Limited Liability Partnership Canada Guide for Ontario Professionals

So, what exactly is a limited liability partnership in Canada? Think of it as a smart business structure that combines the flexibility of a traditional partnership with the personal asset protection you’d normally associate with a corporation. It’s built specifically for certain regulated professionals, giving them a shield against liability stemming from another partner’s professional error.

Simply put, your personal assets aren’t on the line because a colleague made a mistake.

Understanding the Limited Liability Partnership

The core idea behind a Limited Liability Partnership (LLP) is a legal shield for your personal wealth. It’s a powerful hybrid structure made for groups of regulated professionals practising together in Ontario, from downtown Toronto to every corner of the province.

Here’s a practical analogy: imagine a team of skilled architects working together at the same firm in Burlington. If one architect makes a major design flaw that leads to a lawsuit, the other partners on the team aren’t personally on the hook for that specific error. Their homes, cars, and savings are safe from claims that arise from their partner’s professional negligence. This is the single biggest advantage of an LLP.

How Liability is Separated

The game-changer with an LLP is how it handles liability. While it feels a lot like a general partnership day-to-day in terms of management and taxes, the legal protection is where it really shines. This structure draws a clear line in the sand between different kinds of business debts and obligations.

An LLP effectively builds a firewall around each partner’s personal assets. It protects them from claims of negligence, wrongful acts, or omissions committed by another partner or by an employee who was supervised by another partner.

But it’s important to know this protection isn’t a get-out-of-jail-free card. The shield has its limits. All partners are still personally on the hook for:

- Their own professional negligence. You are always responsible for your own work and for the work of anyone you directly supervise.

- General business debts. This covers things like the office lease, supplier contracts, and any bank loans taken out by the firm.

- Contractual obligations. When the partnership signs a contract, every partner is collectively responsible for fulfilling it. You can see how complex these situations can get by looking into common breach of contract remedies.

A Structure for Regulated Professionals

This type of business structure isn’t open to just anyone. In Ontario, the LLP was brought in under the Partnerships Act specifically to serve professionals in regulated fields.

Since the early 1990s, it’s become the go-to structure for groups of lawyers, accountants, architects, and certain health professionals across Canada. A key step is that these groups must first get approval from their provincial regulatory body before they can even form an LLP. This requirement helps ensure the structure upholds high professional standards while offering that critical liability protection.

Who Can Form an LLP in Ontario

Not just anyone can set up a limited liability partnership in Canada. Think of the LLP structure as a special designation, reserved exclusively for a select group of regulated professionals here in Ontario.

This isn’t an arbitrary rule. It’s a very deliberate policy designed to strike a crucial balance between offering liability protection and maintaining professional accountability. So, if you’re thinking of starting an LLP for your new restaurant or software company, you’ll have to look at other business structures.

The Exclusive List of Eligible Professions

In Ontario, the ability to form an LLP is tightly controlled by the Partnerships Act. The list of eligible professionals is specific, and it’s geared toward fields where practitioners carry a significant amount of personal risk and responsibility.

While the list can evolve, it consistently includes professions like:

- Lawyers who are members of the Law Society of Ontario.

- Chartered Professional Accountants (CPAs) registered with CPA Ontario.

- Architects belonging to the Ontario Association of Architects.

- Engineers licensed by Professional Engineers Ontario.

- Certain Regulated Health Professionals like physicians, dentists, chiropractors, and optometrists, all governed by the Regulated Health Professions Act, 1991.

There’s a clear theme here. The LLP is a tool for professionals whose conduct is already policed by a robust governing body, creating a built-in system of checks and balances.

Why Professional Governance Is a Mandatory Checkpoint

Here’s the most critical part: your first stop in forming an LLP isn’t the government registry. It’s your own professional college or society. You absolutely must get their consent before you can even begin the registration process. This is a non-negotiable step.

Think of it as getting your credentials verified. Organizations like the Law Society of Ontario or the College of Physicians and Surgeons of Ontario are the gatekeepers. They are responsible for confirming that all proposed partners are licensed, in good standing, and carrying the required professional insurance. For highly specialized practitioners, like experienced labour lawyers in Ontario, this oversight is what maintains high standards across the profession.

This pre-approval step is how the province ensures the privilege of limited liability is only given to professionals who have already proven their commitment to high ethical and practice standards. It directly ties the legal benefits of the LLP to professional accountability.

Making professional governance a mandatory checkpoint is really about protecting the public. It guarantees that a firm operating as an LLP isn’t just set up for liability protection, but is also actively monitored by a body dedicated to upholding that profession’s integrity. This foundational link is what a limited liability partnership in Canada is all about—a structure built on a bedrock of proven professional trust.

LLP vs. General Partnership vs. Corporation

Picking the right business structure in Ontario is a big deal. It’s one of those foundational decisions that has serious, long-term legal and financial ripples. Think of it like choosing the right foundation for a house—your choice will define its stability, how it’s taxed, and most importantly, how much personal risk you’re taking on.

For professionals like doctors, lawyers, and accountants, the choice usually boils down to three main contenders: the Limited Liability Partnership (LLP), the General Partnership (GP), and the Corporation. Each one strikes a different balance between protection, flexibility, and paperwork, so understanding how they really stack up is crucial.

Personal Liability: A Tale of Three Shields

The single biggest difference between these structures is how they protect your personal assets—your house, your car, your savings—from business troubles.

A General Partnership offers no shield at all. You and your partners are legally one and the same as the business. If the firm gets sued or racks up debt, even because of another partner’s mistake, your personal assets are fair game. It’s a true “all-for-one, one-for-all” approach to risk, which can be a scary prospect in high-stakes fields.

A Corporation gives you the strongest shield available, often called the “corporate veil.” Because the corporation is a completely separate legal entity, you generally aren’t personally on the hook for its debts or legal battles. This is top-tier protection, but it comes with a heavier administrative burden.

A Limited Liability Partnership (LLP) offers a more nuanced, hybrid shield. It protects you from being personally liable for the professional negligence or malpractice of your other partners. But, and this is a big “but,” you are still personally responsible for your own negligence and for the general business debts, like the office lease or a bank loan. It’s a targeted shield, not a complete one.

Tax Treatment: Flow-Through vs. Double Taxation

How your profits make their way to your bank account—and how the Canada Revenue Agency (CRA) treats them—is another critical piece of the puzzle.

LLPs and General Partnerships enjoy something called “flow-through” taxation. The partnership itself doesn’t file a tax return and pay income tax. Instead, all profits and losses “flow through” directly to the individual partners, who then report their share on their personal T1 tax returns. It’s simple and avoids getting taxed twice.

Corporations are a different story. They’re taxed as separate legal entities, which can create a situation known as “double taxation.” Here’s how it works: first, the corporation pays tax on its profits at the corporate rate. Then, when that after-tax profit is paid out to shareholders as dividends, the shareholders have to pay personal income tax on that money again. There are ways to manage this, but it’s a fundamental difference to be aware of.

The flow-through tax model of a limited liability partnership in Canada is often a major draw for professionals. It combines the operational simplicity of a partnership with a tax structure that avoids the two layers of tax inherent in a corporation.

Operational Complexity and Management

How you actually run the business day-to-day also changes dramatically depending on the structure you choose.

A General Partnership is the simplest of the bunch. You can get one started with minimal paperwork, and you have tons of flexibility in how you manage things. The flip side is that this lack of formal structure can become a weakness, sometimes leading to disputes if you don’t have a rock-solid partnership agreement.

An LLP builds on the partnership model but adds a formal registration step. It keeps most of the operational flexibility but absolutely requires a comprehensive partnership agreement to spell out how the firm is governed, how profits are split, and what each partner’s responsibilities are.

A Corporation is the most complex by far. Setting one up involves higher costs and a lot more paperwork, including mandatory annual filings, holding director’s meetings, and keeping detailed corporate records (like minute books). While it offers the best liability protection, it demands a much higher level of administrative discipline to keep everything in good standing.

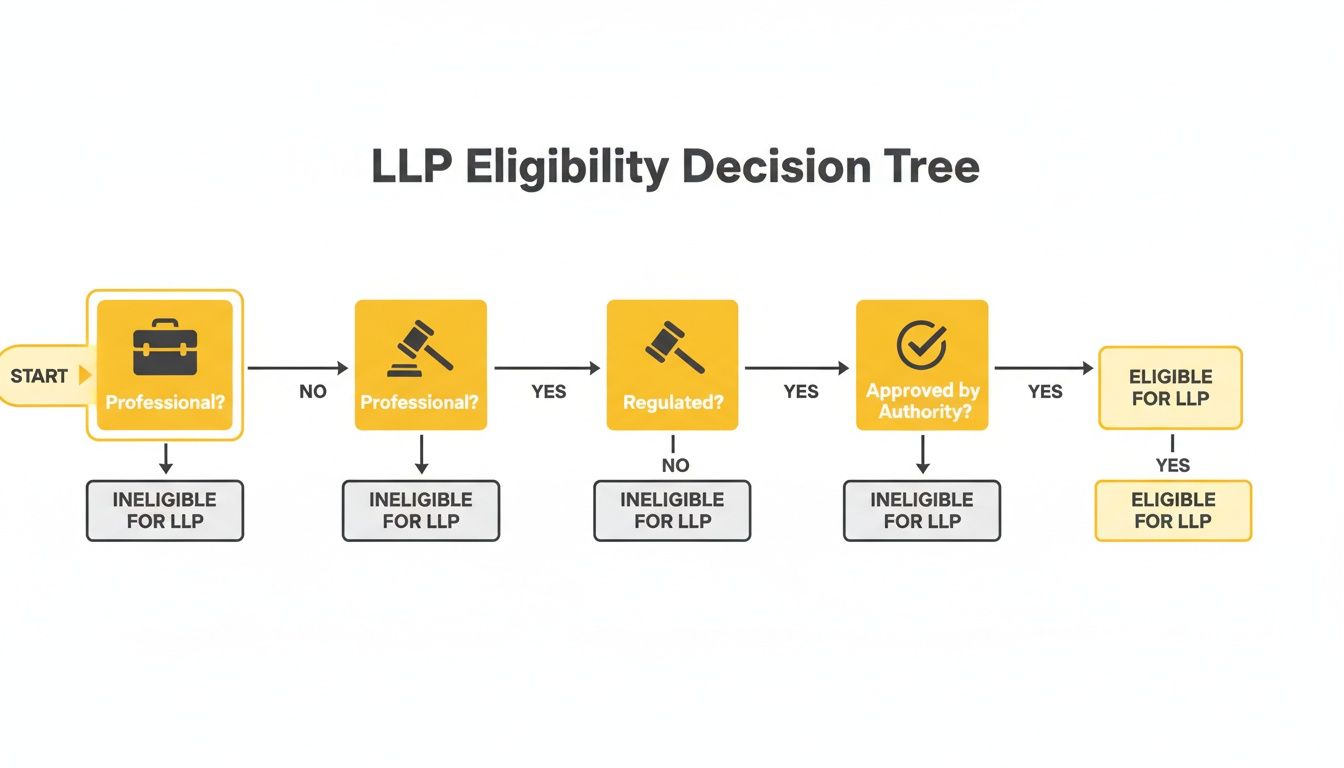

The decision tree below maps out the key checkpoints for professionals in Ontario who are thinking about going the LLP route.

As the visual shows, forming an LLP isn’t just a simple business registration; it’s a process that begins with your professional standing.

To see how these options fit into the bigger picture, a guide to general business structure types can give you valuable context on their core differences. And since you may hear about other structures, it’s worth reading our guide on what an LLC is in Canada to understand why it’s not an option here like it is in the US.

Comparing Business Structures in Ontario

To help you see the differences at a glance, we’ve put together a simple table comparing the key features of LLPs, General Partnerships, and Corporations for professionals in Ontario.

| Feature | Limited Liability Partnership (LLP) | General Partnership (GP) | Corporation (Inc.) |

|---|---|---|---|

| Personal Liability | Partners protected from other partners’ negligence; liable for own. | Unlimited personal liability for all business debts. | Limited personal liability; protected by the “corporate veil.” |

| Taxation | Flow-through: Profits taxed on personal T1 returns. | Flow-through: Profits taxed on personal T1 returns. | Separate Entity: Corporation pays tax, then shareholders pay tax on dividends. |

| Setup & Admin Complexity | Moderate: Requires provincial registration and a formal agreement. | Low: Simple to start, but a partnership agreement is vital. | High: Formal incorporation, annual filings, and corporate records. |

| Eligibility | Restricted to certain regulated professions (e.g., lawyers, doctors). | Open to any two or more people starting a business for profit. | Open to anyone; specific rules may apply for professional corporations. |

This table provides a high-level overview, but the best choice for your practice will always depend on your specific profession, risk tolerance, and long-term goals.

The Strategic Advantages of an LLP Structure

So, why do so many of Ontario’s most established professional firms—from top-tier law offices in Toronto to cutting-edge architectural practices in Burlington—opt for the Limited Liability Partnership (LLP) model? It comes down to a powerful combination of personal protection, tax simplicity, and professional credibility. It’s a structure that genuinely offers the ‘best of both worlds’ for many regulated professionals.

Let’s move past the textbook definitions and look at the real-world benefits that make the LLP so appealing across the GTA.

Protecting Your Personal Assets

This is the big one. The single most compelling reason to form an LLP is the targeted liability shield it provides. It puts a protective wall between your personal financial life and the professional actions of your partners. This isn’t just a legal theory; it has massive real-world consequences.

Picture an architectural firm in Oakville set up as an LLP. One partner makes a critical error on a major commercial project, resulting in a lawsuit for professional negligence. If they were a general partnership, every single partner’s personal assets—their home, their savings, their investments—could be on the line to cover the judgment.

With an LLP, the fallout is contained. Only the firm’s assets and the personal assets of the partner who made the mistake are exposed to that specific claim. The other partners are shielded, their financial well-being intact.

This targeted protection is the bedrock of modern professional practice. It lets you collaborate and build a thriving business without shouldering unlimited personal risk for a colleague’s error. It also allows firms to attract top talent who are rightly cautious about their personal exposure. Of course, protecting professional assets is one thing; you should also have a plan for your personal assets. You can explore key considerations in our guide on wills and estate law in Ontario.

Achieving Greater Tax Efficiency

Beyond liability protection, the LLP offers a straightforward and often more favourable approach to taxation compared to a corporation. LLPs use what’s known as “flow-through” taxation, which can make tax season a lot simpler and more efficient.

Essentially, the partnership itself doesn’t pay income tax. Instead, think of it like a conduit: all profits and losses “flow through” the business directly to the individual partners. Each partner then reports their share of the income on their personal T1 tax return.

This approach delivers two key benefits:

- Avoids Double Taxation: In a corporation, profits get taxed once at the corporate level, and then again when they’re paid out to shareholders as dividends. An LLP’s earnings are only taxed once, at the partner’s personal income tax rate.

- Simplifies Filing: Partners incorporate their business income directly into their personal tax filings, eliminating the need to manage a separate, often more complex, corporate tax return.

This structure makes the LLP an incredibly efficient way to get profits into the hands of the partners who earned them.

Enhancing Credibility and Stability

Finally, setting up a formal LLP sends a clear signal to clients, lenders, and the public. It says your practice is serious, stable, and built to last. This isn’t just about appearances; it translates into real business advantages. The official registration and legal framework give the business a sense of permanence that a simple handshake or general partnership agreement just can’t match.

This credibility boost can be the tipping point when you’re looking for financing. Lenders notice the difference. Banks are often more comfortable lending to LLPs because of the formal structure and professional oversight. To learn more about how lenders and regulators view different business entities, you can explore the insights on business structures from Miller Thomson.

For any professional practice in the GTA looking to grow, that kind of stability and access to capital is invaluable.

How to Register Your LLP in Ontario Step by Step

Ready to make your LLP official? The process in Ontario isn’t a confusing maze; it’s a clear, structured path. By tackling it one step at a time, you can build your new professional firm on a rock-solid legal foundation right from the start.

Think of this as your roadmap. Following these steps in the correct order is non-negotiable, as each one unlocks the next. Let’s walk through the four key stages to get your LLP up and running.

Step 1: Secure Approval from Your Governing Body

Before you even dream up a business name or think about government forms, your first move is to get the blessing of your professional governing body. This is a hard-and-fast rule. Skipping this step is like trying to build a house without a permit—it’s a non-starter.

Whether you’re dealing with the Law Society of Ontario, CPA Ontario, or the Ontario Association of Architects, you have to apply for and receive their official approval to practise as an LLP. They’ll do their due diligence, verifying that every partner is in good standing and carries the required professional liability insurance.

Step 2: Choose and Register a Compliant Business Name

Once you have that green light from your professional body, it’s time to pick a name. But it’s not just about creativity; the name you choose has to follow specific rules laid out in Ontario’s Business Names Act and your profession’s own regulations.

The biggest rule? Your name must clearly identify your business as an LLP. This means it has to end with one of these official designations:

- Limited Liability Partnership

- LLP

- L.L.P.

- Société à responsabilité limitée

- SRL

- S.R.L.

After you’ve landed on a compliant name, the next hurdle is a NUANS (Newly Updated Automated Name Search) report. This search ensures your name isn’t too similar to an existing one, which could cause confusion. With a clear report, you can then register the name with the Ontario government. As you move through this stage, getting a handle on your business registration numbers is a key part of formalizing your new entity.

Step 3: Draft a Comprehensive Partnership Agreement

This step isn’t legally required to get registered, but honestly, it’s the most important thing you’ll do. Your partnership agreement is the constitution of your firm. It’s the internal playbook that governs how you’ll operate, make decisions, and, crucially, handle disagreements.

Relying on the default rules in the Partnerships Act is a massive gamble. A custom, well-drafted agreement lets you set your own terms, protecting every partner and providing a clear framework for any situation that comes your way.

This document should spell everything out: how profits are shared, who contributes what capital, management roles, voting rights, and the exact process for bringing on new partners or letting one go. It absolutely must include a clear dispute resolution process to keep small issues from turning into big problems.

Step 4: File Your LLP Registration with the Province

With regulatory approval in hand, a registered name, and your partnership agreement sorted, you’ve reached the final step: officially registering your LLP with the provincial government. This means completing and submitting a “Form 6, Limited Liability Partnership” under the Business Names Act.

This form gathers the essential details about your firm—its registered name, business address, and the names and addresses of all partners. Submitting this form with the required fee is what makes your LLP an official legal entity in Ontario.

Be prepared for the costs. The initial setup with bodies like the Law Society of Ontario often involves application fees, plus annual renewals. A well-drafted partnership agreement is also an essential investment for outlining everything from management structures to profit sharing.

How the CRA Treats Your LLP: A Guide to Taxes

Getting a handle on how the Canada Revenue Agency (CRA) sees your Limited Liability Partnership is non-negotiable. For many professionals, one of the biggest draws of an LLP is its tax structure—it’s a whole different ball game compared to a corporation, and frankly, it’s often a much better one.

The magic lies in what’s known as “pass-through” taxation. Think of your LLP as a pipeline. All the money the firm earns flows through this main pipeline, but the pipeline itself isn’t taxed. Instead, the profits are channelled directly to the individual partners at the other end. It’s the partners who then deal with the tax man, not the business entity.

Understanding Pass-Through Taxation

So, what does “pass-through” actually mean in practice? Simple: the LLP itself does not pay income tax. Zero.

The partnership still has to communicate with the CRA, of course. It files an annual T5013 Statement of Partnership Income, which is basically an information return. It tells the government, “Here’s how much we made or lost, and here’s how we carved it up among the partners.”

From there, the responsibility shifts entirely to the individual partners. Each partner gets a T5013 slip showing their slice of the pie—their share of the firm’s net income or loss. This number gets plugged directly into their personal T1 income tax return.

The main takeaway is that LLP profits in Canada are only taxed once. The money flows straight through to the partners and is taxed at their personal marginal rates, neatly avoiding any corporate tax along the way.

This is a huge advantage over the corporate model. A corporation gets taxed on its profits, and when those profits are paid out as dividends, the shareholders get taxed on them again. This “double taxation” is a common headache that the LLP structure was built to solve.

Turning a Business Loss into a Tax Advantage

The pass-through model isn’t just for profits; it works for losses, too. If the LLP has a tough year and ends up in the red, those losses also flow directly through to the partners. This can be a surprisingly useful tool, especially when a practice is just getting off the ground.

Each partner can take their share of the business loss and use it to offset other personal income. Let’s say you had some investment gains or other side income. Your portion of the LLP’s loss could be used to reduce your total taxable income, which could mean a smaller tax bill for the year.

This kind of flexibility is a major perk that isn’t really available to corporate shareholders. It’s another reason why the limited liability partnership Canada structure is often the smartest financial choice for professionals building their practice.

Common Questions About LLPs in Canada

We’ve walked through the essentials of setting up a limited liability partnership in Canada, but a few key questions always come up in practice. Here are the answers to the most common queries we hear from professionals right here in Ontario.

Can Any Business in Ontario Become an LLP?

This is a big one, and the answer is a firm no. The LLP structure isn’t a free-for-all for any type of company. In Ontario, it’s specifically reserved for a handful of regulated professions.

Think lawyers, chartered professional accountants, architects, and certain healthcare professionals. It’s not an option for businesses like a coffee shop, a software company, or a construction firm. The bottom line is that your profession’s governing body must explicitly give its members the green light to form an LLP.

What Happens if My Partner in an LLP Gets Sued for Malpractice?

This question gets to the very heart of why LLPs exist. If one partner in an Ontario LLP is sued for professional negligence—say, they made a critical error on a client’s file—the liability is walled off.

The only assets on the line for that specific claim are those of the partner who made the mistake and the partnership’s own business assets. Crucially, the personal savings, home, and other assets of the innocent partners are shielded from that lawsuit.

However, it’s vital to remember that this shield has its limits. All partners are still on the hook for the firm’s general debts and contractual obligations. You can dig deeper into how time limits affect legal claims by reading about the statute of limitations in Canada.

The key takeaway is that the LLP shield protects you from a partner’s professional foul-up, not from everyday business risks. The rent on the office lease or the firm’s line of credit? That’s still a shared responsibility.

Figuring out the right business structure isn’t just a box to tick; it’s a critical decision that needs expert legal advice. At UL Lawyers, we work with professionals across Ontario to build the proper foundation for their practices. Reach out to us to make sure your partnership is set up for both success and security.

Related Resources

NEED A LAWYER?

We are here 24/7 to address your case. You can speak with a lawyer to request a consultation.

905-744-8888GET STARTED WITH A FREE CONSULTATION

Why Choose UL Lawyers

- Decades of combined experience

- Millions recovered for our clients

- No fee unless we win your case

- 24/7 client support

- Personalized legal strategies