Pecuniary and Non Pecuniary Damages: An Ontario Guide to Compensation

When you’ve been seriously injured, the path to recovery can feel overwhelming. Beyond the physical and emotional challenges, one of the biggest questions looming is, “What is my claim actually worth?” In Ontario, the answer lies in understanding two completely different types of compensation: pecuniary and non-pecuniary damages.

Simply put, pecuniary damages cover the concrete financial losses you can prove with a receipt or a pay stub. Non-pecuniary damages, on the other hand, are meant to compensate for the intangible, human cost of your suffering.

Decoding Your Personal Injury Compensation

After an injury in Ontario, the goal of the legal system is to try and put you back in the financial position you were in before the accident ever happened. This is done through an award of “damages”—the legal term for the money paid by the at-fault party to compensate you for your losses.

Imagine your total compensation is built from two very different kinds of building blocks. The first, pecuniary damages, represents every dollar you’ve lost or had to spend because of the injury. These are the tangible costs you can track.

The second kind, non-pecuniary damages, acknowledges the impacts that don’t come with a price tag. We’re talking about the physical pain, the emotional distress, and the loss of enjoyment of life that you’ve experienced.

The Two Pillars of Your Claim

Getting a handle on the difference between these two categories is the first and most crucial step in understanding the true potential value of your claim. Each one is calculated, argued, and proven in its own unique way.

- Pecuniary Damages: This is all about making you “financially whole” again. It covers the specific, quantifiable monetary losses that are a direct result of your injury.

- Non-Pecuniary Damages: This is about recognizing the profound, non-financial toll the injury has taken on your quality of life. It’s compensation for the human cost.

Understanding the principles of fair compensation is a cornerstone of Canadian personal injury law. For instance, looking at how various compensation schemes for victims are structured can offer a broader perspective on the different ways financial redress can be provided.

Pecuniary vs Non-Pecuniary Damages At a Glance

To make this even clearer, here’s a quick side-by-side comparison of the two types of damages you’ll encounter in an Ontario personal injury claim.

| Characteristic | Pecuniary Damages | Non-Pecuniary Damages |

|---|---|---|

| Purpose | To reimburse for actual financial losses. | To compensate for pain, suffering, and loss of enjoyment of life. |

| Calculation | Based on receipts, invoices, and expert financial projections. | Based on legal precedent and the severity of the injury’s impact. |

| Nature | Objective and quantifiable. | Subjective and non-quantifiable. |

| Examples | Lost wages, medical bills, future care costs. | Pain, emotional distress, loss of companionship. |

| Legal Cap | Generally no cap (based on proven need). | Capped by the Supreme Court of Canada. |

This table helps illustrate why your legal team has to build two very different cases—one based on numbers and one based on the human experience—to secure your full compensation.

Why Ontario Law Treats Them Differently

In Canadian personal injury law, these two types of damages are not treated equally, especially when it comes to legal limits. Pecuniary losses, like your lost income or the cost of future medical care, are theoretically uncapped because they are meant to cover your actual, proven financial needs for the rest of your life.

Non-pecuniary damages for pain and suffering, however, have a strict nationwide limit. In a series of landmark decisions from 1978, the Supreme Court of Canada set a maximum award. This cap is adjusted for inflation each year. As of early 2024, that upper limit is over $450,000—a figure reserved only for the most catastrophic, life-altering injuries.

The core purpose of damages is not to punish the wrongdoer, but to compensate the injured person. Pecuniary damages restore your bank account, while non-pecuniary damages acknowledge your suffering.

Successfully navigating these distinct rules requires a deep understanding of the specific evidence needed to prove each part of your claim. If you’d like to dive deeper, you might find our guide on the fundamentals of the law on personal injury helpful. Our firm, proudly serving Burlington and the entire GTA, is here to help you build the strongest possible case for both.

Calculating the Financial Cost of Your Injury

When an accident turns your life upside down, the financial fallout can be swift and severe. This is exactly what pecuniary damages are designed to address. Their sole purpose is to compensate you for every single quantifiable dollar you’ve lost because of the injury. The goal is simple: to put you back in the same financial position you were in before the accident ever happened.

Imagine your financial life before the injury as a stable, complete structure. The accident shatters it, leaving gaps and cracks everywhere. Pecuniary damages are the materials—the bricks, mortar, and beams—needed to rebuild that structure from the ground up.

This isn’t just a matter of adding up a few receipts. It’s a meticulous process of calculating every tangible loss, both what you’ve already lost and what you will lose in the future. It’s a detailed accounting of the true financial toll of your injury.

Accounting for Past and Future Income Loss

One of the biggest financial hits after an injury is lost income. And we’re not just talking about the paycheques you missed while you were recovering. We’re talking about the full impact on your ability to earn a living for the rest of your life.

To prove what you’ve already lost, we gather concrete evidence to paint a clear picture of your earnings before the accident. This usually includes:

- Pay stubs and employment records

- T4 slips and past income tax returns

- Letters from your employer confirming your pay rate and missed time

Figuring out future income loss is where things get more complex. It’s about projecting what you would have earned if you hadn’t been injured. This often involves bringing in vocational experts to assess your capacity to work—and what kind of work you can still do—and economists to project your lost earnings over your entire career. They factor in everything you’ll now miss out on, like promotions, raises, and pension contributions.

The True Cost of Future Care

For serious injuries, the need for medical and personal care doesn’t stop when you leave the hospital. In fact, future care costs are often the largest and most critical part of a personal injury claim. These damages are meant to provide the funds you’ll need to live with dignity and get the support you require for the rest of your life.

These costs can cover a huge range of necessities, such as:

- Ongoing physiotherapy, occupational therapy, and psychological counselling

- Medications and specialized medical equipment

- Home modifications like ramps, lifts, or accessible bathrooms

- Attendant care services to help with daily activities

This is where specialists like life care planners are essential. They create an exhaustive report that details every single anticipated medical and personal need, putting a price tag on each one. It’s also important to remember that some of these needs might be covered by your no-fault benefits. That’s why it’s so critical to understand all available sources of support, including your rights to accident benefits in Ontario.

A key challenge in calculating future pecuniary damages is converting a lifetime of expenses into a single, lump-sum payment today. This process, known as capitalization, involves complex economic formulas to ensure the money is sufficient to cover future costs when accounting for inflation and investment returns.

To ensure these calculations are fair and consistent, Ontario’s Rules of Civil Procedure provide specific guidance on future pecuniary damage awards. The rules mandate specific discount rates that actuaries must use, making expert analysis indispensable.

Out-of-Pocket Expenses and Other Losses

Finally, pecuniary damages also cover all those smaller, out-of-pocket expenses that can quickly add up to a significant amount. Every cost you’ve incurred because of the injury, no matter how small it seems, needs to be tracked and accounted for.

It’s crucial to keep meticulous records of everything, including:

- Travel expenses for medical appointments (mileage, parking, transit)

- Hiring help for housekeeping and home maintenance

- Extra childcare costs you wouldn’t have otherwise needed

- Any other expense that is a direct result of your injury

Proving your claim for pecuniary damages is an evidence-based process. Every receipt, every pay stub, and every expert report matters in building a strong case that shows the true financial reality you’re facing after an injury.

Placing a Value on Pain and Suffering

While pecuniary damages are all about rebuilding your financial life, brick by brick, non-pecuniary damages tackle a much tougher question: How do you put a dollar value on pain? On suffering? On the simple joy of living your life, now lost?

These damages aren’t meant to magically replace what you’ve lost—that’s impossible. Instead, they serve as a form of solace, a legal recognition of the profound, non-financial toll an injury has taken. It’s an acknowledgment that an injury is far more than medical bills; it’s a fundamental disruption to who you are and how you live.

The Landmark Cap on General Damages

Here in Canada, there’s a limit on how much can be awarded for pain and suffering. This wasn’t always the case. The rule was established back in 1978 through a trio of landmark Supreme Court of Canada decisions involving catastrophically injured young people. The Court set a maximum, or “cap,” on non-pecuniary general damages to keep awards from becoming wildly unpredictable.

At the time, that cap was set at $100,000. Of course, money was worth more then. To keep pace with the cost of living, that amount is adjusted for inflation every year. Today, that cap has climbed to over $450,000.

It’s critical to understand what this number really means.

The cap is a ceiling, not a target. It is reserved only for the most severe and catastrophic injury cases, such as quadriplegia or a severe traumatic brain injury. The vast majority of personal injury claims in Ontario will result in non-pecuniary awards far, far below this maximum.

This framework means there’s no simple formula for calculating your pain and suffering. It’s a detailed, human-focused evaluation shaped by decades of Canadian legal decisions.

How Courts Assess Non-Pecuniary Damages

You can’t produce a receipt for pain or put a price tag on a hobby you can no longer enjoy. Because of this, courts in Ontario look to precedent. They review past cases with similar injuries and life impacts to figure out a fair and reasonable compensation range for your specific situation. This is a highly nuanced process where the small details can make a big difference.

Several key factors come into play when an award for non-pecuniary damages is being considered:

- Severity of the Injury: What is the nature of the physical harm? How much pain is involved? How long will recovery take, if it’s even possible?

- Impact on Daily Life: How has this injury affected your ability to handle basic daily tasks, from getting dressed to managing your home?

- Loss of Enjoyment of Life: This looks at your inability to take part in sports, hobbies, social events, and other activities that once brought you joy.

- Your Age: Age is a major factor. A permanent injury will impact a younger person for a much larger portion of their life than it will an older person.

- Psychological Harm: The emotional and mental toll—like depression, anxiety, or PTSD—is a crucial part of the assessment.

Because this is all so subjective, building a strong case takes more than just a stack of medical reports. It requires telling your story in a compelling way. To dive deeper into this specific type of compensation, you can read our in-depth guide on how pain and suffering damages are calculated in Ontario.

Our team, serving Burlington and the entire GTA, knows how to build that powerful narrative. We work to show the true, full impact the injury has had on your life, ensuring you get the fair recognition you deserve.

Navigating Car Accident Claims in Ontario

When you’re hurt in a car accident in Ontario, the path to getting compensated for your pain and suffering is different—and frankly, a lot more complicated—than for other types of personal injury claims, like a slip and fall. The system has its own unique set of rules that you absolutely have to understand.

Think of it as a game with a special rulebook. If you don’t know the rules, you can easily find yourself losing out on fair compensation, even when the other driver was clearly at fault.

These rules were introduced to manage the sheer volume of claims and keep insurance premiums in check. But for an injured person, they create some serious hurdles. Two of the biggest ones you’ll hear about are the “threshold” and the “deductible.”

First, You Have to Meet the Injury Threshold

Before a dollar amount for your pain and suffering can even be considered, you must first prove your injury is serious enough to meet a specific legal test. This is what lawyers call the threshold.

Under Ontario’s Insurance Act, your injury must qualify as a permanent serious impairment of an important physical, mental, or psychological function, or a permanent serious disfigurement.

That’s a mouthful, and it’s not a simple diagnosis.

- “Permanent” means your doctors don’t expect you to fully recover.

- “Serious” means the injury substantially interferes with your life—your ability to work, take care of yourself and your home, or enjoy your hobbies.

Proving you meet this threshold is often a major battle with the insurance company and requires solid medical evidence.

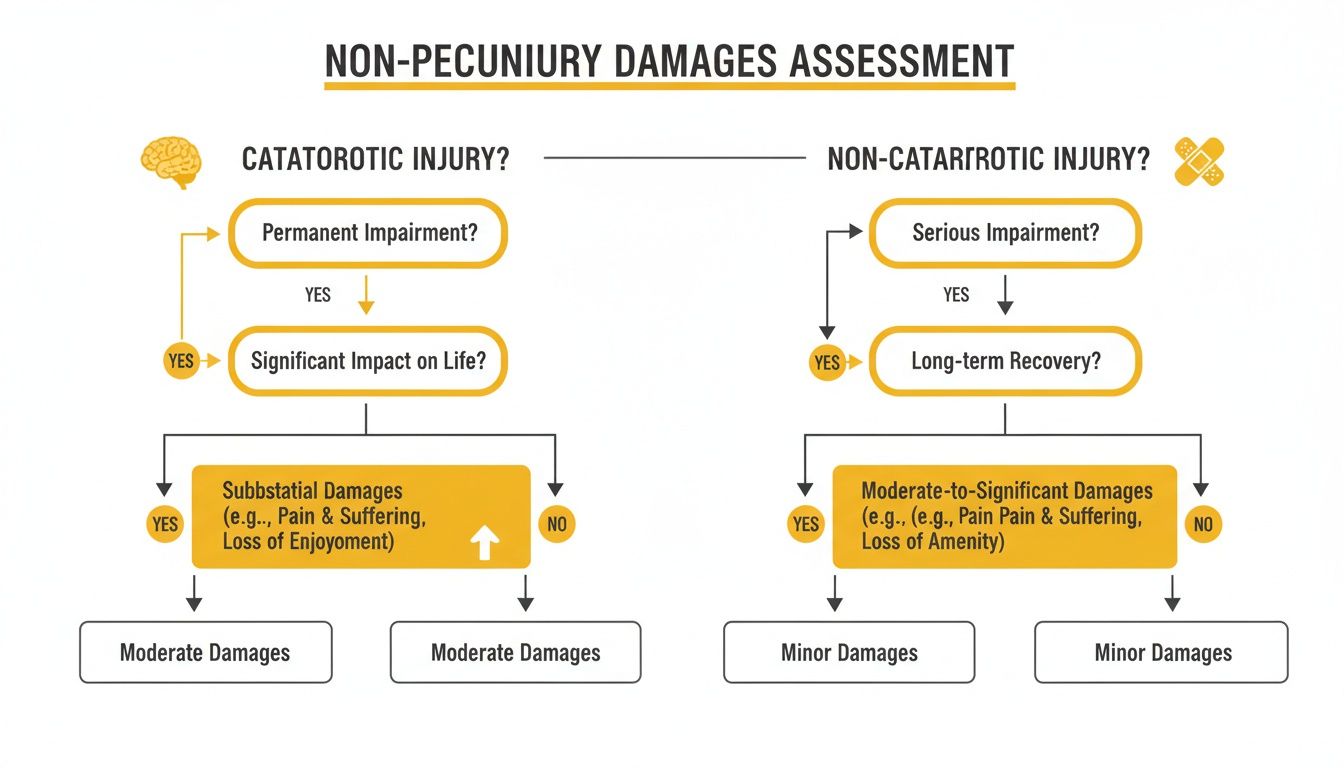

This flowchart illustrates how injuries are assessed and how the severity impacts the claim.

As you can see, the distinction between injury levels is a critical step that shapes the entire compensation process.

Then, You Have to Deal With the Statutory Deductible

Let’s say your injury is severe enough to clear the threshold. Great. But there’s another roadblock waiting for you: the statutory deductible.

This is a set amount of money that, by law, gets automatically subtracted from any award for pain and suffering. The government adjusts this number every year to account for inflation.

In Ontario, even after you prove your case, the law requires a large deductible to be taken from your pain and suffering award. The amount a judge or jury says you deserve isn’t what you actually get in your pocket.

For example, in 2024, the deductible for these claims is a staggering $46,580.48. If a jury awards you $100,000 for your suffering, the insurance company gets to keep the first $46,580.48. You walk away with only $53,419.52.

The “Vanishing Deductible”

There is one exception to this rule. If your pain and suffering award is high enough, the deductible disappears completely. This is sometimes called the “vanishing deductible.”

For 2024, that magic number is $155,267.12. If your award is for that amount or more, you get to keep the whole thing—no reduction. This is meant to protect those who have suffered the most severe injuries.

Getting your head around these complicated financial rules is a perfect example of why having an expert guide is so important. You can learn more by checking out our in-depth article on motor vehicle accident compensation.

It’s crucial to remember that these frustrating threshold and deductible rules only apply to your claim for non-pecuniary (pain and suffering) damages. Your claims for pecuniary losses, like income you’ve lost or medical care you’ll need in the future, don’t have these same strings attached. Our team, serving Burlington and all of the GTA, knows these MVA regulations inside and out and can help you navigate this complex process.

Building a Strong Foundation for Your Claim

Knowing the difference between pecuniary and non-pecuniary damages is step one. Proving them is the real challenge. A successful personal injury claim in Ontario isn’t just a good story; it’s a case built on a foundation of solid, undeniable evidence.

Knowing the difference between pecuniary and non-pecuniary damages is step one. Proving them is the real challenge. A successful personal injury claim in Ontario isn’t just a good story; it’s a case built on a foundation of solid, undeniable evidence.

This is the point where you shift from being a victim to being an active participant in your own fight for justice. The strength of your claim hinges entirely on how well you can prove every single loss—both the ones that show up on a bank statement and the ones that don’t.

Think of yourself as an investigator building a file. Every document, receipt, and note is a piece of the puzzle, reinforcing the reality of your situation. This gives your legal team the ammunition they need to fight effectively for you.

Documenting Your Pecuniary Losses: The Paper Trail

Proving your financial losses—the pecuniary damages—is all about meticulous record-keeping. These are tangible, out-of-pocket costs, and they demand a clear paper trail. Every expense, no matter how small, helps paint the full picture of the financial burden you’re carrying.

Start collecting these items right away and keep them organized in a dedicated folder or digital file:

- Employment Records: This is the bedrock of any income loss claim. Gather your pay stubs, T4 slips, and a letter from your employer confirming your pay rate and the exact time you’ve missed from work.

- Medical and Rehabilitation Receipts: Every single bill needs to be saved. This includes physiotherapy, prescriptions from the pharmacy, chiropractic care, and any medical devices you’ve had to purchase.

- Out-of-Pocket Expenses: Keep receipts for everything. This means mileage and parking for appointments, assistive devices, and even the cost of hiring someone to handle household chores you can no longer manage.

The rule is simple: if you paid for it because of the accident, keep the receipt. Insurance companies are notorious for disputing any expense that isn’t backed by documentation. Your diligence here is your best weapon.

Capturing Your Non-Pecuniary Losses: The Human Story

This is where things get more complex. You can’t get a receipt for pain or an invoice for lost enjoyment of life. To prove non-pecuniary damages, your evidence needs to paint a vivid, human picture of how the injury has fundamentally changed your world.

It’s about capturing the human cost through consistent, detailed records. These documents give a voice to your suffering and provide the crucial evidence needed to support your claim for pain and suffering.

Here are your most powerful tools:

- Detailed Medical Reports: We need more than just a diagnosis. Reports from your family doctor and specialists that describe your pain levels, physical limitations, and long-term prognosis are vital.

- A Personal Pain Journal: Honestly, this can be one of the most compelling pieces of evidence you can create. On a daily or weekly basis, jot down your pain levels (on a scale of 1-10), the challenges you face with simple tasks, social events you had to miss, and the emotional toll it’s all taking on you.

- Statements from Others: Ask friends, family members, or even co-workers to write down what they’ve observed. How have you changed since the injury? Their outside perspective provides powerful, third-party validation of your struggles.

Evidence Checklist for Your Personal Injury Claim

To help you stay organized, we’ve put together a practical checklist. Use this to ensure you’re gathering the essential documents needed to build a robust claim for both your financial and personal losses.

| Type of Damage | Essential Evidence to Collect |

|---|---|

| Pecuniary | Pay stubs, T4s, and a letter from your employer (for income loss). |

| Receipts for all medical treatments (physiotherapy, chiropractic, massage, etc.). | |

| Pharmacy receipts for prescriptions and medical supplies. | |

| Invoices for assistive devices (crutches, braces, etc.). | |

| Receipts for housekeeping, caregiving, or home maintenance help. | |

| Parking and mileage logs for all medical-related travel. | |

| Invoices for any home or vehicle modifications. | |

| Non-Pecuniary | A daily or weekly pain journal detailing your physical and emotional state. |

| Photos or videos showing your injuries and recovery process. | |

| Written statements from family, friends, and colleagues about your life changes. | |

| A list of hobbies and activities you can no longer participate in. | |

| Comprehensive medical reports from all treating physicians and specialists. | |

| Records from psychologists or counsellors detailing the mental health impact. |

This list isn’t exhaustive, but it’s a strong starting point. The more thorough you are, the less room there is for the insurance company to downplay the true impact of your injuries.

Understanding legal precedents can also bolster your case, which is where effective legal research strategies come in. At UL Lawyers, we guide our clients through this entire evidence-gathering process, ensuring every detail is captured. Our goal is to build the strongest possible foundation to secure the full and fair compensation you rightfully deserve.

Why Expert Legal Guidance Isn’t Optional

Trying to navigate Ontario’s personal injury system alone is a gamble, and the stakes are incredibly high. As we’ve seen, the rules around pecuniary and non-pecuniary damages are a minefield of complexity, filled with strict caps, confusing motor vehicle accident deductibles, and tricky calculations for future losses. This is not a place for guesswork.

An experienced personal injury lawyer does a lot more than just fill out forms. Think of them as your strategist and your staunchest advocate, protecting you from insurance company tactics that are designed to pay you as little as possible. Their know-how is absolutely essential to building a solid, evidence-based case that can’t be easily dismissed.

Securing the Full and Fair Compensation You Deserve

A dedicated legal team works to make sure that every dollar of your financial loss and every moment of your suffering is properly documented and argued for. Here’s how they make that happen:

- Bringing in the Right Experts: A good lawyer has a trusted network of specialists—medical experts, vocational assessors, and economists—who can provide the authoritative reports needed to prove the true cost of your future care and lost income.

- Telling Your Story: They take the raw facts of your pain and struggle and shape them into a powerful legal narrative. This ensures the real human cost of your injury isn’t lost in a sea of legal jargon.

- Levelling the Playing Field: Insurance companies have deep pockets and teams of lawyers. Having your own expert counsel puts you on equal footing, shielding you from lowball offers and procedural traps. To see just how crucial this is, learn more about how a lawyer for an insurance claim becomes your most important ally.

The true value of a personal injury lawyer lies in their ability to see around corners—to anticipate legal challenges and build a case that is strong enough to withstand intense scrutiny. They manage the legal battle so you can focus on the one thing that truly matters: your recovery.

Hiring an expert isn’t just another cost; it’s an investment in your well-being and your future. From our offices in Burlington, we help clients across the GTA and throughout Ontario get the full and fair compensation they rightfully deserve.

Common Questions About Injury Compensation in Ontario

After an accident, the path forward can feel overwhelming and filled with uncertainty. It’s only natural to have a lot of questions. Getting clear, straightforward answers about your rights is the first step toward getting the compensation you deserve for all your losses—both the financial ones (pecuniary damages) and the personal ones (non-pecuniary damages).

Here are some of the most common questions we hear from our clients across Ontario.

Is There a Limit on How Much I Can Claim for Lost Income?

No, there isn’t a legal cap on how much you can claim for lost income, either for time you’ve already missed or for what you’ll miss in the future. Your claim is meant to reflect the actual money you’ve lost because of the injury.

This figure is built on solid evidence: your past pay stubs, your career path before the accident, and detailed reports from vocational and economic experts. It’s a key difference from pain and suffering damages, which do have a cap set by the Supreme Court of Canada. Your income loss claim, on the other hand, is specifically tailored to your individual financial situation and has no theoretical limit.

How Long Do I Have to File a Personal Injury Lawsuit in Ontario?

The clock starts ticking right away. In Ontario, you generally have two years to file a personal injury lawsuit, according to the Limitations Act.

This two-year period usually begins on the day of the accident. However, in some cases where an injury isn’t obvious right away, the “discoverability” principle might apply, starting the clock later. But there are very few exceptions. Missing this deadline is catastrophic for your case—you lose your right to sue forever. That’s why it is absolutely critical to speak with a lawyer as soon as you can.

Can My Family Members Also Receive Compensation?

Yes, they can. This is a crucial, and often overlooked, part of a personal injury claim. Under Ontario’s Family Law Act, certain family members who have also suffered because of your injury can file their own claims.

These family members typically include your spouse, children, grandchildren, parents, and siblings. Their claims can cover very real losses, such as:

- The loss of care, guidance, and support you used to provide.

- The loss of companionship.

- Out-of-pocket expenses they paid for things like hospital parking or helping care for you.

For car accident cases, it’s worth noting that these family law claims for non-pecuniary loss are also subject to a statutory deductible, though it’s less than the one applied to your own claim.

Contributory negligence is a critical factor in any personal injury claim. Even if the other party was mostly at fault, any responsibility assigned to you will directly reduce your final compensation. An experienced lawyer’s role is to minimize this reduction by presenting evidence that clearly establishes the other party’s liability.

What If My Own Actions Contributed to the Accident?

This is a very common scenario, legally known as contributory negligence. If a court decides you were partially at fault for the accident or your injuries, your total compensation award will be reduced by your percentage of blame.

Let’s say you’re awarded $200,000 in damages, but the court finds you were 25% responsible (maybe you were speeding slightly). Your final payout would be cut by 25%, so you would receive $150,000. Insurance companies will almost always try to shift as much blame as they can onto the injured person to lower what they have to pay. This is one of the most important battlegrounds where having a skilled lawyer makes all the difference.

The legal landscape in Ontario is complex. From correctly calculating pecuniary and non-pecuniary damages to fighting back against claims of contributory negligence, getting expert guidance isn’t just helpful—it’s essential.

At UL Lawyers, we represent clients in Burlington, the GTA, and across Ontario. We make sure you have a dedicated advocate fighting for the full compensation you are entitled to. Contact us for a free consultation to talk about your case.

Related Resources

The Essential Guide to the Law About Car Accidents in Ontario

Continue reading The Essential Guide to the Law About Car Accidents in OntarioToronto Car Accident Lawyer: Your Guide to Winning a Claim

Continue reading Toronto Car Accident Lawyer: Your Guide to Winning a ClaimNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies