What is Common Law Marriage in Canada and its Implications for You

When people ask me, “what is common law marriage in Canada,” the answer often surprises them. Here in Ontario, there’s actually no such thing as a “common law marriage.” What we have are common law relationships, and they kick in automatically once a couple meets specific criteria—no certificate, no ceremony, no paperwork required.

What Common Law Really Means in Ontario

The phrase ‘common law marriage’ is a popular term, but it’s a bit of a misnomer in Canada. It’s better to think of a common law relationship not as a substitute wedding, but as a legal acknowledgement that your partnership has hit a certain milestone of commitment and interdependence.

Once you cross that threshold, you gain specific rights and take on certain obligations, especially around things like spousal support.

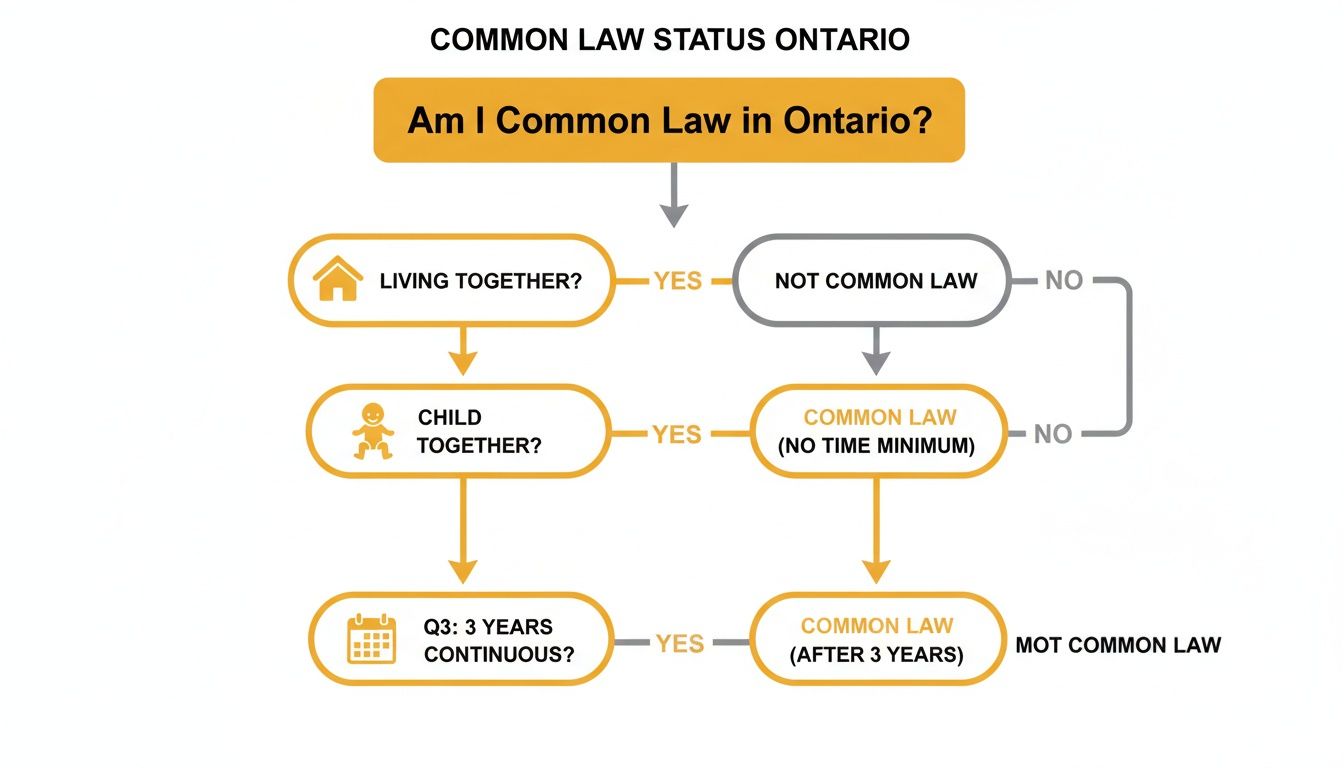

In Ontario, you’re considered common law partners under the provincial Family Law Act if you tick one of these two boxes:

- You have lived together continuously in a conjugal (marriage-like) relationship for at least three years.

- You are living together in a relationship of “some permanence” and you have a child together (by birth or adoption).

This distinction is absolutely critical. The rights and responsibilities you have as a common law partner are very different from those of a married spouse, particularly when a relationship ends and property needs to be divided.

Key Thresholds for Common Law Status

It’s important to understand that just having a roommate you’re dating doesn’t cut it. The relationship must be “conjugal,” which is a legal way of saying it has to look and feel like a marriage. This means presenting yourselves to the world as a committed couple, mixing finances, and sharing an emotional and intimate bond.

In essence, Canadian family law recognizes that when a cohabiting couple’s relationship becomes marriage-like, they deserve some of the same protections. For instance, here in Ontario—where our firm helps clients throughout the GTA and beyond—that three-year cohabitation period (or having a child together) can open the door to spousal support claims. For a broader look at relationship trends, you can find interesting Canadian marriage statistics and trends on Nussbaum Law.

Here’s where it gets tricky for most people: different laws use different timelines. The definition that makes you common law for provincial family matters is not the same one the federal government uses for your income taxes.

The most significant mistake people make is assuming common law status automatically entitles them to a 50/50 split of property like married couples. In Ontario, this is not true, and protecting your assets requires proactive legal planning.

This is a point of confusion for so many, so let’s break it down simply.

Quick Guide to Common Law Status in Ontario vs Federal Law

This table gives a quick snapshot of the two main definitions you’ll run into as a resident of Ontario.

| Jurisdiction | Definition for Common Law Status |

|---|---|

| Ontario Law | Live together for 3 years OR have a child in a permanent relationship. |

| Federal Law (CRA) | Live together for 12 continuous months OR have a child together. |

Getting these two different timelines straight is the first, and most important, step to understanding your rights and obligations as a common law partner in Ontario.

Understanding Provincial vs Federal Rules

Figuring out a common-law relationship in Canada can feel like you’re playing by two different rulebooks at the same time—and in a way, you are. The most important thing to grasp is that the Ontario government and the federal government define your relationship status differently. This dual-definition system is where most of the confusion for couples comes from.

Think of it like this: you have one ID for provincial matters (like family law in Ontario) and a completely separate one for federal matters (like filing your taxes). They aren’t interchangeable, and each one gets you access to different things.

For instance, a federal body like the Canada Revenue Agency (CRA) will consider you common-law partners after you’ve lived together in a marriage-like relationship for just 12 continuous months. That relatively short timeline has an immediate impact on your finances.

Once the CRA sees you as common-law, you must file your taxes as a couple. This changes how your household income is assessed and can affect your eligibility for benefits like the GST/HST credit or the Canada Child Benefit.

Ontario’s Approach to Family Law

On the other hand, Ontario’s provincial laws—specifically the Family Law Act—set a much higher bar. When it comes to things like spousal support or making a claim against a partner’s estate, you’re only considered common-law if you meet one of two specific conditions.

This flowchart breaks down Ontario’s criteria, making it easier to see where you stand.

As you can see, the path to common-law status for family law in Ontario requires either living together for three years or having a child together in a “relationship of some permanence.”

As you can see, the path to common-law status for family law in Ontario requires either living together for three years or having a child together in a “relationship of some permanence.”

This distinction is massive. You could be filing your taxes together as a common-law couple for two whole years before Ontario law would even recognize your right to claim spousal support if you separated.

How Different Rules Affect Your Life

These parallel legal systems create real-world consequences that touch almost every part of your life. Knowing which set of rules applies to your situation is the key to protecting yourself.

Here’s a simple breakdown of how the different definitions play out:

- Federal Jurisdiction (1-Year Rule): This rule covers federal laws and programs. It kicks in for filing income tax, applying for federal benefits like CPP survivor benefits, and sponsoring a partner for immigration. If you’re exploring sponsorship, you can find more on the spousal sponsorship in Canada requirements.

- Provincial Jurisdiction (3-Year or Child Rule): This applies to laws specific to Ontario. The biggest areas are family law—including spousal support rights and obligations upon separation—and making a dependant’s support claim on a partner’s estate if they die without a will.

It’s crucial to remember: while the federal government might see you as a couple after one year, Ontario’s family courts won’t grant rights like spousal support until you hit that three-year mark or have a child together.

This difference also underscores why province-specific legal advice is so important. For example, Quebec’s legal system is based on a distinct civil code where cohabiting partners (often called “de facto spouses”) have very few automatic rights, no matter how long they’ve lived together. This is a world away from Ontario, where common-law status automatically triggers significant legal rights and obligations.

Your Rights and Obligations in a Common Law Relationship

So, your relationship has crossed the common-law threshold in Ontario. You’ve either lived together for three years or you’ve had a child together. It might feel like nothing has changed, but from a legal standpoint, the ground has shifted beneath your feet.

You and your partner now have a specific set of rights and obligations to each other, many of which look a lot like those of a married couple. It’s really important to get a handle on what this actually means for you, your partner, and the assets you’ve built together.

The biggest and most immediate change involves financial support. If you separate, common-law partners have the exact same right to claim spousal support—and the same duty to pay it—as married spouses. This isn’t a minor detail; it’s a cornerstone of Ontario’s Family Law Act.

The law recognizes that one partner often becomes financially dependent on the other over time. Spousal support is there to acknowledge that dependency and to help soften the economic blow that a separation can cause.

The Right to Spousal Support

Spousal support isn’t a given. It has to be earned, so to speak. One partner has to show they’re entitled to it, and a court will look at a whole host of factors to decide if support is needed, how much it should be, and for how long.

They’ll weigh things like:

- Financial needs and means: What’s the income, earning potential, and overall financial picture for both people?

- Length of the relationship: As a general rule, longer relationships can lead to longer periods of support.

- Roles during the relationship: Did one partner step back from their career to raise children? That person might have a stronger claim than someone whose career continued without interruption.

- Any orders or agreements: If you signed a cohabitation agreement, that will be a major factor in the court’s decision.

Don’t underestimate this. The right to claim spousal support is one of the most significant legal changes that happens when you become common-law partners in Ontario.

The Great Misconception: Property Division

And now we come to the single biggest misunderstanding about common-law relationships in Canada: property division.

Let me be crystal clear. Unlike married couples, common-law partners in Ontario do not have an automatic right to equalize their property. There is no 50/50 split of the assets you gathered during your time together.

This means that when you separate, you generally leave with whatever is legally in your name, and your partner leaves with what’s in theirs. You can probably imagine how this can lead to some profoundly unfair situations, especially if one partner poured their money or labour into an asset—like a house or a business—that is only owned by the other on paper.

In Ontario, common-law partners do not have the same property rights as married spouses under the Family Law Act. There is no automatic equalization of family property, a fact that can have devastating financial consequences upon separation if you are unprepared.

Thankfully, that’s not the end of the story. Canadian law has other tools to help fight for a fair outcome. These legal arguments are built on principles of equity, designed to stop one person from being unfairly enriched at the other’s expense.

Seeking Fairness Through Trust Claims

If you find yourself in a tight spot where you’ve contributed to your partner’s property but your name isn’t on the title, you’re not out of options. You can go to court and make a claim based on the legal ideas of unjust enrichment and constructive trust.

- Unjust Enrichment: To make this claim work, you have to prove three things: your partner gained a benefit (was “enriched”), you suffered a loss (a “deprivation”), and there was no good legal reason for it (like a gift or a contract). For example, if you paid for all the renovations on a house that your partner owned alone, their property value went up while you were out of that money.

- Constructive Trust: If a judge agrees you’ve proven unjust enrichment, they can impose a “constructive trust.” This is a powerful fix. The court can declare that you have an actual ownership stake in that property, even though your name isn’t on the deed.

These claims aren’t simple. They require you to bring forward detailed evidence of all your contributions, whether they were financial (like paying bills or mortgage instalments) or non-financial (like handling all the childcare and housework, or doing unpaid work for a family business). It’s also wise to be proactive in your financial planning; for instance, our guide on what is a Power of Attorney for Property in Ontario can help you understand other important legal tools.

Child Custody and Support Remain the Same

When children are involved, Canadian law doesn’t care about your marital status. It is completely irrelevant.

Whether you are married, common-law, or were never even living together, the rules for child custody and support are identical. Every single decision is guided by one principle: the best interests of the child.

Both parents are legally required to support their children financially, and both parents have the right to ask for custody or parenting time. Child support is almost always calculated using the Federal Child Support Guidelines, which ensures a standard and consistent approach for families all across Canada.

What Happens When a Common-Law Relationship Ends?

Let’s be honest: breaking up is hard. The end of any long-term relationship brings a wave of emotional and financial stress. For common-law partners in Ontario, though, navigating a separation or the death of a partner comes with a unique set of legal hurdles. The law doesn’t offer the same automatic safety nets that married couples have, which makes planning ahead absolutely critical.

Taking control of these situations means knowing your options. It’s about making sure your contributions to the relationship are properly recognized and that your future is secure, rather than leaving life-altering decisions up to a judge or outdated legal defaults.

Navigating a Separation

When a common-law relationship comes to an end, the two biggest flashpoints are almost always spousal support and how to divide up the property you’ve accumulated. While the rules for spousal support are the same for both common-law and married couples, property division is a completely different ballgame—and a much more complicated one.

The good news? A messy courtroom battle isn’t your only path forward. Many couples find a way to sort things out using less confrontational and far more cost-effective methods.

- Negotiation: This is usually the first stop. You and your ex-partner, typically with your lawyers guiding you, try to hash out an agreement on your own terms.

- Mediation: If you hit a roadblock in negotiations, a neutral third-party mediator can step in. They don’t make decisions for you; their job is to help you talk to each other and find a middle ground you can both accept.

- Arbitration: Think of this as a private court. You and your partner agree to let an arbitrator make a final, legally binding decision. It’s often faster and more private than the public court system.

These approaches can save a tremendous amount of time, money, and emotional energy. The ultimate goal is to create a separation agreement—a formal, legally binding contract that clearly lays out how everything, from property to support, will be handled.

When a Partner Dies Without a Will

This is, without a doubt, one of the most devastating and overlooked risks for common-law couples in Ontario. The law is brutally clear: if your common-law partner dies without a valid will (this is called dying “intestate”), you have no automatic right to inherit their estate. Zero.

Under Ontario’s succession laws, their assets automatically pass to their closest blood relatives—their children, parents, or siblings. You could be left with nothing, not even the home you shared for years if it was only in their name.

The harsh reality is that without a will, years of shared life, emotional commitment, and financial interdependence can be erased in the eyes of inheritance law. A common-law spouse can be left with no home and no assets, regardless of the length or nature of the relationship.

This gap in the law can lead to catastrophic results, forcing the surviving partner into a difficult and expensive legal fight at the worst possible time.

Thankfully, there is a legal option, but it means going to court. You can file what’s known as a dependant’s support claim against the estate.

To win this claim, you have to prove to a judge that you were financially dependent on your deceased partner and that they failed to make adequate provisions for you. The court looks at a whole host of factors, like your financial needs, the size of the estate, and what you contributed to the relationship. But make no mistake: this is a complex, stressful, and costly process with no guaranteed outcome.

The Ultimate Protection: Wills and Powers of Attorney

The simplest and most powerful way to protect each other is to take matters into your own hands. You don’t have to leave your future to chance or the mercy of the courts. Creating solid estate documents isn’t just about planning for death; it’s a powerful act of commitment and care for your partner.

- A Will: This is the only way to guarantee your partner inherits your assets and is looked after according to your wishes. Each of you needs your own will that clearly names the other as a beneficiary.

- Powers of Attorney: These documents are just as important. They let you appoint your partner (or another trusted person) to make financial and personal care decisions for you if you ever become incapacitated and can’t make them for yourself.

Drafting these documents is a straightforward process that provides incredible peace of mind. To learn more about this vital area, you can explore our resources on Wills and estate law in Ontario. Taking this step ensures your intentions are honoured and your partner is protected, no matter what the future holds.

How to Prove Your Common Law Relationship

Simply sharing an address isn’t enough to be considered common-law in the eyes of Canadian law. You have to prove your relationship was “marriage-like”—or what the legal world calls a conjugal relationship. This comes up in all sorts of situations, from making a claim in family court to applying for spousal sponsorship or dealing with the Canada Revenue Agency (CRA).

Think of it like building a case for your partnership. You need to gather different pieces of evidence that, when you put them all together, paint a clear and undeniable picture of a committed, interdependent couple. A single document won’t cut it. Instead, courts and government bodies want to see a collection of proof that shows just how intertwined your lives truly are.

What Does “Conjugal Relationship” Actually Mean?

Before you can prove it, you need to know what you’re trying to prove. The term “conjugal” goes way beyond just being romantic partners or roommates. Canadian law is looking for evidence of a shared life that operates in much the same way a marriage does.

This boils down to a few key elements:

- Shared Shelter: Living together under the same roof is the baseline, the absolute starting point.

- Sexual and Personal Behaviour: This includes things like fidelity, emotional support, and an intimate relationship.

- Social and Public Presentation: How do you hold yourselves out to the world? Do your friends, family, and community see you as a committed couple?

- Economic Interdependence: This is a big one. It shows that you rely on each other financially and have merged your economic lives.

At its core, a court wants to see that you didn’t just share a space—you built a life together.

Gathering Your Evidence

Proving your relationship requires tangible, concrete documentation. The more evidence you can pull together across different categories, the stronger your claim will be. Picture each document as a single brick; one brick doesn’t make a house, but enough of them create a solid structure that’s impossible to ignore.

A strong case is built on showing consistency over time. Below is a breakdown of the kinds of proof you should start collecting. To make it easier, we’ve organized them into a handy checklist.

Evidence to Support Your Common Law Relationship

This table lists the kinds of documents and evidence you can use to build a strong case for your common-law status. The goal is to show a pattern of commitment and shared life from multiple angles.

| Category of Evidence | Examples of Documentation |

|---|---|

| Financial Interdependence | Joint bank accounts or credit cards. Shared utility bills (hydro, gas, internet). Residential lease or mortgage with both names. Proof of joint ownership of major assets (e.g., car, home). Naming each other as beneficiaries on insurance, RRSPs, or work benefits. |

| Shared Home & Life | Government-issued IDs (like driver’s licences) showing the same address. Mail addressed to both of you at the same home. Documents showing shared parenting duties for children. |

| Public Recognition | Photos of you together at social events, on holidays, and with family. Sworn statements (affidavits) from friends, family, or colleagues. Proof of travelling together (e.g., flight itineraries, hotel bookings). |

Remember, no single item on this list is the magic bullet. It’s the combined weight of all this evidence that will make your case compelling.

A key takeaway is that proving your common-law status is about demonstrating a pattern of behaviour. It’s the combined weight of your shared finances, home, and social life that validates your relationship legally.

This evidence becomes especially crucial in certain situations. For instance, when applying for spousal sponsorship, Immigration, Refugees and Citizenship Canada (IRCC) demands extensive proof. You can see just how detailed this gets by reviewing our complete spousal sponsorship checklist.

The best strategy is to be proactive. Gathering these documents as you go is the smartest way to protect your rights and ensure your relationship is officially recognized when it matters most.

The Essential Role of a Cohabitation Agreement

For common-law couples in Ontario, a cohabitation agreement is one of the smartest financial tools you can have. It’s easy to think of legal contracts as unromantic, but creating one is really an act of care. It’s about you and your partner setting your own rules for property and support, instead of leaving those huge decisions up to a court if you ever separate.

Think of it as a custom-built financial plan for your partnership. It brings clarity and security to your relationship by letting you decide, ahead of time, how to handle your assets if you go your separate ways. This kind of proactive planning is crucial, especially since common-law couples in Ontario don’t have the automatic right to equalize property.

Defining Your Financial Future, Together

A cohabitation agreement lets you sidestep the one-size-fits-all legal rules and create a framework that truly fits your unique relationship. When you’re defining these financial boundaries, creating a robust personal financial plan is a great first step to get on the same page, and this agreement makes those shared intentions legally binding.

A solid agreement will typically map out a few key areas:

- Property Division: You can clearly state how property you each brought into the relationship will be handled, and how you’ll split any assets you acquire together.

- Spousal Support: You get to decide if spousal support will be paid if you break up, including how much and for how long. You can also agree to waive the right to support altogether.

- Debt Responsibility: The agreement can spell out who is responsible for which debts, both those from before and those accumulated during the relationship.

In essence, it’s a foundational blueprint for your future. It protects both of you as individuals and actually strengthens your partnership by fostering total financial transparency.

More Than Just a “Prenup” for Common-Law Couples

While it works a lot like a prenuptial agreement, a cohabitation agreement is specifically tailored for unmarried couples. If you want to learn more about how these contracts are structured, our guide on prenups in Canada offers some great insights that are just as relevant for cohabiting partners.

A cohabitation agreement transforms ambiguity into certainty. It replaces the unpredictable outcomes of court claims like ‘unjust enrichment’ with a clear, mutually agreed-upon roadmap that reflects your intentions as a couple.

By talking openly about money and expectations now, you build a much stronger foundation for your relationship. It’s a genuine investment in your shared future, ensuring that if your paths ever do diverge, it can happen with fairness, respect, and a clear plan already in hand.

Common Questions About Common-Law Relationships in Ontario

Even when you understand the basic definition of common-law in Canada, the real-world questions are often what matter most. People want to know how the rules apply to their specific, everyday situations. This FAQ section tackles some of the most common “what if” scenarios we see from couples in Ontario.

Can We Be Considered Common-Law if We Keep Our Finances Separate?

Absolutely. Keeping separate bank accounts doesn’t automatically mean you aren’t in a common-law relationship. While things like joint accounts or shared credit cards are strong indicators of a partnership, they aren’t the only thing a court looks at.

The courts in Ontario take a holistic view. They’ll consider how you live, if you present yourselves as a couple to friends and family, and the nature of your emotional bond. Separate finances are just one piece of a much larger puzzle, and that single factor won’t disqualify you.

What Happens to the House I Owned Before My Partner Moved In?

This is a huge point of confusion for many couples. In Ontario, a home you owned before the relationship began is not automatically split down the middle if you separate. Unlike with married couples, it’s generally considered your separate property.

But it’s not always that straightforward. If your partner contributed significantly to the home’s upkeep or value—say, by helping with mortgage payments, funding a renovation, or even handling all the household duties so you could focus on your career—they might have grounds for an unjust enrichment claim. This type of claim could give them a right to a portion of the increase in the home’s value during your relationship.

This is precisely why a cohabitation agreement is so valuable. It lets you decide from the very start how a pre-owned property will be handled, saving you from a potentially messy and expensive court battle later on.

Can I Sponsor My Common-Law Partner for Immigration to Canada?

Yes, you can. For immigration purposes, the federal government of Canada recognizes common-law partnerships right alongside legal marriages. Immigration, Refugees and Citizenship Canada (IRCC) provides a clear pathway for spousal sponsorship.

The key requirement is proving you’ve lived together in a committed, marriage-like relationship for at least 12 consecutive months. You’ll need to provide a mountain of evidence to back this up, like shared lease agreements, joint utility bills, and proof that you are known publicly as a couple.

Is There a Time Limit to Make a Claim After a Separation?

Yes, and this is critical to understand. The deadlines are strict. In Ontario, the Limitations Act gives you a two-year window from the date you separate to file a court claim for spousal support or a property-related issue like unjust enrichment.

If you miss that deadline, you may lose your right to make a claim for good. It’s incredibly important to get legal advice shortly after a separation to know where you stand and ensure your rights are protected.

Navigating the complexities of family law requires clear guidance and strong advocacy. At our Burlington-based firm, we are dedicated to providing compassionate and expert legal support for individuals and families across the GTA and all of Ontario. If you have questions about your rights in a common-law relationship, contact us for a consultation.

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies