Your Guide to the Probate Fees Calculator Ontario

Dealing with an estate can feel like a mountain of paperwork and legal terms. A good place to start is by getting a handle on the key costs involved. In Ontario, one of the biggest is the Estate Administration Tax, which most people simply call “probate fees.”

The calculation itself is surprisingly straightforward. The first $50,000 of an estate’s value is completely exempt from the tax. Anything over that amount is taxed at a flat rate of 1.5%. That’s the core formula you’ll need, and it’s what powers any probate fees calculator in Ontario.

What Exactly is Ontario’s Estate Administration Tax?

Let’s break it down without the legalese. When someone in Ontario passes away, their will usually needs to be validated by the court. This process, called probate, officially confirms the will is legitimate and gives the executor the legal authority to start managing and distributing the deceased person’s assets as instructed.

The Estate Administration Tax is the fee the provincial government charges for granting this authority. It’s not a tax that beneficiaries have to pay out of their own pockets. Instead, it’s paid directly from the estate’s funds before anyone receives their inheritance. This makes it a crucial expense to account for, as it directly reduces the total value that gets passed on to loved ones.

The Real-World Cost of Probate Fees

While 1.5% might not sound like a lot, it can add up to a substantial amount, especially for estates with high-value assets like real estate in the GTA, from Burlington to Toronto. For an executor managing an estate or anyone planning their own, understanding this cost is non-negotiable.

Here’s a quick summary of the fee structure in a table format:

Ontario Probate Fee Tiers

This table offers a clear snapshot of how the tax applies based on the estate’s total value.

| Total Estate Value | Applicable Tax Rate | Example Fee |

|---|---|---|

| Up to $50,000 | 0% | $0 |

| Over $50,000 | 1.5% on the value exceeding $50,000 | On a $250,000 estate, the fee is $3,000 |

As you can see, the tax scales quickly. An estate with a family home and some savings totalling $250,000 would owe tax on $200,000 of its value, resulting in a $3,000 fee. For a larger estate valued at $2.5 million, that same formula results in a tax bill of $36,750.

Key Takeaway: The tax is calculated on the total value of the assets passing through probate, not the net value after debts are settled. This is a critical detail that often catches people by surprise and is vital for accurate planning.

Knowing which assets are subject to this tax and which are exempt is a cornerstone of effective estate management. These details can get complicated, which is why having a solid grasp of wills and estate law is so important for executors and families throughout Ontario.

How to Accurately Calculate Probate Fees

Getting the probate fee calculation right in Ontario is less about complex math and more about meticulous preparation. The whole process hinges on one critical number: the total value of the estate’s assets as of the date of death. This is the figure that you’ll plug into any probate calculator and, more importantly, report on the official Estate Information Return filed with the court.

Your first job as an executor is to take a complete inventory of everything the deceased owned in their sole name. This isn’t just a quick look at the big-ticket items like a house. You need to dig into every corner of their financial life—bank accounts, investment portfolios, cars, art, jewellery, and any other valuable personal belongings. It’s like creating a detailed financial snapshot at the moment of passing.

To do this correctly, you must determine each asset’s Fair Market Value (FMV). This isn’t what was originally paid for an item, but what it would likely sell for today. For something like a house in a hot market like Burlington or anywhere across the GTA, this almost always means getting a professional appraisal to satisfy the court.

Applying the Ontario Probate Tax Formula

Once you have that final, defensible number for the total value of the probatable assets, the calculation itself is surprisingly simple. Ontario uses a two-tiered system for its Estate Administration Tax:

- The first $50,000 of the estate’s value is completely exempt. 0% tax.

- Any amount over $50,000 is taxed at a flat rate of 1.5% (which works out to $15 for every $1,000).

Let’s move beyond the theory and look at how this plays out in the real world. Seeing the formula applied to a few different estate sizes makes the financial impact much clearer.

Real-World Calculation Examples

Here are a few common scenarios to show you exactly how the probate tax is calculated.

Example 1: A Modest Estate Valued at $250,000

- Total Estate Value: $250,000

- Exempt Amount: -$50,000

- Taxable Value: $200,000

- Probate Fee Calculation: $200,000 x 0.015 = $3,000

Example 2: A Mid-Sized Estate Valued at $900,000

- Total Estate Value: $900,000

- Exempt Amount: -$50,000

- Taxable Value: $850,000

- Probate Fee Calculation: $850,000 x 0.015 = $12,750

Example 3: A Larger Estate Valued at $2,000,000

- Total Estate Value: $2,000,000

- Exempt Amount: -$50,000

- Taxable Value: $1,950,000

- Probate Fee Calculation: $1,950,000 x 0.015 = $29,250

As you can see, the probate fees can become a significant expense, scaling directly with the estate’s value. It’s a crucial responsibility for any executor to ensure this tax is paid from the estate’s funds before a single dollar is distributed to the beneficiaries.

This entire process, from tracking down and valuing assets to filing the final return, is a core part of an executor’s duties. For a more detailed look at these responsibilities, our guide explains how to probate a will in Ontario. Nailing these calculations is your first major step toward a smooth and compliant estate administration.

Identifying Assets That Are Subject to Probate

Getting the probate calculation right starts with one crucial step: knowing exactly which assets to include. It’s a common and often costly mistake to misjudge the value of an estate by including things that are exempt or, worse, leaving out assets that should be there. This isn’t just about an accurate tax calculation; it’s the bedrock of smart estate planning.

At its core, probate applies to assets the deceased owned in their sole name. Think of these as the assets that the will controls and that need a court-certified executor to step in and manage. Without that court certificate (officially a Certificate of Appointment of Estate Trustee with a Will), banks and other financial institutions simply won’t release these assets to the executor.

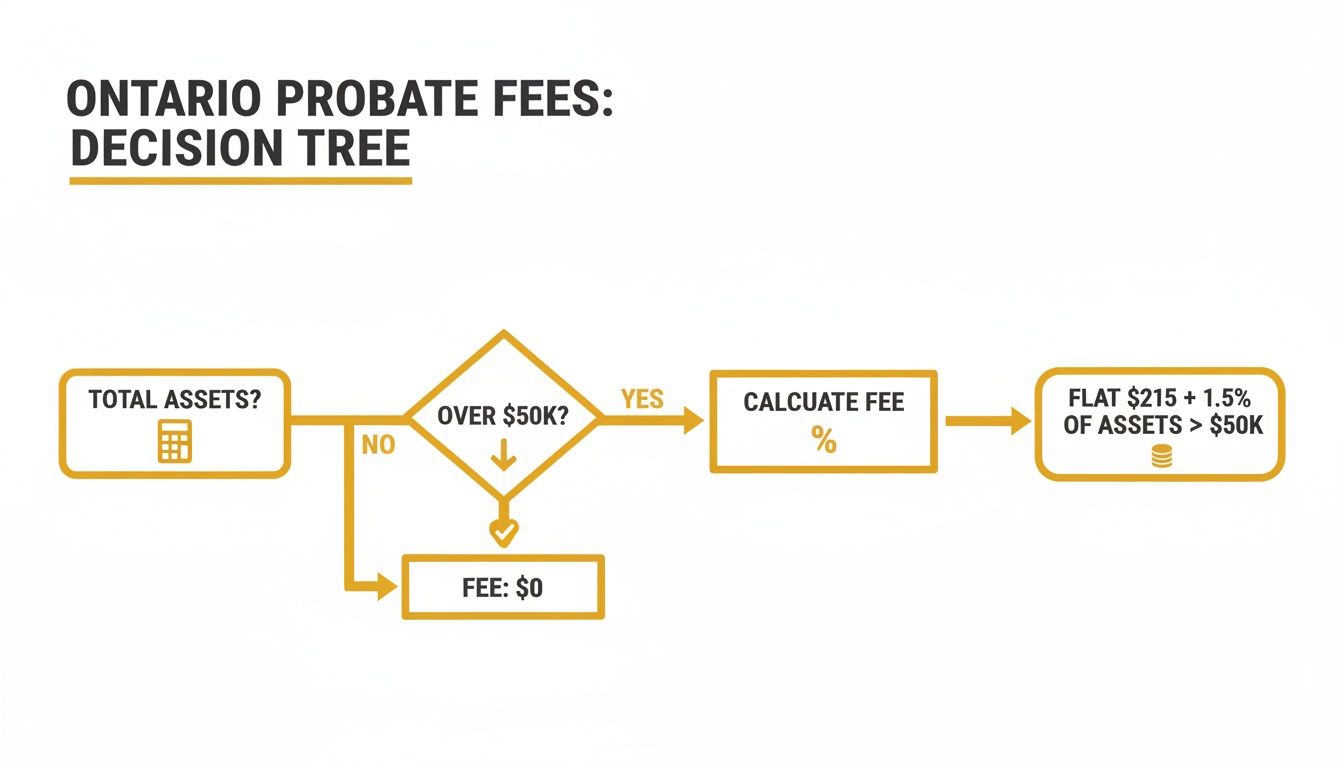

This decision tree gives you a quick visual on how the calculation kicks off.

As you can see, it all begins with tallying up the total assets. That $50,000 threshold is the magic number that determines whether or not fees apply.

Assets Typically Included in Probate

When you’re pulling together the numbers for the estate’s value, you’ll almost always need to count the following:

- Solely Owned Real Estate: Any property registered only in the deceased’s name, whether it’s a condo in Toronto or the family cottage in Muskoka.

- Personal Bank Accounts: Chequing and savings accounts that were held exclusively by the deceased.

- Investments in Non-Registered Accounts: This includes any stocks, bonds, or mutual funds held in the individual’s name alone.

- Vehicles and Personal Property: Cars, boats, valuable art, jewellery, and other significant personal belongings owned solely by the person who passed away.

- Business Interests: Any shares in a private corporation that were owned personally by the deceased.

Assets That Can Bypass Probate

Here’s where a bit of foresight in estate planning really pays off. Many assets can be structured to pass directly to beneficiaries without ever touching the probate process, meaning they aren’t subject to the Estate Administration Tax.

Assets that usually get a free pass include:

- Jointly Held Assets: Property or bank accounts owned as “joint tenants with right of survivorship.” When one owner passes, the asset automatically belongs to the surviving owner(s). It’s a seamless transition.

- Registered Accounts with Named Beneficiaries: RRSPs, RRIFs, and TFSAs are prime examples. If a specific person (not “the estate”) is named as the beneficiary, the funds go straight to them.

- Life Insurance Policies: The payout from a life insurance policy is paid directly to the named beneficiary, completely outside of the estate.

- Assets in a Trust: Assets that have been placed into certain types of trusts are governed by the trust’s own rules, keeping them separate from the probatable estate.

Grasping this distinction is absolutely critical. Ontario’s probate fee structure, with its 1.5% rate on values over $50,000, can take a significant bite out of an estate. By ensuring assets bypass probate where appropriate, you preserve more of that value for your loved ones.

Executor’s Tip: Always double-check ownership documents and beneficiary designations. I’ve seen situations where a forgotten beneficiary update on an old RRSP, or a property deed that wasn’t properly set up for joint tenancy, unexpectedly dragged a major asset back into the estate. That single oversight can dramatically increase the probate fees owed.

Properly structuring assets is a powerful tool, but keep in mind that it also has implications during a person’s lifetime. For example, how an asset is held can directly affect what can be done under a Power of Attorney for property if someone becomes unable to manage their own affairs.

Using an Online Probate Fees Calculator Effectively

Online calculators can give you a quick estimate of the Estate Administration Tax, but they’re only as good as the numbers you plug into them. It’s a classic “garbage in, garbage out” situation. Using one of these tools isn’t just about getting a final number; it’s about understanding what that number truly represents and making sure your input is spot-on from the get-go.

Before you even think about typing a number into a calculator, you need to have a solid figure ready: the total fair market value of all assets that actually have to go through probate. This means methodically inventorying everything the estate holds and valuing it as of the date of death. If you just throw in a rough guess, you’ll get a misleading estimate that could cause major headaches and financial shortfalls later on.

Preparing for an Accurate Calculation

To get a reliable figure from any online tool, you have to do the legwork first. This involves gathering precise values for every solely-owned asset, exactly as you would for the official court application. A great way to make sure you don’t miss anything is by working through a comprehensive asset list. Our estate planning checklist for Canada is a helpful resource for organizing this critical information.

Here’s a look at the official Government of Ontario’s pre-estimate tool. Notice how simple it is? There’s only one box: “Total value of the estate.” This really drives home the point that the quality of your initial valuation work is everything. The calculator simply crunches the number you provide.

Interpreting the Calculator’s Output

That final number the calculator spits out isn’t just a random estimate—it’s a preview of a real legal and financial obligation. This is the amount the estate will eventually have to pay to the Minister of Finance for Ontario.

The mechanics are straightforward: you enter the estate’s value determined at the time of death, before most debts are settled. For any estate worth more than $50,000, the calculator instantly applies the 1.5% tax to the amount over that threshold. If you’re interested in strategies to reduce this amount, you can learn about minimizing probate fees on taxpage.com.

Key Insight: The calculator’s result directly corresponds to the amount you will declare and swear to on the Estate Information Return submitted to the court. A precise pre-estimate helps you set aside the right amount of cash, preventing financial surprises or delays and making the entire probate application process much smoother.

Proven Strategies to Minimize Ontario Probate Fees

While an online probate fees calculator for Ontario gives you a solid estimate of the bill, its real power is showing you just how much you can save with a bit of foresight. Smart estate planning isn’t about finding shady loopholes; it’s about using legally sound, court-approved methods to structure your assets in the most efficient way possible.

By thinking strategically about how your assets are held and passed on, you can genuinely reduce the value of your estate that needs to go through probate. This directly lowers the Estate Administration Tax, ensuring more of your hard-earned wealth goes to your beneficiaries instead of the government.

The Power of Joint Ownership

One of the most straightforward and effective tools in the estate planning kit is joint ownership. When you own an asset—like a house or a bank account—as joint tenants with right of survivorship, it automatically passes to the surviving owner when you die. It completely bypasses your will and, crucially, the probate process.

Think about a couple in Burlington who own their $1.2 million home jointly. When one spouse passes away, the home transfers to the survivor without a single dollar in probate fees on its value. If that same house were owned solely by the deceased, it would have added a hefty $17,250 probate bill to the estate.

Leveraging Designated Beneficiaries

Another incredibly useful strategy involves assets that let you name a beneficiary directly. This is a key feature for some of the most common Canadian investment and insurance products:

- Registered Retirement Savings Plans (RRSPs)

- Registered Retirement Income Funds (RRIFs)

- Tax-Free Savings Accounts (TFSAs)

- Life Insurance Policies

As long as you name a specific person (and not “the estate”) as the beneficiary, the funds flow directly to them upon your death. The money never technically becomes part of the estate that gets probated, so its value is completely excluded from the tax calculation.

Important Tip: Make a habit of reviewing your beneficiary designations after major life events like a marriage, divorce, or the birth of a child. I’ve seen too many costly and heartbreaking situations where an outdated beneficiary sent funds into the estate by mistake.

Advanced Planning with Multiple Wills

For those with more complex finances, particularly business owners, Ontario law permits the use of multiple wills. This is a more sophisticated strategy, but it can lead to massive savings. It involves creating two distinct wills:

- A Primary Will: This will covers only the assets that absolutely require probate to be transferred, like real estate or bank accounts held in your name alone.

- A Secondary Will: This handles assets that can be transferred without probate, most commonly the shares of a privately-owned corporation.

Imagine a business owner in the GTA with company shares valued at $2 million. By putting those shares into a secondary will, they are kept entirely out of the probate application. This one move could save their estate roughly $30,000 in probate fees.

If you’re serious about protecting your legacy, it’s worth digging into the various legal avenues available. Learning about proven strategies to avoid probate court can give you a clear roadmap, from setting up trusts to structuring ownership in a way that truly benefits your loved ones.

When You Should Consult an Ontario Estate Lawyer

An online probate fees calculator is a fantastic tool for getting a quick estimate, but its job stops at the basic math. It can’t decipher a confusing clause in a will, advise on a complex business asset, or help you navigate a disagreement between beneficiaries.

Knowing when to put the calculator aside and call a professional is one of the most important parts of handling an estate responsibly. It’s not about admitting defeat; it’s a smart move to protect the estate’s value and honour the deceased’s final wishes.

Getting an experienced estate lawyer involved can provide much-needed clarity. They ensure everything you do is by the book under Ontario law and can often spot opportunities to save the estate significant money—far more than their fees. This is especially true when dealing with the complex legal environment in the GTA, whether you’re in Burlington, Mississauga, Toronto, or beyond.

Clear Signals It’s Time to Get Legal Advice

Think of a lawyer as your guide through tricky territory. You might be fine on a straight, simple path, but you’ll want an expert for the winding roads and unexpected obstacles. Certain situations are clear red flags that it’s time to bring in a professional.

If the estate you’re managing has any of these elements, it’s best to seek legal advice right away:

- Business Ownership: Figuring out the value of a private corporation and handling the transfer of shares is a highly specialized task. It’s far more involved than plugging numbers into a form.

- Out-of-Province Property: Any real estate located outside of Ontario falls under the laws of that specific province or country. This means there are extra legal hoops to jump through.

- Ambiguous or Contested Wills: If the will’s wording is unclear, seems out of date, or if beneficiaries are already starting to raise concerns, a lawyer is crucial. They can help you interpret the will correctly and hopefully head off a costly court battle.

- Complex Assets or Debts: An estate with a sophisticated investment portfolio, large outstanding debts, or ongoing lawsuits needs a strategic hand at the wheel.

A Lawyer’s Perspective: An online calculator tells you the what—the potential tax amount. An experienced estate lawyer tells you the how and the why—how to navigate the probate process properly, why one strategy is better than another, and how to protect yourself from personal liability as an executor.

Ultimately, a lawyer provides peace of mind. They make sure you’re not just checking your math, but that you are fulfilling all your legal duties as an executor. You can move forward confidently, knowing the estate—and you—are protected from unnecessary risk. For comprehensive support, you can learn more about our dedicated approach to wills and estates.

At UL Lawyers, we understand that administering an estate is a heavy responsibility. Based in Burlington and serving all of the GTA and Ontario, our team knows that if your situation feels even a little complicated, or if you just want the assurance that everything is being handled perfectly, we’re here to help. Contact us for a consultation to ensure you navigate the process with confidence.

Related Resources

Your Ultimate 8-Point Spouse Sponsorship Checklist for Canada (2026)

Continue reading Your Ultimate 8-Point Spouse Sponsorship Checklist for Canada (2026)Your Guide to Spousal Open Work Permit Eligibility in Canada

Continue reading Your Guide to Spousal Open Work Permit Eligibility in CanadaNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies