How Much Does Insurance Increase After an Accident in Ontario? Find Out

After a car accident in Ontario, the immediate worry is often financial. It’s a valid concern. On average, a single at-fault collision can cause your car insurance premiums to jump anywhere from 25% to over 100%.

The exact amount isn’t set in stone; it depends heavily on the specifics of the incident and, just as importantly, your personal driving history.

Your Guide to Insurance Hikes After a Collision

Navigating the aftermath of a collision can feel overwhelming. Suddenly, you’re faced with a significant, unexpected increase in your insurance costs. For drivers in Burlington, the Greater Toronto Area (GTA), and right across Ontario, understanding why this happens is the first step toward managing the financial impact.

The simple truth is that insurance companies don’t view all accidents the same way. When you’re deemed at-fault, your insurer immediately reassesses your risk profile. From their perspective, you’ve become more likely to file another claim in the future, and your premium gets adjusted to reflect that heightened risk. It’s a standard practice across the entire industry.

While each province has its own regulations, the principle is the same across Canada. You can dig deeper into post-accident rate increases with Insurify’s research to see broader trends.

An at-fault accident isn’t just a mark on your record; it’s a signal to your insurer that your risk level has changed. Your new premium reflects their prediction of future costs.

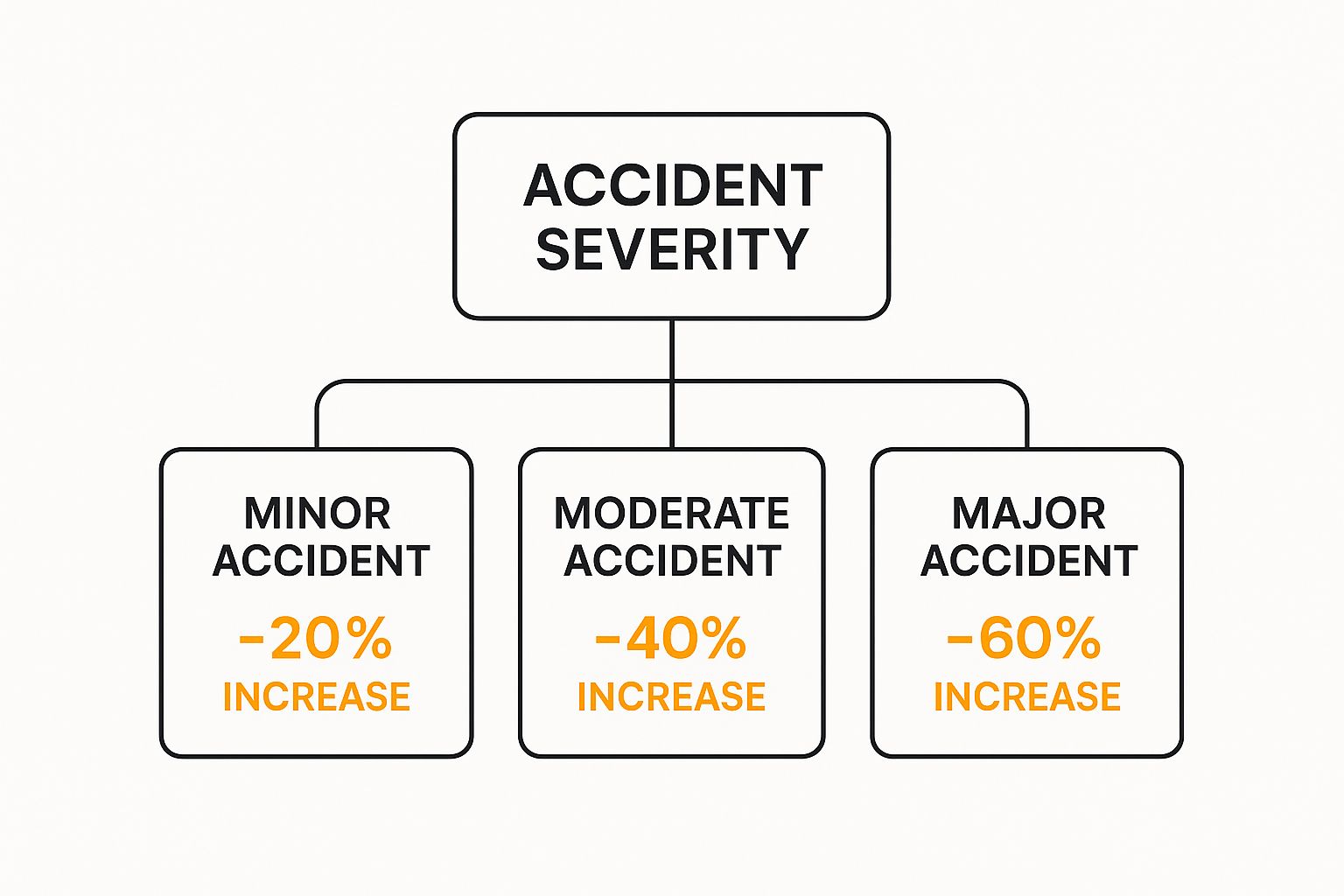

To give you a clearer picture of what to expect, the table below breaks down the potential increases based on how severe the accident was. Think of it as a reference guide to help you anticipate the financial changes and prepare for what’s next.

Estimated Premium Increase in Ontario After an At-Fault Accident

This table provides a quick overview of potential insurance rate increases based on the severity of an at-fault accident in Ontario.

| Accident Severity | Typical Premium Increase Range | Key Considerations |

|---|---|---|

| Minor (e.g., fender-bender, low property damage) | 10% - 25% | This might be covered by accident forgiveness if your policy includes it. |

| Moderate (e.g., significant damage, no major injuries) | 25% - 50% | Your previous driving history plays a much larger role in determining the final percentage. |

| Major (e.g., vehicle is a total loss, injuries involved) | 50% - 100%+ | This will stay on your record for at least six years, significantly impacting your rates. |

As you can see, the consequences range from manageable to quite severe, which is why a clean driving record and features like accident forgiveness can be so valuable.

Why Your Premium Goes Up After an Accident

It’s completely natural to feel like your insurance company is penalizing you with a rate hike after an accident. But from their point of view, it’s not personal—it’s just business. At its core, setting an insurance premium is all about predicting the future. Insurers in Ontario are essentially making a calculated bet on how likely you are to file a claim down the road.

A great way to think about it is to compare your driving record to a financial credit score. A long, clean history of safe driving builds up your “score,” showing insurers you’re a dependable, low-risk client. That’s why drivers who’ve never had a collision often get the best rates.

When an at-fault accident happens, though, it changes the entire equation. Much like missing a loan payment dings your credit score, a collision tells your provider that your risk level has just gone up. The incident suggests you’re now more likely to be involved in a future claim, and your premium has to be adjusted to match that new reality.

The Business of Risk Assessment

At the end of the day, insurance is a business built entirely on managing risk. When an insurer pays out a claim, they’re taking a financial hit. To stay afloat, they have to carefully balance the money they bring in from premiums against the claims they expect to pay out.

An at-fault accident shifts your statistical profile. Your insurer isn’t punishing you; they are recalibrating your rate based on new data that suggests you are more likely to cost them money in the future.

This recalibration is why a premium increase can feel so detached and impersonal. It’s a direct, data-driven response to a change in your risk classification. Your insurer simply moves you from a low-risk category into a higher one, and your new rate reflects the average cost tied to that group.

Grasping this business logic is the first step for drivers in Burlington, the GTA, and across Ontario to better manage their policies after a crash. The legal side of an accident can be incredibly complex, so it helps to be informed. For a deeper dive into what follows a collision, our guide on navigating Canadian car accident law is a great resource.

This risk-based system also explains why not all accidents have the same impact. A minor fender-bender might only nudge your risk profile slightly, leading to a smaller rate increase. On the other hand, a serious collision with major damage or injuries signals a much higher risk, resulting in a far more significant and longer-lasting premium hike.

What Decides How Much Your Rates Go Up?

So, how much will your insurance premium actually jump after a crash? It’s not a number pulled out of thin air. Insurance companies in Ontario have a well-defined process to figure out the new rate, and if you’re a driver in the GTA, it pays to understand what they’re looking at.

There are really four big pieces to the puzzle that your insurer will examine. Each one helps build a picture of your new risk level.

- Who was at fault? This is the big one.

- How serious was the collision? A minor fender-bender isn’t the same as a multi-car pile-up.

- What does your driving record look like? A history of safe driving can really help.

- What’s in your policy? Some add-ons, like Accident Forgiveness, can be a real game-changer.

Let’s break down how each of these plays out.

At-Fault vs. Not-At-Fault in Ontario

In Ontario, fault is everything. You might have heard of our “no-fault” system, but that’s just about getting quick access to benefits after a crash. When it comes to your insurance rates, your insurer absolutely determines who was to blame using a guide set by the province called the Fault Determination Rules.

The outcome of that decision is what really matters for your wallet.

If you’re found 0% at fault, your rates shouldn’t increase because of that specific accident. But if you’re found even partially to blame—say, 50%—get ready for a rate hike. Getting rear-ended, for example, almost always means you’re 0% at fault. A T-bone in an intersection? That could easily be a 50/50 split or even 100% your fault, depending on what happened.

The Seriousness of the Crash

Not all at-fault accidents are created equal. Insurers look at the total claim cost, which covers everything from vehicle repairs to injury payouts, and classify the accident’s severity based on that number.

A minor scrape with a claim under $2,000 will have a much lighter touch on your premium than a major collision where a car is written off and there are significant medical bills.

This image shows a good visual breakdown of how the cost of a claim can affect the size of your premium increase.

As you can see, the financial hit scales up right alongside the severity of the accident. It’s the industry’s way of standardizing how they measure risk.

Your Driving Record and Policy Details

Finally, your own history behind the wheel and the specifics of your policy come into play. An insurance company is likely to be a lot more understanding with a driver who has a spotless 10-year record than with someone who has a history of tickets and previous claims.

A single at-fault accident might only cause a small bump for a long-time safe driver, but it could trigger a massive increase for someone already considered high-risk.

This is also where certain policy features can save the day.

Accident Forgiveness is a popular add-on in Ontario for a reason. It’s basically a “get out of jail free” card for your first at-fault accident, stopping your premium from going up as a direct result of that one incident.

While these rules are specific to Ontario, the core ideas are similar across Canada. The legal side of a car accident can feel overwhelming, which is why it’s so important to know your rights. To get a better handle on this, check out our guide on motor vehicle accident compensation in Ontario.

How Ontario Determines Who Is At Fault

One of the biggest points of confusion in Ontario’s car insurance system is the whole idea of “fault.” Many drivers hear the term “no-fault” and think it means no one is ever blamed for a crash. This is a common, and often expensive, misunderstanding.

While our system means you deal directly with your own insurance company for claims, fault is absolutely determined. In fact, it’s the single most important factor that decides whether your premiums will go up after an accident.

The Official Rulebook: Fault Determination Rules

Insurers don’t just guess who’s to blame or rely on a police officer’s opinion at the scene. They are legally required to follow a very specific, government-regulated guide called the Fault Determination Rules. This document lays out over 40 common accident scenarios, each with a clear-cut rule for assigning blame.

If you’re found to be 0% at fault for the collision, you can breathe a sigh of relief. Your insurance rates are protected by law and shouldn’t increase because of that specific incident. This is a vital protection for good drivers who just happen to be in the wrong place at the wrong time.

The Financial Cost of Being at Fault

The picture changes dramatically if you are found even partially responsible. Being assigned 50% or even 100% of the fault will almost certainly trigger a significant rate hike. Your insurer now sees you as a higher risk to insure, and your premiums will reflect that new risk for several years.

Let’s look at how the Fault Determination Rules play out in everyday situations for drivers in Burlington and across the GTA:

- Rear-End Collisions: In nearly every scenario, the driver who hits the car in front of them is considered 100% at fault. The rules operate on the assumption that the driver behind was either following too closely or wasn’t paying proper attention.

- Intersection Accidents: A “T-bone” crash at an intersection can often lead to a 50/50 split of fault, especially if both drivers insist they had a green light and there are no witnesses to confirm either story. However, if one driver clearly ran a stop sign, they will be found 100% at fault.

- Parking Lot Incidents: Even a minor fender-bender in a parking lot is governed by these rules. For example, a driver pulling out of a parking spot is typically found at fault if they collide with a car already moving down the main laneway.

Being found at fault isn’t just a label; it’s a trigger for financial consequences. The Fault Determination Rules provide a clear, predictable framework that directly connects your actions on the road to the price you pay for insurance.

Understanding how this works is crucial. Knowing what to document and what information to gather at the scene can make all the difference in making sure fault is assigned correctly. For a step-by-step guide, check out our article on what to do after a car accident in Ontario.

How Long an Accident Stays on Your Record

If you’ve been in an at-fault accident, the resulting premium hike isn’t a life sentence. Thankfully, in Ontario, there’s a clear timeline for how long it will affect your wallet. Think of it like a mark on your insurance history that gradually fades over time.

For almost every insurance provider in Ontario, an at-fault accident will impact your premiums for six years starting from the date of the collision. This means that for six straight years, you can expect your renewal rate to be higher than it would have been otherwise.

But the good news is that the sting lessens with time. The surcharge is usually harshest right after the accident, on your first renewal. As each year passes without another incident, the weight of that old accident diminishes, until it eventually disappears from their calculations.

Insurance Record vs. MTO Abstract

It’s really important for Ontario drivers to grasp the difference between two separate but related records. This is a common point of confusion, so let’s clear it up.

- Your Insurance Record: This is the history your insurance company keeps on you. An at-fault accident stays on this file for about six years, and this is what directly influences your premium.

- Your MTO Driver’s Abstract: This is your official driving record with the government (Ministry of Transportation of Ontario). Any traffic convictions linked to the accident, like a careless driving ticket, will only stay on this abstract for three years.

When it comes to your insurance rates, the at-fault claim is the main event. While the ticket might disappear from your government record in three years, the insurance company will keep the claim itself on their books for the full six years.

Knowing this six-year timeline gives you a light at the end of the tunnel. Once you cross that mark, the at-fault accident should no longer be used to set your premium, giving you a fresh start. If you’re still dealing with the immediate aftermath of a crash, our guide on what to do after a motor vehicle accident in Ontario can walk you through the first critical steps.

How to Lower Your Insurance After an Accident

Seeing your insurance premium jump after an accident is a tough pill to swallow, but it doesn’t mean you’re stuck paying that higher rate forever. For drivers across Ontario, from Burlington to the rest of the GTA, there are some smart, practical moves you can make to get your costs back under control.

It’s easy to feel like you’ve lost all control, but that’s not the case. Remember, you’re still the customer, and you absolutely have the power to find a better deal.

Take Back the Wheel by Shopping Around

The most powerful tool in your arsenal is simple: shop for new insurance quotes. Not every insurance company in Ontario penalizes drivers in the same way for an at-fault accident. One insurer might jack up your rate by 40%, while another might see the same incident and only apply a 25% surcharge.

By getting quotes from several different providers, you get a clear picture of how they each view your updated risk profile. This is your best shot at finding a company whose math works more in your favour.

Tweak Your Policy Details

If you’d rather not switch insurers, the next best thing is to look at adjusting your current policy. A few small changes can often help cancel out a chunk of that premium increase, making your coverage more manageable.

-

Raise Your Deductible: Your deductible is what you pay out of pocket before your insurance kicks in. Simply increasing it from, say, $500 to $1,000 can make a real difference in your premium. The key is to make sure you have that higher amount saved and accessible if you ever need to file another claim.

-

Bundle Your Policies: Insurers love it when you keep all your business with them. If your car and home insurance are with different companies, ask for a quote to bundle them. The multi-policy discount is often one of the biggest ones you can get.

-

Rethink Your Coverage: Does it still make sense to have full collision and comprehensive coverage on an older car? If your vehicle’s market value is low, you could end up paying more in premiums than the car is even worth. It might be time to scale back.

Never assume your new, higher rate is set in stone. By actively comparing quotes and fine-tuning your policy, you can often claw back significant savings and lessen the financial impact of an at-fault accident.

Finally, don’t forget to ask your current insurer about telematics programs. These programs track your real-world driving habits through an app or a small device—things like how smoothly you brake and accelerate. It’s a direct way to prove you’re a safe driver, despite the recent accident on your record, and earn a discount for it.

The aftermath of an accident can be complex; if you’ve been injured, consulting with an experienced injury lawyer in Burlington can provide clarity on your rights and options.

Your Questions Answered: Navigating Rate Hikes

After a fender bender in Ontario, it’s natural for your mind to race with questions. Getting straight answers is the first step toward making smart decisions for your wallet and your driving record. Let’s break down some of the most common concerns drivers have.

Should I Just Pay Out-of-Pocket for a Small Dent?

It can be tempting to handle a minor scrape with a cash payment to avoid involving your insurance company. On the surface, it seems like a clean way to sidestep a rate increase. But this approach is riskier than you might think.

What if the other driver later complains of a neck injury? Or what if a mechanic finds hidden frame damage behind that small dent? If you didn’t report the incident, you’re on your own, and the financial fallout could be devastating.

The safest bet is almost always to report the collision. It creates a formal record and ensures your insurer has your back if things get more complicated. At the very least, get a quote from a body shop before making any decisions—repairs are almost always more expensive than they look.

Can a Parking Lot Accident Really Hike My Insurance?

Absolutely. A common myth is that parking lot accidents are a “no-fault” free-for-all, but that’s not true in Ontario. Insurance companies apply the exact same Fault Determination Rules on private property as they do on a public highway.

If you back out of a spot and hit a car driving down the lane, you’ll likely be found 100% at fault. The location doesn’t matter; the rules of the road still apply, and your premium will reflect it.

What is Accident Forgiveness? Think of it as a one-time “get out of jail free” card for your insurance premium. This optional add-on prevents your rates from going up after your first at-fault accident. It’s a great safety net, but it doesn’t wipe the slate clean—the accident still goes on your record.

So, How Does Accident Forgiveness Actually Work?

Accident Forgiveness is an extra bit of coverage you can buy, usually offered to drivers with a long, clean history. When you have it and cause your first at-fault collision, your insurance company agrees not to apply the usual surcharge to your premium at renewal.

But it’s important to understand the fine print. It only works for your first at-fault claim. Any subsequent accidents will trigger a rate increase. Also, the accident isn’t erased; it’s still part of your insurance history. If you decide to shop around for a new policy, other insurers will see that collision and will almost certainly factor it into the price they quote you.

Will My Rates Go Up if My Car Is Stolen or Vandalized?

Probably not. Claims for theft, vandalism, a shattered window from a break-in, or hail damage are handled under your comprehensive coverage.

Since these are events you had no control over, they aren’t considered “at-fault” incidents. As a result, they typically don’t affect your premium in the same way a collision would.

Trying to make sense of the legal aftermath of an accident can be overwhelming. The team at UL Lawyers provides the expert guidance needed to protect your rights and ensure you get a fair outcome. For a free, no-obligation consultation to talk about your situation, visit us at UL Lawyers.

Related Resources

How to File a Lawsuit in Ontario: A Practical Guide

Continue reading How to File a Lawsuit in Ontario: A Practical GuideNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies