Denied a Claim? A Critical Illness Insurance Lawyer in Hamilton Can Fight for You

Receiving a denial letter for your critical illness claim can feel like a punch to the gut. But here’s the crucial thing to remember: a critical illness insurance lawyer in Hamilton can challenge the insurer’s decision and fight for the benefits you paid for. You absolutely do not have to accept their “no” as the final answer or try to take on a massive insurance company by yourself.

An experienced lawyer knows the playbook insurers use and can build a powerful case to counter their tactics. We are a Burlington, Ontario-based firm, but we are proud to serve clients across Hamilton, the entire GTA, and all of Ontario.

Your Guide to Fighting a Critical Illness Claim Denial in Hamilton

Getting a life-altering diagnosis is overwhelming enough. The financial support from your critical illness policy was supposed to give you breathing room, letting you focus on your health, not your bills. When that claim is denied, it feels like the very safety net you dutifully paid for has been ripped away.

This is a shockingly common experience for people in Hamilton and right across Ontario. Insurers often hide behind complicated policy wording, incredibly strict medical definitions, and tiny procedural details to justify a denial. It’s a strategy that can leave you feeling completely powerless.

Why Legal Support Is So Important

Think of this guide as your roadmap for fighting back. We’ll break down the most common reasons claims get rejected and show you exactly how a lawyer can turn the tables to secure your benefits.

Critical illness insurance has been around in Canada for over 30 years, with more than 2 million Canadians holding policies. Yet, a Canadian survey revealed a startling statistic: 17% of claims were denied. A huge reason for this is that the definitions in the policy were far more restrictive than people ever realized. You can get more insights into these critical illness insurance challenges and see why having an expert in your corner is non-negotiable.

An insurance policy is a contract, but it’s a contract where the insurance company wrote all the rules. A lawyer’s job is to make sure those rules are applied fairly and legally, not just in a way that protects the insurer’s profits.

Hiring a legal advocate shifts the balance of power. They take your uphill battle and turn it into a strategic, calculated challenge. A lawyer will:

- Dive deep into your policy to understand its specific terms.

- Pinpoint the real reason behind the denial, which isn’t always what’s stated in the letter.

- Gather the right evidence to build a strong, compelling case.

With the right legal expertise on your side, you can push back against the insurer’s decision and work toward getting the financial support you are rightfully owed.

Why Insurance Companies Deny Critical Illness Claims in Ontario

Getting a denial letter for your critical illness claim can feel like a punch to the gut. The reasons the insurer gives often sound confusing, wrapped up in technical jargon and policy fine print. It’s important to remember that insurance companies are businesses, and they often lean on the complexities of their own policies to protect their financial interests.

But a denial isn’t the final word. Far from it. Think of it as the starting point of a negotiation. Insurers are often banking on the hope that you’ll be too overwhelmed or discouraged to challenge their decision. This is where understanding their playbook becomes your first advantage.

Alleged Misrepresentation on Your Application

One of the most common tactics is claiming you made an “alleged misrepresentation” on your original application. The insurance company will go back and scrutinize every answer you gave, sometimes years after you first bought the policy, looking for any inconsistency, no matter how small.

They might point to a forgotten doctor’s visit from a decade ago or a minor health detail you didn’t think was important. From their perspective, even an honest mistake can be used to void the entire policy. They’ll argue that if they had known the “full truth,” they never would have offered you coverage in the first place. A lawyer’s job is to push back and show that the omission wasn’t fraudulent or even relevant to your current illness.

Disputes Over Pre-Existing Conditions

Another frequent reason for denial is linking your illness to a pre-existing condition. Every policy has a clause that excludes coverage for health problems you had before your insurance started. It sounds straightforward, but this is where things can get murky.

Insurers can sometimes draw very thin lines, connecting a new, serious diagnosis to a completely unrelated symptom you might have had years ago. This is precisely where a critical illness insurance lawyer in Hamilton is invaluable. They work with independent medical experts to sever that weak link, proving your diagnosis is new, unrelated to the past, and fully covered by your policy.

The insurer’s goal is to interpret every ambiguity in the policy in their favour. Your lawyer’s job is to enforce the legal principle that ambiguities should actually be interpreted in favour of the policyholder—the person who didn’t write the contract.

Your Diagnosis Doesn’t Meet Their Definition

This is perhaps the most frustrating denial of all. The insurance company might agree that you’re sick, but then argue that your condition doesn’t fit the exact, rigid definition written in their policy.

For example, your doctor confirms you had a heart attack, but the insurer denies the claim because your medical tests didn’t show the specific enzyme levels or ECG changes listed in their policy’s definition. You’re left fighting over semantics, not your health. A lawyer can challenge this, arguing that the insurer is using an unreasonably narrow interpretation of the medical facts just to avoid paying the claim. To see how this works in practice, you can learn more about how a skilled lawyer for an insurance claim builds a compelling case.

To make it clearer, let’s break down how these arguments typically unfold and how a legal professional responds.

Common Reasons for Claim Denials and How a Lawyer Responds

This table shows the standard arguments insurers use to deny a claim and the strategic counters a lawyer will deploy to protect your rights.

| Reason for Denial | Insurer’s Argument | Your Lawyer’s Counter-Argument |

|---|---|---|

| Misrepresentation | ”You failed to disclose a past medical consultation on your application." | "The undisclosed information was minor, unintentional, and medically irrelevant to the current critical illness claim.” |

| Pre-existing Condition | ”Your current diagnosis is a result of symptoms you had before coverage began." | "Independent medical evidence proves the current illness is a new diagnosis and not a continuation of a past condition.” |

| Policy Definition | ”Your medical tests do not precisely match the criteria for the illness as defined in the policy." | "The insurer is applying an overly strict and bad-faith interpretation of the definition; the diagnosis clearly falls within the spirit and intent of the coverage.” |

Ultimately, facing a denial is about challenging an interpretation. With the right expertise, you can ensure your side of the story is heard and that the policy you paid for honours its promise.

Decoding the Fine Print in Your Insurance Policy

Your critical illness insurance policy isn’t just a piece of paper—it’s a legally binding contract. The problem is, it’s often packed with dense, technical language that can give the insurance company an edge when it comes time to review a claim. The line between an approved payout and a denial letter can hinge on just a few words buried in the fine print.

Getting a handle on these key clauses is the first real step in protecting yourself. Too many policyholders in Hamilton get blindsided by specific terms they didn’t even know existed until their claim was denied. This is where a skilled critical illness insurance lawyer in Hamilton comes in; they specialize in translating this legalese and pushing back against an insurer’s self-serving interpretations.

Key Clauses That Cause Disputes

Time and again, we see disputes arise from two particularly tricky clauses in Canadian critical illness policies: the “survival period” and the highly specific medical “definitions of covered illnesses.” These aren’t minor details. They form the foundation for a huge number of claim denials.

The survival period clause can feel especially cruel. It dictates that you must survive for a set period after your diagnosis for the policy to pay out. This is often 30 days, though it can differ between policies. If a person passes away before that window closes, the insurer can refuse to pay the benefit to their family or estate, even with a confirmed diagnosis of a covered illness.

Imagine a situation where an insurer denies a claim because the policyholder died 28 days after a massive stroke, falling just shy of the 30-day survival period. A lawyer can dig into the exact timing of the diagnosis and the policy’s wording to challenge such a devastating outcome.

The definitions for covered illnesses are just as rigid. There’s no standard, one-size-fits-all critical illness policy in Canada. Comprehensive policies might cover 24–26 conditions, while a more basic plan may only cover five. This means your eligibility is entirely dependent on whether your medical situation meets the exact criteria spelled out in your specific contract. You can find more details on how these critical illness insurance policies vary and what that means for your claim.

How Wording Impacts Your Claim

The difference in wording from one policy to the next can be staggering. For example, one insurer might define a “heart attack” in fairly broad terms. Another might demand proof of certain enzyme levels in your bloodwork, along with very specific changes on an electrocardiogram (ECG). If your medical file doesn’t tick every single one of their boxes, they’ll send you a denial letter.

An experienced lawyer can build a case arguing that the insurer is applying an unreasonably strict interpretation of your condition, essentially acting in bad faith. When an insurance company refuses to honour its obligations under the contract, it can be considered a breach of that contract. You can learn more by reading our guide on remedies for a breach of contract in Ontario. Understanding these rights is key to spotting the red flags and successfully fighting back against an insurer’s decision.

Understanding the True Financial Impact of a Critical Illness

When a serious illness enters your life, the last thing you should have on your mind is money. Unfortunately, many people in Hamilton hold onto a common and costly belief: that the Ontario Health Insurance Plan (OHIP) will cover everything. It won’t.

This is precisely why your critical illness insurance policy exists. It’s designed to fill the massive financial gaps that public healthcare simply doesn’t—and was never intended to—address.

The lump-sum, tax-free payout from your policy isn’t a windfall; it’s a lifeline. It’s there to shield your family from the financial crisis that so often follows a medical one. This is what makes a wrongful denial so utterly devastating. It pulls the rug out from under you, yanking away the very safety net you put in place to protect your family’s stability.

The Real Costs OHIP Does Not Cover

The out-of-pocket expenses can pile up with frightening speed, easily running into tens of thousands of dollars. That lump-sum benefit is specifically meant to help you handle these unexpected costs.

Think about what that money is actually for:

- Lost Income: One of the most immediate hits is the loss of your paycheque. You might have to stop working altogether, or your spouse may need to cut back their hours to step into a caregiving role.

- Prescription Drugs: OHIP doesn’t cover many newer, specialized medications, particularly those you take at home rather than in a hospital.

- Home Modifications: Suddenly, your home might not be safe. You could be looking at installing ramps, stairlifts, or accessible bathrooms just to move around.

- Travel and Accommodation: If the best treatment centre is in another city, the costs for fuel, hotels, and meals can become overwhelming.

A wrongful denial isn’t just a breach of contract; it’s a direct threat to your family’s financial survival at a time when you are most vulnerable. Getting the benefits you’re owed is absolutely critical to maintaining your quality of life and being able to focus on getting better.

Why Your Policy Is a Financial Shield

These uncovered expenses really underscore the growing financial burden on Canadian families. As healthcare costs continue to climb, private insurance plays an increasingly vital role. To put it in perspective, total health spending in Canada hit about $331 billion in 2022, yet individual families are still left shouldering substantial costs on their own. For a deeper dive into these trends, you can explore insights on the global critical illness insurance market.

This is exactly why having a critical illness insurance lawyer in Hamilton is so important. A good lawyer knows your claim is about so much more than a policy document—it’s about protecting your home, your savings, and your family’s future.

It’s also worth remembering that your critical illness policy can work in tandem with other benefits. To see the full picture of your potential support system, take a look at our guide on navigating long-term disability in Canada, as you might be eligible for help from more than one source.

How a Hamilton Lawyer Builds a Winning Case Against Insurers

Going up against a massive insurance company after they’ve denied your claim can feel like David versus Goliath. They have deep pockets, entire legal departments, and a roster of doctors ready to back their decision. A specialized critical illness insurance lawyer in Hamilton is the equalizer you need, methodically building an evidence-based case to break down the insurer’s arguments and get you the benefits you’re owed.

This isn’t about firing off a few angry letters and hoping for the best. It’s a strategic process that kicks off the second you sit down for that initial, free consultation. Your lawyer’s first job is to get to know your story inside and out. They’ll pour over your insurance policy, the denial letter, and your complete medical history to pinpoint exactly why the claim was turned down and where the insurer’s case is weakest.

This deep dive is the foundation for everything that follows. From here, the real work begins: building a counter-argument so strong it can’t be ignored.

Gathering and Strengthening Evidence

An insurer’s denial almost always comes down to how they interpret the medical facts. To fight back effectively, your lawyer needs to gather powerful, compelling evidence that tells your side of the story. This goes way beyond just resubmitting the same paperwork.

Here’s what that looks like in action:

- Requesting Comprehensive Medical Records: Your lawyer will chase down every single relevant document. We’re talking initial consultation notes, every diagnostic test result, and all specialist reports, making sure not a single detail gets missed.

- Securing Independent Medical Opinions: This is often the game-changer. Your lawyer will bring in independent medical experts to provide a fresh, unbiased assessment of your case. Their expert opinion can directly contradict the insurer’s doctors, adding incredible weight to your claim.

- Interpreting Policy Language with Legal Precedent: With a deep understanding of Canadian insurance law and past court rulings in Ontario, your lawyer will build a legal argument showing why the insurer’s reading of your policy is flawed or, in some cases, amounts to bad faith.

A denial is often based on the insurance company’s opinion of your medical condition. By obtaining an independent medical evaluation, your lawyer replaces the insurer’s biased opinion with an objective, expert-backed fact, fundamentally changing the dynamic of the dispute.

From Negotiation to Litigation

Once this compelling package of evidence is ready, your lawyer crafts a formal demand letter. This is no simple request. It’s a detailed legal document that lays out the facts, references relevant case law, and makes the strength of your position crystal clear.

More often than not, this letter gets the insurance company back to the negotiating table, where a skilled lawyer can secure a fair settlement without you ever seeing the inside of a courtroom. But if the insurer still won’t budge, your lawyer won’t hesitate to file a lawsuit and fight for you in the Ontario court system.

While your critical illness insurance claim is the focus, a good lawyer also looks at the bigger picture. This can include exploring other legal options, like understanding medical negligence claims for illness, if the circumstances warrant it.

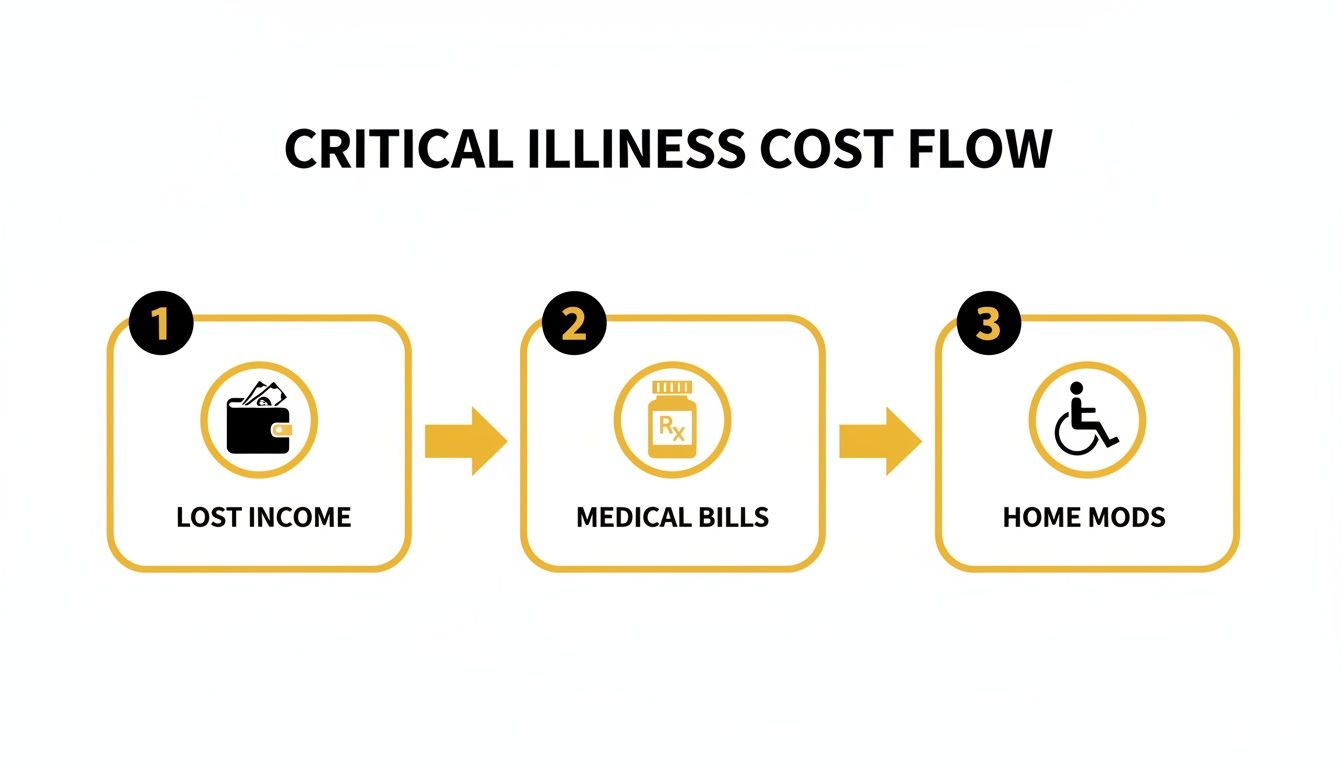

The image below shows just how quickly the financial pressures can stack up after a diagnosis, reinforcing why this fight is so critical.

As you can see, a diagnosis often triggers a domino effect of lost income, rising medical bills, and unexpected costs for things like home modifications—exactly what your policy was supposed to protect you from.

Choosing the Right Critical Illness Insurance Lawyer for Your Case

When an insurer denies your critical illness claim, the lawyer you choose is easily the most important decision you’ll make. This isn’t a job for a generalist. You need a specialist who lives and breathes this specific area of law.

Start your search by zeroing in on law firms with a proven, deep-seated history in disability and insurance law, particularly with critical illness claims. A lawyer who dabbles in this area while mostly handling wills or real estate just won’t have the same grasp of the intricate medical definitions and policy jargon that insurers love to hide behind. You need a legal team that can point to a long track record of going toe-to-toe with Canada’s insurance giants—and winning.

Key Qualities to Look For

Think of your first consultation not as a meeting, but as an interview. You’re hiring someone for a crucial role, and you need to be sure they have the skills and the right mindset for the job.

Here are a few essential questions to get you started:

- What percentage of your practice is dedicated to critical illness and disability claims? This question cuts right to the chase and tells you if you’re talking to a true specialist.

- Can you share some experience with cases similar to mine? While respecting client confidentiality, they should be able to walk you through their strategies and past successes.

- How have you successfully challenged major insurance companies in the past? You want a fighter, not someone who will be intimidated by a big corporate legal team.

One of the most important aspects to consider is how the firm gets paid. You should look for a lawyer who works on a contingency fee basis. This is often called a “no-win, no-fee” arrangement, and it means exactly what it sounds like: you don’t pay anything upfront, and the lawyer’s fee comes out of the settlement they win for you.

This model is a game-changer. It gives you access to top-tier legal help without adding to the financial mountain you’re already climbing. It also means your lawyer’s success is directly tied to your own, giving them every incentive to fight for the best possible outcome.

Finding the right critical illness insurance lawyer in Hamilton is about finding a partner who is so confident in their ability to win that they’re willing to share the risk with you. For other types of legal conflicts, it can also be helpful to know the role of a civil litigation lawyer in Hamilton and how they navigate complex disputes.

Got Questions? We’ve Got Answers

When your critical illness claim is denied, your head is probably swimming with questions. It’s a stressful, confusing time. We get it. Here are some straightforward answers to the questions we hear most often from people just like you here in Hamilton and across Ontario.

What’s This Going to Cost Me? Can I Even Afford a Lawyer?

This is usually the first thing people ask, and it’s a fair question. The good news is, you don’t need any money upfront.

Nearly all experienced critical illness lawyers work on a contingency fee basis. Think of it as a “no-win, no-fee” promise. Our fee is simply a percentage of the money we win back for you. If we don’t succeed in getting you a settlement, you don’t owe us a dime for our time. This way, everyone can afford to fight back, and the financial risk is on our shoulders, not yours.

How Long Do I Have to Take Legal Action?

There’s a strict deadline in Ontario, and it’s not something you can ignore. It’s called a limitation period.

Generally, you have two years to file a lawsuit, starting from the day the insurance company officially denies your claim in writing. This is a hard-and-fast rule under Ontario’s Limitations Act. If you miss that two-year window, you could lose your right to sue for your benefits forever. That’s why it’s so important to call a lawyer as soon as you get that denial letter.

Can’t I Just Fight the Insurance Company Myself?

You can try, but honestly, it’s an uphill battle. You’re not just dealing with a customer service department; you’re going up against a massive corporation with teams of lawyers and medical experts whose entire job is to minimize payouts. They know their own complex policies inside and out—including every loophole.

A specialized lawyer doesn’t just help; they level the playing field. They bring deep knowledge of Canadian insurance law, the right medical arguments, and proven negotiation strategies to the table. They turn an unfair fight into a fair one.

Hiring a critical illness insurance lawyer in Hamilton gives you an expert advocate who knows exactly how to dismantle the insurer’s arguments and fight for the full benefits you paid for and deserve.

If you’ve received a denial letter for your critical illness claim, don’t try to take on the insurance giant by yourself. At UL Lawyers, we have the experience to challenge their decision and secure the compensation you’re entitled to.

Contact us today for a free, no-obligation consultation to find out how we can help.

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies