Prenuptial Agreement Canada: Essential Guide to Asset Protection

In Canada, a prenuptial agreement is a legal contract a couple signs before getting married, spelling out how their assets and debts will be handled if the relationship ends. In provinces like Ontario, you’ll often hear it called a marriage contract, but the purpose is the same: it’s a financial planning tool that gives both partners clarity and security.

What a Canadian Prenuptial Agreement is Really About

It’s time we changed how we think about prenuptial agreements. Forget the old cliché that they’re a plan for divorce. A prenup in Canada is much better thought of as a financial roadmap for your life together. It’s a sign of maturity and open communication, letting you and your partner make big decisions with cool heads and mutual respect.

This document is governed by provincial laws, like Ontario’s Family Law Act. It gives you the power to create your own rules for things like property division and spousal support, rather than having the default provincial laws automatically applied if you separate.

Moving Past the Stigma

The old stigma around prenups is definitely fading. More and more Canadian couples see them as a smart, practical step. This is especially true if one or both partners are coming into the marriage with their own assets, a business, or even significant debt like student loans.

A well-crafted agreement encourages transparency right from the start. Laying all your financial cards on the table builds a solid foundation of trust. It ensures you’re both on the same page about your financial future—both as a couple and, in the unlikely event you go your separate ways, as individuals.

A prenuptial agreement isn’t about planning to fail; it’s about building a partnership with a shared understanding of financial responsibilities and expectations. It transforms abstract worries into a concrete, mutually agreed-upon plan.

What Does a Marriage Contract Actually Do?

At its core, a marriage contract is a tool for certainty and control. It helps you take charge of your financial life, which is a huge benefit for couples from all walks of life.

Here’s what a prenuptial agreement typically aims to do:

- Protect Pre-Marital Assets: It can shield property, investments, or a business that one partner owned before the wedding.

- Define Matrimonial Property: You can clearly spell out how any assets or wealth you build during the marriage will be divided.

- Clarify Debt Responsibility: The agreement can ensure you aren’t on the hook for your partner’s pre-existing or future personal debts.

- Outline Spousal Support: You can set the terms for spousal support—the amount, how long it’s paid—or even agree to waive it completely.

It’s worth noting that a similar agreement exists for unmarried couples living together. If you’re curious about that, you can find out more by reading our guide on what is common law marriage in Canada. By tackling these financial conversations head-on, you’re taking a responsible step to secure your future.

Why Modern Canadian Couples Are Choosing Prenups

Let’s get one thing straight: getting a prenuptial agreement in Canada isn’t about planning for failure. It’s about building a marriage on a foundation of transparency and mutual respect. Today’s couples, especially across Ontario and the GTA, are practical. They recognize that modern relationships often start with complex financial histories, and they’d rather talk about it upfront.

Think about it. One partner might be a business owner in Burlington, while the other is building a career in Toronto. One could be sitting on a family inheritance, while the other is managing student loan debt. A marriage contract takes these real-world scenarios and creates a clear, agreed-upon plan. It’s not a sign of weak commitment; it’s a testament to a strong one, where both people enter the marriage with their eyes wide open.

Protecting Individual Assets and Businesses

A major reason couples opt for a prenup is to protect assets they’ve acquired before the wedding bells ring. Let’s say you’ve spent the last decade pouring your heart and soul into building a business in Burlington. Without a prenup, the increase in your company’s value during the marriage is typically considered family property, meaning it could be split if you separate.

A marriage contract can draw a clear line in the sand, defining your business as a separate asset. This ensures your hard work and risk-taking remain yours. The same logic applies to other important assets:

- Family Inheritance: A prenup can safeguard any inheritance you expect to receive, ensuring it stays within your family line or is reserved for your children.

- Real Estate: If you owned a house or condo before getting married, the agreement can specify exactly how that property will be treated.

- Investments and Savings: It can protect the RRSPs, TFSAs, or investment portfolios you diligently built up before you even met your partner.

Shielding a Partner from Debt

A prenup is a two-way street. Just as it protects assets, it can also shield you from your partner’s pre-existing debts. If your fiancé has significant student loans or business liabilities, a marriage contract can state that you won’t be on the hook for those debts if the marriage ends.

This creates a financial firewall. It gives both of you peace of mind and allows for genuine financial independence within the partnership, preventing one person’s past from derailing the other’s future.

Addressing Second Marriages and Blended Families

When couples are entering a second marriage, especially when children from previous relationships are in the picture, a prenuptial agreement in Canada becomes almost non-negotiable. The number one concern is often protecting the inheritance you intend to leave for your kids. A prenup ensures the assets you’ve earmarked for them aren’t unintentionally divided in a divorce.

A prenuptial agreement allows couples to create a customized financial plan that honours both their commitment to each other and their obligations to their children from prior relationships, preventing potential conflicts down the road.

This clarity is also crucial for your estate plan, making sure your will can be carried out exactly as you intended. For a deeper dive into this, our estate planning checklist for Canada is a great place to start.

This practical approach to marriage is becoming the new normal. Canadian surveys have shown a significant shift in attitudes, with a growing number of younger Canadians viewing prenups as a pragmatic financial tool. This points to a growing trend of financial pragmatism in relationships. To fully grasp the reasons, it helps to understand the financial impacts of major life changes like marriage and divorce.

What Goes Into an Enforceable Ontario Prenup?

When you’re drafting a prenuptial agreement in Ontario, it’s not a blank canvas. The law sets clear boundaries around what you and your partner can agree on. Think of it like a custom-built home: you get to choose the layout, the finishes, and the style, but you still have to follow the provincial building code to ensure the structure is safe and sound.

A prenup that a court will actually uphold—what we call an enforceable agreement—needs to be built on a foundation of fairness, full transparency, and the specific rules laid out in Ontario’s Family Law Act.

What Your Agreement Can Cover

A well-crafted Ontario prenup gives you the power to design your own financial road map for your marriage. It allows you to opt out of the default property and support rules that would otherwise apply if your relationship ends.

Here are the key areas you can take control of:

- Property Division: This is a big one. You can decide exactly how assets and debts—both those you bring into the marriage and those you acquire together—will be handled. It’s your chance to step outside of Ontario’s standard “equalization of net family property” system. You could, for instance, protect a family business, an inheritance, or specific investments from being divided.

- Spousal Support: You can define the rules for spousal support ahead of time. This might mean setting an amount, defining how long it would be paid, or even agreeing to waive it entirely. This provides huge peace of mind and can help avoid a long, expensive court fight later on.

- Financial Management During the Marriage: A prenup isn’t just about separation. It can also lay out how you’ll manage money as a couple. This could cover everything from how you’ll use joint accounts and pay household bills to who is responsible for specific debts.

- The Matrimonial Home: The family home gets special treatment under the law, but you still have some say. A prenup can set out a plan, like giving one partner the first option to buy out the other’s share at fair market value if you separate.

What’s Off the Table?

Knowing what you can’t include is just as critical. Ontario law is crystal clear on one thing: the best interests of children are paramount. That means you can’t make binding decisions about your kids’ futures years in advance.

Under the Family Law Act, any clause in a marriage contract that tries to limit a spouse’s rights to the matrimonial home is unenforceable. In the same way, all decisions about children are made based on their best interests at the time of separation, not what an agreement said years before.

This brings us to the non-negotiables. You simply cannot use a prenuptial agreement to decide:

- Decision-Making Responsibility or Parenting Time: A judge will always decide parenting time and decision-making responsibility (what used to be called custody and access) based on what’s best for the child at the time you separate. An old agreement won’t override that.

- Child Support: This is a fundamental right that belongs to the child, not the parents. You can’t waive child support or lock in a specific amount in a prenup. The amount will always be calculated using the Federal Child Support Guidelines.

- Possession of the Matrimonial Home: You cannot sign away your right to live in the home after a split. Both spouses have an equal right to stay in the matrimonial home until a court says otherwise or you both agree on what to do with it.

For a deeper dive into the specifics, our Ontario prenuptial agreement guide covers these legal nuances in more detail.

The Formalities: Getting it Right

Beyond the substance of your agreement, there are strict procedural rules you have to follow. Miss one of these, and a judge could throw the whole document out.

The three absolute must-haves are:

- It must be in writing. A handshake or verbal promise won’t cut it.

- It must be signed by both of you.

- Your signatures must be witnessed. Someone needs to physically watch each of you sign and then add their own signature as a witness.

To make this even clearer, we’ve put together a simple table outlining what’s allowed and what’s not.

What Your Ontario Prenuptial Agreement Can Cover

This table gives you a quick snapshot of what topics you can legally include in your prenup versus those that are strictly prohibited by law.

| Permitted Clauses | Prohibited Clauses |

|---|---|

| How to divide assets like businesses, investments, and pensions. | Pre-determining decision-making responsibility or parenting time arrangements. |

| Rules for spousal support, including amount, duration, or a full waiver. | Setting, limiting, or waiving child support obligations. |

| How to handle increases in the value of pre-matrimonial property. | Limiting a spouse’s right to possession of the matrimonial home. |

| Responsibility for debts, both those brought into the marriage and those acquired during it. | Including clauses that are unconscionable or grossly unfair to one party. |

| Agreements regarding ownership of specific items, like art or family heirlooms. | Any provision that encourages the neglect of a child. |

At the end of the day, an enforceable prenup is one that’s fair, transparent, and legally sound. It’s a tool that respects your ability to make your own choices while honouring the core protections built into our family law system.

How to Create Your Agreement: A Step-by-Step Guide

Drafting a prenuptial agreement (or a marriage contract, as it’s called in Ontario) isn’t something you just sit down and do in an afternoon. It’s a thoughtful process. Think of it as a journey you and your partner take together to build a clear and solid financial foundation for your life ahead.

Following the right steps is crucial. It ensures your agreement is fair, legally sound, and will actually stand up in court if it’s ever needed.

The real work starts long before any lawyers are involved. It begins with a conversation. This is where you need to learn how to communicate better in relationships, because this first step is all about transparency and mutual understanding, not about winning a negotiation.

Start the Conversation Early

Timing is everything. You should ideally start talking about a prenup several months before your wedding. Kicking off the discussion early takes the pressure off. If you leave it to the last minute, a court could see the looming wedding date as a form of duress, which could put the entire agreement at risk.

An early start gives you both breathing room to think clearly, pull together all the necessary information, and find the right legal professionals without feeling rushed. Honestly, it’s a healthy exercise for any couple, giving you a chance to get on the same page about your financial goals and future expectations.

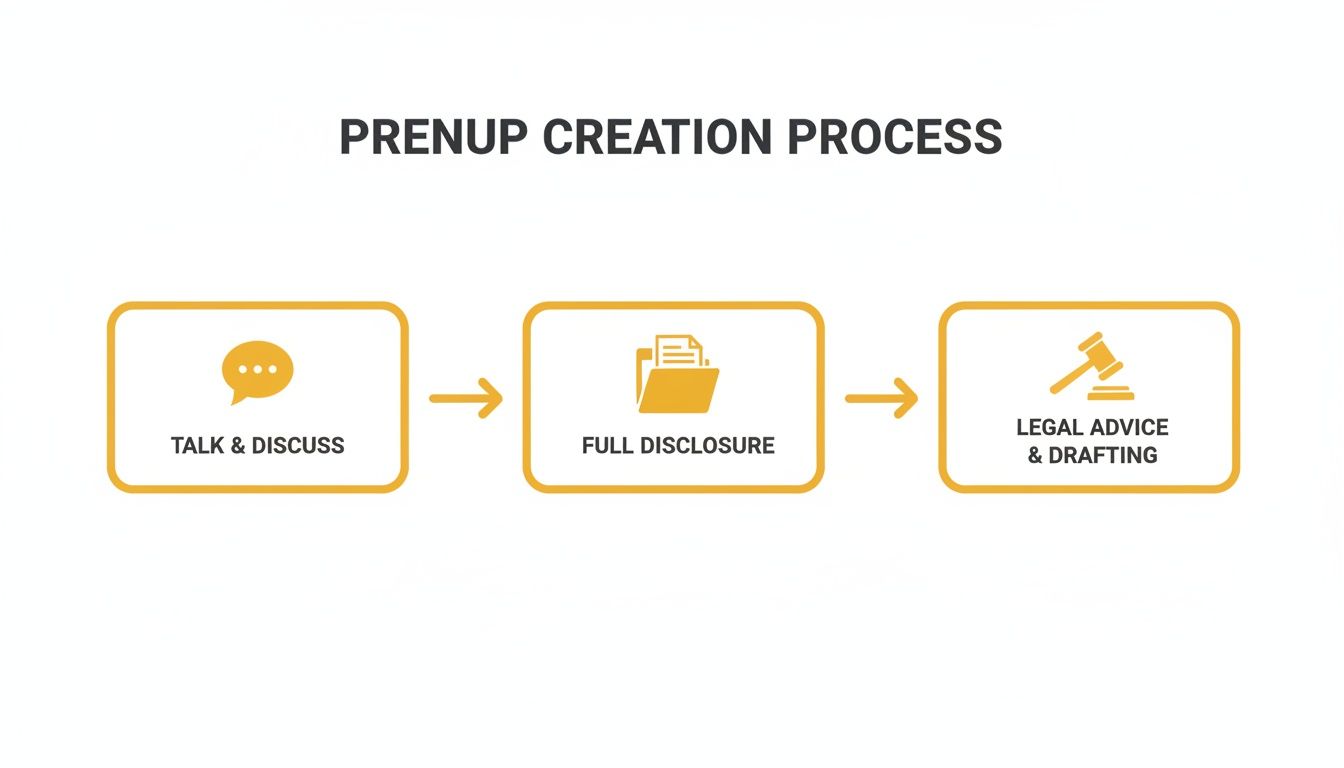

The infographic below breaks down the essential stages of the process.

As you can see, it all boils down to communication, transparency, and professional guidance. These are the three pillars of a strong, enforceable agreement.

The Critical Role of Full Financial Disclosure

Once you’ve both agreed to create a prenup, the next step is full and honest financial disclosure. This is the non-negotiable cornerstone of any valid agreement in Ontario. It means both of you lay all your financial cards on the table.

You’ll need to list everything you own and everything you owe. Simple as that.

- Assets: This includes cash in the bank, investments like RRSPs and TFSAs, any real estate, vehicles, business shares, and even valuable personal items.

- Debts: This covers mortgages, student loans, credit card balances, lines of credit, and any business liabilities.

Trying to hide an asset or misrepresent a debt is a surefire way to have a court toss out your agreement later on. Transparency isn’t just a nice-to-have; it’s a legal requirement that proves you both acted in good faith.

Full financial disclosure ensures that both partners are making informed decisions. Without knowing the complete financial picture, it’s impossible to create an agreement that is fair and equitable—the primary test an Ontario court will apply.

Why Independent Legal Advice Is Essential

After you’ve shared your financials, you’ve reached the most critical step: each of you must get Independent Legal Advice (ILA). This means you each hire your own family lawyer to go over the draft agreement and explain what it means for you, personally. One lawyer simply cannot advise both of you; it’s a clear conflict of interest.

ILA is so important for a few key reasons:

- Ensures Understanding: Your lawyer makes sure you genuinely understand what you’re signing, including the rights you might be gaining or giving up.

- Protects Against Pressure: It acts as a crucial safeguard, proving that neither of you felt pressured or forced to sign something you weren’t comfortable with.

- Strengthens Enforceability: When a prenup is challenged in court, one of the very first things a judge will check is whether both people had ILA. If you did, your agreement is far more likely to be upheld.

This need for professional guidance is exactly why grabbing a generic template online for a prenuptial agreement in Canada is such a massive risk. Those one-size-fits-all documents rarely meet the specific legal standards of Ontario’s Family Law Act and can be challenged and overturned surprisingly easily. The same logic applies to other major life-planning documents, like a will. For more on that, check out our guide on how to make a will in Ontario.

The good news is that attitudes are changing. Today, a significant percentage of Canadians view prenups in a positive light, seeing them as a pragmatic financial tool. This cultural shift is backed by laws like Ontario’s Family Law Act, which is designed to uphold fair agreements built on full disclosure and independent legal advice.

Common Myths About Canadian Prenuptial Agreements

Prenuptial agreements come with a lot of baggage. Thanks to movies and pop culture, they’re often wrapped up in persistent myths that can make even bringing them up feel like a relationship-killer. These old ideas often paint prenups as a pessimistic tool for the super-rich or a sure sign that the marriage is already on shaky ground.

Let’s clear the air and bust some of the most common myths about prenuptial agreements in Canada. The reality is that these agreements are just practical financial planning tools for everyday people. Whether you own a small business in Burlington, have a pension you’ve been building for years, or just want to start your marriage with financial clarity, a prenup can offer incredible peace of mind.

Myth 1: Prenups Are Only for the Rich

This is probably the biggest myth of them all. The truth is, a prenup is a smart move for anyone entering a marriage with their own assets, debts, or simply a desire for a clear financial roadmap. It’s not about how much money you have; it’s about planning responsibly for the future.

Think about these everyday situations where a prenup is incredibly useful for couples across the GTA and Ontario:

- Protecting a small business: You’ve poured your heart and soul into your startup and want to make sure it’s protected as your separate property.

- Managing debt: One of you is bringing significant student loans into the marriage, and you both agree the other shouldn’t be on the hook for that debt if you separate.

- Safeguarding a future inheritance: You expect to receive a family inheritance someday and want to keep it separate to pass on to your own children.

- Clarifying pension division: You’ve built up a sizable pension and want to define exactly how it would be handled in a separation.

Myth 2: Getting a Prenup Means You Expect to Divorce

This myth treats a practical conversation like a vote of no confidence in the relationship. A much healthier way to look at it is as an act of mutual respect and proactive planning. You buy house insurance not because you expect a fire, but to have a safety net just in case. A prenup works the same way for your financial life together.

A prenuptial agreement isn’t a prediction of failure; it’s a blueprint for financial fairness. It shows you’re both mature enough to talk about tough subjects and plan for your shared life with honesty and clarity.

In Canada, prenups are still quite uncommon. Legal experts estimate that only 5% to 10% of marrying couples sign one. A big part of the reason is what researchers call “false optimism”—that deep-seated belief that bad things happen to other people, not us. This can make broaching the topic feel like you’re waving a red flag. You can find more insights on this trend and why it’s so persistent over at Separation.ca.

Myth 3: A Prenup Is an Unbreakable Contract

While a well-drafted prenup is a very strong legal document, it’s not invincible. A Canadian court, especially here in Ontario, can and will set aside an agreement (or just certain parts of it) if it’s found to be fundamentally unfair or was signed under the wrong circumstances.

A court might step in and disregard a prenup if:

- There was duress or coercion: One person was pressured or forced into signing, particularly if the document was sprung on them just days before the wedding.

- Financial disclosure was incomplete: A partner hid assets or wasn’t honest about their financial situation, which means the other person couldn’t make a fully informed decision.

- The agreement is grossly unfair: The terms are so lopsided they’re considered “unconscionable,” leaving one person in severe financial hardship while the other is not.

- There was no independent legal advice: At least one of the partners didn’t have their own lawyer review the document and explain their rights and obligations.

This is exactly why getting professional legal advice isn’t just a good idea—it’s essential. An experienced family lawyer makes sure the agreement is fair, transparent, and created by the book, giving it the strongest possible chance of holding up if it’s ever needed.

How a Family Lawyer Can Secure Your Future

Trying to draft a prenuptial agreement in Canada on your own is a risky move. While it’s tempting to grab a template from the internet, these generic documents rarely hold up in court. They simply don’t account for the specific, strict requirements of Ontario’s Family Law Act, which can leave your agreement wide open to being challenged and thrown out later.

This is exactly why having an experienced family lawyer in your corner isn’t just a good idea—it’s essential.

Beyond Drafting The Document

A good family lawyer does more than just fill in the blanks on a form. We’re here to offer strategic advice that’s custom-fit to your financial picture and what you both want for the future. We make sure your agreement rests on the unshakable foundations of enforceability: full financial disclosure and independent legal advice for both you and your partner.

Think of us as both a facilitator and a protector. We guide you and your partner through what can sometimes be tricky conversations, helping turn a potentially awkward task into a constructive dialogue built on mutual respect. Our job is to safeguard your interests while keeping your relationship strong.

A family lawyer’s role is to translate your mutual understanding into a legally sound document that provides genuine security. They anticipate potential challenges and craft clauses that are clear, fair, and designed to stand the test of time.

At UL Lawyers, we take a client-focused approach, guiding couples across the GTA and Ontario with compassion and clarity. We make sure every “i” is dotted and every “t” is crossed so your marriage contract truly delivers peace of mind.

This kind of forward-thinking legal planning is just as important for other areas of your life, too. You can learn more about protecting your legacy from our trusted estate planning lawyers near me.

When you invest in professional legal advice, you’re doing more than just signing a contract. You’re building a secure foundation for the future you’re creating together—one based on transparency, fairness, and a clear understanding of your financial lives.

A Few Common Questions About Ontario Prenups

When you’re thinking about a prenuptial agreement, it’s natural to have a lot of practical questions. Let’s walk through some of the most common ones we hear from our clients here in Burlington and across Ontario to give you a clearer picture.

How Much Does a Prenuptial Agreement Cost in Ontario?

There’s no single price tag for a prenup; the cost really depends on how complex your financial life is. For a couple with straightforward assets, you might be looking at a few thousand dollars. It’s a relatively simple process.

But if your finances involve more moving parts—think business ownership, family trusts, or a diverse investment portfolio—the cost will naturally be higher. That’s because more time goes into the financial disclosure, back-and-forth negotiations, and the actual drafting of the agreement. A critical part of the process is that each of you needs your own lawyer for Independent Legal Advice (ILA). While it’s an upfront cost, think of it as an investment in your future clarity. It’s almost always a fraction of the cost of a messy, contested separation down the road.

What Happens Without a Prenup in Ontario?

If you get married without a prenup, you’re essentially opting into the default rules set out by Ontario’s Family Law Act. The cornerstone of this law is the “equalization of net family property.”

In simple terms, this means almost all the wealth you and your spouse build during the marriage gets split down the middle if you separate. The law calculates the growth in each person’s net worth, and the spouse with more has to pay the other to even things out. The matrimonial home is a big exception—its entire value is shared, even if one person owned it before the wedding. On top of that, a judge would decide on spousal support based on a long list of legal factors, giving you very little say in the outcome.

Without a prenup, you’re letting the government’s standard-issue rules decide your financial fate. A marriage contract lets you and your partner write your own rules based on what you both agree is fair for your unique situation.

Can We Change a Prenup After Getting Married?

Absolutely. A prenup (which is called a marriage contract once you’re married) isn’t set in stone. In fact, we often recommend that couples review their agreement every few years or whenever a major life event happens.

What kind of events? Things like:

- Having or adopting children

- Starting a new business

- Receiving a significant inheritance

- A major shift in one person’s career or income

To update the agreement, you both have to be on board with the changes. The new version has to follow the same legal steps as the original: it needs to be in writing, signed by both of you, and witnessed. And just as importantly, you should both get Independent Legal Advice on the revisions to ensure everything is still fair and enforceable.

Is a Cohabitation Agreement the Same as a Prenup?

A cohabitation agreement is basically a prenup for common-law partners. It’s a crucial distinction because, in Ontario, common-law couples don’t get the same automatic property rights as married couples under the Family Law Act.

Without an agreement, what you bring into the relationship or acquire during it generally remains your own. A cohabitation agreement lets you create your own playbook for dividing property and handling spousal support if you ever separate, providing certainty where the law doesn’t. A smart move is to include a clause that automatically converts the cohabitation agreement into a binding marriage contract if you decide to get married later on.

Navigating the complexities of a prenuptial agreement requires clear, professional guidance to ensure your future is protected. At UL Lawyers, we provide expert legal advice to couples across Ontario, helping you create a fair and enforceable agreement with compassion and clarity. Contact us today for a consultation.

Related Resources

How to Incorporate a Business in Ontario: A Founder's Guide

Continue reading How to Incorporate a Business in Ontario: A Founder's GuideYour Guide to a Prenuptial Agreement in Ontario

Continue reading Your Guide to a Prenuptial Agreement in OntarioNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies