Workers' Compensation Benefits: Ontario Guide to Coverage and Claims

When you get hurt on the job, everything can feel uncertain in an instant. But in Ontario, you’re not meant to face that alone. Think of workers’ comp benefits as a critical safety net, an insurance plan your employer is required to have, designed to catch you when you fall. It’s there to cover your medical costs and lost wages so your main focus can be on getting better.

Your Rights to Workers’ Comp Benefits in Ontario

A workplace injury doesn’t just affect your health; it throws your job, your income, and your future into question. Thankfully, Ontario’s system, managed by the Workplace Safety and Insurance Board (WSIB), is built to handle these exact challenges.

It’s what we call a “no-fault” system. This is a crucial detail. It means you don’t need to prove your employer was careless or did something wrong to qualify for help. The entire point is to get support to injured workers quickly while protecting employers from being sued every time an accident happens. If you’re working in the Greater Toronto Area or anywhere else in Ontario, you have very specific rights under this system.

Understanding the WSIB Safety Net

The whole idea behind the WSIB is a fundamental trade-off. Workers give up the right to sue their employer over a workplace injury. In return, employers fund an insurance pool that provides a defined set of benefits. This arrangement makes the process much more predictable for everyone.

This guide is designed to pull back the curtain and show you how it all works. We’ll break down what benefits are on the table and, just as importantly, how you can access them. We’ll look at the essentials, including:

- Eligibility Requirements: Who actually qualifies and for what types of injuries.

- Types of Benefits: What you can expect, from replacing lost paycheques to covering medical treatments.

- The Claims Process: A step-by-step walkthrough to get your claim filed properly.

- Appealing a Decision: Your options if the WSIB turns down your claim.

The primary goal of the WSIB system is to help injured workers recover and safely return to work. It’s not just about financial compensation; it’s about providing a structured path back to health and employment.

While we’re focused on Ontario, it’s worth noting that strong safety rules are the best way to prevent claims from ever being needed. You can see how other regions build comprehensive frameworks by looking at resources on Australian workplace safety standards.

Knowing your rights is the first and most important step. We’ll walk you through the process, so you can move forward with confidence.

How to Know If You Qualify for WSIB Benefits

Figuring out if you’re eligible for workers’ compensation is the first, and most important, hurdle after getting hurt on the job. In Ontario, the Workplace Safety and Insurance Board (WSIB) doesn’t just look at the injury itself; they zero in on the connection between your injury or illness and your employment.

To get the green light, two fundamental pieces have to be in place. First, you must be considered a “worker” in an industry that WSIB covers. Second, your injury or illness must have happened “by accident arising out of and in the course of” your employment. That phrase is the legal cornerstone for any successful claim.

Defining a “Work-Related” Injury or Illness

When we talk about a “work-related” injury, it’s easy to picture a single, dramatic accident—like a fall from a ladder on a construction site. But that’s just one piece of the puzzle. The WSIB’s definition is much broader and covers a whole range of health issues.

This includes injuries that creep up on you over time. Think of an office worker who develops debilitating carpal tunnel syndrome after years of typing, or a factory employee whose hearing is permanently damaged by constant exposure to loud equipment. These gradual-onset conditions are just as legitimate as a sudden accident.

The same goes for occupational diseases, which are illnesses directly caused by exposure to something in your work environment. A classic example is a tradesperson who develops lung disease after breathing in asbestos dust. At the end of the day, it’s the proven link to your job that matters, not how quickly the condition appeared.

Are You a Covered “Worker” in Ontario?

The vast majority of employees in Ontario are covered by the WSIB, whether you’re full-time, part-time, temporary, or just seasonal. If you work in what’s called a “compulsorily covered” industry—like construction, manufacturing, or trucking—you are automatically protected.

Some sectors, however, are not automatically included. This list often includes banks, trusts, and insurance companies. Even in these cases, an employer can choose to apply for optional WSIB coverage to protect their team. What about independent contractors or sole proprietors? They generally aren’t covered by default but have the option to buy their own personal insurance directly from the WSIB.

Key Takeaway: Never assume you aren’t covered. The WSIB rules can be complex, and many different work arrangements fall under their protection. It’s always worth looking into your eligibility instead of writing off the possibility of getting the benefits you need.

Common Scenarios and Eligibility Questions

Today’s work environment isn’t always a traditional office or job site, which brings up some common questions about what counts as a workplace injury.

Let’s break down a few scenarios:

- Working from Home: If you’re set up to work from home, your home office is your workplace. An injury that happens while you’re actively doing your job duties is usually covered. Tripping over the power cord for your work laptop and breaking your wrist? That would very likely be considered a work-related incident.

- Company Events: What if you get hurt at the company picnic or holiday party? If your employer encouraged or expected you to be there, an injury could easily be seen as happening “in the course of” your employment.

- Pre-Existing Conditions: This is a big one. Having a pre-existing health issue doesn’t automatically rule out a claim. If a workplace incident makes that old injury or condition significantly worse, you may still be entitled to benefits for that aggravation.

It’s also crucial to know the difference between WSIB and other benefits. WSIB is strictly for injuries and illnesses tied to your job. For conditions that develop outside of work, you might want to read our guide on what qualifies for long-term disability in Ontario.

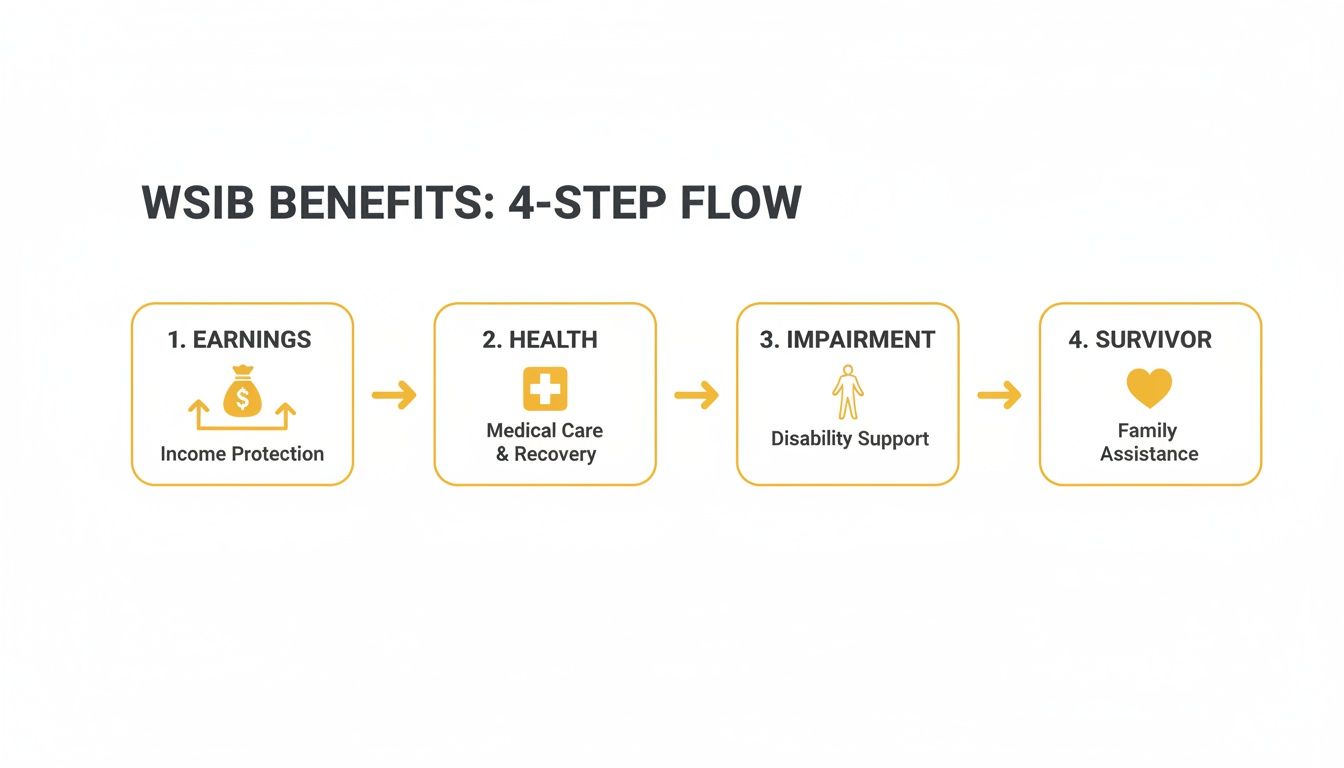

The 4 Main Types of WSIB Benefits

So, your WSIB claim has been approved. The big question now is, what kind of help can you actually expect? Ontario’s workers’ compensation system is more than just a paycheque replacement; it’s a full support network designed to help you with your health, your finances, and your future.

Think of your workers’ comp benefits as a safety net with four key strands, each designed to catch a different part of the fallout from a workplace injury. Let’s break down what they are so you know exactly what you’re entitled to.

Loss of Earnings (LOE) Benefits

For most people, the first and most pressing worry is how to keep the lights on and food on the table without a regular income. That’s precisely what Loss of Earnings (LOE) benefits are for. This is the financial backbone of your claim, designed to replace the wages you’re losing while out of commission.

The WSIB calculates this support at 85% of your net average earnings—that’s your take-home pay after taxes and other typical deductions like CPP and EI. They look at your recent pay history to figure out a fair average, so the benefit is a realistic reflection of what you were actually bringing home.

This financial support keeps coming until you’re able to return to work and are no longer losing pay because of the injury, or until you turn 65. It’s all about creating a stable financial floor beneath you, so you can focus 100% on getting better.

Health Care Benefits

Beyond your income, the WSIB’s job is to cover every approved medical expense tied to your work injury. This ensures that you get the best possible care without having to worry about the cost. Your recovery should never be limited by what you can afford.

The scope of what’s covered is pretty broad and is always based on what you need to recover.

- Medical Treatments: This covers everything from your family doctor visits and hospital stays to any surgeries or specialist appointments you might need.

- Prescription Medications: Any drugs your doctor prescribes to treat your injury are covered.

- Rehabilitation Services: This is a big one. It includes crucial therapies that get you moving again, like physiotherapy, chiropractic treatments, and occupational therapy.

- Medical Devices and Equipment: If you need things like crutches, a specialized brace, a hearing aid, or even modifications to your home or car because of your injury, the WSIB can cover those costs.

Non-Economic Loss (NEL) Benefits

Sometimes, a workplace injury leaves a permanent mark. It could be a physical or psychological condition that you’ll have to live with long after you’ve recovered as much as you’re going to. A Non-Economic Loss (NEL) benefit is a one-time, lump-sum payment that acknowledges this permanent change to your life outside of work.

It’s not about wages. It’s compensation for the permanent impact on your quality of life—the things you used to enjoy that you no longer can.

A NEL award is calculated based on two things: the degree of your permanent impairment (which is determined by a doctor using a specific rating guide) and your age. The more significant the impairment and the younger you are, the larger the NEL payment.

This benefit is a formal recognition that some injuries change your life forever, affecting your hobbies, your family life, and your overall well-being.

Survivor Benefits

In the tragic event that a worker dies from a work-related injury or disease, the WSIB provides survivor benefits for their spouse and dependent children. This is the final strand of the safety net, designed to prevent a devastating financial crisis from compounding a family’s grief.

These benefits are multifaceted and include:

- Lump-sum payments for the surviving spouse.

- Ongoing monthly payments to support the spouse and any dependent children.

- Financial aid to help cover funeral and burial expenses.

- Bereavement counselling for family members to help them process their loss.

It’s a critical component of the system, offering a measure of security and support when a family needs it most.

To make it easier to see how these benefits fit together, here’s a quick summary of what each one is designed to do.

Overview of Key WSIB Benefit Types

| Benefit Type | Purpose | What It Covers |

|---|---|---|

| Loss of Earnings (LOE) | To replace lost income while you cannot work. | 85% of your pre-injury net average earnings. |

| Health Care Benefits | To pay for all approved medical treatments. | Doctor visits, physiotherapy, prescriptions, medical devices. |

| Non-Economic Loss (NEL) | To compensate for a permanent impairment. | A lump-sum payment for the long-term impact on your life. |

| Survivor Benefits | To support dependents after a work-related death. | Lump-sum and monthly payments, funeral costs, counselling. |

Each of these benefits plays a unique and essential role in helping injured workers and their families navigate the difficult road to recovery.

Navigating The WSIB Claims Process Step-By-Step

When you get hurt on the job, the path to receiving workers’ comp benefits can feel overwhelming. It’s a blur of forms, deadlines, and unfamiliar terms. But if you take it one step at a time, the process is much more manageable. The journey begins the second you get injured, and what you do right then is critical.

Your first two moves are the most important, and they’re non-negotiable: report the injury to your employer and get medical attention right away. Even if it feels like a minor sprain or strain, reporting it creates an official record. Seeing a doctor provides the medical evidence that will become the backbone of your claim.

From that point on, getting your claim approved becomes a team effort—or at least, a process with three key players: you, your employer, and the Workplace Safety and Insurance Board (WSIB). Each has a specific role and strict deadlines to follow. Understanding how these pieces fit together is the best way to avoid frustrating delays.

The infographic below shows what a successful claim can lead to, from financial support to medical care and more.

Think of it as a safety net. The system is designed to catch everything from your immediate lost wages and physiotherapy costs to permanent impairments and, in the worst cases, support for your family.

The Worker’s Responsibilities

As the injured worker, your main job is to officially file a claim with the WSIB. This is done by filling out and sending in a Worker’s Report of Injury/Disease (Form 6). You have a firm deadline: it must be filed within six months of the date you were injured or the date you realized you had an occupational disease.

Be meticulous when you fill out Form 6. Vague statements like “hurt my back at work” aren’t enough. You need to be specific about how, when, and where the injury happened. The more detail you provide, the fewer questions the WSIB adjudicator will have.

A solid incident report is the foundation of a strong claim. To get it right, it’s worth learning how to write a comprehensive work incident report, as this will make filling out your Form 6 much easier.

The Employer’s Role and Deadlines

Your employer has their own set of mandatory reporting duties. As soon as they are aware of a workplace injury, they must complete an Employer’s Report of Injury/Disease (Form 7) and submit it to the WSIB.

The clock starts ticking immediately. If the injury caused you to miss time from work or earn less than your regular pay, your employer must send in their report within just three business days. This is a critical step; if your employer drags their feet, your entire claim gets held up.

By law, your employer must cooperate with the WSIB and actively participate in your return-to-work plan. This means keeping the lines of communication open and offering suitable modified duties that align with your medical restrictions, if possible.

The WSIB’s Decision-Making Process

Once the WSIB has the reports from you, your employer, and your doctor, your file lands on the desk of a case manager or adjudicator. Their job is to sift through all the evidence and determine if your claim is valid under the Workplace Safety and Insurance Act.

Generally, the WSIB aims to make a decision on your claim within 10 business days of receiving all the required documents. To get a deeper understanding of who is covered and how, you can check out our detailed guide on WSIB insurance in Ontario.

The adjudicator essentially works through a checklist to validate your claim:

- Is your employer covered by WSIB insurance?

- Are you considered a “worker” under the Act?

- Did the injury or illness happen “by accident arising out of and in the course of” your job?

- Is there medical evidence to confirm your injury and its connection to the incident?

If the answers are all a clear “yes,” the decision can come quickly. But if there’s missing information, conflicting stories, or grey areas, the adjudicator will need to dig deeper, which naturally extends the timeline.

Common Reasons WSIB Claims Are Denied and How to Appeal

Getting that denial letter from the WSIB can feel like a punch to the gut. It’s frustrating, disheartening, and can leave you wondering how you’ll manage. But it’s critical to know this: a denial is not the final word. In fact, it’s often just the starting point of a longer conversation, and you have a clear, legal path to challenge the decision.

The first move is to figure out why your claim was rejected. Denials don’t just happen randomly; they’re almost always tied to specific gaps or questions the WSIB had about your application. By zeroing in on that exact problem, you can start building a much stronger case for an appeal.

Understanding Why Your Claim Was Denied

While every situation is different, most WSIB denials boil down to a handful of common issues. Pinpointing which one applies to you is the key to building a winning appeal strategy. The WSIB adjudicator needs clear and convincing evidence, and if they feel a piece of the puzzle is missing, they’ll often play it safe and deny the claim.

Here are some of the most frequent reasons your workers’ comp benefits might get turned down:

- Missed Deadlines: The WSIB runs on a strict clock. You have six months from the date of your injury to file your Form 6. Missing this deadline is one of the quickest ways to get an automatic rejection.

- Weak Medical Evidence: Your claim is only as strong as the medical paperwork backing it up. If your doctor’s reports are vague, don’t clearly connect your injury to what happened at work, or fail to describe your physical limitations, the WSIB may decide there isn’t enough proof.

- Disputes Over “Work-Relatedness”: Sometimes, your employer might argue that the injury didn’t actually happen at work or because of your job duties. This is a common hurdle for gradual-onset issues like repetitive strain injuries or for incidents that nobody else witnessed.

- Pre-existing Conditions: The WSIB or your employer might suggest that your pain and symptoms are caused by an old injury or a condition you had before the workplace incident, not the new event.

A denial isn’t a judgment on whether your injury is real; it’s simply a decision based on the information they had at the time. The appeals process is your chance to provide new, better, or clearer information to get that decision overturned.

The WSIB Appeals Process Step-by-Step

If you disagree with the WSIB’s decision, you don’t just call up the original case manager to argue. Instead, you enter a formal, multi-level appeals system designed to give your claim a fresh set of eyes.

- File an Intent to Object Form: This is your first official step. You have six months from the date on the decision letter to get this form in. It tells the WSIB you’re formally disputing their findings and locks in your right to appeal.

- Get Your Claim File: Once you’ve filed your intent, you have the right to ask for a complete copy of your WSIB file. This is absolutely crucial. It contains every piece of information the adjudicator used to deny your claim, including your employer’s report and any medical opinions they gathered.

- Submit the Appeal Readiness Form: After you’ve gone through your file and gathered new evidence—maybe a more detailed report from your doctor or statements from coworkers—you’ll complete this form to officially get your appeal underway.

- The Appeals Resolution Officer (ARO): Your case will land on the desk of an ARO. This person reviews everything from scratch, including all the new information you’ve provided. The ARO might try to mediate a solution or simply make a new decision. A lot of appeals are successfully resolved right here.

- A Hearing at WSIAT: If the ARO still says no, your final stop is the Workplace Safety and Insurance Appeals Tribunal (WSIAT). This is an independent body, completely separate from the WSIB, that holds formal hearings. The decision they make is final and binding. At this stage, having a lawyer in your corner is absolutely essential.

Trying to navigate this process while recovering from an injury is a massive challenge. The principles involved in fighting an insurance board’s decision are often similar, regardless of the type of benefit. You can find more helpful information by reading about what to do after an Ontario accident benefits denial.

When You Need a Lawyer for Your Workers’ Comp Claim

While some WSIB claims sail through smoothly, many become a frustrating maze of red tape and legal jargon. You can try to navigate it alone, but there are certain points where going without a professional in your corner puts your rightful workers’ comp benefits in real jeopardy.

This isn’t about looking for a fight. It’s about levelling the playing field so you can put all your energy into getting better. Knowing when to pick up the phone and call a lawyer is crucial. Many injured workers across the GTA and Ontario assume they only need legal help after a denial, but the warning signs often appear much earlier.

Key Moments to Seek Legal Advice

Some situations are immediate red flags. These are the moments when the WSIB’s decision-making gets technical, and your employer’s interests might diverge sharply from your own. If you find yourself in any of these scenarios, it’s time to seriously consider getting a lawyer involved.

You should reach out for legal representation if:

- Your claim is denied. This is the most clear-cut sign. A lawyer will dissect the denial letter, find the weak spots in the WSIB’s argument, and build a solid case for an appeal.

- Your benefits are cut back or stopped without warning. The WSIB might say you’re ready for modified work, but if your doctor disagrees, you’ll need help proving it. A lawyer can gather the right medical evidence to support your position.

- Your employer is fighting your claim. If your boss argues the injury happened off-site or blames a pre-existing condition, you need an advocate to stand up for you.

- You’re being pushed back to work too soon. A premature return can be dangerous. A lawyer ensures your return-to-work plan is safe and medically sound, protecting you from further injury.

- You’re left with a permanent impairment. Figuring out a Non-Economic Loss (NEL) award is complicated. An expert can make sure the assessment is fair so you get the maximum compensation you deserve.

A lawyer’s job is to take the legal weight off your shoulders. They manage the paperwork, speak to the WSIB on your behalf, gather strong medical opinions, and represent you at hearings. This lets you focus on what actually matters: your recovery.

The Value of Professional Representation

A lawyer who specializes in this area knows the ins and outs of Ontario’s Workplace Safety and Insurance Act. They understand what an adjudicator is looking for and how to present your case in the most convincing way possible. They can see potential roadblocks from your employer or the WSIB coming and prepare a strategy to overcome them.

Hiring a lawyer means you won’t be intimidated into accepting a bad decision or returning to a job that could make your injury worse. When you’re up against a complex insurance system, having an expert on your side is critical. To see how this applies more broadly, you can learn about hiring a lawyer for an insurance claim on our website. Ultimately, it’s about getting the best possible outcome for you and your family’s future.

Frequently Asked Questions About WSIB Benefits

When you’re dealing with a workplace injury, it’s natural to have a lot of questions. Let’s tackle some of the most common ones we hear from injured workers across Ontario, with clear, straightforward answers.

How Long Do I Have to Report a Workplace Injury in Ontario?

It’s crucial to report your injury to your employer right away, even if it seems minor at the time. When it comes to the WSIB, you have a firm deadline: six months from the day of the injury to file your claim.

What if it’s an occupational disease that crept up over years? The clock starts ticking differently. In that case, the six-month deadline begins on the date you are officially diagnosed.

Can I Be Fired for Filing a WSIB Claim in Ontario?

No, absolutely not. Ontario’s Workplace Safety and Insurance Act has powerful rules in place to protect you. It is illegal for your employer to fire, punish, or penalize you in any way for getting hurt on the job, reporting that injury, or filing a WSIB claim.

This is one of your most fundamental rights within the system. It’s often called the ‘right to claim,’ and it’s there to make sure you can get the help you need without worrying about losing your job.

What Happens If My Employer Disputes My WSIB Claim?

If your employer decides to challenge your claim, the WSIB steps into the role of an impartial investigator. They will gather evidence from everyone involved—you, your employer, and your doctors—and review everything carefully before making a decision.

Should the WSIB side with your employer and deny your claim, remember that this isn’t the end of the road. You have the right to appeal, and this is precisely the point where getting advice from a lawyer becomes critical.

Do I Have to Pay Taxes on WSIB Benefits?

Here’s some good news: no, you don’t. In Canada, WSIB payments for lost wages, non-economic loss awards, and survivor benefits are all considered non-taxable income.

This means you won’t have to declare these benefits on your income tax return, and the full amount you receive is yours to help you through your recovery.

If you’re dealing with a denied claim or just feel lost in the WSIB system, you don’t have to figure it out by yourself. The experienced team at UL Lawyers, based in Burlington and serving all of the GTA and Ontario, is here to stand up for your rights and fight for the benefits you’re entitled to. Contact us today for a free consultation at https://ullaw.ca.

Related Resources

Severance Pay Calculator Ontario Guide

Continue reading Severance Pay Calculator Ontario GuideA Guide to Benefits from Workers' Compensation in Ontario

Continue reading A Guide to Benefits from Workers' Compensation in OntarioNEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies