A Modern Guide to Prenups in Canada

In Canada, what many people call a “prenuptial agreement” is legally known as a marriage contract. Forget the dramatic movie portrayals; this isn’t about planning for a breakup. It’s a powerful financial planning tool for couples, designed to create a clear blueprint for your life together and foster transparency right from the start.

Rethinking Prenups in Modern Canadian Relationships

The entire conversation around prenups in Canada is changing, and for the better. The old stigma—that they signal a lack of trust—is fading fast. Today, these agreements are increasingly seen as a sign of a mature, practical partnership.

Think of it less as preparing for the end and more as designing a strong foundation for your future. It’s no different than business partners signing a shareholder agreement before launching a company. A marriage contract lets you and your partner set clear, mutual expectations upfront. It opens the door for a truly honest conversation about money, assets, and debts—a dialogue that can only strengthen your relationship.

Why Are More Canadian Couples Choosing Prenups?

It’s no surprise that prenups are becoming more common, especially for couples in Ontario and across the Greater Toronto Area (GTA). Lifestyles and relationships today look a lot different than they did even a generation ago.

Just consider a few common scenarios:

- Later Marriages: People are often getting married later, which means they’re bringing significant personal assets, established careers, or investments into the partnership.

- Individual Asset Accumulation: One or both partners might have a down payment saved, a growing business, or a future inheritance they want to protect.

- Blended Families: For partners with children from a previous relationship, a prenup is a crucial tool to ensure certain assets are earmarked for their kids’ futures.

- Clarity on Debt: An agreement can clearly define who is responsible for pre-existing debts, protecting one partner from taking on the other’s financial baggage.

A prenuptial agreement is fundamentally a tool for communication. It forces a couple to have a frank discussion about their financial goals, expectations, and values, which is one of the healthiest things you can do before marriage.

Taking this proactive step gives both of you genuine peace of mind. By working through the details together, you build a shared financial vision, letting you step into your marriage with confidence and a unified plan.

The very structure of Canadian families is evolving. According to Statistics Canada, the number of married couples increased by 6% between 2016 and 2021, but the most dramatic shift has been the explosion in common-law relationships, which grew by 447% between 1981 and 2021. This highlights how Canadians are forming partnerships differently and underscores the growing need for clear domestic contracts. You can explore these marriage statistics in Canada to see the full picture.

Crafting an Ironclad Prenup in Ontario

For a prenup to actually work when you need it, it has to be more than a template you download and sign over dinner. In Ontario, these agreements—officially called marriage contracts—are held to some pretty strict legal standards. A court simply won’t enforce a contract that isn’t fair, transparent, and built on a solid legal foundation.

Think of it like building a house. You wouldn’t dream of skipping the foundation and hoping the walls stay up. A prenup is no different. If you miss the fundamental legal pillars, a judge could set the whole thing aside, leaving you right back in the middle of the uncertainty you were trying to avoid.

These rules aren’t just about ticking boxes. They’re in place to make sure the agreement is resilient and protects both people, preventing one partner from being strong-armed into a deal they don’t fully grasp.

The Non-Negotiable Legal Checklist

To make sure your marriage contract will hold up in Ontario, it has to meet a few key criteria. These aren’t just good ideas; they’re mandatory.

- It Must Be in Writing: A handshake deal or a verbal promise about who gets what won’t fly. The entire agreement needs to be a formal, written document.

- It Must Be Signed by Both Parties: Pretty straightforward, but crucial. Both of you have to willingly sign the final document to show you agree to its terms.

- It Must Be Witnessed: Your signatures need to be witnessed by someone else, who then also signs the document.

Getting these basic formalities wrong can make the entire agreement invalid from the get-go. They’re the first line of defence in creating a document that an Ontario court will actually recognize.

The Cornerstones of a Valid Prenup

Beyond the signatures and paperwork, two elements are absolutely critical to creating a truly “ironclad” prenup: full financial disclosure and independent legal advice. This is where many DIY or poorly drafted agreements fall apart.

Full and Honest Financial Disclosure

This is non-negotiable. Before anyone signs anything, both partners must lay all their financial cards on the table. We’re talking about a complete and truthful list of every asset, every debt, and all sources of income. Trying to hide a secret investment account or downplaying the value of your business is a surefire way to get a prenup thrown out later on.

The whole point of disclosure is to make sure you’re both making informed decisions. You can’t intelligently agree to waive your right to a share of an asset if you don’t even know it exists.

In the eyes of the court, fairness begins with transparency. A prenuptial agreement built on incomplete or misleading financial information is built on a foundation of sand. It simply will not stand up to legal scrutiny.

Independent Legal Advice (ILA)

This is arguably the single most important step for making your prenup enforceable. Independent Legal Advice (ILA) means each of you hires your own separate family lawyer to go over the agreement. Your lawyer’s job is to explain what the fine print really means, how it impacts your rights, and to make sure your interests are being protected.

Having ILA creates a powerful shield against any future claims that someone was pressured, coerced, or simply didn’t understand what they were signing. When both partners have had a lawyer review the document, it becomes incredibly difficult for one person to successfully argue they didn’t know what they were getting into.

As you plan your financial future together, it’s also smart to think about estate planning. You can get a head start by understanding potential costs with tools like an Ontario probate fees calculator.

This kind of financial foresight is becoming more common. Family lawyers across Canada are seeing a big jump in millennials asking for prenups. This is often driven by people marrying later in life and wanting to protect the assets they’ve already built. The more complex your financial picture, the more important this planning becomes.

An experienced family lawyer from a firm like UL Lawyers will ensure every single one of these legal boxes is properly ticked, resulting in a resilient agreement that offers genuine peace of mind and stands the test of time.

Defining the Boundaries of Your Agreement

Knowing what you can and cannot put into a Canadian prenup is the difference between an agreement that works and one that’s just a piece of paper. Think of it as drawing a clear map for your financial future together; you need to know where the legal roads are and where the dead ends lie. A well-drafted marriage contract gives you and your partner control, but only within the limits the law allows.

Trying to include clauses that are legally out of bounds doesn’t just get those specific parts thrown out—it can jeopardize the entire agreement. By understanding what’s permissible versus what’s prohibited right from the start, you and your partner can build a plan based on realistic, legally sound expectations. This clarity is your best defence against future disputes.

What You Can Include in Your Prenup

A prenup in Canada, particularly in Ontario, gives you a surprising amount of power to customize your financial life as a couple. It’s your chance to opt out of the default rules set by provincial family law and create a plan that actually fits your specific situation.

Here are the key areas you have control over:

- Property Division: You get to decide exactly how assets—whether acquired before or during the marriage—will be divided if you separate. This covers everything from bank accounts and investments to real estate and vehicles.

- The Matrimonial Home: The family home gets special treatment under Ontario law. A prenup lets you specify exactly how this crucial asset will be handled, which can be a significant departure from the default 50/50 split.

- Protection of Specific Assets: Do you own a business? Expecting a family inheritance? Have a cottage that’s been in the family for generations? A prenup can designate these assets as separate property, shielding them from division upon separation.

- Debt Responsibility: You can clearly state who is on the hook for debts brought into the marriage and any new debts accumulated during it. This is a huge benefit, as it protects you from being held liable for your partner’s financial missteps.

- Spousal Support: While there are some important limits, you can set out the terms for spousal support. This includes whether it will be paid at all, for how long, and in what amount. It brings a lot of predictability to an otherwise uncertain area.

A marriage contract is your opportunity to write your own financial rulebook. It allows you to replace the government’s ‘one-size-fits-all’ approach with a personalized plan that reflects your shared values and circumstances.

Setting these terms clearly doesn’t just protect your assets; it also connects to your broader financial picture. For example, the decisions you make in a prenup can directly influence how you structure your estate plan. You can learn more by exploring our guide on wills and estate law to see how these critical legal documents work together.

What You Cannot Include in Your Prenup

While Canadian prenups are flexible, they have some very firm, non-negotiable limitations. The law is crystal clear that certain rights, especially anything involving children, simply cannot be signed away in a domestic contract. The court system will always prioritize the well-being of children above any agreement between parents.

These topics are strictly off-limits:

- Child Custody (Decision-Making Responsibility): You cannot pre-determine who will make major decisions for your children. A court will always decide this based on the child’s best interests at the time of separation.

- Parenting Time (Access): In the same way, you can’t use a prenup to lock in a future parenting schedule. This is also determined by what’s best for the child when the time comes.

- Child Support: This is a big one. The right to child support belongs to the child, not the parents. You cannot waive it or set a fixed amount in your prenup. The amount must follow the federal Child Support Guidelines.

- Possession of the Matrimonial Home: A prenup can’t be used to waive a spouse’s right to live in the matrimonial home after separation. This is a specific right protected by law to prevent one partner from being left homeless.

- Unconscionable or Unfair Terms: Any clause that is grossly unfair or would leave one spouse in a state of severe financial hardship can be challenged and thrown out by a judge. The agreement has to be fundamentally fair.

To make it even clearer, here’s a simple breakdown of what’s on and off the table when you’re drafting your agreement in Ontario.

What You Can vs. Cannot Include in an Ontario Prenup

| Permissible Clauses | Prohibited Clauses |

|---|---|

| How to divide property owned before marriage. | Pre-determining child custody or parenting time. |

| Rules for dividing property acquired during marriage. | Waiving or setting a fixed amount for child support. |

| How the matrimonial home will be dealt with. | Clauses that are illegal or against public policy. |

| Protecting specific assets (e.g., business, inheritance). | Waiving the right to possess the matrimonial home. |

| Assigning responsibility for debts. | Grossly unfair terms that would cause severe hardship. |

| Setting terms for spousal support (waiver or amount). | Any clause that undermines a child’s best interests. |

| How finances will be managed during the marriage. | Provisions that encourage divorce or infidelity. |

Knowing these boundaries from the outset is the first, most critical step toward crafting a prenup that will actually stand up in court and protect both of you down the road.

Your Step-By-Step Guide to Creating a Prenup

The idea of creating a prenup can feel overwhelming, but it’s best to think of it as a clear, structured project. When you break it down into manageable steps, the whole process becomes much less intimidating. Let’s walk through the entire journey, from that first crucial conversation with your partner to signing the final document.

The real goal here is to turn a complex legal task into a collaborative effort that actually strengthens your relationship. Understanding how it all works demystifies the process, making sure you and your partner feel in control every step of the way.

Step 1: Initiate the Conversation Early

The most important step happens long before any lawyers get involved. You need to talk about it. Start discussing a prenup with your partner well before the wedding—ideally, at least six to twelve months before your wedding day. Starting early takes the pressure off. A court will look very skeptically at an agreement signed the week before the wedding, as it raises red flags about pressure and duress.

Frame this conversation around planning your future together, not a lack of trust. It’s a practical tool for building a transparent financial foundation. Think of it as a chance to get on the same page about everything from how you’ll handle joint bank accounts to protecting a family business or inheritance.

Step 2: Each Partner Hires Their Own Lawyer

Once you’ve both agreed to move forward, this next step is non-negotiable for making your prenup stick. Each of you must hire your own, separate family lawyer. This is what the legal world calls Independent Legal Advice (ILA), and it’s absolutely essential for creating an enforceable agreement.

Why is this so critical? Having your own lawyer ensures that:

- Both of you genuinely understand your legal rights and what you might be agreeing to give up.

- Neither person can later say they were forced into it or didn’t get what the terms meant.

- Your specific, individual interests are properly represented during the negotiations.

A prenup is only as strong as the process used to create it. Having two separate, dedicated lawyers is the single best way to ensure the agreement is fair, balanced, and will be upheld by a court.

Step 3: Complete Full Financial Disclosure

With your lawyers on board, the next phase is all about transparency: full and honest financial disclosure. This means you both need to lay all your financial cards on the table by creating a complete inventory of your assets, debts, and income.

You’ll need to gather documents like:

- Bank and investment account statements.

- Appraisals for any property you own, along with mortgage details.

- Valuations for any businesses and your most recent tax returns.

- A clear list of any major debts, like student loans or credit lines.

This isn’t optional. Trying to hide an asset or misrepresenting your financial situation is a surefire way to have a court throw out the entire agreement later on. It’s all about making sure you’re both negotiating with a clear and complete picture of the financial reality.

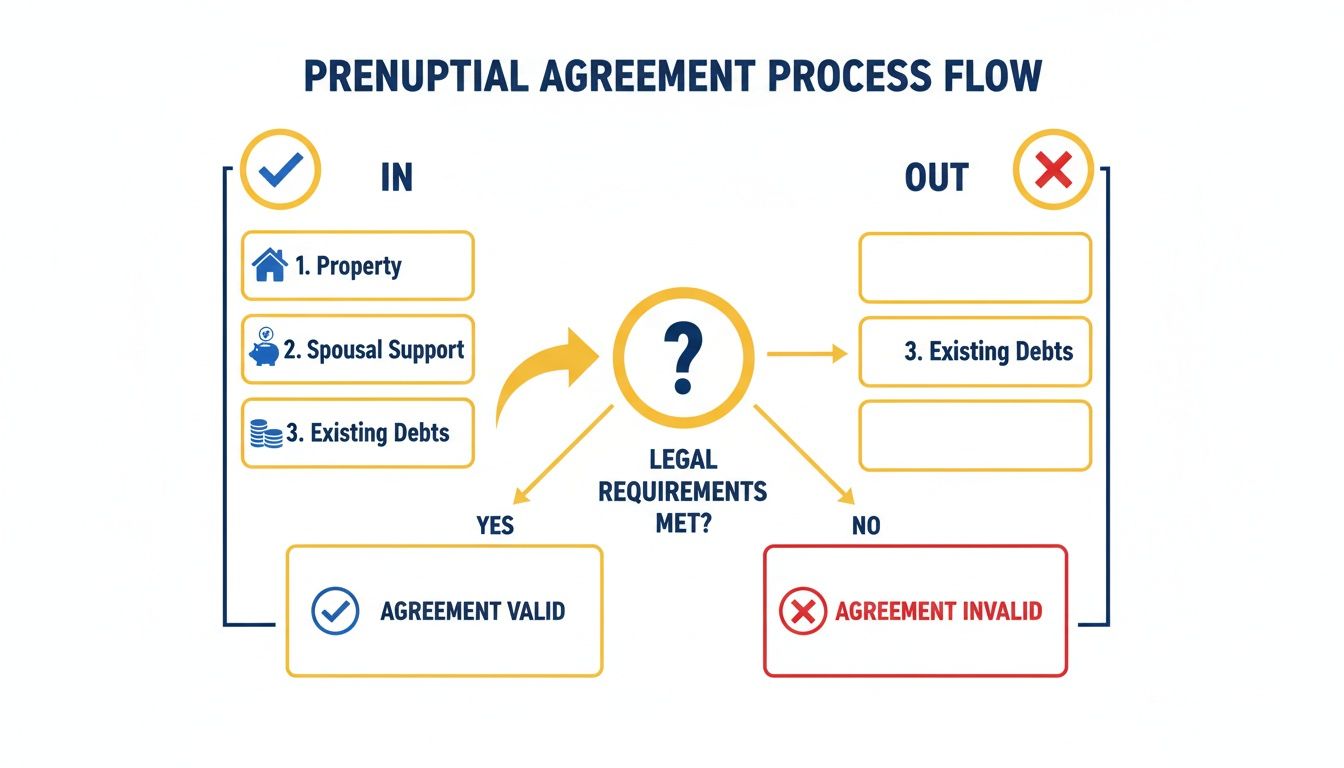

This flowchart maps out the key elements of a prenup, showing what goes in and what stays out.

As you can see, things like property division and spousal support are fair game, but you can’t pre-determine issues related to children.

Step 4: Negotiate, Draft, and Finalize the Agreement

Now your lawyers get to work. Based on your goals and financial disclosures, one lawyer will draft the first version of the agreement. The other lawyer then reviews that draft with their client, suggesting changes and negotiating terms. This is a very collaborative stage, with some back-and-forth until a final version is reached that everyone is happy with.

While you’re thinking about which assets to protect, it’s also a good time to consider other legal documents that secure your financial well-being. For example, you can learn more about what is a power of attorney for property and see how it fits into your overall life plan.

Once the final text is agreed upon, you’ll have one last meeting with your respective lawyers to go over it in detail. After you confirm you understand and accept all the terms, you’ll sign the document with a witness present. Just like that, your prenup becomes a legally binding contract.

Common Mistakes That Can Invalidate Your Prenup

A well-drafted prenup can be one of the smartest decisions a couple makes, but it’s not bulletproof. Even with the best of intentions, a few critical mistakes during the drafting process can make the entire agreement worthless in the eyes of a Canadian court. Knowing what these pitfalls are is the best way to avoid them and ensure your agreement actually protects you.

Think of your prenup as a legal structure. Its strength depends entirely on the integrity of its foundation. A single crack—like a hidden asset or a signature given under pressure—can bring the whole thing tumbling down when it’s put to the test. When a marriage contract is challenged, judges will look very closely at both the process and the final terms for any hint of unfairness.

Hiding Assets or Debts

This is, without a doubt, the number one reason prenups in Canada get tossed out. The entire process hinges on absolute, honest-to-goodness transparency. If one partner conveniently “forgets” to disclose a major asset, downplays the value of their business, or hides a mountain of debt, the other person can’t possibly give their informed consent.

It’s really quite simple: you can’t agree to give up your rights to something if you don’t even know it exists. A court will almost always set aside an agreement if it finds out one person was negotiating with a stacked deck. This isn’t a minor clerical error; it’s a fundamental breach of the good faith needed to create a binding contract.

Pressure, Coercion, or Duress

A prenup has to be signed freely and voluntarily. A classic example of what not to do is springing the agreement on your partner a week before the wedding with a “sign this or it’s all off” ultimatum. That kind of last-minute pressure is a massive red flag for any judge.

An agreement signed under duress isn’t a real agreement. Canadian courts are committed to protecting the more vulnerable person in these scenarios and won’t hesitate to invalidate a prenup that was born out of coercion or undue influence.

The best way to steer clear of this is to start the conversation months—not weeks—before the wedding. This gives you both plenty of time to think things over, get proper legal advice, and negotiate without the immense emotional pressure of the big day looming over your heads.

Skipping Independent Legal Advice (ILA)

As we’ve stressed before, each partner having their own lawyer isn’t just a good idea; it’s a critical piece of the puzzle for an enforceable prenup in Ontario. When one lawyer tries to advise both parties, or if one partner decides to go it alone, it creates a huge vulnerability. The unrepresented partner can later argue they had no idea what they were signing or the legal rights they were giving up.

Having Independent Legal Advice (ILA) proves to the court that both of you had a professional in your corner, explaining your rights and the contract’s implications. This single step is your best defence against a future claim of misunderstanding or unfairness. While this process is about what happens in a separation, it shares a theme with estate planning, where unclear intentions can spark legal fights. For example, understanding how to contest a will often involves looking at whether someone was pressured or unduly influenced—the very thing ILA helps prevent in a prenup.

Unconscionable or Grossly Unfair Terms

While you can customize the rules away from standard family law, a prenup can’t be completely outrageous. An agreement that leaves one spouse destitute while the other walks away with everything is what the law calls “unconscionable.” Canadian courts reserve the right to intervene and throw out an agreement that is just too lopsided to be upheld.

This doesn’t mean everything has to be split 50/50. But the outcome must land within a reasonable zone of fairness, ensuring neither person faces severe financial hardship because of the terms they signed.

Partnering with a Lawyer to Protect Your Future

Throughout this guide, we’ve tried to shift the perspective on prenups in Canada. A marriage contract isn’t about planning for failure; it’s a smart financial planning tool for any modern couple. Think of it as an act of total transparency that actually strengthens the foundation of your relationship.

But its success isn’t a given. As we’ve covered, whether a prenup holds up in court depends entirely on meeting strict legal requirements. This is why getting professional legal guidance isn’t just a good idea—it’s absolutely essential if you want an agreement that offers real protection.

Why Choose UL Lawyers for Your Prenup

At UL Lawyers, we’ve helped countless couples across the Greater Toronto Area (GTA) and Ontario create marriage contracts that are fair, clear, and legally solid. We get that this process involves more than just knowing the law; it requires a great deal of sensitivity and open communication.

Our approach is always human-first. We start by taking the time to really listen and understand your specific situation, your financial picture, and what you both hope to achieve. We truly see our clients as part of our extended family, and our main goal is to make this process feel empowering, not intimidating.

A great family lawyer does more than just draft a document; they help facilitate an important conversation. Our role is to translate your shared intentions into a resilient legal agreement that gives you both genuine peace of mind.

With our deep expertise in Ontario’s Family Law Act, we make sure every detail is handled correctly. From managing the full financial disclosure process to providing strong independent legal advice, we guide you meticulously through each step. We’re here to answer every single question, making sure you feel confident and fully informed from start to finish.

It’s also worth noting that even with a solid prenup, understanding the full landscape of legal support, like paralegal services for divorce, can be helpful for long-term planning.

Take the Next Step with Confidence

Putting a marriage contract in place is one of the most significant steps you can take to safeguard your assets and build a secure future together. You don’t have to figure this out on your own.

The team at UL Lawyers is here to give you the expert support you need. We invite you to contact UL Lawyers for a consultation to talk about how we can help you craft a fair agreement that protects what matters most and brings you lasting security.

Frequently Asked Questions About Prenups in Canada

Even with a good understanding of the basics, it’s natural to have more specific questions about how a prenup works in the real world. Let’s tackle some of the most common questions we hear from couples in Ontario to give you the clarity you need.

How Much Does a Prenup Cost in Ontario?

There’s no single price tag for a prenup in Ontario. The cost really depends on how complex your financial picture is and how much back-and-forth is needed to reach an agreement.

For a couple with relatively simple assets, you might be looking at a few thousand dollars in total legal fees. But if you have business interests, several properties, or sophisticated investments, the price will naturally go up. This reflects the extra time your lawyers will need to draft and review everything carefully.

Keep in mind, that total cost is split. Each partner must have their own independent legal counsel, and you each pay for your own lawyer. While it feels like a big expense upfront, it’s almost always a fraction of the financial and emotional toll of a messy separation down the road.

Can We Get a Prenup After We Are Married?

Yes, absolutely. If you sign this kind of agreement after you’re already married, it’s simply called a marriage contract (or sometimes a postnuptial agreement).

It serves the exact same purpose as a prenup and has to follow the same strict legal rules—including full and honest financial disclosure and independent legal advice for both of you. Many couples go this route when their financial situation changes dramatically, like when one person starts a business, gets a significant inheritance, or decides to sell a major asset.

What Happens Without a Prenup in Ontario?

If you don’t have a valid marriage contract, Ontario’s Family Law Act sets the rules for how your property is divided if you separate. The standard procedure is called an equalization of net family property.

Essentially, this process involves adding up the value of most assets each of you acquired during the marriage, and then splitting the total value down the middle. The spouse who accumulated more has to write a cheque to the other spouse for half of the difference. A prenup lets you bypass these default rules and create your own plan.

A prenup is all about creating certainty. It lets you replace the government’s one-size-fits-all formula with a personalized roadmap that you and your partner build together—one that truly reflects your financial reality and goals.

Are Prenups Only for the Wealthy?

This is probably the biggest misconception out there. While prenups are definitely smart for protecting significant assets, they offer practical benefits for couples from all walks of life. A prenup is a powerful financial planning tool that can:

- Protect a future inheritance, regardless of its size.

- Keep a small, growing business from being split up in a divorce.

- Define how debts, like student loans, will be treated.

- Ensure financial stability for a partner who steps back from their career to raise children.

At its core, a prenup is just a financial plan for your partnership. For anyone curious about the real-world consequences, especially regarding what happens if you sign a prenup and get divorced, it’s worth exploring the specifics. It’s about being proactive and establishing clear expectations, no matter your net worth.

Crafting a prenuptial agreement that is both fair and legally sound is one of the smartest steps you can take for your future together. The experienced team at UL Lawyers is here to guide you through every step with compassion and expertise. Contact us today to learn how we can help you protect your tomorrow. https://ullaw.ca

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies