The Essential Guide to the Law About Car Accidents in Ontario

The moments right after a car crash are a blur. It’s chaotic, stressful, and disorienting, but Ontario’s car accident laws are very clear about what you need to do. Under the Highway Traffic Act, your first and most important legal duty is to remain at or immediately return to the scene. What you do next can make all the difference for your health and any future claim you might need to make.

Your First Steps After an Ontario Car Accident

With adrenaline pumping, it’s easy to feel overwhelmed and even miss injuries. Running through a mental checklist helps you stay grounded and protect yourself from the get-go. The key goals are simple: keep everyone safe, meet your legal duties, and gather the facts for your insurance company.

Secure the Scene and Ensure Safety

Safety first, always. If you can, pull your vehicle over to the shoulder. The last thing you want is to cause another collision. Flip on your hazard lights right away.

Look carefully for traffic before you open your door. Once you’re out, check on yourself and your passengers. If anyone is hurt, even if it seems minor, call 911 immediately for police and paramedics. A good rule of thumb is to never move someone with a serious injury unless they’re in immediate danger, like a fire.

Fulfill Your Legal Reporting Duties

The law in Ontario is specific about when you absolutely must call the police. You are legally required to report the accident if:

- Anyone has been injured.

- The combined damage to all vehicles looks like it’s over $2,000. (It doesn’t take much to hit this number.)

- You think another driver might be under the influence of drugs or alcohol.

- A pedestrian, cyclist, or government vehicle was involved.

If none of those conditions apply and everyone is safe, you can drive to a Collision Reporting Centre. These are safe, off-road locations designed specifically for reporting minor incidents.

Gather Critical Information and Evidence

The information you gather at the scene is the bedrock of your insurance claim. This is where you become your own best advocate. Having a video record from the start by installing a dash cam can be a game-changer, providing unbiased proof of what happened.

Pull out your smartphone and start documenting everything.

- Driver and Vehicle Details: Get the essentials from the other driver(s): name, address, phone number, driver’s licence number, and their insurance company and policy number. Snap a picture of their licence plate.

- Witness Information: If anyone saw what happened, politely ask for their name and number. An independent witness can be incredibly powerful for your claim.

- Photographic Evidence: Don’t just take pictures of the dents. Capture the whole scene from different angles. Get shots of skid marks, road conditions, traffic signals, and any debris on the road.

One crucial piece of advice: never admit fault. An automatic “I’m sorry” might feel natural, but it can be twisted into a legal admission of liability. Just stick to the facts when talking to the other driver.

Finally, get checked out by a doctor as soon as you can, even if you feel perfectly fine. Injuries like whiplash or concussions can take hours or even days to show up. Having a medical record dated right after the accident creates a clear, undeniable link between your injuries and the crash itself. This is vital for accessing benefits and proving your case down the road.

How Ontario’s No-Fault Insurance System Really Works

Let’s clear up one of the biggest myths in Ontario’s law about car accidents: the term “no-fault insurance.” When drivers hear this, they often think it means no one is ever blamed for causing a crash. This couldn’t be further from the truth, and believing it can be a costly mistake.

The reality is, Ontario’s no-fault system isn’t about who’s to blame—it’s about getting you immediate help. Think of it as a first-aid kit built right into your car insurance policy.

The whole point is to make sure you deal directly with your own insurance company for initial benefits right after a collision. This design cuts through the red tape, giving you faster access to the support you need for your recovery without waiting weeks or months for fault to be sorted out.

Your Immediate Lifeline: Statutory Accident Benefits

The heart of this system is a package of mandatory benefits called the Statutory Accident Benefits Schedule (SABS). These benefits are included in every single auto insurance policy in Ontario, creating a critical safety net for anyone hurt in a collision.

Your SABS are your first stop for compensation. They’re specifically designed to cover the immediate medical bills and financial strain you face after an accident so you can focus on healing. These benefits aren’t just for drivers—they’re available to passengers, pedestrians, and cyclists who are injured in an accident involving a vehicle.

The most crucial thing to remember? Your right to claim these benefits has nothing to do with proving the other driver was careless. It’s about you being injured, plain and simple.

Many people worry that claiming accident benefits from their own insurer is like admitting fault. That’s absolutely false. Accessing your no-fault SABS is your legal right and is completely separate from the process of figuring out who was legally responsible for the crash.

Knowing what you’re entitled to is the first step toward a successful recovery. You can dive deeper into this topic by reading our detailed guide on what no-fault insurance in Ontario means for your claim.

The Two Sides of a Car Accident Claim

So, if no-fault benefits cover your immediate needs, how is the at-fault driver held accountable? This is where an Ontario car accident claim splits into two distinct, parallel tracks:

- The Accident Benefits Claim: This is the “no-fault” side of things. You make this claim with your own insurer to access your SABS for medical treatments, rehabilitation, and income replacement. It’s designed to be fast and efficient.

- The Tort Claim (The Lawsuit): This is the “at-fault” side. If another driver’s negligence caused your injuries, you have the right to sue them for damages that SABS don’t cover. This includes things like pain and suffering, future medical care costs, and other long-term financial losses.

This two-part system is brilliant, really. It ensures you get help right away while still preserving your right to hold the responsible person financially accountable for the harm they caused. While your insurer pays your initial benefits, they will deal with the at-fault driver’s insurance company behind the scenes to get their money back.

Make no mistake: fault still matters a great deal. It determines who can be sued and whose insurance rates will ultimately go up. The “no-fault” label is just about the process—it ensures your recovery isn’t put on hold while the lawyers and insurance companies figure out who pays the final bill.

Figuring Out Who’s at Fault and Why It Matters

Even with Ontario’s no-fault benefits system giving you immediate help, the question of “who caused the accident?” is still a massive piece of the puzzle. The answer has a direct impact on your insurance rates and, more importantly, your ability to sue the other driver for losses that your own benefits just don’t cover.

Insurance companies don’t just make an educated guess here. In Ontario, they’re bound by a specific set of guidelines called the Fault Determination Rules. These rules are literally part of the provincial Insurance Act and lay out dozens of common (and not-so-common) accident scenarios with clear diagrams to figure out who was to blame.

This isn’t some subjective call made by an adjuster; it’s a standardized process. The rules examine the accident against the rules of the road and assign fault by percentage—0%, 25%, 50%, or 100%—to each driver.

How Fault Plays Out in Real-World Crashes

Let’s look at how this works on the streets. Seeing the rules applied to everyday situations makes it much clearer why decisions are made the way they are. Here are a few classic examples you’d see anywhere in the GTA.

- Rear-End Collisions: Getting hit from behind? The driver who hit you is almost always considered 100% at fault. The law expects every driver to leave enough space to stop safely, no matter what the person in front of them does.

- Left-Turn Accidents: If you’re making a left turn at an intersection and get into a crash with a car coming straight through, you’ll likely be found 100% at fault. The person turning has the responsibility to wait until the coast is completely clear.

- Parking Lot Fender-Benders: When a car backs out of a parking spot and hits someone driving down the main lane, the driver pulling out is typically 100% at fault. The car already moving in the lane has the right-of-way.

Of course, not every accident is that black and white. What happens when both drivers made a mistake?

Shared responsibility is a fundamental part of Ontario’s accident laws. Even if you were partially at fault, it doesn’t automatically kill your chances of getting compensation from a driver who was more to blame.

The Impact of Contributory Negligence

This is where a legal concept called contributory negligence comes in. It’s a way of saying that sometimes, more than one person’s actions lead to a collision. If you’re found partly responsible, you can still pursue a claim against the other driver, but the amount of money you receive will be reduced by your percentage of fault.

Let’s walk through an example. Say another driver blows through a red light and T-bones your car. It seems clear-cut, but what if you were going 15 km/h over the speed limit? The Fault Determination Rules might find the other driver 75% at fault for running the light, but you could be assigned 25% of the fault because your speed made the crash worse or harder to avoid.

So, what does this mean for your wallet? If a court decides your total damages for pain, suffering, and other losses are $100,000, your 25% fault would shrink that award by $25,000. The most you could recover from the other driver’s insurance would be $75,000.

Getting a handle on these rules is tricky, which is why a solid understanding of the official vehicle accident laws in Ontario is so critical to protecting yourself. The final fault determination is what unlocks your right to seek full compensation from the person who caused your injuries, making it absolutely essential to get it right from the start.

Navigating Your Two Paths to Compensation

After a car accident in Ontario, your top priority should be your health, not worrying about how to pay the bills. The law gives you two separate but connected ways to get the financial support you need. Think of it like having two different tools in a toolkit: one for immediate repairs and the other for a complete, long-term rebuild.

Understanding how these two avenues work together is the key to navigating car accident law in Ontario. The first path involves your own insurance company and is built for speed. The second is a claim against the driver who caused the crash, and it’s designed to be comprehensive.

Path One: The Accident Benefits Claim

Your first stop for financial help is your own insurance company, no matter who was at fault for the accident. This is Ontario’s “no-fault” system in action. This claim gives you access to Statutory Accident Benefits (SABS), which are essentially a package of benefits that act as your financial first aid.

To get the ball rolling, you’ll need to fill out and send an Application for Accident Benefits (OCF-1) to your insurer. These benefits are a lifeline, covering the essential costs that start piling up right after a collision.

SABS are designed to help with things like:

- Medical and Rehabilitation Needs: This covers treatments OHIP doesn’t, such as physiotherapy, chiropractic sessions, and psychological counselling.

- Income Replacement Benefits (IRBs): If you can’t work because of your injuries, these benefits will replace a portion of your lost income.

- Attendant Care Benefits: For more severe injuries, this benefit helps pay for someone to assist with your personal care, whether it’s a professional or a family member.

- Other Expenses: This can also cover housekeeping help, costs to get back to school, and other expenses that are a direct result of your accident.

The system is set up to get you help quickly. But sometimes, insurers deny legitimate claims or cut off benefits before you’re ready. When that happens, you have to be prepared to challenge their decision to protect your recovery.

Path Two: The Tort Claim or Lawsuit

While SABS are crucial for immediate support, they rarely cover the full picture of your losses, especially after a serious crash. That’s where the second path—the tort claim—comes in. A tort claim is just a legal term for a lawsuit you file against the at-fault driver and their insurance company.

The whole point of a tort claim is to make you “whole” again, at least financially. It’s about addressing the long-term fallout from the accident that SABS just aren’t designed to cover. It’s your right to hold the negligent person accountable.

This is the claim where you can demand compensation for losses such as:

- Pain and Suffering: This is compensation for the physical pain and emotional turmoil you’ve been forced to endure.

- Future Care Costs: This covers lifelong medical needs, from ongoing medication and therapy to home modifications. When navigating your two paths to compensation, it’s crucial to account for all necessary medical equipment, such as specialized car transfer patient lifts, which might be required due to severe injuries.

- Economic Losses: This covers all of your past and future lost income that isn’t covered by IRBs, as well as the loss of your ability to earn a living down the road.

- Family Member Claims: Your immediate family members might also have a claim for the loss of guidance, care, and companionship they’ve experienced because of your injuries.

The Critical Legal Threshold

There’s a catch when it comes to suing for pain and suffering in Ontario. Your injuries have to meet a specific legal test. The Insurance Act requires that your injury be a “permanent serious disfigurement” or a “permanent serious impairment of an important physical, mental or psychological function.”

This just means you can’t sue for minor injuries like bumps and bruises. You have to prove, using solid medical evidence, that your injury has fundamentally and permanently interfered with your life. This threshold is one of the most important concepts in Ontario’s car accident law. To learn more, explore our complete overview of motor vehicle accident compensation in Ontario.

These two paths—SABS for immediate help and a tort claim for long-term justice—are meant to work together. Knowing how to manage both is the key to getting the fair compensation you deserve after a car accident.

Critical Timelines You Absolutely Cannot Miss

When it comes to the law about car accidents, the clock starts ticking the second the collision happens. Here in Ontario, your right to get compensation is tied to a series of very strict deadlines. Missing one isn’t a small slip-up; it can permanently slam the door on your ability to receive the benefits and financial support you need.

Think of it like a train leaving the station. If you’re not on board by the departure time, it’s gone, and you’re left on the platform. Legal deadlines are just as absolute. It’s why the very human urge to “wait and see how I feel” can be one of the most costly mistakes you can make after a crash.

Taking quick, deliberate action is your best defence. Knowing these dates keeps all your legal doors open, whether you need immediate accident benefits for physiotherapy or want to hold the at-fault driver accountable for your injuries.

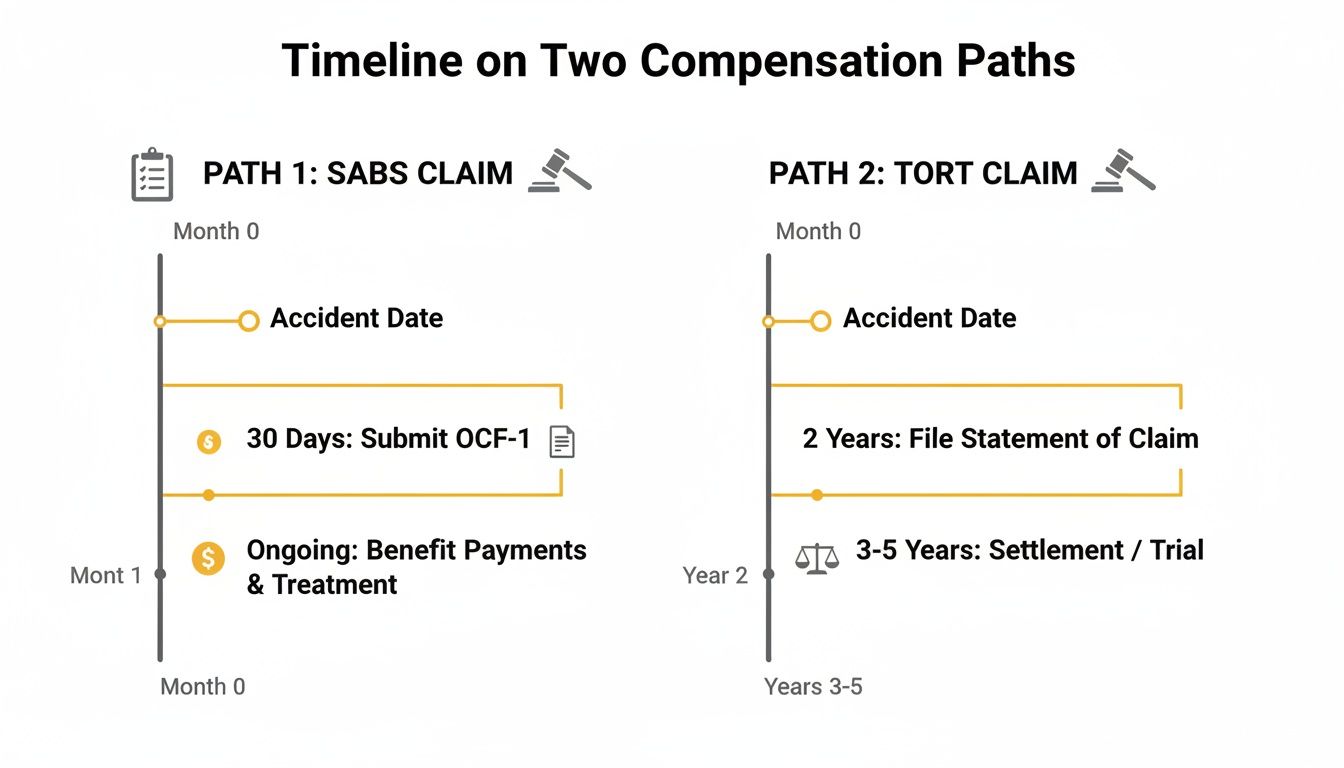

This timeline shows the two separate tracks your claim will follow. One is for immediate support, the other is for long-term justice.

The SABS claim is built for speed to get you help right away, while the tort claim is a longer process to secure fair compensation for your pain and suffering. Each has its own non-negotiable schedule.

Your First Reporting Deadlines

The very first deadlines you’ll encounter involve telling your own insurance company about the accident and applying for your no-fault benefits. These are your most urgent first steps.

- Tell Your Insurer (Within 7 Days): You need to let your own insurance company know about the accident right away. The absolute latest you can do this is seven days after the crash. This is the official starting gun for the entire claims process.

- Submit Your Benefits Application (Within 30 Days): Once you’ve notified them, your insurer will send you a package called an Application for Accident Benefits (OCF-1). You must fill this out and send it back within 30 days of receiving it. This is how you access your Statutory Accident Benefits (SABS).

If you don’t meet these early deadlines, you risk delaying or even being denied crucial benefits that pay for things like physiotherapy, medication, and lost wages.

Acting fast isn’t about admitting fault. It’s a procedural must-do to protect your rights. Insurers work on a strict schedule, and if you don’t play by their rules, you’re giving them an easy reason to push back on your claim from day one.

The Big One: The Lawsuit Deadline

While those initial deadlines get your immediate benefits rolling, the most important timeline of all governs your right to sue the driver who caused the accident.

In Ontario, the law is completely clear: you have exactly two years from the date of the accident to file a lawsuit (also known as a tort claim). This is a firm cutoff set by Ontario’s Limitations Act, 2002. If you miss this two-year window by a single day, your right to sue is gone forever, no matter how serious your injuries are. For a deeper dive into how these legal clocks work, you can learn more about the statute of limitations in Canada.

Special Deadlines to Keep on Your Radar

Sometimes, unusual situations come with their own unique, and often much shorter, timelines. A classic example is when a government body might be partially at fault.

Let’s say your crash was caused by a massive pothole the city never fixed, or a traffic light that malfunctioned. In that case, you might have a claim against the municipality (like the City of Toronto or Hamilton). If so, you have to give them written notice of your intent to sue within just 10 days of the accident. This incredibly tight deadline is there so the municipality can investigate immediately. Miss it, and your case against them is likely over before it even starts.

To help you keep track, here is a quick summary of the most important deadlines you need to know.

Ontario Car Accident Claim Deadlines You Must Know

| Action Required | The Deadline | What Happens If You Miss It |

|---|---|---|

| Notify your own insurer of the accident. | Within 7 days of the crash. | Your claim for accident benefits could be delayed or denied. |

| Submit your SABS application (OCF-1). | Within 30 days of receiving the form. | You lose access to immediate benefits like income replacement and medical rehab. |

| Give notice to a municipality (if they are at fault). | Within 10 days of the accident. | You lose your right to sue the city or government body responsible. |

| File a lawsuit (tort claim) against the at-fault driver. | Within 2 years of the accident date. | You permanently lose your right to sue for pain and suffering and other damages. |

These aren’t suggestions; they are hard-and-fast rules. Understanding them is the first and most critical step in protecting your right to fair compensation.

Why You Need a Personal Injury Lawyer in Your Corner

Trying to navigate a complex legal claim while you’re supposed to be recovering from a serious injury is a nightmare. After a car accident, you’re not just dealing with physical pain; you’re also up against insurance adjusters whose job is to pay out as little as possible. This is where getting an expert in car accident law on your side isn’t a luxury—it’s a necessity.

Think of an experienced personal injury lawyer as your dedicated advocate, the person who levels the playing field against massive insurance companies. They take over all the communications, shielding you from the constant, stressful phone calls and endless paperwork. This frees you up to focus on the one thing that truly matters: your health.

Your Advocate in Complex Situations

Some situations after an accident are giant red flags telling you to get professional legal help right away. Trying to handle these on your own can seriously risk your right to fair compensation.

You should call a lawyer if:

- You’ve suffered a serious injury: We’re talking about broken bones, a brain injury, spinal cord damage, or anything that lands you in the hospital, requires surgery, or needs long-term rehabilitation.

- Your insurer has denied your benefits: If your own insurance company denies your claim for Statutory Accident Benefits (SABS)—things like physiotherapy or income replacement—a lawyer can fight that decision for you.

- The fault determination is disputed: If you’re being unfairly blamed for what happened, a lawyer will dig in and find the evidence needed to prove the other driver’s negligence.

A lawyer’s job is to build a rock-solid case for you. They gather all the crucial evidence—police reports, witness statements, expert opinions—to prove who was at fault and document the full impact of your injuries and losses.

They also connect with medical experts to get detailed reports that confirm how severe your injuries are and map out your future care needs. This is a critical step for figuring out the true value of your claim, so you don’t end up accepting a lowball offer that leaves you short down the road. Most importantly, they make sure every single legal deadline is met, protecting your claim from being thrown out on a technicality.

Demystifying the Cost of Legal Help

A lot of people hesitate to call a lawyer because they’re worried about the cost, especially when medical bills are piling up and they can’t work. The good news is that almost all personal injury lawyers in Ontario work on a contingency fee basis.

You’ve probably heard this called a “no win, no fee” agreement. It means exactly what it sounds like: you pay absolutely no legal fees upfront. Your lawyer only gets paid if they win your case, and their fee is a percentage of the final settlement or court award. If they don’t secure a settlement for you, you owe them nothing for their time.

This model opens the doors to justice for everyone, no matter their financial situation. It lets you get top-tier legal help without any financial risk, ensuring your rights are protected by a professional who has a real stake in getting you the best possible outcome. If you’re not sure where to start, a good first step is to get a free consultation from a personal injuries lawyer near you who can look at your case and walk you through your options.

Common Questions After a Car Accident in Ontario

Even after you get a handle on the basics, real-life accidents bring up very specific questions. The world of car accident law has a lot of “what ifs,” so let’s tackle some of the most common ones we see from our clients.

What if I Was Partially to Blame for the Crash? Can I Still Sue?

Yes, you can. Ontario law operates on a principle known as contributory negligence, which is a formal way of saying that fault can be shared. You can absolutely pursue a claim against another driver even if you were partly responsible for what happened.

How it works is simple: your final compensation is just reduced by whatever percentage of fault is assigned to you. For instance, if you’re found 20% at fault for a collision and your total damages add up to $100,000, you would receive $80,000. A huge part of a personal injury lawyer’s job is to build a strong case that minimizes your share of the blame, making sure you get the maximum compensation possible.

What Happens if the Other Driver Takes Off or Doesn’t Have Insurance?

It’s a nightmare scenario, but you’re not out of luck. Every car insurance policy in Ontario must include something called Uninsured Automobile Coverage. This is your safety net. It means you can make a claim through your own insurance company if you’re hit by someone who is uninsured or who flees the scene in a hit-and-run.

In some rare hit-and-run cases where your own policy might not cover you, there’s another backstop: Ontario’s Motor Vehicle Accident Claims Fund (MVACF). Claims against the Fund have very specific rules and tight deadlines, so getting legal advice right away is absolutely critical to protect your options.

Never assume you have no recourse just because the other driver can’t be found. Your own insurance policy is specifically designed to protect you in situations just like this.

The Insurance Company Made an Offer. Do I Have to Take It?

Not at all—and in most cases, you shouldn’t. Think of that first settlement offer as the insurance company’s opening bid in a negotiation. It’s almost always a lowball figure that doesn’t fully capture the long-term reality of your injuries, like future physio treatments, loss of earning potential, or ongoing pain and suffering.

Jumping on that first offer without speaking to a lawyer is a major gamble. An experienced lawyer will meticulously calculate what your claim is truly worth—now and in the future—and will negotiate aggressively for a fair number. They’ll tell you straight up if an offer is reasonable or if it falls short of what you need to properly recover.

Trying to figure out a car accident claim on your own can feel like an uphill battle, but it’s not one you have to fight alone. From our office in Burlington, we serve clients all across the GTA and throughout Ontario. The team at UL Lawyers is here to offer the clear, expert legal guidance you need to protect your rights and get your life back on track. For a free, no-obligation consultation to discuss your specific situation, visit us at https://ullaw.ca.

Related Resources

Pecuniary and Non Pecuniary Damages: An Ontario Guide to Compensation

Continue reading Pecuniary and Non Pecuniary Damages: An Ontario Guide to CompensationToronto Car Accident Lawyer: Your Guide to Winning a Claim

Continue reading Toronto Car Accident Lawyer: Your Guide to Winning a ClaimNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies