Workers Compensation Guide: Your Rights & Employee Benefits in Ontario

When you get hurt at work in Ontario, figuring out where to turn for help can feel overwhelming. The most important thing to understand is the difference between workers’ compensation and employee benefits, and it all boils down to one simple question: where did the injury or illness happen?

If it’s work-related, you’ll be dealing with workers’ compensation, which is run by the Workplace Safety and Insurance Board (WSIB) in Ontario. If it’s a personal health issue, you’ll look to your private employee benefits.

Your Safety Net After a Workplace Injury

A workplace injury is more than just a physical event; it throws your life into a tailspin of paperwork, phone calls, and deep financial anxiety. For workers across Ontario, from Burlington to the Greater Toronto Area (GTA), there are two main safety nets designed to catch you—but they are built for entirely different situations.

The first, and the one that matters most for a work-related injury, is the system managed by the Workplace Safety and Insurance Board (WSIB). Think of the WSIB as a mandatory, province-wide insurance plan that nearly every Ontario employer pays into. Its sole purpose is to provide specific benefits if you’re hurt on the job, no matter who was at fault.

Distinguishing WSIB from Private Benefits

Your other safety net is the private employee benefits package your employer provides. This is the plan that usually covers things like prescription drugs, dental visits, and, critically, disability insurance like Short-Term Disability (STD) and Long-Term Disability (LTD).

These two systems are not interchangeable. They are designed for completely different scenarios:

- WSIB (Workers’ Compensation): This is your dedicated resource for any injury or illness that happens because of your job. It could be a sudden accident, like a fall on a construction site, or a disease that develops slowly over time from your work environment.

- Employee Benefits (LTD/STD): This coverage kicks in for health issues and disabilities that are not work-related. For instance, if you get into a car accident on a Saturday or are diagnosed with a serious illness, your employer’s LTD plan is what steps in to replace a portion of your income.

The easiest way to remember this is to focus on the cause. If the injury is directly tied to your work duties or workplace, you go to the WSIB. If it happens outside of work, you turn to your employer’s private disability plan.

Grasping this fundamental difference is the most critical first step toward getting the support you’re entitled to. The protections under workers’ compensation are unique and required by Ontario law.

Beyond just covering your medical bills, workers’ compensation can also pay for other crucial recovery aids. This might include physiotherapy to get you back on your feet or necessary medical equipment rentals to make life at home more manageable. Knowing what’s available is key to a smoother recovery.

WSIB vs Employee Disability Benefits at a Glance

To make the distinction even clearer, here’s a quick side-by-side comparison of Ontario’s WSIB and a typical employer-provided disability insurance plan.

| Feature | Workers’ Compensation (WSIB) | Employee Disability Benefits (STD/LTD) |

|---|---|---|

| Purpose | For work-related injuries & illnesses | For non-work-related injuries & illnesses |

| Funding Source | Employer premiums (mandatory) | Employer/employee premiums (part of benefits package) |

| Eligibility | Based on employment in an insured industry & a work-related incident | Based on the insurance policy’s definition of disability |

| Medical Coverage | Covers all approved treatment costs (prescriptions, therapy, etc.) | Typically covered by the extended health portion of your benefits |

| Wage Replacement | 85% of your pre-injury net average earnings | Usually 60-70% of your pre-disability gross earnings |

| Decision-Maker | WSIB adjudicators and case managers | Private insurance company adjusters |

| Fault | A “no-fault” system; benefits are paid regardless of who was at fault | Not applicable |

As you can see, while both provide a safety net, they operate in completely separate lanes with different rules, funding, and benefit amounts. Getting it right from the start is crucial.

How WSIB Protects Ontario Workers

Think of Ontario’s Workplace Safety and Insurance Board (WSIB) as a mandatory insurance plan that covers almost every workplace in the province. It’s not an optional extra; it’s a legal requirement put in place to protect people who get hurt or become ill because of their job.

The most important thing to understand about the WSIB system is that it’s “no-fault.”

This “no-fault” principle is the bedrock of the entire system. It means you don’t have to prove your employer did anything wrong to cause your injury. If you were hurt while doing your job, you’re entitled to benefits. It’s that simple.

This is a game-changer for injured workers. It means you can focus on getting better instead of gearing up for a long, expensive court battle to prove who was at fault.

What Kinds of Injuries Are Covered?

WSIB coverage is surprisingly broad and isn’t just for dramatic, one-time accidents. It’s designed to cover the many ways a job can affect a person’s health over time.

Generally, the injuries and illnesses covered fall into a few key areas:

- Traumatic Accidents: These are the sudden events we often picture—a slip and fall, an injury from machinery, or hurting your back while lifting something heavy.

- Repetitive Strain Injuries: These injuries don’t happen overnight. They build up from doing the same motions again and again, like carpal tunnel syndrome from typing or tendonitis from working on an assembly line.

- Occupational Diseases: Sometimes, the workplace itself can make you sick. This category covers illnesses from being exposed to harmful substances or conditions, like lung disease from breathing in dust or hearing loss from years of loud noise.

- Mental Stress: In specific circumstances, WSIB will also cover mental health conditions that are a direct result of a traumatic workplace event or ongoing workplace harassment.

This comprehensive approach makes sure you’re protected whether your injury happened in a single moment or developed slowly over years of hard work.

The Core Benefits WSIB Provides

When WSIB approves your claim, you get access to a bundle of benefits designed to keep you financially stable and help you recover. It’s not just a single cheque; it’s a structured support system.

The main benefits you can expect are:

- Loss of Earnings (LOE) Payments: This is your income replacement. WSIB pays 85% of your net average earnings (your take-home pay before the injury) for as long as your work-related condition causes you to lose wages.

- Full Medical Coverage: WSIB pays for all necessary and approved healthcare to treat your injury. This covers everything from physiotherapy and prescriptions to your doctor’s appointments and even travel costs to get there.

- Vocational Rehabilitation Services: If you can’t go back to your old job because of your injury, WSIB steps in to help you get back to work. That could mean training for a new career, help with your job search, or making changes to your workplace so you can return safely.

At its heart, the WSIB system is a trade-off. Workers give up the right to sue their employer for a work injury. In exchange, they receive guaranteed, no-fault benefits to cover their lost wages and medical needs without a drawn-out legal fight.

Knowing how this system is supposed to work is crucial for every employee in Ontario. For a closer look at the specifics of coverage and what your employer’s obligations are, our detailed guide on WSIB insurance in Ontario is a great resource. This knowledge is your best tool for acting quickly and confidently if you ever need to rely on this critical safety net.

Understanding Your Group Employee Benefits Package

Think of it this way: WSIB is a specialized safety net just for work-related injuries. Your group employee benefits package, on the other hand, is the much broader support system for your overall health and well-being, both on and off the clock. It’s essentially a private health plan your employer has arranged for you and your colleagues.

This package is designed to kick in for all the life events and health challenges that have nothing to do with your job. For instance, if you slip on an icy sidewalk while walking your dog on a Sunday and break your ankle, that’s where your employee benefits come into play. If you’re diagnosed with an illness that forces you to be off work for months, your disability benefits are what you’ll rely on for income. These are private insurance policies, not a government program like WSIB.

The Key Components of Your Benefits Plan

Most group benefits packages in Ontario share a similar structure, even if the specific coverage amounts differ between employers. They are typically built around providing income replacement if you can’t work and helping cover day-to-day medical expenses.

It’s crucial to remember that these plans are governed by a detailed insurance contract, not a piece of provincial legislation like the Workplace Safety and Insurance Act. Your rights, the rules, and the claim procedures are all laid out in the policy documents from the insurance company.

Here’s what you’ll usually find inside:

- Short-Term Disability (STD): This is your first line of defence. It replaces a portion of your income for a limited time—often up to six months—if a non-work-related illness or injury keeps you from your job.

- Long-Term Disability (LTD): When STD runs out, LTD is designed to take over. If you’re still unable to work, this benefit can provide a percentage of your income for a much longer period, sometimes all the way to age 65.

- Extended Health Coverage: This helps pay for many medical expenses that the Ontario Health Insurance Plan (OHIP) doesn’t cover. Think prescription drugs, physiotherapy, vision care, or specialized medical equipment.

- Dental Coverage: This part of the plan helps with the costs of everything from routine cleanings and fillings to more significant procedures like crowns or orthodontics.

How Disability Benefits Actually Work

Navigating a disability claim, especially for Long-Term Disability, is a completely different ball game than filing with WSIB. The first thing you need to understand is the “elimination period,” which is just an industry term for a waiting period. This is a specific amount of time you must be continuously disabled and off work before your LTD benefits can even start.

The elimination period is like the deductible on your car insurance. You have to get through that initial period of loss—often using sick days, savings, or STD benefits—before the long-term insurance policy starts to pay out.

A very common elimination period is 17 weeks, or about four months. You won’t see a dollar of LTD benefits during that time. This is precisely why Short-Term Disability exists—it’s meant to bridge that financial gap until your LTD coverage is eligible to begin. Getting familiar with the details of long-term disability insurance claims can make a world of difference when you need to rely on this coverage.

Remember, the entire process is handled by a private insurance company, not a government agency. Their decision to approve or deny your claim hinges entirely on one thing: whether your medical evidence proves you meet the specific definition of “disability” written in your policy. That definition, and every other rule in the book, is found in the benefits booklet your employer gave you. That document is your guide.

When WSIB and LTD Benefits Overlap

This is where things can get really tricky. When you’re injured at work in Ontario, you suddenly find yourself standing at the intersection of two very different systems: the Workplace Safety and Insurance Board (WSIB) and your own employer’s private benefits, like Long-Term Disability (LTD). It’s easy to feel caught in the middle, stuck between two sets of rules, paperwork, and decision-makers.

The first question on everyone’s mind is, “Can I get paid by both?” The straightforward answer is no—you can’t “double-dip” and receive full payments from both WSIB and an LTD insurer for the same time off work. The entire benefits system in Canada is designed to prevent you from earning more while disabled than you did when you were working.

So, how do they manage this? Through a process called offsetting.

How Offsetting Really Works

Think of your income replacement as a glass you need to fill. Your LTD policy might promise to fill it up to, say, 67% of your old salary. But if WSIB is already pouring in benefits—which cover 85% of your net average earnings—your glass is already full.

In that scenario, your LTD insurer doesn’t have to add anything. They simply “offset” what they owe you by the amount WSIB is already paying. Because WSIB is the primary payer for a workplace injury, the LTD insurer’s obligation is reduced, often to zero.

This concept is the key to understanding how workers’ compensation and employee benefits are coordinated. The exact same principle applies to Canada Pension Plan (CPP) Disability benefits; if you get approved for CPP, your LTD insurer will almost always deduct that amount from your monthly payment.

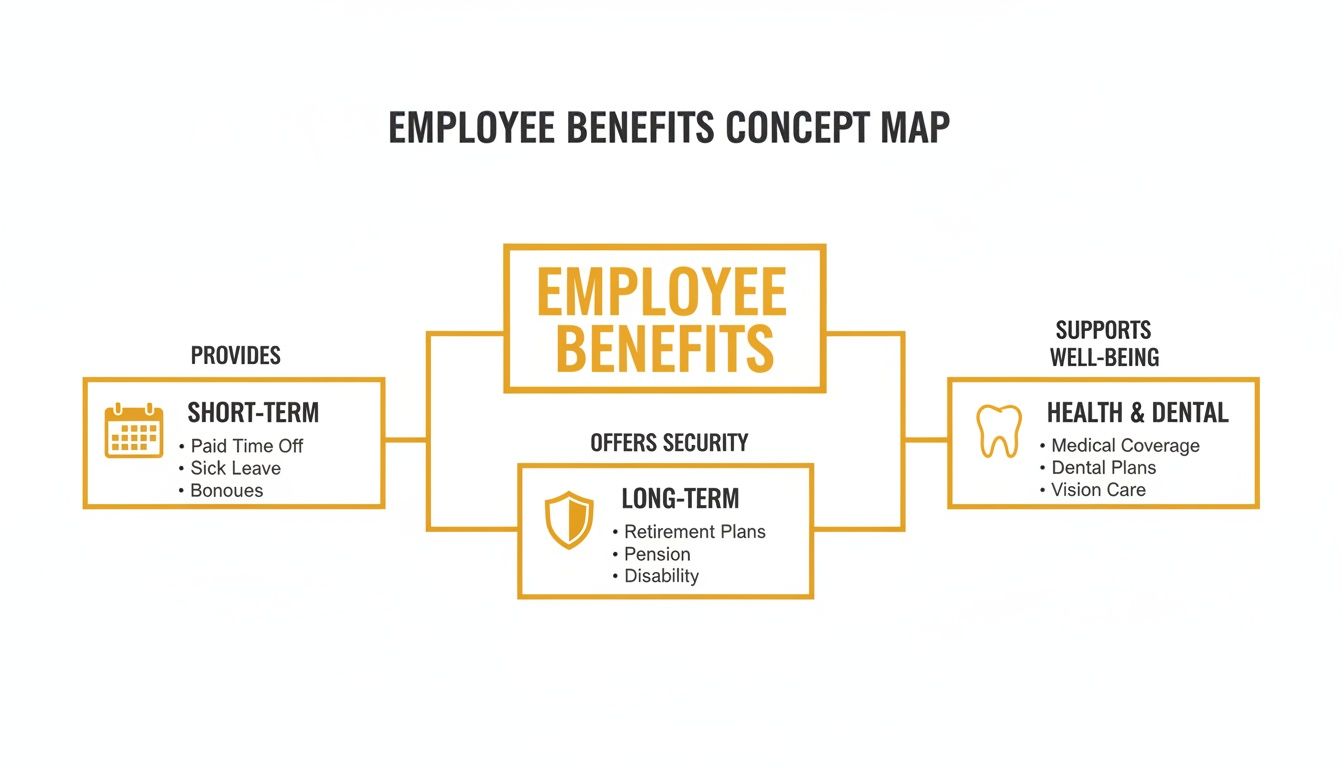

This map shows how your employee benefits—short-term, long-term, and health coverage—are meant to work together as a safety net. Each plays a specific role, but their paths can definitely cross with WSIB.

What to Do if WSIB Denies Your Claim

Here’s where it gets complicated. A WSIB denial can feel like a devastating blow, pulling your main source of support right out from under you. This is the moment you absolutely must pivot and lean on your employer’s disability benefits as your backup plan.

You should immediately apply for Short-Term Disability (STD), which will likely transition to an LTD claim. But here’s the critical part: you must appeal the WSIB denial at the same time.

Let’s trace a common path for an injured Ontario worker:

- The Injury & Denial: You get hurt on the job in Burlington and apply to WSIB. They deny your claim, saying your injury isn’t work-related.

- Pivoting to LTD: While you start the WSIB appeal process, you apply for LTD through your work’s insurance. Based on your doctor’s reports saying you can’t work, the LTD insurer approves your claim and starts payments.

- The Payback Agreement: Before they pay you a dime, the LTD insurer will require you to sign a reimbursement agreement. This is a contract that says if your WSIB appeal succeeds, you have to pay the LTD insurer back for every dollar they gave you.

- Winning the Appeal: A year later, your appeal is successful! WSIB sends you a lump-sum cheque for all the retroactive benefits you were owed for the past year.

- Settling Up: You then have to use that WSIB money to repay your LTD insurer. In the end, WSIB becomes the rightful payer, and your private insurance plan gets its money back.

A denied WSIB claim is not the end of the road. It’s a signal to shift your strategy, use your private benefits as a bridge, and fight the WSIB decision.

Health Benefits and CPP Disability: The Other Pieces of the Puzzle

While wage loss is the biggest concern, don’t forget about medical costs. WSIB is supposed to cover all necessary treatments for a work injury, but approvals can be slow. This is where your employer’s extended health benefits can be a lifesaver, allowing you to pay for prescriptions or physiotherapy out-of-pocket and get reimbursed while you wait on WSIB.

The Canada Pension Plan (CPP) Disability benefit is another potential layer of support. This federal program is for people with a “severe and prolonged” disability. Since it’s a separate government plan, you can apply for it at any time. But remember the offset rule: any money you receive from CPP Disability will almost certainly be deducted from your LTD payments.

Grasping these details is much easier when you have a clear picture of what qualifies for long-term disability in Ontario, as the eligibility rules can vary quite a bit from one plan to another.

To help you see how these systems fit together, we’ve put together a table outlining a few common situations.

Benefit Coordination Scenarios for Ontario Workers

This table illustrates how different benefits interact depending on the situation, helping workers understand their potential entitlements.

| Scenario | Primary Payer | Secondary or Potential Payer(s) | Key Consideration |

|---|---|---|---|

| Workplace Injury, WSIB Claim Accepted | WSIB | Extended Health Benefits (for gaps) | LTD benefits are typically offset to $0 because WSIB pays a higher rate. |

| Workplace Injury, WSIB Claim Denied | LTD/STD Insurer | Extended Health Benefits, CPP Disability | You must actively appeal the WSIB denial while receiving LTD benefits. |

| Non-Work-Related Illness or Injury | STD, then LTD Insurer | CPP Disability, Extended Health Benefits | WSIB is not involved. Your private plan is the main source of income replacement. |

| Successful WSIB Appeal After LTD Paid | WSIB (retroactively) | N/A | You must use the retroactive WSIB funds to reimburse the LTD insurer. |

Understanding these dynamics is the first step toward protecting your income and health after an injury. Knowing who pays, when, and how they interact can prevent financial hardship while you focus on your recovery.

Navigating Your Claim Responsibilities

Filing a successful workers’ compensation claim isn’t just about what happens after you get hurt. It’s about following a specific roadmap laid out by Ontario law, and both you and your employer have time-sensitive parts to play. Getting these steps right is the key to protecting your right to benefits and ensuring the whole process runs smoothly.

Think of it as a formal partnership. You both have distinct roles, and if one person misses their cue, the entire system can grind to a halt. As the injured worker, your job is all about clear communication and cooperation. For your employer, their obligations are strict legal requirements designed to support you and keep things moving forward.

Your Duties as an Injured Employee

What you do immediately after a workplace injury is critical. The ball is in your court to get the process started by giving the right information to your employer and the WSIB. Dropping that ball can cause frustrating delays or even jeopardize your entire claim.

Here’s what you absolutely must do:

- Report Your Injury Immediately: Tell your supervisor or employer about your injury the moment it happens. Don’t tough it out or wait to see if it gets better. Even if it seems minor, reporting it creates an official record that can be vital later on.

- Get Medical Help Right Away: Your health always comes first. See a doctor or head to a clinic as soon as you can, and be very clear that your injury happened at work. This ensures your medical records accurately connect your condition to the workplace incident.

- Work with the WSIB and Your Employer: This isn’t a one-time thing; it’s an ongoing responsibility. You’ll need to provide information to the WSIB, show up for any required medical exams, and actively help create a return-to-work plan with your employer.

Think of these first steps as laying the foundation for your claim. Reporting it immediately establishes the “when” and “where.” Seeking prompt medical care documents the “what.” And your ongoing cooperation shows you’re committed to your recovery.

Your Employer’s Legal Obligations

Your employer’s role is just as clearly defined and legally binding. They can’t just wash their hands of the situation and leave you to figure it all out. The Workplace Safety and Insurance Act gives them several non-negotiable duties the moment you report an injury.

These aren’t just suggestions—they’re legal requirements, and there are penalties if they don’t comply.

Key Employer Responsibilities in Ontario

Whether they’re in the GTA, Burlington, or anywhere else in the province, every employer must follow these rules:

- Pay Your Wages for the Day of Injury: Your employer must pay your full wages and benefits for the entire day you were injured, no matter what time the accident happened.

- Submit the Form 7 to WSIB: This is a big one with a tight deadline. If your injury causes you to miss work or requires you to get healthcare, your employer must file a Form 7 (Employer’s Report of Injury/Disease) with the WSIB within three business days of finding out about it.

- Maintain Communication: They are expected to stay in touch with you during your recovery and keep you in the loop about potential return-to-work options.

- Fulfill the Duty to Accommodate: This is a major responsibility under both the WSIB Act and Ontario’s Human Rights Code. Your employer has to work with you to find a safe and early way for you to return to work. This means offering suitable modified duties that respect your medical restrictions. They can’t just fire you because you got hurt.

If an employer fails to meet these obligations, they can face penalties from the WSIB and open themselves up to serious legal trouble. Knowing what your employer is required to do empowers you to make sure your rights are being protected every step of the way.

Knowing When to Get Legal Advice

While Ontario’s benefits systems are meant to be accessible, going it alone can be tough, especially if your claim gets denied or disputed. It happens more often than you’d think, and getting that denial letter can leave you feeling completely lost and financially exposed. Knowing the signs that it’s time to call in a professional is key to protecting your rights.

Think of it like this: you can probably change a lightbulb yourself, but for a major rewiring job, you call an electrician to avoid a bigger mess. When your income and health are at stake, a lawyer is that essential expert.

Critical Red Flags in Your Claim

Some situations are more than just minor bumps in the road; they’re serious roadblocks that can cut off your access to workers’ compensation or employee benefits.

Keep an eye out for these moments:

- Your WSIB Claim is Denied: A WSIB denial isn’t the end of the story. It’s the start of a formal appeal process with tight deadlines and a high bar for evidence.

- Your Benefits are Suddenly Stopped: If your LTD or WSIB payments abruptly end, you need to find out why and act fast to challenge the decision.

- There is a Return-to-Work Dispute: Your doctor says you’re not ready, but your employer or the insurer is pushing you to come back. This is a classic standoff that often needs a skilled negotiator.

- Your Employer Fails to Accommodate: If your employer isn’t offering proper modified duties or is pressuring you to return to work before you’re medically ready, they could be violating your rights.

When you hire a lawyer, your conversations are protected. When considering legal advice for your claim, it’s crucial to understand the attorney client privilege rules to protect your confidential communications as you build your case.

This is exactly when a firm with deep experience in Ontario’s complex benefits landscape becomes your biggest advantage. A dedicated lawyer can take over, managing all the moving parts for you. They’ll gather the right medical evidence, handle all communications with the insurance company, and build a solid case to get you what you’re owed.

Fighting a WSIB appeal or an unfair LTD decision involves navigating a maze of legal procedures. An experienced workplace injury lawyer knows the playbook insurers use and, more importantly, how to counter their tactics. They become your champion, fighting for the benefits you deserve so you can focus on the one thing that truly matters—getting better.

To see how this applies to private insurance, you can learn more from our guide on finding the right lawyer for an insurance claim and understand the difference expert guidance can make.

Frequently Asked Questions

When you’re dealing with an injury, the last thing you need is confusion about where to turn for help. Let’s clear up some of the most common questions we hear from workers in Ontario about WSIB and private disability plans.

Can I Choose Which Benefit to Apply For?

This is a common point of confusion, but the answer is a firm no. The source of your injury or illness determines which path you must take.

If your injury happened at work or is a result of your job duties, you are required by law to file a claim with the Workplace Safety and Insurance Board (WSIB). Private disability plans provided by your employer are specifically for non-work-related health issues, and their policies will explicitly exclude anything that should be covered by WSIB.

Trying to apply to the wrong one will just lead to a denial and a lot of wasted time. For any health issue that stems from your job, WSIB is always the starting point.

What if My Employer Pressures Me Not to File a WSIB Claim?

This is a major red flag. It is absolutely illegal for an employer in Ontario to try to stop you from filing a WSIB claim or punish you for doing so. This tactic is known as “claim suppression,” and it’s a serious violation of the Workplace Safety and Insurance Act.

Your right to claim benefits is protected by law. If you feel any pressure from your employer, document everything they say or do. It’s a very good idea to seek legal advice right away to make sure your rights are protected.

Remember, WSIB is a no-fault system. The goal is to provide you with wage loss and medical benefits, not to assign blame to you or your employer. You are entitled to this protection.

How Long Does a WSIB Claim Take?

There’s no single answer here—it really depends on the complexity of your case. A straightforward claim for a simple injury might get a decision in a few weeks.

However, more complicated situations, like occupational diseases, repetitive strain injuries, or mental stress claims, can easily take several months to resolve.

While you’re waiting for a WSIB decision, don’t just sit without an income. You should immediately apply for any other available support, such as:

- Sick leave through your employer

- Short-Term Disability (STD) benefits

- Employment Insurance (EI) sickness benefits

These benefits act as a financial bridge. If your WSIB claim is eventually approved, the WSIB will pay you retroactively, and you’ll then repay the other benefits provider. This coordination is crucial for keeping your finances stable while you wait for a final decision on your workers compensation employee benefits.

At UL Lawyers, we understand how overwhelming it can be when your income and health are on the line. If you are struggling with a denied claim or feel lost in the system, you don’t have to face it alone. Contact us for a free consultation to discuss your case and learn how our dedicated team can fight for you. Visit us at https://ullaw.ca to get the help you deserve.

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies