Your Guide to a Prenuptial Agreement in Ontario

In Ontario, a prenuptial agreement is a legal document, officially called a marriage contract, that lets a couple set their own rules for things like property division and spousal support if the marriage ends. Think of it as a financial planning tool that gives you clarity and peace of mind before you say “I do.”

What a Prenup Really Means in Ontario

Let’s clear the air—a prenuptial agreement in Ontario isn’t just for the super-rich or for people who expect their marriage to fail. It’s better to see it not as a breakup plan, but as a transparent financial blueprint for your life together. It’s a smart, practical step for any couple ready to define their financial future on their own terms.

Without a marriage contract, the default rules in Ontario’s Family Law Act take over, dictating how your property is split and if spousal support gets paid. A prenup lets you and your partner craft an agreement that feels genuinely fair for your specific situation, instead of relying on a one-size-fits-all legal formula.

A Modern Tool for Financial Clarity

The stigma around prenups is fading. In fact, a striking number of Canadians now view these agreements as a smart and practical step, showing a real cultural shift toward financial pragmatism before marriage. Family lawyers across Ontario are seeing this firsthand, with more and more young couples wanting to start their life together with total transparency.

The process itself encourages—and frankly, forces—honest conversations about money right from the start. When you openly discuss assets, debts, and financial goals, you’re not just signing a document; you’re building a stronger foundation for your partnership based on mutual respect and understanding.

To get a handle on what an Ontario marriage contract can and cannot do, here’s a quick summary.

Key Aspects of an Ontario Marriage Contract

| Area Covered | What It Can Do | What It Cannot Do |

|---|---|---|

| Property Division | Define how property owned before and acquired during the marriage is divided upon separation. | Violate the principle of equal division of the matrimonial home’s value. |

| Spousal Support | Set terms for spousal support, including amount, duration, or waive it entirely. | Make decisions about child custody or child support. |

| Debt Responsibility | Clarify who is responsible for debts each person brings into the marriage. | Set terms that are unconscionable or grossly unfair to one party. |

| Inheritances | Protect future inheritances or gifts from being shared upon separation. | Be enforced if one party did not provide full financial disclosure. |

Ultimately, a well-crafted agreement gives you control over your financial future.

Defining Your Financial Partnership

A prenuptial agreement empowers you to make critical decisions ahead of time. It provides a structured way to sort out important financial matters, ensuring both of you are on the same page long before any issues could arise. This kind of proactive planning is invaluable for preventing future conflicts and avoiding costly legal battles down the road.

A well-drafted marriage contract is about setting expectations and protecting both individuals. It’s a document of financial respect, clarifying intentions and providing certainty so you can focus on building your life together without ambiguity.

Consider it a foundational document for your shared life. Here’s a look at what it typically covers:

- Protecting Pre-Marital Assets: It can ensure that property, investments, or savings you bring into the marriage remain yours if you separate.

- Clarifying Debt Responsibility: The agreement can specify who is responsible for any debts that each partner brings into the marriage.

- Guiding Future Property Division: You can decide how assets accumulated during the marriage, like a house or investments, will be divided. This is quite different from the rules for unmarried couples, which you can learn more about by reading our article on what constitutes a common-law marriage in Canada.

- Addressing Spousal Support: It allows you to agree on the terms of spousal support—whether it will be paid, how much, and for how long.

Making Your Prenup Legally Bulletproof

Drafting a prenuptial agreement in Ontario isn’t just a casual conversation about “what-ifs.” It’s a formal legal process. For your agreement to have any real teeth and actually hold up in court, it has to meet the specific requirements laid out in Ontario’s Family Law Act.

Think of these rules less as hurdles and more as built-in safeguards. They’re there to make sure the final document is fair, transparent, and legally sound for both of you. A handshake deal or a verbal promise simply won’t cut it. The entire foundation of an enforceable prenup is that it’s a physical document, leaving no room for “he said, she said” arguments down the road.

The Essential Legal Formalities

To be considered valid, every single prenup must meet a few non-negotiable conditions. These steps are designed to ensure both partners are entering the agreement with their eyes wide open and without any undue pressure.

Here are the three core requirements:

- It must be in writing. An oral agreement about property or spousal support has no legal weight in this context.

- It must be signed by both partners. This is your formal consent to every clause within the document.

- The signatures must be witnessed. A third party needs to watch each of you sign and then add their own signature.

These are the bare bones of a valid contract. But to make your agreement truly “bulletproof” against future legal challenges, two other elements are arguably even more important.

Full and Honest Financial Disclosure

Transparency is the cornerstone of a fair prenup. This means both you and your partner must provide full and honest financial disclosure, laying all your cards on the table—every asset, every debt, and all sources of income.

If one person tries to hide an asset or deliberately undervalues their net worth, it gives the other person a powerful reason to ask a court to throw the entire agreement out later on. It’s like building a house on a shaky foundation; if the financial information is wrong, the whole structure is compromised.

The Critical Role of Independent Legal Advice

While it’s not technically mandatory in every single situation, getting Independent Legal Advice (ILA) is the single most important step you can take to protect your prenup. ILA means each of you hires your own lawyer to review the draft agreement. That lawyer’s job is to explain what it all means, make sure you understand the rights you’re giving up, and confirm you’re signing it voluntarily.

When both parties have their own legal counsel, it becomes extremely difficult for one person to later claim they were pressured, coerced, or didn’t comprehend what they were signing. ILA acts as a powerful shield against such arguments.

In Ontario, these agreements are legally called marriage contracts under the Family Law Act. Courts will generally enforce them as long as they meet the formal requirements—in writing, signed, and witnessed—and the process was fair. This fairness is where full financial disclosure and ILA become so crucial. It’s important to remember, though, that a prenup can’t dictate child custody or access, as the court always prioritizes the child’s best interests.

Ultimately, a judge wants to see that the process was fair from start to finish. Getting separate legal advice is the best way to demonstrate that fairness. We explore this topic more deeply in our comprehensive guide on prenuptial agreements in Canada. Taking these steps carefully is what transforms your agreement from a simple piece of paper into a powerful, legally binding contract.

What Goes Into a Prenuptial Agreement?

Think of a prenuptial agreement as the financial blueprint for your marriage. It’s not some generic, off-the-shelf document; it’s a deeply personal contract you and your partner build together, reflecting your unique circumstances and goals. This is where you get down to the nitty-gritty, moving from the general idea of a “prenup” to the specific clauses that will shape your financial lives.

The main goal is to decide ahead of time what happens to property and finances if you ever separate. By having these conversations now, while you’re on the same team, you can make clear, rational decisions. This simple act of planning can prevent a world of conflict and confusion down the road.

Protecting Your Individual Property

One of the biggest reasons couples in Ontario opt for a prenup is to protect assets they’re bringing into the marriage. It’s a way of saying, “what was mine before we got married will stay mine if we ever part ways.” Simple as that.

Your agreement can get very specific about how these pre-marital assets are handled. This often includes things like:

- Real Estate: A house, condo, or cottage you owned before the wedding.

- Investments: Stocks, bonds, RRSPs, or other investment portfolios.

- Business Interests: Your shares in a company or a business you started from the ground up.

- Personal Savings: Money you had in the bank before saying “I do.”

Without a prenup, any increase in the value of these assets during your marriage could be split. Your agreement can make it crystal clear that both the original asset and any growth it sees will remain your own separate property.

A prenup is also fantastic for safeguarding future assets. You can add a clause that ensures any inheritance or large gifts you receive from your family during the marriage won’t be considered family property to be divided.

A well-crafted prenuptial agreement acts like a financial firewall. It preserves specific assets for you, ensuring that family wealth, inheritances, or property you owned before marriage are handled exactly as you intend—not according to a one-size-fits-all legal formula.

Defining Marital Property and Debts

Beyond protecting what’s yours, a prenup needs to set the rules for property you acquire during the marriage. You don’t have to stick with Ontario’s default rules. Instead, you can create your own system that makes sense for your relationship.

For example, you might agree that anything earned or bought during the marriage will be kept in separate names and treated as separate property. Or, you could decide on a specific percentage split for assets you own jointly.

Tackling debt is just as critical. A prenup can state that each of you is solely responsible for the debts you bring into the marriage, as well as any you take on in your own name while married. This protects you from being on the hook for your partner’s pre-existing student loans or credit card debt if you separate.

The Matrimonial Home: A Special Case

In Ontario, the matrimonial home gets special treatment under the Family Law Act. This is a big one. Even if one of you owned the home long before the marriage, its full value is typically split down the middle if it was your primary family residence during the marriage.

A prenup can’t take away a spouse’s right to live in the matrimonial home. What it can do, however, is change the rules for how the home’s financial value is divided, giving you more control than the default 50/50 split. Planning for major assets like a home is a key part of overall property management, a topic we explore in our guide on the power of attorney for property.

What You Can’t Include

While a prenup gives you a lot of power, it’s not limitless. Ontario law is very clear: you cannot use a prenup to make decisions about children. Any clauses dealing with the kids will not be enforced by a court. Specifically, you cannot pre-determine:

- Child Custody or Parenting Time: A judge will always make these decisions based on the child’s best interests at the time of the separation, not based on an old agreement.

- Child Support: The amount of child support is calculated using federal guidelines. You can’t waive it or set your own amount in a prenup.

For couples who already have kids, a prenup might touch on a shared commitment to a parenting philosophy, perhaps even agreeing to explore co-parent counselling if challenges arise. But it’s crucial to understand these clauses are about intention, not legal obligation. They can’t legally bind future custody or support arrangements.

Mapping Out the Prenup Process and Costs

So, you’re thinking about a prenup. Where do you even begin? Getting a handle on the actual process—what it looks like day-to-day and what it costs—can take a lot of the mystery and stress out of it. It’s not just a single, intimidating meeting; it’s a series of well-defined steps meant to make sure both of you feel protected, informed, and genuinely comfortable with the final agreement.

If I could give just one piece of advice, it would be this: start early. Seriously. Trying to get a marriage contract signed a week before the wedding is a recipe for disaster. It creates enormous pressure and can even give one person a reason to challenge the agreement’s validity down the road. To avoid any whiff of duress or coercion, you should really kick off the conversation and get lawyers involved at least three to six months before your wedding day. This gives everyone enough breathing room for calm discussions, thoughtful negotiations, and proper reviews.

The Key Stages of Creating Your Prenup

The journey from your first conversation to a signed agreement follows a pretty clear path. Each stage builds on the one before it, ensuring everything is transparent and fair from start to finish.

-

Initial Consultations with Family Lawyers: The whole thing kicks off when each of you finds and meets with your own separate family lawyer. This is the cornerstone of getting what we call Independent Legal Advice (ILA). In that first meeting, you’ll talk about your finances, what you hope to achieve with the agreement, and get a crash course on your rights under Ontario’s Family Law Act.

-

Gathering and Sharing Financial Information: This is where you lay all your cards on the table. You and your partner will swap detailed financial information—everything from assets and debts to income. We’re talking bank statements, property assessments, investment portfolio summaries, and recent tax returns. Complete honesty here isn’t just a good idea; it’s essential for the agreement to hold up in court.

-

Drafting and Negotiating the Terms: Once all the numbers are out in the open, one of the lawyers will prepare the first draft of the prenup. That draft then goes to the other lawyer, who will review it line-by-line with their client. This is where the back-and-forth really begins, with lawyers proposing changes and refining clauses until both you and your partner are happy with the terms.

-

Final Review and Signing: When a final version is agreed upon, you’re in the home stretch. You’ll each have one last meeting with your lawyer to go over the document one more time. Once you both give the green light, you’ll sign the agreement with a witness present. Your lawyer will then sign a special document called a Certificate of Independent Legal Advice, confirming you understood what you were signing.

To help you visualize how this unfolds, here’s a typical timeline:

Prenup Process Timeline and Key Stages

The process of creating a prenuptial agreement is a structured journey. Below is a step-by-step breakdown of the typical stages and the recommended timing to ensure a smooth and stress-free experience.

| Stage | Description | Recommended Timing |

|---|---|---|

| Initial Discussions | You and your partner have an open conversation about wanting a prenup and your shared financial goals. | 6+ months before the wedding |

| Lawyer Selection | Each partner researches and retains their own independent family lawyer. | 5-6 months before the wedding |

| Financial Disclosure | Both partners gather and exchange complete financial documents (assets, debts, income). | 4-5 months before the wedding |

| Drafting & Negotiation | One lawyer drafts the agreement; the other reviews. Lawyers negotiate terms back and forth. | 2-4 months before the wedding |

| Finalization & Signing | The final agreement is reviewed and signed by both partners with their lawyers. | 1-2 months before the wedding |

Following a clear timeline like this one helps prevent last-minute scrambles and ensures the agreement is created thoughtfully and without undue pressure.

Understanding the Investment in Your Future

Naturally, one of the first questions people ask is: what does a prenup actually cost in Ontario? Think of it as an investment—you’re spending a bit now to protect your interests and provide clarity for the future.

The cost for a properly drafted, enforceable prenup can vary significantly. The final price tag really depends on how complex your financial picture is. For a couple with straightforward assets, the legal fees might only be a few thousand dollars. But if your situation involves multiple properties, business ownership, or complex investments, the cost will be higher because it simply takes more time for lawyers to draft, negotiate, and finalize everything.

Consider the cost of a prenuptial agreement not as an expense, but as an investment in financial certainty and relational peace of mind. The upfront cost is a small fraction of the potential legal fees and emotional turmoil of a contested separation.

This kind of proactive planning is a lot like other important life decisions. It’s about creating a clear, mutually-agreed-upon roadmap for your future, much like the steps you would take when figuring out how to make a will in Ontario. By tackling these big topics head-on, you build a stronger, more transparent foundation for your life together.

Common Prenup Mistakes and How to Avoid Them

Crafting a prenuptial agreement in Ontario is a smart, proactive move, but it’s a process that demands real attention to detail. It’s surprisingly easy for a small oversight to undermine the very document you’re creating for protection. The best defence is knowing the common pitfalls so you can build an agreement that’s fair, resilient, and will hold up if ever put to the test.

Even with the best of intentions, couples often stumble into a few key traps. These mistakes usually come from a lack of information, bad timing, or trying to cut corners on crucial legal steps. Let’s walk through what can go wrong so you can get it right.

Rushing the Process Last Minute

One of the most damaging things you can do is wait until the wedding is just around the corner to start the prenup process. An agreement signed under the pressure of an imminent wedding day is practically begging to be challenged later on. It opens the door for one person to argue they were pressured or coerced into signing it just to avoid the embarrassment of cancelling the event. Legally, this is known as signing under duress.

An Ontario court will absolutely look at the timing. If it looks like one partner was handed a complex legal document at the eleventh hour, a judge is far more likely to set the agreement aside. The solution couldn’t be simpler: start the process 3-6 months before your wedding date. This timeline removes any hint of pressure and gives everyone enough breathing room for thoughtful negotiation.

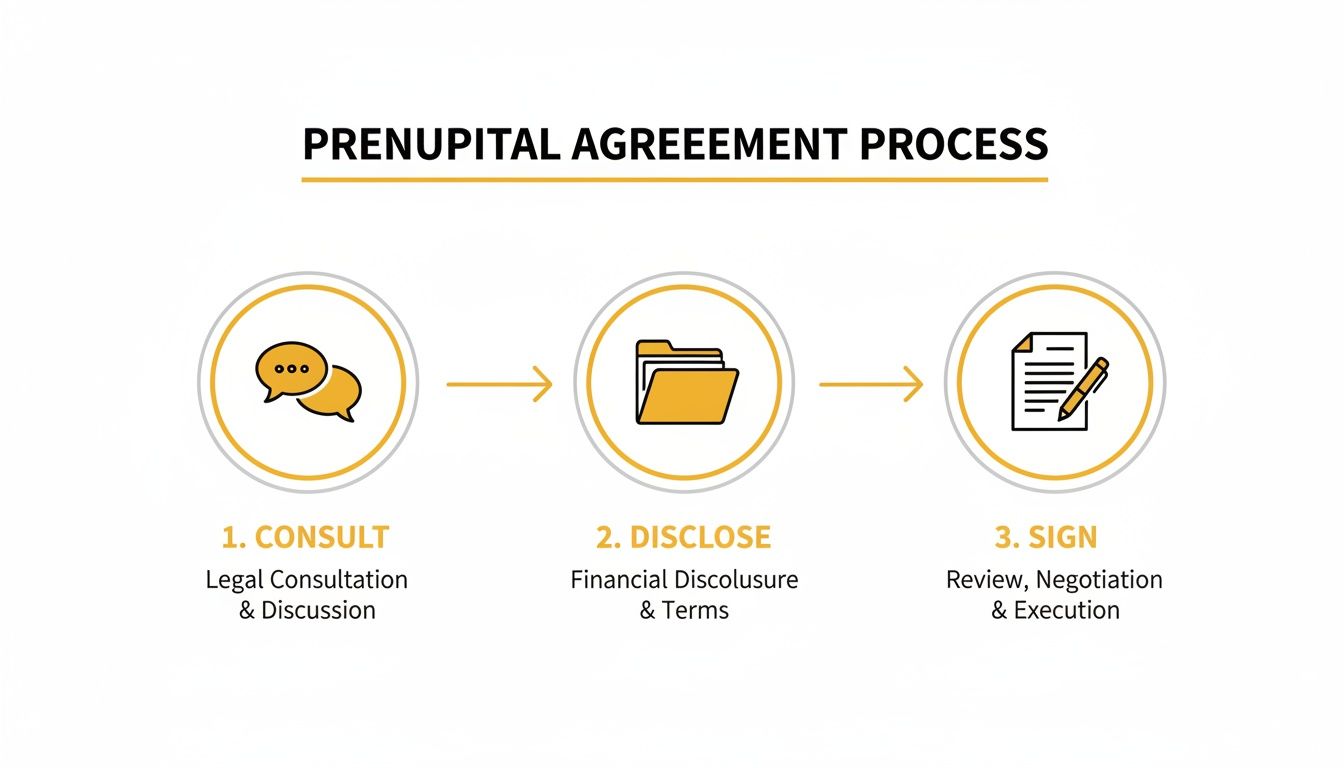

This infographic lays out the basic flow.

As you can see, proper consultation and full disclosure are the essential first steps that have to happen long before you get anywhere near signing.

Incomplete or Misleading Financial Disclosure

Think of financial disclosure as the foundation of your prenup. If that foundation is cracked, the whole structure will collapse. Hiding assets, understating your income, or conveniently “forgetting” to list debts can be a fatal flaw for your agreement’s validity. The entire process hinges on complete and total honesty from both of you.

If it comes out later that one person wasn’t truthful about their finances, a court can—and very likely will—throw out the entire contract. The only way to avoid this is with meticulous transparency.

- Gather everything: Get statements for all your bank accounts, investment portfolios, RRSPs, and any property you own.

- List all debts: This means mortgages, lines of credit, student loans, and credit card balances. No exceptions.

- Share income details: Provide recent tax returns and pay stubs to give a clear picture of your earnings.

This isn’t just about building trust as a couple; it’s a non-negotiable legal requirement for a fair agreement.

Using a Single Lawyer for Both Partners

It might seem efficient or less confrontational to use the same lawyer, but this is a critical mistake. One lawyer cannot ethically represent both of you when creating a marriage contract. Why? Because your interests, by definition, are separate. This situation creates a clear conflict of interest.

The only way to ensure the agreement is fair and enforceable is for each of you to have your own Independent Legal Advice (ILA). Your lawyer’s job is to protect your specific interests, explain what your rights are, and make sure you fully grasp what every single clause means for you. Having two separate lawyers is what shields the agreement from a future claim that one person was at a disadvantage. It’s an absolute must for a legally sound prenup in Ontario.

These kinds of time-based considerations are critical in many areas of the law. For instance, you can learn more about the strict deadlines for filing legal claims by reading about the statute of limitations in Canada.

Why a Prenup Is a Smart Move for Your Future

Forget the movie clichés. A well-drafted marriage contract is really about one thing: peace of mind. It’s a practical tool that helps build clarity and security right into the foundation of your relationship.

Think of it less as a plan for failure and more as responsible planning, grounded in mutual respect and honesty. By having these conversations upfront, you and your partner get to enter your marriage with total financial transparency. You’re not leaving big life decisions up to the default rules in Ontario’s Family Law Act; you’re consciously creating a future that works for both of you.

Who Benefits Most from a Prenuptial Agreement?

While any couple can find value in the clarity a prenup brings, it becomes especially important in certain situations. If any of these sound like you, a marriage contract is a particularly savvy move.

- Business Owners: If you’ve poured your life into building a company, a prenup can shield it from being divided in a separation. This protects not just your own future but also the stability of your business and any partners involved.

- Individuals with Significant Personal Assets: Coming into the marriage with your own savings, investments, or property? A prenup lets you clearly define those as your separate property, keeping them protected.

- Those Expecting an Inheritance: A well-structured agreement can safeguard future inheritances or large family gifts, ensuring they remain outside the pool of matrimonial property if you ever separate.

- Couples Entering a Second Marriage: If you have children from a prior relationship, a prenup is crucial. It protects their inheritance and preserves the assets you’ve already earmarked for their future.

Building a Foundation of Financial Security

A prenup does more than just spell out what happens if things go wrong. It sets clear financial expectations from the very beginning. The process itself forces you to have candid conversations about money, debt, and life goals—topics that are critical for any strong partnership but are often the hardest to talk about.

A prenuptial agreement isn’t an admission of doubt; it’s an act of financial stewardship for your relationship. It provides a clear, agreed-upon roadmap that reduces future uncertainty and allows your marriage to grow on a foundation of trust and mutual understanding.

By tackling these subjects head-on, you get rid of ambiguity and potential conflicts before they even start. And looking at the bigger picture, a prenup is a powerful tool for your long-term financial health. It’s a key piece when you explore broader asset protection planning strategies to secure your wealth. This isn’t about being negative; it’s about being thoughtful and prepared for the life you’re building together.

A Few Common Questions About Prenups in Ontario

It’s completely normal to have questions when you’re thinking about a prenuptial agreement. After all, you’re planning your future together, and it’s smart to get clear on the details. Here are some straightforward answers to the questions we hear most often from our clients across the GTA and throughout Ontario.

Can We Change Our Prenup After We’re Married?

Life changes, and an agreement that made perfect sense when you first got married might not fit your reality ten years down the road. So, the short answer is yes, you can definitely change or update your prenuptial agreement after the wedding.

To make a change, you and your spouse will need to create an “amending agreement.” This is a new document that has to follow all the same legal rules as your original prenup: it must be in writing, signed by both of you, and properly witnessed. It’s also a very good idea for both of you to get independent legal advice again to make sure the new terms are fair and will hold up.

What Happens If We Don’t Have a Prenup?

If you get married in Ontario without a prenuptial agreement, the province’s Family Law Act steps in and provides a default set of rules for how property and support are handled if you ever separate. There’s nothing inherently wrong with this system, but it’s a one-size-fits-all approach that might not be what you and your partner would choose for yourselves.

Without a prenup, the law typically dictates:

- Equalization of Net Family Property: The value of almost all property you accumulate during the marriage is calculated and divided equally. Critically, this includes the full value of the matrimonial home, even if one of you owned it before you got married.

- Potential for Spousal Support: One spouse might be ordered to pay support to the other. This depends on a number of factors, like differences in income and the roles each of you took on during the marriage.

A prenup gives you the power to set your own terms instead of falling back on the government’s standard formula.

Is Our Ontario Prenup Valid If We Move?

This is a great question, particularly for couples who might move for a new job or to be closer to family. While a prenup signed in Ontario is a legally binding contract here, things can get a bit more complex if you move to a new province or another country.

Every jurisdiction has its own family laws. While the principles might be similar, a court in another province could interpret your agreement’s clauses differently than an Ontario court would.

If you move out of Ontario, you absolutely should have your prenup reviewed by a family lawyer in your new location. They can tell you if your current agreement is likely to be respected there or if it makes more sense to draft a new one that aligns with local laws.

How Do I Bring This Topic Up with My Partner?

Starting the “prenup talk” can feel a little daunting, but it doesn’t have to turn into an argument. The best approach is to frame it as a positive and practical step you’re taking together for your shared future.

Here are a few tips for navigating the conversation:

- Choose the Right Time and Place: Find a quiet, private time when neither of you is stressed or rushed. This isn’t a conversation to have in the middle of a disagreement or when you’re running out the door.

- Frame It as a Team Effort: Use words like “we” and “us.” Try something like, “I was thinking it would be smart for us to look into a marriage contract. It could be a great way to make sure we’re on the same page financially right from the start.”

- Focus on Practicality, Not Doubt: Explain that it’s about being proactive and protecting both of you, just like buying home insurance or writing a will. It’s a tool for clarity and preventing future misunderstandings, not a prediction of doom.

- Suggest Learning Together: Propose that you research the topic together or even book introductory meetings with lawyers to just get information. This turns it into a collaborative project, not an ultimatum.

Navigating the legal intricacies of a prenuptial agreement requires expert guidance. The team at UL Lawyers is here to provide clear, compassionate advice to help you build a fair and secure foundation for your future. To discuss your situation and understand your options, contact us for a consultation. Learn more at https://ullaw.ca.

Related Resources

Living Will Ontario: A Complete Guide to Advance Directives

Continue reading Living Will Ontario: A Complete Guide to Advance DirectivesPower of Attorney vs Guardianship in Ontario Explained

Continue reading Power of Attorney vs Guardianship in Ontario ExplainedNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies