Ontario Accident Benefits Denial: The System Is Failing Injured People — And the Data Proves It

Ontario’s Accident Benefits System Is Failing Injured People — And the Data Proves It

Despite promises of no-fault coverage under Ontario’s Statutory Accident Benefits Schedule (SABS), tens of thousands of injured drivers, passengers and pedestrians face benefit refusals or caps every year. Regulatory data from FSRA and tribunal reports confirm that insurers routinely interpret the rules in their favour—leaving Ontarians without access to medically necessary treatments or income support.

The Numbers Are Not Just Alarming — They Are Systemic

- Over 70% of non-catastrophic medical benefit claims incur refusals or Minor Injury Guideline (MIG) caps.

- Between 2017 and 2024, the success rate for injured applicants at the Licence Appeal Tribunal (LAT) plunged from 33% to a mere 8–11%.

- LAT backlog trends show nearly 20% of decisions missed the 90-day target in 2023–24, delaying critical treatments.

- FSRA reports more than 16,000 LAT applications were filed in 2023–24, yet only 8% of appellants prevail after full hearings.

These figures underscore that claim denials are not isolated incidents but part of a broader pattern that jeopardises injured Ontarians’ recovery.

Catastrophic, Income, and Medical Claims Are Being Routinely Denied

Insurers leverage every SABS provision to limit payouts:

- Medical and rehabilitation claims often stall at the $4,500 MIG threshold, even when injuries exceed minor soft-tissue strains.

- Income replacement disputes delay or deny wage benefits for self-employed and salaried workers alike, citing insufficient employer documentation.

- Attendant care applications hinge on precise care logs; vague entries or missing timestamps result in automatic refusals.

- Catastrophic benefit claims face strict interpretations of impairment definitions, with entitlement cut off at the first sign of dispute.

Self-Represented Claimants Are Virtually Doomed

Data from UL Lawyers’ case reviews reveal that self-represented individuals win under 5% of reconsideration requests or LAT appeals. Without structured medical evidence, expert reports and strategic timelines, insurers overpower untrained claimants—often before they have a chance to fully articulate their needs.

Appeals Rarely Fix the Problem

- Only about 15% of reconsideration requests succeed, according to FSRA statistics.

- LAT appeals end in claimant victories fewer than 10% of the time, with insurers prevailing in roughly 74% of hearings.

- Judicial reviews offer slim recourse, focusing on procedural errors rather than substantive entitlement.

These low success rates mean that once a denial lands in your mailbox, the odds are heavily stacked against you.

What This Means for Injured Ontarians

- Delayed access to physiotherapy, chiropractic care and psychological support prolongs recovery timelines.

- Financial strain from unpaid wage loss and out-of-pocket expenses can push families into debt.

- Mental health impacts escalate when claimants feel powerless against large insurers and complex regulations.

In short, the system’s failures translate into tangible hardships across Ontario communities—from Burlington to Ottawa.

UL Lawyers’ Position: The System Must Change

Based in Burlington and serving all GTA regions and beyond, UL Lawyers calls for:

- Clearer SABS guidelines and stricter oversight to curb insurer overreach.

- Faster tribunal processes, with firm deadlines to reduce wait times.

- Enhanced support for self-represented claimants, including public legal aid for accidents.

We believe that injured Ontarians deserve a system that honours its no-fault promise, rather than one that discourages recovery and justice.

Understanding Ontario Accident Benefits Denial

Facing an Ontario accident benefits denial can feel like hitting a brick wall. You’ve got the denial notice in hand, deadlines staring back at you, and the clock is ticking. Acting quickly, though, can protect your entitlement and keep your appeal on solid footing.

The Statutory Accident Benefits Schedule (SABS) sets out what treatment, income replacement and other benefits insurers must offer after a crash. Insurers commonly push back by pointing to gaps in medical documentation or slapping the Minor Injury Guideline (MIG) cap onto your recovery plan.

Here’s what to focus on right away:

- Reconsideration Window: You have 30 days from the denial date to submit fresh evidence.

- Denial Reasons: Look for service refusals, missing reports or an overly broad application of the MIG cap.

- Evidence Checklist: Gather up-to-date medical records, detailed treatment plans and any out-of-pocket expense receipts.

Real claimants who challenge the MIG cap with tailored therapy goals often win expanded treatment approvals.

Key Patterns In Denials

Year after year, data shows a disproportionate number of non-catastrophic claims get capped or denied under SABS.

Over 70% of medical benefit claims below the catastrophic threshold face refusals or caps, according to FSCO.

UL Lawyers’ case reviews underline a stark reality: self-represented claimants without structured medical evidence or legal guidance see almost no success.

Initial Actions After Benefit Denial

Below is a quick reference table summarising the first steps, their purpose and deadlines to launch your appeal effectively.

| Action | Purpose | Deadline |

|---|---|---|

| Review Denial Notice | Pinpoint reasons for refusal | Within 30 days |

| Obtain Medical Records | Close documentation gaps | Within 30 days |

| Submit Reconsideration | Officially kick-start the appeal | Within 30 days |

Use this roadmap to set priorities before diving into detailed evidence gathering.

Learn more about Ontario accident benefits in our article on accident benefits in Ontario.

Identifying Common Denial Reasons

Insurance adjusters know the SABS thresholds inside and out. They’ll often seize on the Minor Injury Guideline or benefit caps to push a claim past its limit and onto the denial pile.

Insurers typically focus on:

- Benefit caps on medical and rehab services hitting $4,500 MIG.

- Gaps or missing details in medical records.

- Lack of granular functional assessments showing ongoing need.

- Flexible policy wording that can be interpreted against you.

Ontario’s Statutory Accident Benefits Schedule (SABS) sets those monetary rules. The MIG rose from $3,500 to $4,500 in early 2025. Non-catastrophic medical and rehabilitation coverage climbed from $65,000 to $80,000 in January 2024. Catastrophic benefits remain open to $1,000,000 for qualifying impairments.

Learn more about SABS monetary rules and thresholds.

Below is a quick reference so you can see where refusals tend to fall.

Common Denial Reasons by Benefit Type

| Benefit Type | Cap Amount | Common Denial Reason |

|---|---|---|

| Medical and Rehab | $4,500 MIG | Treatment cost exceeds guideline limit |

| Non-Catastrophic Rehab | $80,000 | Insufficient evidence of functional need |

| Catastrophic Benefits | $1,000,000 | Failure to meet catastrophic impairment definition |

Use this as your roadmap: if your claim matches one of these patterns, you’ll know exactly where to shore up your evidence.

Spotting Early Red Flags

Physiotherapy claims often hit the MIG cap in just a few sessions. Once that happens, expect a freeze on coverage and a close look at every note.

Book a thorough assessment with a sports medicine specialist. Get a detailed treatment plan with milestones. If you sense pushback, seek an upgraded medical opinion.

Without progress notes or quantitative goals, insurers will deny. Objective metrics—like functional capacity tests—help you stay ahead.

Key Takeaway: Insurers target cost drivers first, so proactive medical planning matters.

Example Of Moving Out Of Guideline

When Ms Singh’s therapy was abruptly capped at $4,500, she didn’t accept defeat. She:

- Commissioned a formal functional capacity evaluation from her physiotherapist.

- Submitted fresh imaging to confirm structural damage beyond soft-tissue strains.

- Highlighted progressive treatment milestones and ongoing care needs.

Her orthopaedic surgeon’s detailed report convinced the insurer to reclassify her claim outside the MIG.

Benefit Types At Greatest Risk

Income replacement and attendant care claims can stall without crystal-clear support:

- Employer statements must spell out pre-accident duties in full detail.

- Care logs need timestamps and specific task descriptions.

- Medical opinions must clearly define impairment severity.

A patchwork of vague documents makes denials almost inevitable. Consistency and precision keep claims alive.

How Precise Assessments Keep Claims On Track

Solid functional assessments are your best defence. Early referrals to neurologists or psychiatrists can broaden your eligibility.

- Use validated tools like the Neck Disability Index.

- Show pre- and post-accident functional scores side by side.

- Attach concise physician summaries with every assessment.

Insurer Insight: Strong early evidence reduces the chance of initial refusals.

Common Pitfalls In Evidence Collection

Self-represented claimants often stumble by delaying PHIPA requests or sending:

- Unverified invoices and handwritten expense logs.

- Generic treatment summaries with no specifics on therapy goals.

Track every call, email and document you send. A clear timeline and cover letters sharpen your appeal narrative.

Pro Tip Always cross-reference medical dates with insurer records to avoid inconsistencies.

Catching these red flags early gives you the runway to gather expert reports before deadlines close. Next you will learn how to organise essential evidence and meet FSCO and LAT requirements in the upcoming section.

Gathering Essential Evidence

After an Ontario accident benefits denial, your file is more than paperwork—it’s your key advocate. Insurance adjusters look for any blip or missing date to justify a refusal. That’s why a thorough evidence binder can tip the scales at reconsideration or during a LAT hearing.

Key Documents To Request

Pulling together the right documents can make all the difference:

- PHIPA Clinical Notes from every healthcare provider, showing progress entries in detail.

- Treatment Plans that list goals, therapy types and session frequency.

- Functional Capacity Evaluations outlining specific limits in daily life.

- Employer Income Records verifying earnings and job responsibilities before the crash.

- Expense Receipts for things like medical supplies, travel or equipment.

You can request records under the Personal Health Information Protection Act. By law, hospitals must respond within 30 days. Always get a written confirmation of receipt and chase up anything missing before deadlines pass.

“I won my appeal after adding my physiotherapist’s capacity report,” says a Burlington claimant. That tailored note overcame a $4,500 Minor Injury Guideline cap.

For instance, a detailed functional assessment can spotlight how bending, lifting or standing affects everyday tasks—and link those limits back to your accident injuries.

Organising Your Evidence Chronology

Arrange every page by date, adding brief notes to point out key events or follow-ups. Highlight any gaps where you’re waiting on extra reports.

| Document Type | Purpose | Deadline |

|---|---|---|

| Clinical Notes | Confirm treatment details | Within 30 days |

| Treatment Plan | Outline ongoing care needs | Immediately |

| Income Records | Verify lost earnings | Before LAT filing |

This snapshot helps you track each requirement at a glance—and stops insurers from pouncing on missing proof.

For a broader view of immediate actions, check out our guide on what to do after a car accident in Ontario.

Using Expert Opinions Effectively

Well-crafted medical reports can directly challenge the insurer’s rationale. For chronic pain, a physiatrist’s note quantifying daily impact carries real weight. Neurosurgical or orthopaedic opinions can even bump a case from non-catastrophic to catastrophic.

- Commission independent assessments with clear measurement tools.

- Include physician summaries that reference the SABS definitions.

By zeroing in on concrete impairments, you narrow the debate around entitlement.

Creating A Medical Opinion Cover Letter

A concise cover letter ties everything together. Begin with a summary of medical history and link injuries to the crash. End with specific recommendations, citing relevant SABS sections.

- Brief patient history with key dates.

- Direct physician quotes on impairment severity.

- References to SABS definitions and thresholds.

- A closing paragraph that connects evidence to your entitlement.

This roadmap ensures adjudicators focus on what matters—not getting lost in voluminous files.

A targeted cover letter can reduce insurer focus on irrelevant or outdated records.

With that in place, your binder tells a coherent story and strengthens your appeal.

Preparing For Hearing Or Mediation

Tabs and an index sheet are your best friends here. Always keep original documents safe and have digital backups ready.

- Tab 1: Clinical notes and test results.

- Tab 2: Treatment plans and capacity evaluations.

- Tab 3: Income and expense documentation.

- Tab 4: Medical opinion letters and cover sheet.

Practise flipping to each tab by page number. You’ll save prep time and project confidence in front of tribunal members or mediators.

Next, turn your attention to statutory timelines and dispute resolution strategies.

Managing Timelines And Dispute Forms

No SABS or LAT deadline flexes for special cases. Missing any can turn your claim into a closed file before you even realise it. The secret is simple: map every key date on your calendar, set multiple alerts and cross-check deadlines as they approach.

Understanding Key SABS Deadlines

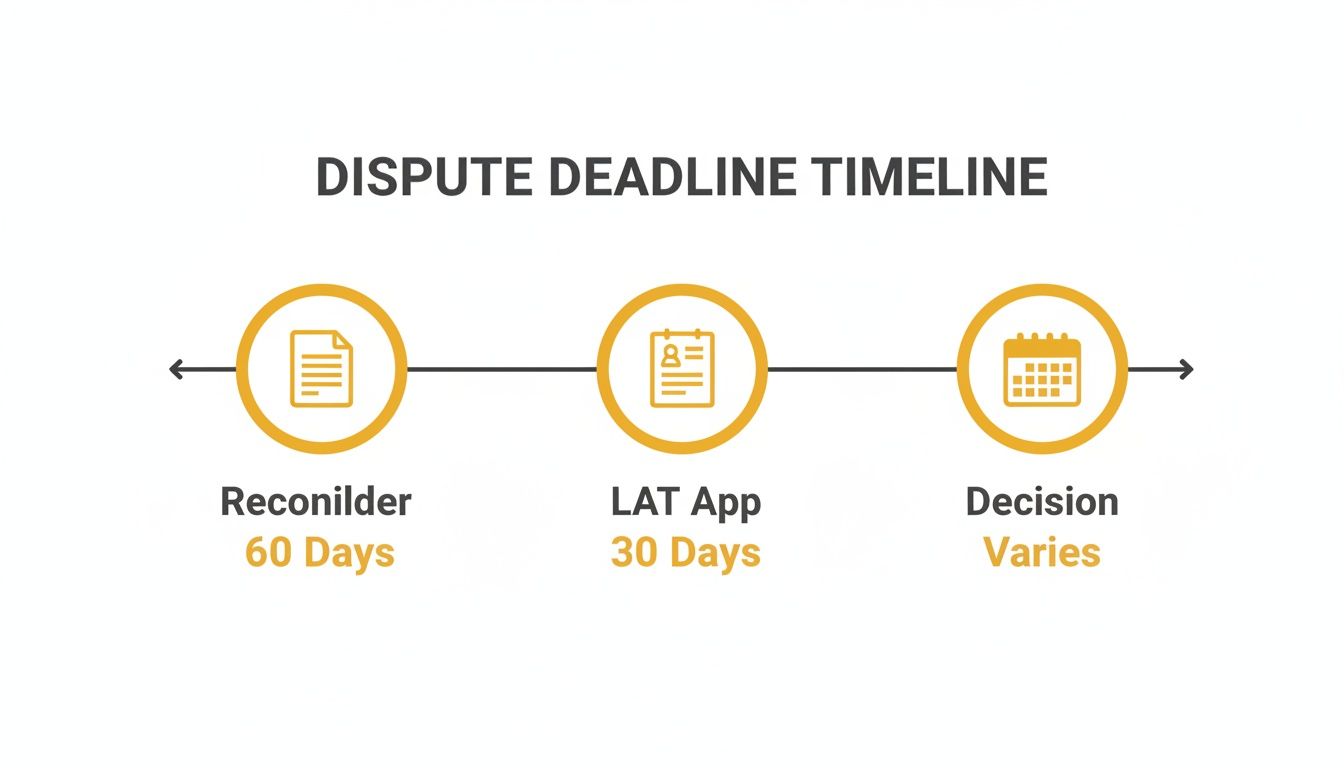

When you receive a denial letter, you have 30 days to ask the insurer to reconsider their decision. If that doesn’t get you anywhere, you’ve got 90 days to file both Form 1 (Notice of Application) and Form 8 (Appellant’s Record) at LAT. And if you’re pursuing a serious injury declaration beyond the Minor Injury Guideline, Schedule 1 gives you 365 days from the accident date.

- 30 days: Submit a written reconsideration request.

- 90 days: Launch your LAT appeal with Form 1 and Form 8.

- 365 days: File a serious injury declaration outside the MIG.

Dispute Forms And Deadlines Overview

Use this at-a-glance reference to keep each form and its deadline front of mind.

| Form Name | Use Case | Filing Deadline |

|---|---|---|

| Reconsideration Request Letter | Challenge initial denial | Within 30 days of denial letter |

| Form 1 Notice of Application | Launch LAT appeal | Within 90 days of final decision |

| Form 8 Appellant’s Record | Organise evidence bundle for LAT | Within 90 days of final decision |

This table helps you spot each form’s purpose and deadline at a glance. Rely on it to avoid any last-minute scrambles.

Choosing Between Mediation, LAT And Judicial Review

Mediation often wraps up in about six to eight weeks when both sides agree. It’s an informal setting—no sworn witness lists or heavy disclosure. In contrast, a LAT hearing follows strict rules and usually takes four to six months, sometimes longer when backlogs rise.

- Mediation: Neutral facilitator, flexible timing.

- LAT Hearing: Detailed disclosure, evidence in advance and formal witness statements.

- Judicial Review: Last resort after LAT; concentrates on legal errors, not fresh facts.

TribunalWatch Ontario data shows LAT processed over 16,000 applications and closed more than 18,000 files in 2023–24. Yet nearly 20% of cases slipped past the 90-day decision goal, leaving many waiting months for essential treatment or benefits. Learn more about LAT backlog trends in auto adjudication.

For electronic filings, lean on the e-LAT portal or FSCO’s secure mail system. Paper submissions head to the LAT registry office—always verify the current address and keep courier receipts as proof.

Tips To Prevent Filing Mistakes

A single typo or missing signature can invalidate hours of preparation. Once, a quick review spotted a mismatched policy number on Form 8 and saved a client from needless delays.

- Double-check policy numbers, file numbers and names across every document.

- Fill in every signature line and date stamp each form.

- Confirm the LAT registry address or portal acknowledgement before submitting.

Before you send anything, have a paralegal or trusted colleague scan your package. Those extra eyes often catch small errors that can derail an appeal.

Key Takeaway

Use calendar alerts and checklist reviews to catch deadlines and details before they become problems.

Now you’re ready to draft detailed position statements and gather witness disclosures. Getting that groundwork done early keeps you ahead of the schedule for LAT mediation or hearing dates.

Learn when legal support makes sense in our guide to insurance appeals representation at UL Lawyers.

Initiating Mediation And LAT Proceedings

Before you step into mediation or face the Licence Appeal Tribunal (LAT), it pays to map out your path. A well-timed pre-hearing conference can transform a chaotic dispute into a structured dialogue. That initial meeting lets everyone agree on the core issues, set deadlines and organise document exchanges. By tackling these details early, you signal to the insurer that you’re serious and ready to move forward.

- Ask the LAT to schedule a pre-hearing conference, specifying the issues and timelines.

- Share full disclosure: medical records, rehab notes and expert opinions.

- Draft a position statement that connects facts to the SABS framework.

- Lock in potential mediation dates or reserve LAT hearing slots.

Preparing Your Position Statement

Your position statement serves as both roadmap and opening bid. Think of it as the file you hand the adjudicator to steer them toward your strongest points. Start with a succinct accident overview and a timeline of key events. Then:

- Identify medical findings that directly counter the insurer’s denial reasons.

- Reference the exact Statutory Accident Benefits Schedule (SABS) provisions at play.

- Close by stating the specific relief you’re after—whether that’s income replacement, housekeeping assistance or therapy costs.

Keeping the document laser-focused ensures the tribunal doesn’t get lost in unnecessary detail.

Statistical Trends And Success Rates

Numbers paint a stark picture of the current battleground. While insurers are winning more often, injured applicants face mounting hurdles. Between 2017 and 2024, the claimant success rate at the LAT plunged from 33% to roughly 8–11%, whereas insurers now prevail in about 70% of appeals. In fact, a recent review shows injured applicants win only 8% of cases compared to an insurer victory rate of 74%. For an in-depth analysis, visit Tribunal Watch Ontario.

That chart underscores a critical warning: miss the 30-day reconsideration window or the 90-day LAT application deadline, and your appeal could be dismissed before it even begins.

Engaging In Mediation Effectively

Mediation can shave months off your timeline and ease legal costs—but only if you come prepared. Your goal is to frame discussions around shared interests, such as returning to work or covering essential treatments.

- Agree on a concise agenda right away to prevent conversations from derailing.

- Circulate evidence folders in advance so everyone reviews the same material.

- Translate medical terminology into clear, plain-language summaries.

- Ask the mediator early about realistic settlement ranges.

- Keep emotions in check; focus on practical solutions instead of re-litigating the past.

“A fair mediator helped me secure interim benefits within two months,” recounts one claimant.

What To Expect At A LAT Hearing

A LAT hearing looks formal but feels more accessible than a courtroom. Knowing the sequence in advance helps you stay calm and focused.

- The adjudicator opens with housekeeping remarks, explaining the day’s flow.

- You lead with witness statements and expert medical evidence.

- Insurer counsel conducts cross-examination of your experts.

- You deliver closing submissions and answer any final questions.

“Preparation and precision at the hearing improved my chances despite low success rates,” says a recent LAT appellant.

Countering Insurer Arguments

Insurers often point to missing records or question ongoing impairment. You can turn those tactics on their head by presenting airtight timelines and robust expert data.

- Spot inconsistencies in insurer correspondence or late-filed records.

- Emphasise your functional capacity scores, complete with date stamps.

- Quote SABS definitions where they bolster your case.

- Challenge any surprise documents, insisting on clear justification.

- Keep concise rebuttal notes ready so you’re never caught off guard.

One client even charted every call and email exchange, exposing the insurer’s shifting positions—and that led to a swift settlement offer.

You might also find our detailed guide on the Ontario Licence Appeal Tribunal helpful for deeper insights. Whether you settle in mediation or proceed to the LAT, thorough preparation and strategic timing make all the difference. Next, we’ll explore when it’s time to bring in expert legal counsel to strengthen your appeal.

When To Seek Expert Legal Support

Handling an Ontario accident benefits denial on your own can quickly become overwhelming. Bringing in legal support often makes a real difference when insurers push back hard on your claim. Complex medical disputes, self-employment income issues or persistent delays at the Licence Appeal Tribunal (LAT) all signal the need for professional guidance. Insurers know the fine print of the Statutory Accident Benefits Schedule (SABS) and will use every trick to stall or deny your application.

Recognising Key Red Flags

When treatment bills climb above the $4,500 MIG cap and the insurer refuses to reclassify, it’s a clear warning. Self-employed income replacement claims add another layer of complexity because you need precise business records, tax returns and loss calculations.

Tip If your LAT application drags past 180 days or you’re facing repeated adjournments, don’t wait to get advice.

- Your medical evidence is complex or conflicts with insurer-appointed examiners

- Disputes over lost business income and detailed tax filings

- Hearing dates pushed beyond the 90-day decision target

A seasoned lawyer will untangle policy language and build submissions that insurers can’t brush aside.

How Contingency Fees Work In Ontario

Contingency agreements mean you only pay if your appeal succeeds. That risk-sharing model often covers:

- Expert medical and vocational reports

- All tribunal filings and attendances

- Administrative expenses for your file

Typical fee ranges from 20% to 35% of benefits recovered. You’ll get a full breakdown upfront—no surprise bills halfway through.

Before you sign, ask:

- What success rate do you have with accident benefits appeals?

- Which expenses are included in the contingency fee?

- How often will I get updates on deadlines and filings?

These questions reveal both experience and transparency.

Typical Legal Costs Overview

| Cost Component | Details |

|---|---|

| Expert Witness Fees | $1,500–$5,000 per report |

| LAT Application Preparation | Billed under contingency agreement |

| Tribunal Hearing Attendance | Hourly rate for complex cases |

Knowing these figures up front lets you budget and avoid mid-case sticker shock.

Local Insight From UL Lawyers

Drawing on years of experience in Burlington, Milton, Oakville and Toronto, UL Lawyers understands how GTA insurers operate. Their familiarity with FSRA and LAT procedures gives clients an edge when pushing for timely decisions.

“We resolve most preliminary motions within weeks rather than months,” says Sunish Rai Uppal.

For more on finding a personal injuries lawyer with local know-how, visit https://www.ullaw.ca/resource/personal-injuries-lawyer-near-me

Questions To Ask During Lawyer Interviews

Choosing the right lawyer involves more than comparing rates. You need open communication, realistic timeframes and a hands-on approach.

- How do you support clients who start self-represented tasks? Ask about client portals and case management tools.

- What’s your team’s availability when urgent LAT deadlines loom? Clarify response times by phone or email.

- Can you share anonymized outcomes from recent accident benefits denials? Look for similar case examples.

- How do you coordinate with medical experts to strengthen evidence? Understand their network and report turnaround.

These discussions help you assess whether the lawyer’s style and resources match your needs.

Emphasising Local Experience

Local connections can speed up document filings and secure quicker mediation dates.

- Ask about specific tribunal contacts and strategies for your region

Working with a firm that knows the local insurance culture turns a daunting Ontario accident benefits denial into a manageable process.

Common Questions About Ontario Accident Benefits Denial

Dealing with a denied accident benefits claim can feel like hitting a brick wall. These answers cut through the jargon, pointing you straight to the Statutory Accident Benefits Schedule (SABS) rules and the official steps you need.

How Do I Request Reconsideration Of A Denied Claim

A quick, well-documented reconsideration can turn things around. Make sure your request lands with the insurer no later than 30 days after you receive the denial letter.

- Draft a clear cover letter summarising what’s in dispute.

- Attach all new evidence—medical reports, treatment notes or expert opinions.

- Cite the exact SABS sections that support your position.

- Send by registered mail or courier and keep that delivery receipt.

Keeping a file of every page helps you follow up confidently.

“Timely reconsideration requests improve chances of overturning denials,” says a Burlington claimant.

What Forms Must I File For A LAT Appeal

If reconsideration doesn’t work, it’s time to go to the Licence Appeal Tribunal (LAT). You have 90 days from the final decision to file:

- Form 1 (Notice of Application): outlines your appeal basis.

- Form 8 (Appellant’s Record): compiles all documents and evidence.

Use the e-LAT portal or mail paper copies to the LAT registry. Label exhibits exactly as listed on Form 8 and save your courier or e-filing confirmation.

Official Resources For Procedures

Before you dive in, bookmark these:

- FSRA SABS guide: Visit FSRA

- LAT practice directions: See LAT docs

Each contains step-by-step instructions and the latest rule updates.

Appeal Timelines And Process

How Long Does The Appeal Process Take

LAT aims to issue decisions in about 90 days, but caseloads can stretch hearings out 4–6 months. If both sides agree, mediation can resolve issues in roughly 6–8 weeks.

When Should I Consider Court Action

Going to court after an LAT decision is costly and rare. Only think about judicial review once you’ve exhausted LAT remedies and spotted a clear legal error. Be ready for tighter deadlines and higher fees.

Key Takeaway

Use appeals and mediation before moving to judicial review.

Summary And Next Steps

This guide lays out the deadlines, forms and strategies you’ll need after an accident benefits denial. Keep each deadline on your calendar and refer back to the official resources to avoid missteps.

For deeper resources visit the e-LAT portal or the FSRA website.

Ready to challenge your denial? Contact UL Lawyers today to secure expert guidance and protect your benefits rights. Visit https://ullaw.ca

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies