Power of Attorney Documents Ontario: Your Essential Guide

In Ontario, a Power of Attorney is a vital legal document that lets you handpick a trusted person to make decisions for you if you can’t. Think of it as your personal contingency plan—a way to ensure your wishes about your money and your health are respected, keeping the government out of your private affairs. For anyone living in Ontario, from Burlington to the broader GTA, it’s a non-negotiable part of a solid life and estate plan.

Why a Power of Attorney Isn’t Just a “Nice-to-Have” in Ontario

What would happen if a sudden illness or accident left you unable to manage your own life? It’s a tough question, but a necessary one. Who would pay your bills, handle your investments, or make critical medical decisions for you?

Without a legally recognized Power of Attorney (POA), your family’s hands would be tied. They’d have no legal authority to step in. This isn’t some far-fetched legal drama; it’s a painful reality that unfolds for unprepared families across Ontario every day.

A Power of Attorney is your safeguard. In this formal document, you (the “grantor”) legally appoint someone you trust (your “attorney”) to act on your behalf. It’s a private agreement that keeps decision-making where it belongs: with the people you choose, not the courts. While it works hand-in-hand with your Will, its role is distinctly different. To get a better handle on this, see our breakdown of a Power of Attorney vs. an executor and how they function under Ontario law.

The Two Pillars of Your Protection

It’s crucial to know that Ontario law splits these responsibilities into two separate documents. You need both for complete coverage; you can’t just have one that does everything.

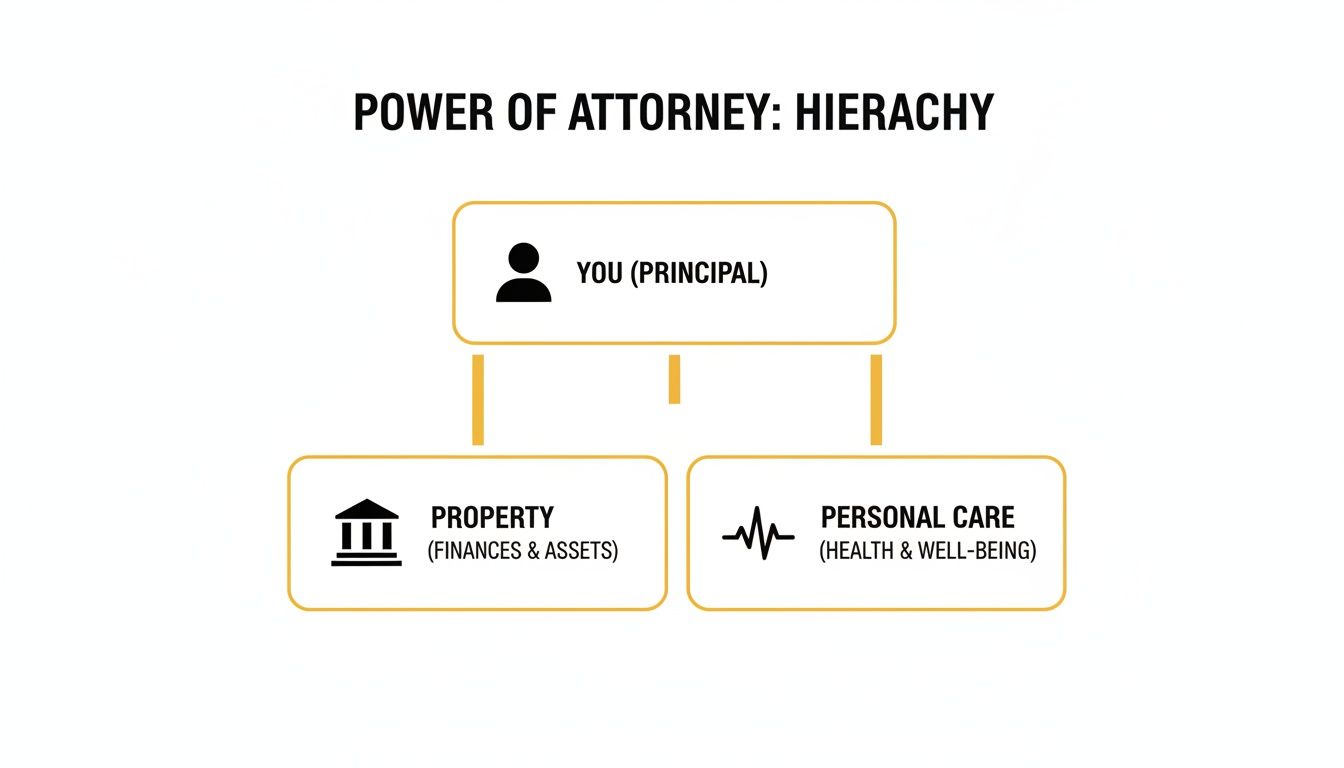

To give you a quick overview, here’s a simple breakdown of the two main types of POAs in Ontario.

Ontario Power of Attorney at a Glance

| Document Type | Governs Decisions About | When It Becomes Active |

|---|---|---|

| Power of Attorney for Property | Your financial world: bank accounts, real estate, investments, taxes, and paying bills. | Can be active immediately upon signing or upon a specific trigger, like incapacity. |

| Power of Attorney for Personal Care | Your health and well-being: medical treatments, housing, diet, and personal safety. | Only becomes active if you are deemed mentally incapable of making these decisions yourself. |

You can absolutely pick different people for these roles. It often makes sense. You might choose your accountant sister to handle your property and your most compassionate, level-headed child to oversee your personal care.

One of the most dangerous myths out there is that your spouse or adult children can automatically take over for you. That’s simply not true in Ontario. Without a valid POA, they have no legal authority. This can mean bank accounts are frozen and doctors can’t get the consent they need for treatment.

The Real Cost of Doing Nothing

Putting this off can have devastating consequences. If you become incapacitated without a Power of Attorney in place, your loved ones are forced to go to court and apply to become your guardian. It’s a process that is notoriously slow, incredibly expensive, and emotionally draining at an already difficult time.

And if no one is able or willing to step up? The Ontario government, through the Office of the Public Guardian and Trustee, will take control. A stranger will manage your money and make personal decisions for you, and their fees will be charged directly to your assets.

Creating power of attorney documents in Ontario is the only way to guarantee your voice is heard and your future is protected, all on your own terms.

Property vs. Personal Care: The Two Pillars of Your Protection

When planning for your future in Ontario, it’s crucial to understand that there isn’t a one-size-fits-all Power of Attorney. A common mistake is thinking a single document can cover every aspect of your life. The reality is quite different. The law intentionally separates your financial affairs from your personal well-being, creating two distinct pillars of protection.

Think of the Continuing Power of Attorney for Property as appointing your personal “Chief Financial Officer.” This is the person you trust implicitly to manage the business side of your life if you can’t do it yourself.

Their mandate is strictly financial. They’re the ones who will pay your bills, manage your investments, file your taxes, and even sell your house if needed. They handle the dollars and cents, ensuring your financial world keeps running smoothly, even when you’re not at the helm.

This chart clearly lays out the division of labour, with you as the decision-maker appointing separate agents for your property and personal care.

As you can see, you remain in charge, but you delegate the responsibilities for your finances and your healthcare down two very different paths.

The Power of Attorney for Personal Care: Your Healthcare Advocate

On the other side of the coin is the Power of Attorney for Personal Care. If your Property POA is your CFO, this person is your “Healthcare Advocate.” Their role is deeply personal and has absolutely nothing to do with money.

This is the person who becomes your voice when you can no longer speak for yourself on matters of health and wellness. Their responsibilities are significant and can include:

- Consenting to or refusing medical treatments.

- Deciding where you live, whether it’s a long-term care home or staying in your own home with support.

- Making day-to-day choices about your diet, clothing, and safety.

This role is incredibly important, as this person will be navigating complex and emotional decisions, including those related to end-of-life services.

Here’s the bottom line: these are two separate legal documents for two different jobs. You can’t just create one do-it-all Power of Attorney. To be fully protected in Ontario, you absolutely need to prepare two distinct power of attorney documents ontario.

Different Roles, Different People

The skills needed for each role are worlds apart, which is why you might choose different people for each.

Your financially astute brother who’s an accountant? He might be the perfect choice to manage your property. But you might appoint your empathetic and clear-headed daughter as your advocate for personal care, trusting she understands your values and wishes on a deeper level.

When Do They Become Active?

Another critical point of difference—and frequent confusion—is when each document actually kicks in.

A Continuing Power of Attorney for Property can be set up to take effect the moment you sign it. This can be a huge convenience. Maybe you’re travelling for six months or recovering from surgery; your attorney can step in and manage your finances even while you’re perfectly capable, just unavailable. You can get a much deeper understanding of this in our guide to the https://www.ullaw.ca/resource/what-is-power-of-attorney-for-property.

In stark contrast, the Power of Attorney for Personal Care is on a much tighter leash. It only becomes active when a medical professional or a capacity assessor has determined you are no longer mentally capable of making your own healthcare decisions. As long as you can understand and communicate your choices, your advocate has no authority.

Getting a firm grasp on these two pillars is the foundational first step in building a plan that truly protects you, your finances, and your well-being, no matter what the future holds.

The Legal Blueprint for a Valid Ontario POA

Creating a Power of Attorney is more than just filling in some blanks on a form; it’s about building a legal document that will stand strong when you and your family need it most. Here in Ontario, the Substitute Decisions Act, 1992 (SDA) lays out the rules of the road. Think of these rules as the legal blueprint for your POA—if even one part is off, the whole structure could be deemed invalid.

This legal framework isn’t just red tape. It’s there to protect you, the person granting the power (the “grantor”), by ensuring you’re making these big decisions with a clear mind and that the final document truly reflects your wishes.

The Core Requirements for Grantors

Before you can even think about who to appoint, the law says you have to meet a few specific criteria. These aren’t just suggestions; they are firm legal thresholds put in place to protect your autonomy.

-

You Must Be of Legal Age: To grant a Power of Attorney for Property, you must be at least 18 years old. For a Power of Attorney for Personal Care, the age is 16.

-

You Must Have Legal Capacity: This is the big one. “Capacity” is a legal term that means you fully understand what a Power of Attorney is and what it means to give that authority to someone else. For a property POA, for instance, you need to have a general idea of your assets and appreciate the responsibility you’re handing over.

If you don’t meet these foundational requirements, any power of attorney documents ontario you sign are invalid from the get-go.

The Role and Rules of Witnessing

Getting the witnessing right is a non-negotiable step, and it’s where many DIY documents go wrong. It’s the legal system’s way of having a third party confirm that you signed the document willingly and understood what you were doing.

In Ontario, your Power of Attorney must be signed in the physical presence of two witnesses. Both of those witnesses also have to sign the document right there in front of you. This simple but rigid process is a common failure point for homemade POAs.

The law is also crystal clear about who cannot be a witness, all to prevent conflicts of interest. The following people are automatically disqualified:

- Your spouse or partner

- Your child (or someone you treat as your child)

- The person you’re appointing as your attorney

- The spouse or partner of your chosen attorney

- Anyone under the age of 18

One mistake here can void the entire document, leaving your family without the legal authority to help you. As we cover in our comprehensive guide on Wills and Estate Law, getting these technical details right is absolutely essential for all of your estate planning.

Avoiding Common Pitfalls Like ‘Springing’ Clauses

While you can find generic POA forms online, they almost never account for the unique details of a person’s life and finances. Ambiguous wording or poorly drafted clauses can create massive headaches down the road. A perfect example is the “springing” clause, which is meant to activate the POA only after a doctor declares you incapable.

Legal experts have started warning against these clauses because they can cause serious delays. Imagine your attorney needs to manage your finances to pay for your care, but they can’t because they’re stuck waiting on a stalled capacity assessment. These holdups can prevent them from accessing critical funds or managing benefits precisely when you need them most.

Ultimately, a valid POA comes down to strict adherence to Ontario’s rules. There is no one-size-fits-all form that works for everyone, which is exactly why getting professional legal guidance is so valuable. An experienced lawyer ensures your POA is not just a piece of paper, but a robust legal tool crafted for your specific life.

How to Choose the Right Attorney

Choosing who will act as your attorney is, without a doubt, the most critical decision you’ll make when preparing your Power of Attorney documents. This isn’t just about filling in a blank on a form; it’s about handing someone the keys to your financial kingdom and the responsibility for your personal well-being.

Get this right, and you gain incredible peace of mind. But the wrong choice can unfortunately lead to family conflict, financial mismanagement, and a future you never intended.

You need to look past the obvious candidates—like your oldest child or a sibling—and really dig into who is best suited for the job. You’re searching for a rare blend of unwavering trustworthiness, level-headed judgment, and a genuine readiness to shoulder this significant responsibility.

Key Qualities of an Effective Attorney

Before you put anyone’s name on that dotted line, think about what these roles truly require. For your Property POA, financial savvy is a must. Can this person handle a budget, communicate with banks, and make smart decisions with your money?

On the other hand, for your Personal Care POA, you need someone with empathy who can make difficult decisions under immense pressure. They must be your advocate.

This checklist can help you evaluate potential candidates for the distinct demands of each role.

Key Qualities of an Effective Attorney

| Quality | Why It Matters for Property POA | Why It Matters for Personal Care POA |

|---|---|---|

| Trustworthiness | They will have complete access to your finances. Absolute honesty is non-negotiable. | You must trust them to honour your personal wishes, even if they disagree. |

| Good Judgement | They must make prudent financial decisions that are in your best interest. | They will face complex medical choices and must act calmly and rationally. |

| Willingness to Act | Hesitation can lead to missed bill payments or financial penalties. | They must be assertive with healthcare providers to ensure your wishes are followed. |

| Organizational Skills | They are legally required to keep detailed records of all financial transactions. | They will need to coordinate appointments and manage healthcare information effectively. |

Considering these points, it becomes clear that the best person for one role might not be the best for the other. It’s perfectly acceptable—and often wise—to name different people for your Property and Personal Care POAs.

Deciding on One Attorney or Several

A question I get all the time is whether to appoint one person or multiple people. Ontario law gives you the option to appoint more than one attorney, but you have to be very clear about how they can make decisions.

- Jointly: This structure means all your named attorneys have to agree on every single decision. It creates a built-in check and balance, but it can be a logistical nightmare. What if they disagree, or one person is on vacation when an urgent bill needs paying?

- Jointly and Severally: This is a much more flexible and often practical approach. It allows any one of your attorneys to act independently. This works beautifully, but it demands an enormous amount of trust between you and everyone you’ve appointed.

The single most crucial step is to have a frank conversation with the person you want to choose. Never spring this on someone. You must ask them directly if they are willing and able to take on this role, making sure they fully grasp what it involves.

Always Appoint an Alternate

Life is unpredictable. What happens if your first-choice attorney passes away, becomes incapacitated themselves, or simply finds they can’t handle the responsibility when the time comes? Without a backup, your whole plan can fall apart.

That’s why appointing an alternate attorney is a non-negotiable safety net for your power of attorney documents ontario.

Your alternate is your plan B, ready to step in seamlessly if your primary choice can’t. This simple step adds a crucial layer of security, ensuring your affairs will always be managed by someone you’ve personally chosen and trust. This kind of detailed planning is something we stress with our clients, as it’s just as vital as the foresight needed when preparing a will. To see how these essential documents work together, you can learn more about the role of a wills lawyer in Toronto.

Ultimately, choosing your attorney is a deeply personal decision that requires a careful balance of practical skills and unwavering trust.

Common POA Mistakes and How to Avoid Them

Believe it or not, a poorly drafted Power of Attorney can cause more trouble than having no document at all. When a POA is flawed, it creates a false sense of security, often leading to a legal and financial nightmare for your family just when they need clear direction the most. If you’re creating power of attorney documents ontario, you need to know about the common pitfalls.

So many people with the best intentions make critical errors that can render their POA completely useless. These aren’t just minor typos; they are fundamental mistakes that could lock your family out of your bank accounts or stop them from making crucial healthcare decisions on your behalf.

Using Outdated or Generic DIY Forms

One of the biggest mistakes we see is people downloading a generic, one-size-fits-all POA template from the internet. These forms are often out of date, don’t comply with specific Ontario laws, and certainly don’t account for your unique family situation or financial picture.

Just recently, we saw a family from Burlington discover their father’s DIY POA was invalid. The form he’d downloaded was missing the specific witnessing clauses required under Ontario’s Substitute Decisions Act. This left them unable to access his funds to pay for his long-term care, forcing them into a costly and emotionally draining court process to become his legal guardian.

Solution: Resist the temptation of a quick, free form. A POA that will actually work when you need it has to be tailored to your life. Professional legal advice ensures your document not only meets current Ontario laws but also truly reflects what you want to happen.

Vague or Overly Restrictive Instructions

When it comes to your POA, clarity is king. Instructions that are too vague give your attorney very little real guidance, which can lead to them making decisions you would never have wanted. Imagine a clause that simply says, “handle my investments.” What does that really mean? It says nothing about your tolerance for risk or your long-term financial goals.

On the flip side, being too restrictive can tie your attorney’s hands. For instance, putting in a clause that forbids selling your home under any circumstances might feel like a good way to protect your assets. But what if your health takes a sudden turn and the only way to pay for essential medical care is to access the equity in your house?

Failure to Appoint an Alternate Attorney

Life is unpredictable. Your first-choice attorney could get sick, pass away, or even move to another country, leaving no one with the authority to act for you when you need it most. Forgetting to name a backup, or an alternate attorney, is a serious oversight.

If your primary attorney can’t act and there’s no designated alternate, your family is right back at square one. They’ll likely have to go to court, which is the very situation you were trying to avoid.

Here’s how you can steer clear of these common but costly errors:

- Be Specific but Flexible: Clearly state your wishes, especially when it comes to healthcare. For a closer look at this, our guide on living wills in Ontario offers deeper insight into how to express your end-of-life preferences.

- Always Name a Backup: Make sure you appoint at least one alternate attorney for both your Property and Personal Care POAs.

- Ensure Proper Execution: Follow Ontario’s strict rules for signing and witnessing to the letter. Even a small deviation can invalidate the entire document.

While our focus here is on Power of Attorney, the underlying principle of careful planning applies to many major life events. Learning about common mistakes to avoid in other areas, like moving, reinforces the same core lesson: foresight and proper preparation are essential for preventing chaos and conflict down the road.

Securing Your Future with Professional Guidance

We’ve walked through the ins and outs of Power of Attorney documents in Ontario, and hopefully, it’s clear just how vital they are to a secure future. The alternative—facing government intervention, family disputes, or financial chaos—is a messy, stressful road nobody wants to travel. Creating a solid plan isn’t just about paperwork; it’s about taking control and protecting yourself and the people you love from uncertainty.

Making this decision now ensures your voice is heard and your wishes are legally locked in. If you’re navigating a long-term disability claim, recovering from a serious accident, or managing complex family dynamics, a valid POA isn’t just a nice-to-have. It’s absolutely essential. It’s time to move from simply knowing about it to taking decisive action.

Preparing your Powers of Attorney now is one of the greatest gifts you can give your family: clarity. You remove the burden of guesswork and potential conflict, allowing them to focus on your care instead of battling bureaucracy or each other.

The Real Value of Expert Advice

Sure, you can find free government forms online, but they are just templates. They’re one-size-fits-all documents that can’t possibly account for your unique family situation, your specific financial setup, or your personal healthcare wishes. Relying on them is a gamble. A simple mistake in wording or an error in how the document is witnessed can make the whole thing invalid, leaving your family completely exposed when they need protection the most.

This is where professional legal guidance really shows its worth. The average salary for professionals who manage POAs in Ontario is around $96,649 a year, which tells you just how specialized this work is. Without properly drafted power of attorney documents ontario, an estimated 65% of Canadians could end up with the Public Guardian and Trustee managing their affairs. This process comes with significant fees that can drain an estate much faster than the one-time cost of getting proper advice. You can learn more about the specialized nature of handling power of attorney matters in Ontario.

From Knowing to Doing

You now have a solid understanding of the difference between a POA for Property and one for Personal Care. You know the legal hoops you have to jump through to make it valid and the common pitfalls that can trip people up. The last step is to turn that knowledge into a concrete, legally-binding plan that has your back.

Taking action brings immediate benefits:

- You Stay in Control: You choose who makes decisions for you, not a court or a government agency.

- You Protect Your Family: You give your loved ones the clear legal authority they need to step in and help without facing frustrating delays.

- You Avoid Costly Fights: A professionally drafted POA is your best defence against legal challenges and expensive guardianship applications down the road.

- You Gain Peace of Mind: There’s real confidence in knowing your affairs are in order, no matter what the future holds.

Don’t leave your future to chance. At UL Lawyers, we help clients all over Ontario, from our home base in Burlington to every corner of the GTA. Our commitment is to make sure your wishes are documented with the legal precision and personal care they deserve.

We invite you to book a consultation today. Let us help you secure your peace of mind and protect what matters most.

Your Top Questions About Ontario POAs, Answered

When you start digging into Power of Attorney documents, a lot of questions pop up. It’s completely normal. Let’s walk through some of the most common ones we hear from our clients, breaking them down into simple, practical answers.

When Does My Power of Attorney Actually Kick In?

This is probably the biggest point of confusion, and the answer is different depending on which POA we’re talking about.

Think of your Continuing Power of Attorney for Property as being “live” the moment it’s properly signed and witnessed. Your chosen attorney could legally use it right away. However, most people add a specific trigger, or a “springing clause,” so it only activates if a doctor, for instance, confirms in writing that you’re no longer capable of managing your own finances.

The Power of Attorney for Personal Care, on the other hand, works differently by law. It stays dormant and has no power until you are mentally incapable of making your own personal care decisions. Until that specific point is reached, your attorney for personal care cannot make any choices for you.

Can I Pick Someone Who Lives Outside of Ontario?

Legally, yes. You can appoint an attorney who lives in another province or even another country. But just because you can doesn’t always mean you should. It’s crucial to think about the real-world logistics.

An attorney for property who isn’t local might run into a wall of red tape trying to deal with your bank branch here in Ontario. Financial institutions can be wary of out-of-province documents and unfamiliar individuals. Likewise, how can an attorney for personal care in another time zone make a quick, informed decision about your health if you’re in the hospital here? Appointing someone close by is often the most practical and effective choice when creating your power of attorney documents ontario.

How Do I Change or Get Rid of My Power of Attorney?

Your POA isn’t set in stone. As long as you have the mental capacity to make your own decisions, you are in the driver’s seat.

To cancel an existing POA, you must sign a formal document called a “Revocation of Power of Attorney.” Once that’s done, you can create a new POA with your updated wishes. The next step is absolutely vital: you have to give a copy of the revocation to your old attorney and anyone who has a copy of the old POA, like your bank or doctor. This ensures they don’t accidentally act on outdated instructions.

A critical point for Ontarians: Creating a new POA does not automatically cancel out an old one. You need to formally revoke the previous document. Without this step, you could have multiple, conflicting POAs floating around—a recipe for confusion and legal headaches for your family.

What if I Don’t Have a POA and I Become Incapacitated?

This is the situation you really want to avoid. If you don’t have a Power of Attorney for Property, no one can legally step in to pay your bills or manage your investments. Not your spouse, not your kids—no one.

To get the authority they need, a family member would have to apply to the court to be appointed as your guardian of property. This process isn’t just slow and costly; it’s also public. If no one is willing or able to take on that role, a government agency called the Office of the Public Guardian and Trustee will be put in charge of your assets, and their management fees will be paid directly out of your estate.

At UL Lawyers, we guide clients in Burlington and across the GTA in creating clear, legally solid Power of Attorney documents that stand up when they’re needed most. Don’t leave your future to chance. Book a consultation with us today and get the peace of mind that comes with knowing your wishes are protected.

Related Resources

Living Wills Ontario: A Complete Guide to Your Healthcare Wishes

Continue reading Living Wills Ontario: A Complete Guide to Your Healthcare WishesA Guide to Study Permit Canada Requirements

Continue reading A Guide to Study Permit Canada RequirementsNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies