flowchart shows a similar thought process for a related, crucial decision: choosing your executor. Your choice depends heavily on your assets and the people you’re leaving them to.

As the visual suggests, picking the right person to manage your estate is deeply connected to what you own and who your beneficiaries are.

As the visual suggests, picking the right person to manage your estate is deeply connected to what you own and who your beneficiaries are.

Why You Should Bother with an Affidavit of Execution

This is one of those small steps that can make a huge difference down the road. An Affidavit of Execution isn’t technically required to make your will valid, but it’s something we strongly recommend. It’s a separate sworn statement, signed by one of your witnesses in front of a lawyer or notary public, confirming all the signing rules were followed perfectly.

Think of an Affidavit of Execution as pre-approved proof for the court. It makes the probate process infinitely smoother and faster for your executor because there’s already a sworn legal document on file confirming the will was properly signed.

Without it, your executor might have to hunt down one of the witnesses years or even decades later. If that witness has moved, forgotten the event, or passed away, it can create a massive headache and delay for your family. Taking an extra five minutes to get this affidavit signed can save your loved ones a world of time, money, and stress.

Navigating Complex Assets and Modern Family Dynamics

Life is messy. Our families and finances rarely fit into neat little boxes, and that’s a reality you have to face when creating your will in Ontario. You’re doing more than just listing off assets; you’re planning for real-life situations.

Whether you’re dealing with a jointly owned home in Burlington or a blended family in Toronto, a generic, one-size-fits-all will template just isn’t going to cut it. These unique circumstances demand careful thought to create a will that’s not only legally sound but also clear and fair to everyone involved. Getting this right is the key to preventing conflict down the road.

Let’s walk through how to tackle some of the most common complexities.

How You Own Real Estate Matters—A Lot

For most Ontarians, their home is their biggest financial asset. But what many people don’t realize is that how you own that property completely changes how it’s handled in your will. It’s a critical detail that can lead to some very unexpected outcomes if ignored.

In Ontario, there are two main ways to co-own property:

- Joint Tenancy with Right of Survivorship: This is how most married couples own their home. When one owner dies, their share automatically transfers to the surviving owner(s). It happens outside of the will and completely bypasses the probate process.

- Tenants in Common: Here, each person owns a distinct, separate share (like 50/50 or even 70/30). Your share does not automatically go to the other owners. Instead, it becomes part of your estate and gets distributed according to the instructions in your will.

This distinction is massive. If you own your house as a joint tenant with your spouse, you can’t leave “your half” to your kids in your will. By law, it’s going directly to your spouse.

Adding another wrinkle is the ever-changing housing market. With Ontario’s market facing volatility, property values can shift significantly. This makes it crucial to keep your estate plan current to ensure the division of your assets still makes sense and reflects their real value.

Thoughtful Strategies for Blended Families

Blended families are more common than ever, bringing together children from different relationships. Your will is the single best tool you have to make sure everyone is treated fairly and your wishes are honoured, but it takes careful planning to avoid hurt feelings and friction.

A frequent worry is how to provide for a new spouse while still protecting an inheritance for children from a previous relationship. A very effective and popular solution for this is creating a spousal trust, sometimes called a life interest trust.

A spousal trust is a great strategy. It allows your surviving spouse to live in the family home and use any income generated by your assets for the rest of their life. Once they pass away, the remaining assets—the “capital”—are then distributed to your children exactly as you laid out in your will. It’s a balanced approach that gives your partner security without disinheriting your kids.

Don’t underestimate the power of open communication, either. Talking about your decisions with your family while you’re still around can prevent a lot of misunderstanding later. It helps manage expectations and shows that your choices came from a place of love and careful thought for everyone.

Planning for Digital and Other Unique Assets

These days, an estate is so much more than just a house and a bank account. Modern assets have crept into our lives, and they need specific instructions in your will.

Here are a few examples of assets that demand special attention:

- Registered Accounts (RRSPs, RRIFs, TFSAs): These accounts let you name a beneficiary directly on the account itself. When you do this, the funds pass to that person outside of your will, which also neatly avoids probate fees. The key is to review these designations regularly to make sure they still align with your overall estate plan.

- Business Shares: If you’re a business owner, your will needs to say what happens to your shares. Should they be sold? Passed to a family member? Often, a shareholders’ agreement will have rules about this, so your will needs to work in tandem with that document.

- Digital Assets: This is a huge and growing category. It includes everything from cryptocurrency and NFTs to social media profiles, domain names, and even loyalty points. Your will must give your executor the explicit authority to access and manage these digital items. It’s a good idea to prepare a separate, securely stored list of accounts and login details that you can reference in your will.

As you design your will, especially one dealing with these kinds of complexities, it’s critical to understand the job you’re handing to your executor. Looking over a detailed Executor Duties Checklist can help you appreciate the scope of the role. And for anyone in an unmarried partnership, understanding your legal standing is crucial; you can learn more about what constitutes a common-law relationship in our guide.

DIY Will Kits vs. Getting Professional Legal Advice

When it comes to writing a will in Ontario, one of the first questions most people ask is, “Can I just do this myself?” It’s a fair question. You’ve probably seen ads for DIY will kits, online templates, and software that promise a cheap and easy way to get it done. While the low price tag is tempting, it’s crucial to understand what you’re giving up by going the DIY route instead of sitting down with a lawyer.

The biggest selling point for a DIY will kit is, without a doubt, the price. They’re much cheaper upfront than hiring a lawyer. For someone with a truly simple situation—say, you’re single with no kids and have very few assets—a basic kit might seem like it does the job. It feels good to check it off your list.

But here’s the thing: that upfront saving can be a trap. A will is arguably one of the most important legal documents you’ll ever sign, and the consequences of a mistake are huge. These kits are one-size-fits-all, and they just can’t offer the tailored advice your unique life requires.

Where DIY Kits Just Don’t Cut It

A simple template can’t ask you probing questions or spot the legal landmines hidden in your plans. Modern life is complicated, and that often calls for a more sophisticated approach than a fill-in-the-blanks form can provide.

Think about these common scenarios where a DIY will is a real gamble:

- You’re in a Blended Family: How do you provide for your new spouse while also making sure your kids from a previous relationship are looked after? This often requires careful legal drafting, sometimes using tools like spousal trusts that a kit won’t explain.

- You Own a Business: Your will has to mesh perfectly with your shareholder agreements. You need a clear succession plan for your business assets, which is far beyond the scope of a generic template.

- You Have Major Assets: A good lawyer doesn’t just draft a will; they provide advice on minimizing taxes to ensure more of your hard-earned estate goes to your loved ones.

- You’re Disinheriting Someone: If you’re planning to leave out a spouse or a child who has a legal right to expect an inheritance, you need ironclad legal advice. This is essential to reduce the odds of your will being challenged—and overturned—in court.

Try to think of legal advice not as an expense, but as an investment. Paying a professional now is a small price to pay for your family’s peace of mind later. It can prevent incredibly expensive and emotionally devastating court battles down the road.

Understanding the Real Cost and Value

The cost to create a will in Ontario can vary quite a bit. Recent data shows the average price for a lawyer-drafted will is around $503, but this can climb depending on how complex your situation is. Looking at other options, a will can cost you nothing for a bare-bones template or a few hundred dollars for a more sophisticated DIY kit. That price gap really reflects the level of legal thinking and personalization involved—a critical factor in your decision. You can learn more about what impacts the cost of a will in Ontario and the reasons for price differences.

When you hire an experienced lawyer, you’re paying for more than just a document. You’re getting an expert who can ensure your will is not only legally sound but also strategically smart. They can see potential challenges you’d never think of, guide you through tricky family dynamics or financial structures, and make sure the language used is airtight. That’s a level of personalized guidance a template can never match.

In the end, it really comes down to your personal circumstances. If your life is truly straightforward, a DIY kit might feel like enough. But for most of us living in the GTA and across Ontario—with homes, families, and unique financial lives—the insight from a professional is priceless. If you’re weighing your options, our guide on finding a top wills lawyer in Toronto can help you take the next step.

Answering Your Questions About Making a Will in Ontario

When you start thinking about writing a will, a lot of questions pop up. It’s completely normal. From “what if I don’t have one?” to “how often does this thing need a refresh?”, getting straight answers is the first step. Let’s walk through some of the most common questions we hear from clients across Burlington, Toronto, and the GTA, so you can move forward with confidence.

What Happens If I Die Without a Will in Ontario?

If you pass away without a legally valid will, it’s called dying “intestate.” This is a situation you really want to avoid.

When you die intestate, you lose all control over who gets your property. The province steps in, and your estate gets carved up according to a strict, one-size-fits-all formula laid out in Ontario’s Succession Law Reform Act.

This means your assets are divided among your closest relatives based on a rigid hierarchy. Your true wishes become irrelevant. For instance, a common-law partner might be left with nothing, as the rules don’t automatically grant them the same rights as a legally married spouse. The whole process can become a slow, public, and expensive mess for your family, piling on more stress when they’re already grieving.

How Often Should I Update My Will?

Think of your will as a living document, not something you create once and then tuck away forever. Life changes, and your will needs to keep up.

A good rule of thumb is to pull it out for a review every 3 to 5 years. But more importantly, you need to update it immediately after any major life event.

Here are some key triggers for an update:

- Getting married or divorced.

- The birth or adoption of a child or grandchild.

- The death of someone you’ve named as an executor or beneficiary.

- A significant shift in your finances, like selling a business or receiving a large inheritance.

Keeping your will current is the only way to ensure it actually reflects your life and your intentions.

A failure to update your will after a divorce can be disastrous. An old will could inadvertently leave everything to a former spouse, creating a legal and emotional nightmare for your actual loved ones.

Can I Just Write My Wishes Down and Have Them Notarized?

This is a very common myth, and the answer is a hard no. Getting a document notarized does not, by itself, create a legally valid will in Ontario.

A notary public’s job is simply to verify your identity and confirm you signed the document. Their seal doesn’t satisfy the strict legal requirements for a will. For a will to hold up in court, it must be either a formal will (signed by you in front of two qualified witnesses who also sign) or a holograph will (written entirely, from start to finish, in your own handwriting). A notary’s stamp can’t replace these critical steps.

With the current economic climate, this isn’t just a legal technicality—it’s about security. While Ontario’s real GDP is forecasted to grow by 2.1 per cent in 2025, the province is also dealing with challenges like a rising unemployment rate. This kind of uncertainty is exactly why locking down your family’s future with a properly drafted will is so crucial. You can discover more about these economic forecasts and their implications.

Do I Need a Lawyer to Make a Will in Ontario?

Legally, no, you aren’t required to use a lawyer. But is it a good idea? Absolutely.

Hiring a legal professional is about so much more than filling out forms. An experienced lawyer provides strategic advice to make sure your will is not only legally sound but also tax-efficient and difficult to challenge in court. If your family situation is complex or you have significant assets, a lawyer’s guidance is invaluable.

Once the will is in place, your executor’s next step will be to have it validated by the court. To get a clearer picture of what that involves, you can read our guide on how to probate a will in Ontario.

At UL Lawyers, we understand that creating a will is a profound act of care for your family. As a firm based in Burlington, we proudly serve clients across the entire GTA and Ontario. If you have more questions or are ready to create a will that protects your legacy and your loved ones, our experienced team is here to help. Contact us today for a consultation. https://ullaw.ca

Related Resources

What is Common Law Marriage in Canada and its Implications for You

Continue reading What is Common Law Marriage in Canada and its Implications for YouA Modern Guide to Prenups in Canada

Continue reading A Modern Guide to Prenups in CanadaNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies